Pioneering transparency on product level backtesting

Interest in backtesting results and the performance of CCPs’ margin models has increased in light of market volatility observed during the COVID-19 crisis in 2020.

By providing an additional product level backtesting data set, Eurex Clearing aims to facilitate analyses on margin coverage as well as the behavior of margin models. In addition to backtesting results on a portfolio level published as part of the CPMI-IOSCO Public Quantitative Disclosures, this disclosure provides assumption-free product level backtesting results of Initial Margin against 1-day P&Ls. Such dataset, evaluated with a set of standard backtesting and procyclicality metrics, allows for a more comprehensible interpretation of margin coverage and better analysis of the procyclicality properties of the margin model, isolated from other effects like portfolio change effect and free from assumptions on fixed-portfolio backtesting approaches.

Scope of product level backtesting disclosure

To facilitate industry discussion on margin procyclicality post-COVID, Eurex Clearing has decided to publish an additional data set with product level backtesting results for some of its top ETD future products and for EURO-Swaps of 4 different tenors.

The backtesting results cover single contract positions (both long and short) in the front-month future series for all ETD products in scope and payer and receiver fixed rate Swaps for all OTC contracts in scope. The additional data set contains a summary of aggregated product level results covering procyclicality and backtesting metrics for a one year and three-year lookback periods. Different backtesting windows are provided for each metric and for 1-day lagged P&Ls.

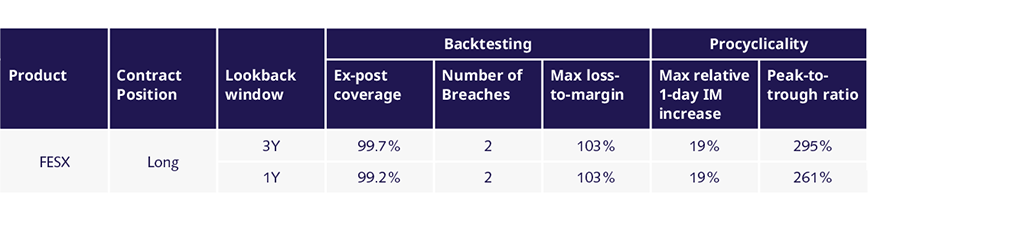

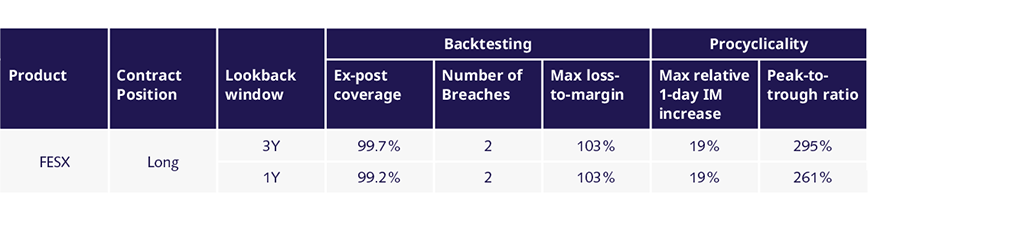

Example: Product level results for EURO STOXX 50® Index Futures (FESX)

This example shows backtesting and procyclicality results for a long position in the EURO STOXX 50® Index Futures front-month contract based on the product level data set. FESX is allocated to the Equity Liquidation Group.

- Product level Key-Performance-Indicators (KPI) against 1-day P&L are shown in Table 1 and can also be collected from the respective tab within the disclosed data set, for each reported product and position.

Table 1: Product level KPIs of long FESX front-month contract

- The additional over-time chart provided below (Figure 1), shows the margin coverage of the long FESX contract against 1-day returns.

Figure 1: Margin coverage of long FESX front-month contract

The two backtesting breaches reported for the long FESX contract are highlighted in the chart of margin coverage over time (see observations marked in red in Figure 1). Both occurred in March 2020 during the peak of the COVID-19 crisis. In terms of procyclicality, Figure 1 depicts the daily IM as percentage of notional) over the three-year backtesting period.

Explanations on the product scope and definitions of considered backtesting and procyclicality metrics can be found in the "Description" tab of the provided product excel file.

The above product view can be obtained for all the products listed in the product excel file. The length and content of the product list may differ between publications, with the latter depending predominantly on the traded volume observed.