Aug 30, 2022

Eurex

Equity Index Derivatives: Amendments to the Contract Specifications for FTSE 100 Declared Dividend Index Futures and for Index Total Return Futures

1. Introduction

The Management Board of Eurex Deutschland took the following decisions with effect from 5 September 2022:

Amendments to the Contract Specifications for Futures Contracts and Options Contracts at Eurex Deutschland (“Contract Specifications”) regarding:

|

|

|

This circular contains all information on the updated sections of the relevant Rules and Regulations of Eurex Deutschland.

Implementation date in production: 5 September 2022

2. Required action

Trading Participants are recommended to pay close attention to the information included in the attachment and analyze the potential impact in their own technical systems. Therefore, it might be necessary for Trading Participants to update their internal processes and technical interfaces to adapt for this change.

3. Details

A. Introduction of quarterly expiries in FTSE 100 Declared Dividend Index Futures (FTDD)

The expiration cycle available for FTDD will be amended such that additional quarterly expiries are introduced (for September and March) and that going forward expirations covering the next three quarters in the March, June, September and December cycle are always available at Eurex Deutschland.

B. Amendments to the Contract Specifications regarding Exchange for Physicals – Index (EFP-I) levels for related index futures

Removal of the specific provisions for FTSE 100 Index Futures and EURO STOXX® Select Dividend 30 Index Futures when transacted in relation to an EFP-I trade. Upon removal of the specific provisions the level applicable to these contracts for EFP-I will revert to the default of 1/10 the size of the Minimum Block Trade Size of these futures.

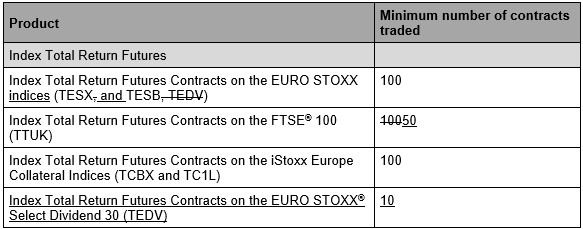

C. Amendments to the minimum number of contracts for Block Trades (MBTS) and for Trade-at-Market transactions (TAM) for FTSE 100 Index Total Return Futures and EURO STOXX® Select Dividend 30 Index Total Return Futures

The following changes will apply in relation to MBTS and TAM levels of Index TRFs on FTSE 100 (TTUK) and EURO STOXX® Select Dividend 30 (TEDV), respectively:

Please refer to the Attachment for the amendments to the Contract Specifications. The full version of the updated Contract Specifications for Futures Contracts and Options Contract at Eurex Deutschland will be published as of the implementation date on the Eurex website www.eurex.com under:

Rules & Regs > Eurex Rules & Regulations > 03. Contract Specifications

Attachment:

- Updated sections of the Contract Specifications for Futures Contracts and Options Contracts at Eurex Deutschland

Further information

Recipients: | All Trading Participants of Eurex Deutschland and Vendors | |

Target groups: | Front Office/Trading, Middle + Backoffice, IT/System Administration, Auditing/Security Coordination | |

Contact: | Elena Marchidann, Equity & Index Product Design, tel. +44-207-862-72 65, elena.marchidann@eurex.com; Lorena Dishnica, Equity & Index Product Design, tel. +44-207-862-72 42, lorena.dishnica@eurex.com; Stuart Heath, Equity & Index Product Design, tel. +44-207-862-72 53, stuart.heath@eurex.com | |

Web: | www.eurex.com | |

Authorized by: | Randolf Roth |