It's the time of the month to review the performance of the business. I enjoy this part of the month as it allows me to reflect on its progress, bottlenecks, and planning for the months ahead. More importantly, it allows me to consider the impact our colleagues and members have had on our business. For me, this is the most crucial part of our business, our people, and our members. Both are equally integral to our success as they underpin our key initiatives. Nascent segments like ESG Derivatives continue to show progress, with further end clients becoming active throughout the month, which should help in the volume development. In short, a heartfelt thank you to all our colleagues, members and end clients who continue to help us build this important segment!

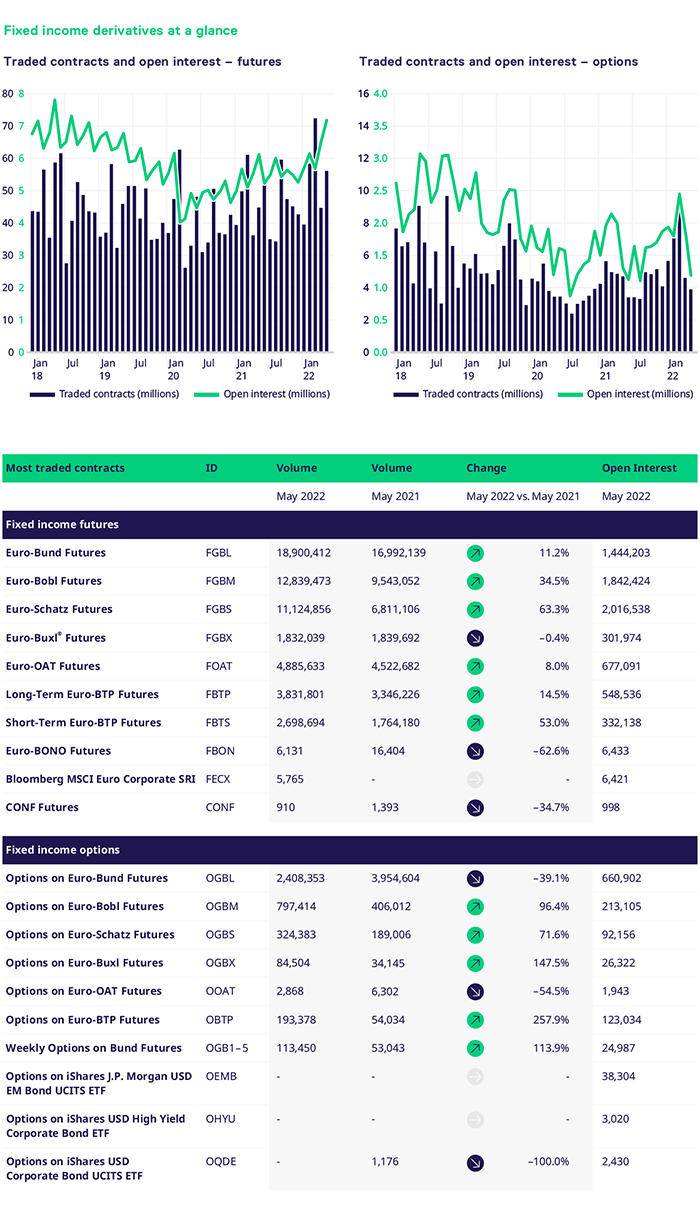

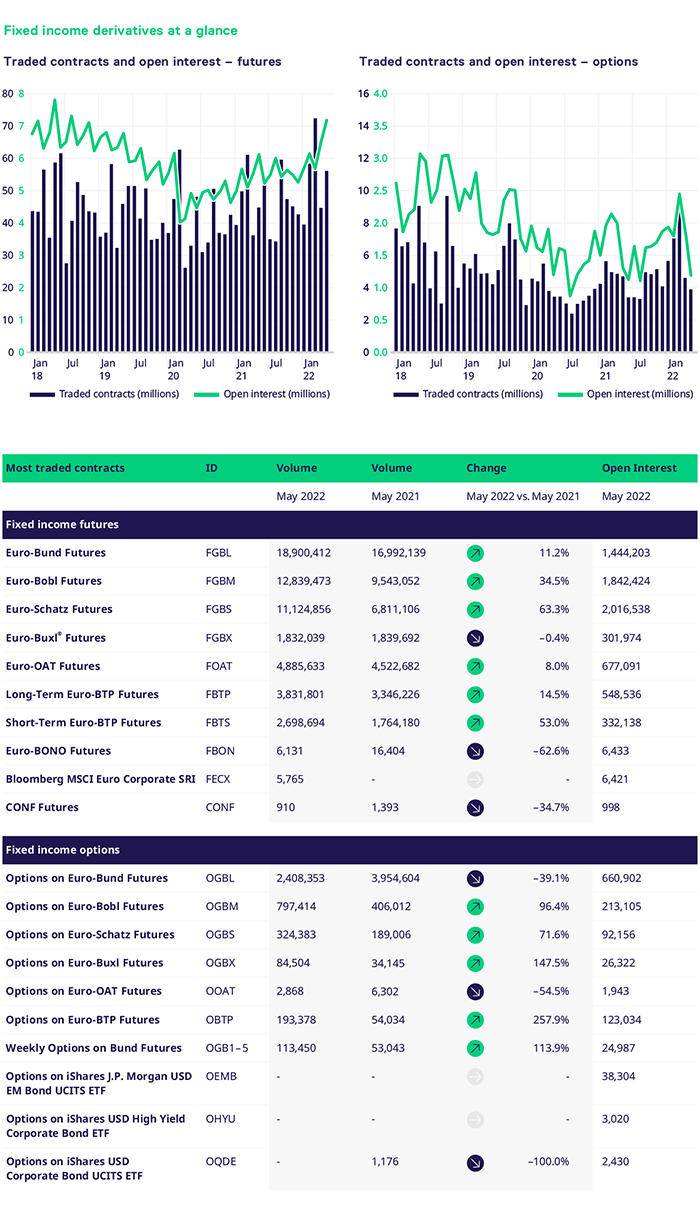

May was another solid month for the FIC business, with futures volumes 25.2% higher than last year's period. The core German segment performed strongly across the board, underpinned by the macroeconomic backdrop. Bund, Bobl and Schatz saw double-digit volume increases, 11.2%, 34.5% and 63.3%, respectively. The long end of the curve was flat versus the same period last year, with c.1.83m contracts trading in May. The Italian and French segments continue their positive momentum with 14.5%, 53% and 8% higher volumes. The front end of the Italian curve has been a strong outperformer throughout 2022.

