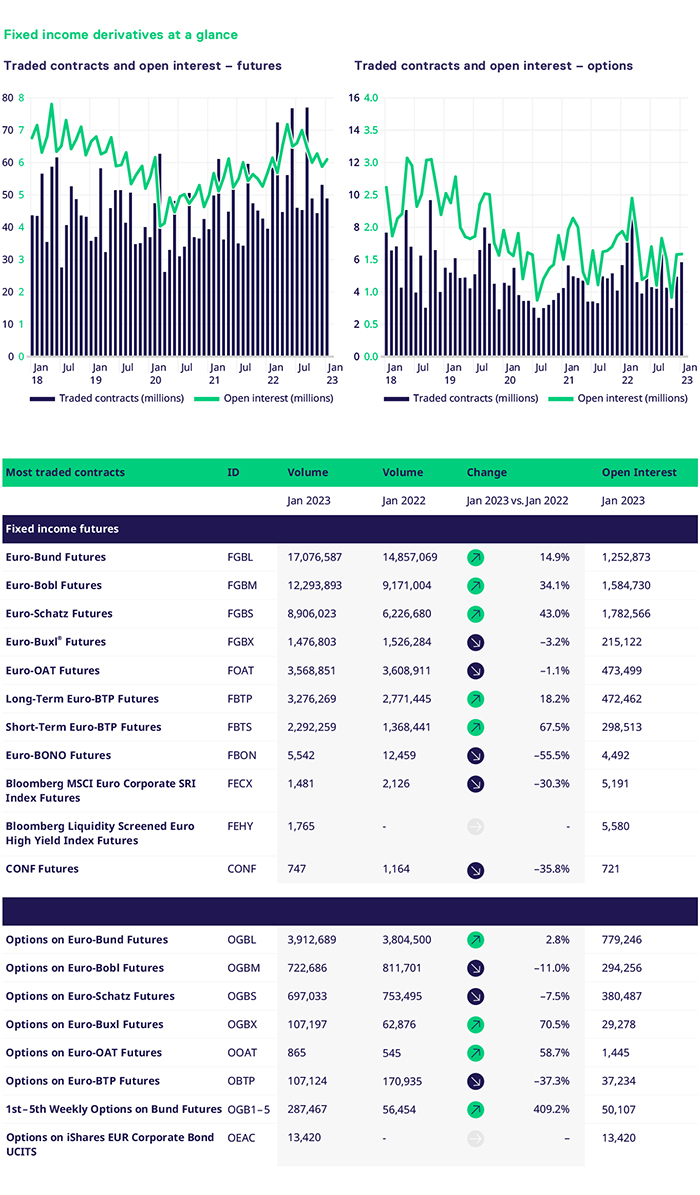

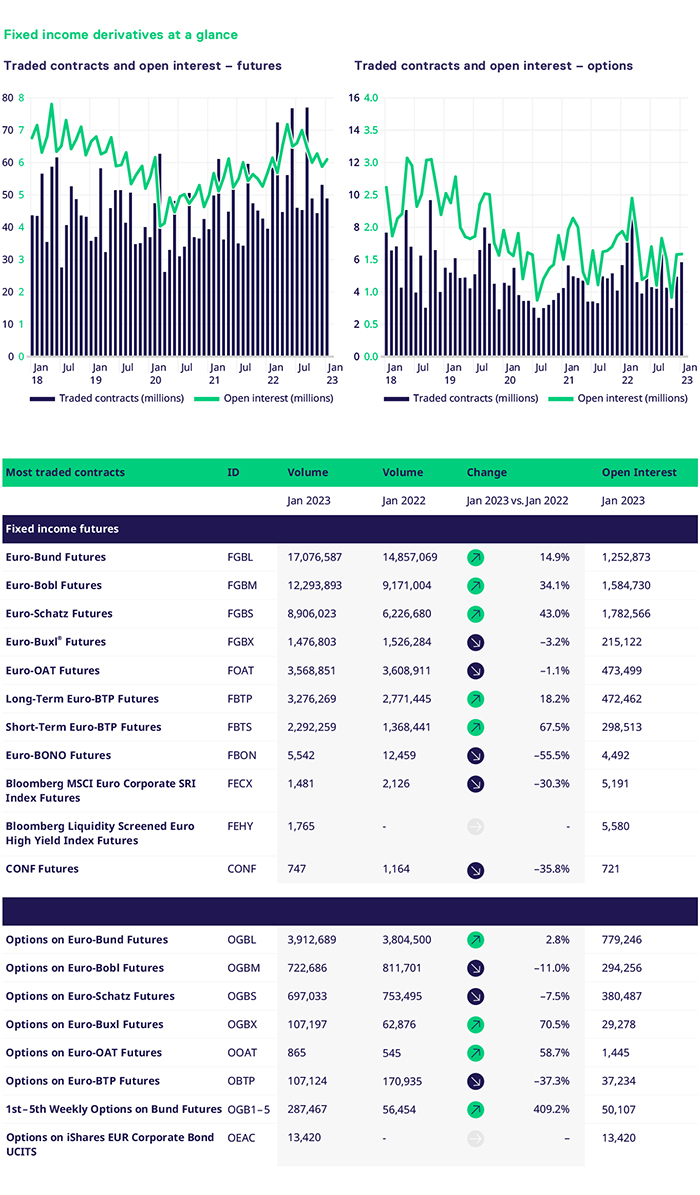

The tailwinds from 2022 continued into the start of 2023, with volumes higher across the Fixed Income and Currencies portfolio. The persistent higher-than-historical inflation weighed on markets, together with further Central Bank tightening that underpinned the rates and FX segments. Volumes in futures were 23.7% higher versus the same period last year, with options volumes modestly higher compared to January 2022 at 3.3%. In the FX space, the team worked closely with our members, clients and liquidity providers to ensure we maintained our momentum, which helped volumes grow by 83.4%. The team recognizes that we are building from a modest absolute base. However, we are focused on creating critical mass and committed to executing the medium-term strategy. That is, to be the incumbent exchange for Euro crosses and select markets. Like most businesses, we are not immune to potential headwinds, and we cannot be everything to everyone, but the team is focused on building a complementary, integrated product portfolio that enables clients to access alternative liquidity pools. The launch of ESTR futures further underscored this.

Our 2023 roadmap is comprehensive, and the team is working with all our stakeholders to bring the initiatives to market. Our focus is on building products and services that enhance the current offering, especially across the curve, and helping clients take advantage of tactical opportunities. Aside from bringing new products to market, it is important to develop the newly launched markets in line with our and our client's expectations.

