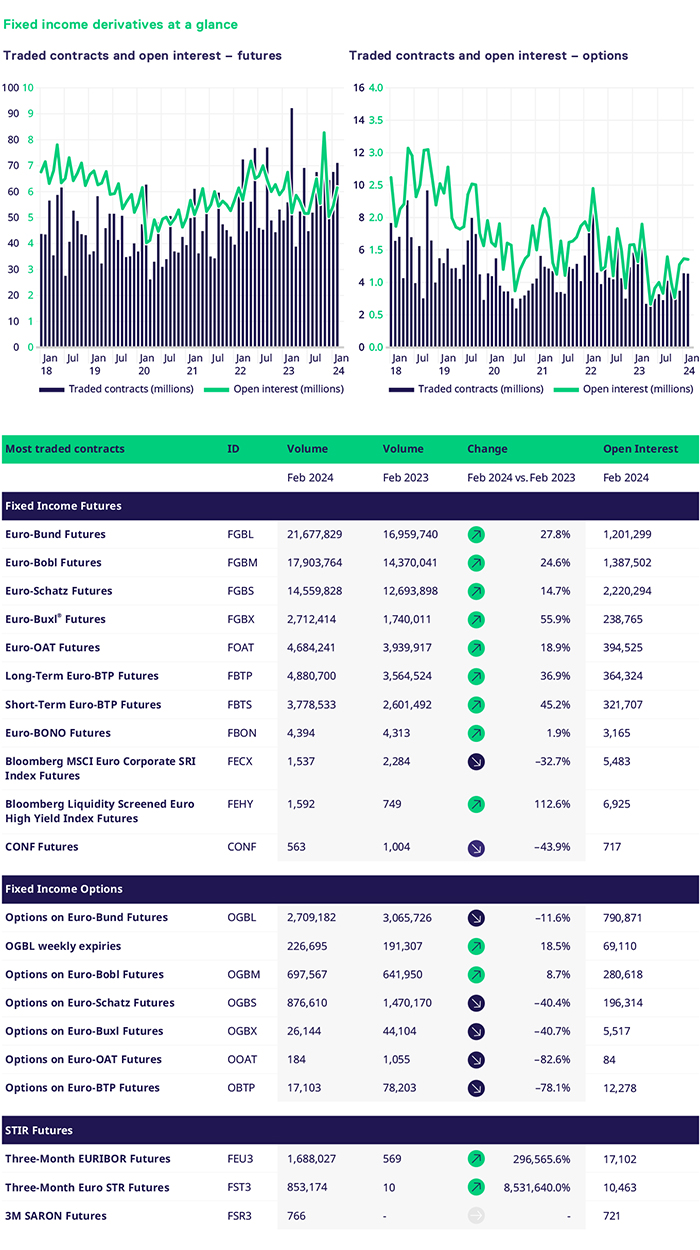

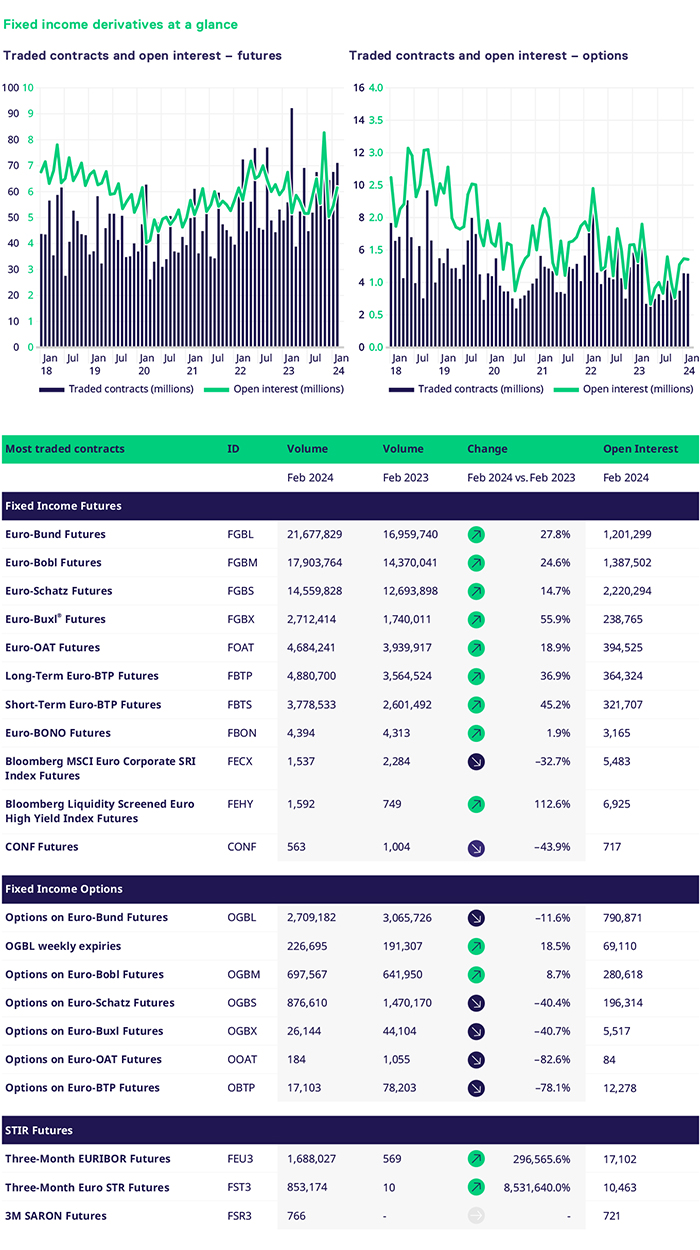

To a large extent, February benefitted from the spillover effect of January. Overall, volumes were strong across the board, especially in the futures space. Options volumes had pockets of light, but vol levels remained anchored, and there was little impetus to encourage vol to break out of tight ranges. The broader macroeconomic backdrop supports levels of elevated volumes and is likely to continue into quarter end. Europe looks attractive on several factors, which I expect will support our core franchise and help accelerate important new initiatives.

February was a busy month for the team, especially where new and nascent initiatives were concerned. In the credit space, we launched two new products, USD Emerging Markets Sovereign Debt and Sterling Corporate Bond index futures We have maintained that our ambition is to be the Global Venue for Credit Derivatives and the team is committed to executing on this. The addition of the two new futures is part of this ambition, and we will launch USD contracts in Q2. Credit is a segment where we believe being multicurrency makes sense. The team can take credit for the work done in this segment, and I am proud of the collective efforts made to take this to the next level from a volume perspective. What gives me confidence in the team is their focus, their interaction with clients and their dedication to truly understanding the clients’ requirements.

The STIR segment was always, and still is, a long-term project. Reflecting on the development to date, the whole team has done a stellar job. We are making progress with client readiness, bank support and liquidity provision. The foundations have been laid for a continuation of progress in Q2 and executing on our focus area of building open interest. What is really encouraging is the amount of client engagement across market participants. The team has been working on ‘tweaking’ elements of our approach to give us the best possible chance of success.

Looking ahead to Q2, there are lots of initiatives in the roadmap to be executed, which will support the business further and propel existing segments forward. I like the following quote from Brad Stulberg, author of ‘The Practice of Groundedness.’ Do not worry about being consistently great. Worry about being great consistently’. This is something that the team strives towards, and we are not complacent in our day-to-day efforts to build a world-class fixed income portfolio of products. We will no doubt make mistakes along the way, yet I have every confidence in the team to learn from these and deliver on our goals.

Lastly, I haven’t focused this update on the numbers, as they speak for themselves. You can see where we are performing well and where we can improve. I would like your input on what you would like to see in these updates going forward. What do you want to see more or less off? Writing has never been one of my strong points. Hence, I would invite our clients, members and liquidity providers to help me shape future editions.