Key Benefits

- Exposure to the difference between implied versus realized volatility

- Create fungibility with futurization

- Allow users to expand their equity portfolio hedging strategies

- Give firms greater price transparency through a centralized order book

- Mitigate risk with Eurex Clearing as the central counterparty

- Expanded functionality and minimal latency on our leading T7 trading architecture

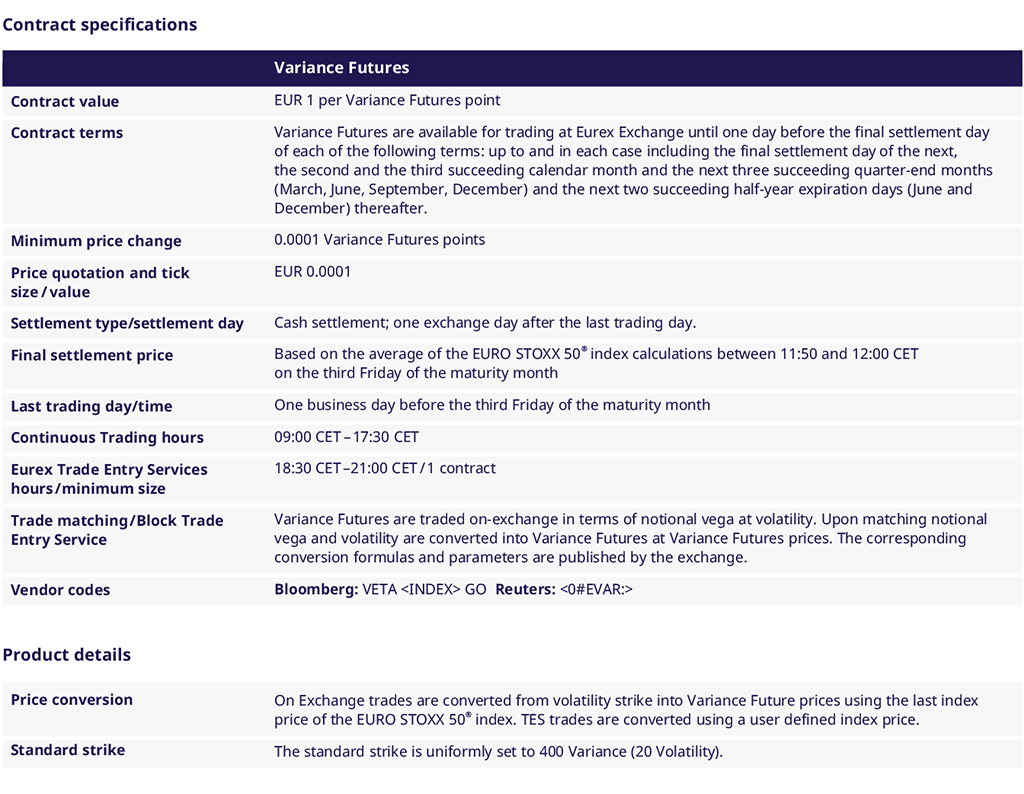

Contract Specifications

Clearing

- Variance Futures are converted from Notional Vega into a quantity of Variance Futures and from Traded Volatility Strike into a Variance Futures Price

- The conversion takes place in real time

- The Realized Variance that is required for the conversion from Volatility Strike into Variance Futures price is updated upon trade match in the Order Book with the last price of the Euro Stoxx® 50 index

- TES transactions (block trades) are converted with the update of the Realized Variance by a user defined index price