Turning my attention to the core business: futures volumes continued to benefit from higher volatility in the front end of the curve, as well as event risk around the Fed and ECB. Bund, Bobl and Schatz volumes were 14.9%, 34.1% and 43% higher, respectively. The long end of the German curve saw a modest decline of 3.2% compared to the same period in 2022. The French segment traded c.3.56m contracts, 1.1% lower vs. Jan '22. The Italian segment continued to outperform, with volume growth in 10Y and 2Y BTP futures of 18.2% and 67.5%, respectively. The credit segment saw pockets of liquidity with the Corporate Bond SRI futures trading 1.4k and the Euro HY futures trading 1.7k. Open Interest in the Corporate Bond SRI stands at around 5.1k and 5.5k in the Euro HY.

Although implied volatility has been edging lower, options volumes remained solid. There were pockets of growth compared to last year's period, with Bund and Buxl options 2.8% and 70.5% higher. The long end was a benefactor of curve positioning and higher realized. Weekly bund options volumes continue to outperform relative to the rest of the complex, with a growth of 409%, trading c.287k. ETF options got off to a quiet start with 13.4k contracts trading.

Overall, the FX segment had a solid start, with volumes 83.4% higher. This was largely driven by USD/KRW, which traded c.77.8k contracts. €/$ and €/£ saw increases of 207% and 1486% compared to Jan '22. To further drive the block and EFP forward FX business, we will enable our clients to trade all currency pairs for free via off-book transactions by introducing a fee waiver for the entire first quarter of 2023.

In short, the business is off to a solid start. This is even more impressive considering the solid performance of 2022. The team is hopeful that we can maintain this momentum throughout Q1. I think we will be better positioned to evaluate the potential for the remainder of the year at that juncture. Importantly,

I am personally looking forward to engaging with clients, partners, members and liquidity providers in the weeks ahead.