As we moved into May, the macroeconomic backdrop was still supportive of our portfolio. Central banks across the globe are grappling with increasingly elevated levels of inflation at a time when voices are growing ever louder on recessionary concerns. The Fed is now debating how it best manages a 'soft or softer' landing for the U.S. economy. Considering the rhetoric around the factors mentioned, options volumes were well supported across the portfolio in May. The German segment outperformed except for the 10y, where Bund options saw a decline versus May 21, with c.2.4m contracts trading versus c.3.9m in May last year. On the other hand, weekly options on Bunds saw a significant increase in volumes of 113.9%, which continued into June. The belly of the curve and the front end saw a significant percentage increase, with Bobl volumes 96.4% and Schatz 71.6% higher versus 2021. Bobl and Schatz segments traded 797k and 324k contracts, respectively. The long end of the curve outperformed with an increase of 147.5%, rading 84.5k contracts.

In a reversal to April, the French OAT segment saw a decline of 54.5% in May and the Italian BTP segment saw a material increase of 257.9%, trading 193.3k contracts. The Italian segment has been performing strongly at the start of June, with ADV levels significantly above 2021 levels.

The team is busily working on the pipeline of initiatives in our roadmap. We have welcomed back the listed FX offering into our area, which I am confident will continue to grow. Our team has been working closely with our colleagues across the business and our members to activate and onboard new clients, which should help accelerate volumes in the coming months. To this end, a warm thank you to everyone working with us on our initiatives to bring them to life. June is already shaping up to be a solid month, with pockets of real growth emerging. Our members and clients make this happen.