As we end the year's final month, I think it is important to reflect on the progress made across the business. Not only the aspects that have had a positive impact but a deeper look into lessons learned, the focus areas for 2023 and a review of how we are collectively performing versus our medium-term goals. In short, are we where we want to be, and if not, what do we need to tweak to better position our business? Overall, the team has worked tirelessly throughout the year to keep initiatives on track, bring new products to market, develop nascent markets and design new products and services for our 2023-2025 roadmap. The team's collaborative effort, our internal stakeholders, colleagues across trading, clearing, risk, IT and members enabled the team to execute its roadmap. Yes, some initiatives have been pushed back to early 2023, but we are confident that we have positioned the portfolio to serve our clients' and members' needs into 2023. We may be a financial infrastructure business, but our people and members drive the initiatives forward. The team is excited by the announcement of the launch of ESTR futures and where we will evolve this segment. With this, I'd like to thank all of you who helped us throughout 2022.

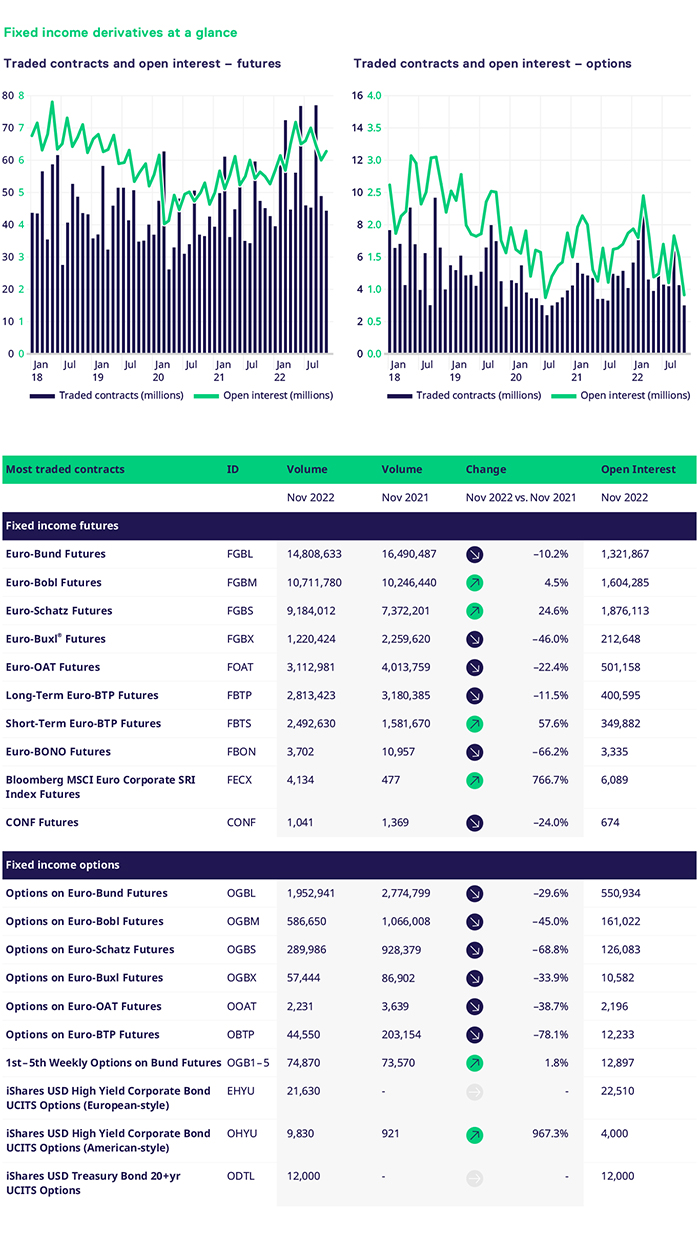

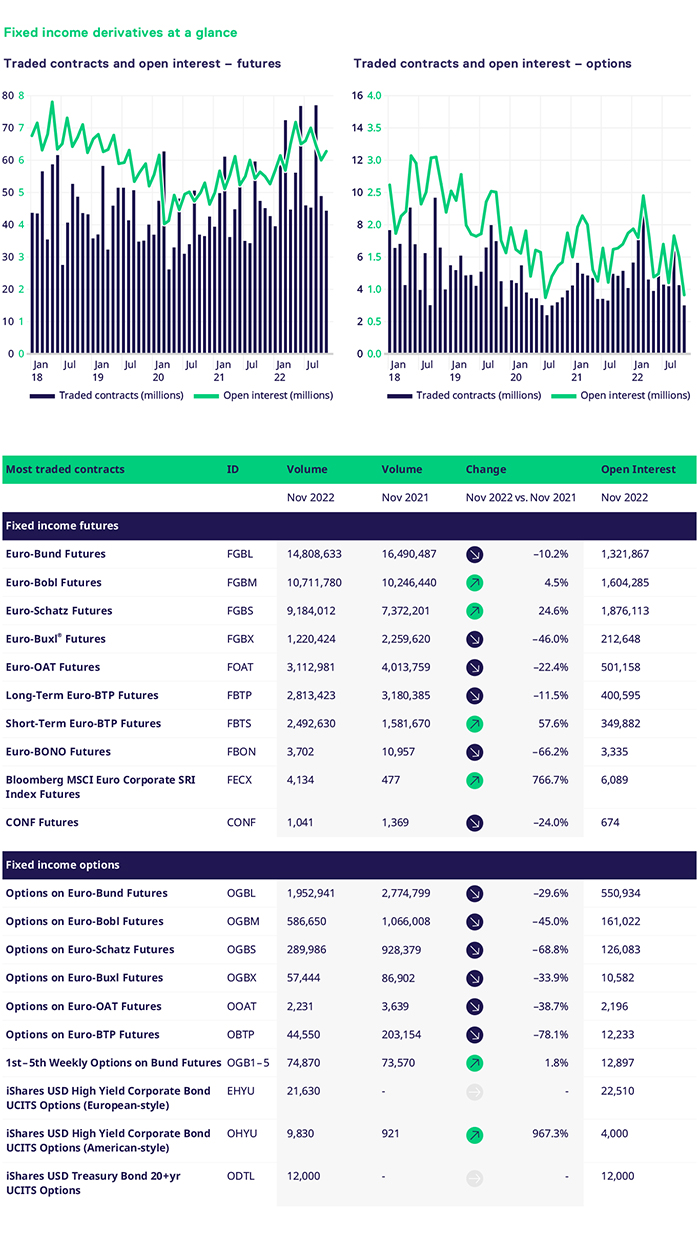

Overall, November was relatively benign, with volatility in a tight range. As a result, we saw pockets of liquidity in the futures portfolio. The front end and the belly of the curve continued to outperform in the German segment, with Schatz and Bobl volumes up 4.5% and 24.6%, respectively. The long end of the curve underperformed along with the 10y sector. Volumes in Buxl and Bund future were 10.2% and 46% lower versus the same period last year. Spreads continued to trade within tight ranges, which had a spillover effect on the 10y points in the French and Italian segments. The 2y sector of the Italian segment outperformed with volumes 57.6% higher, trading c.2.8m contracts. Outside of core rates, the Euro Corporate SRI Index futures traded c4.1k, which was 766% higher versus the same period in 2021, while Euro High Yield Index futures continue to build open interest and attract new users.

Broadly speaking, November was a challenging month for the options segment. Weekly Bund options continued to buck the trend, outperforming relative to the rest of the rates complex. Volumes were modestly 1.8% higher. The ETF options segment was November's bright light, with volumes across several of the underlying's. Emerging Market Bond ETF Options saw c21.6k contracts trade, High Yield and Corporate Bonds ETF Options saw 9.8k and 12k contracts trade, respectively. As we moved into December, the Treasury ETF has seen good volume development, which we will discuss in the review of 2022.

The trend in FX broke after the release of the weaker CPI Numbers in early November, with the USD suffering significant losses against all other G10 currencies. Ultimately, the FX segment turned into a solid month for us, driven by the USD/KRW currency futures pair trading 105.5k contracts. The other pairs saw a decline versus the same period last year with an unchanged open interest of c.80.000 contracts. The number of members and clients that are close to readiness for listed FX is a promising and exciting development, which will help us to accelerate volumes and liquidity in 2023.

November had several highlights; the team was in the Nordics meeting with clients and our partners to discuss the High Yield futures and ETF segment. This was well received with lots to follow up on. There was a roadshow in Madrid with our partners to raise the profile of the credit segment and a round table in Germany to discuss the FX segment's challenges and opportunities with our buy-side clients. This gives me confidence that we are on the right path. We are listening to our members, partners, and clients to bring products to market that serve their needs. To this end, I wish you all prosperous, joyful final weeks and look forward to speaking with many of you before the year is over.