Key Benefits

- Trade select liquid futures during the Asia, Europe and the U.S. time zones

Eurex's trading hours create trading and hedging opportunities for global market participants

01:00 CET - 08:00 CET (Asian hours)

08:00 CET - 17:30 CET (European hours)

17:30 CET - 22:00 CET (U.S. hours)

- Spread trading opportunities

Euro-Bund vs JGB

Euro-Bund / Euro-Schatz vs ASX 10s and ASX 3s

and more

- Exchange-traded benefits

Important exchange-based trading, clearing and risk management functionalities help to reduce counterparty risks and increase margin efficiencies

Trading Hours

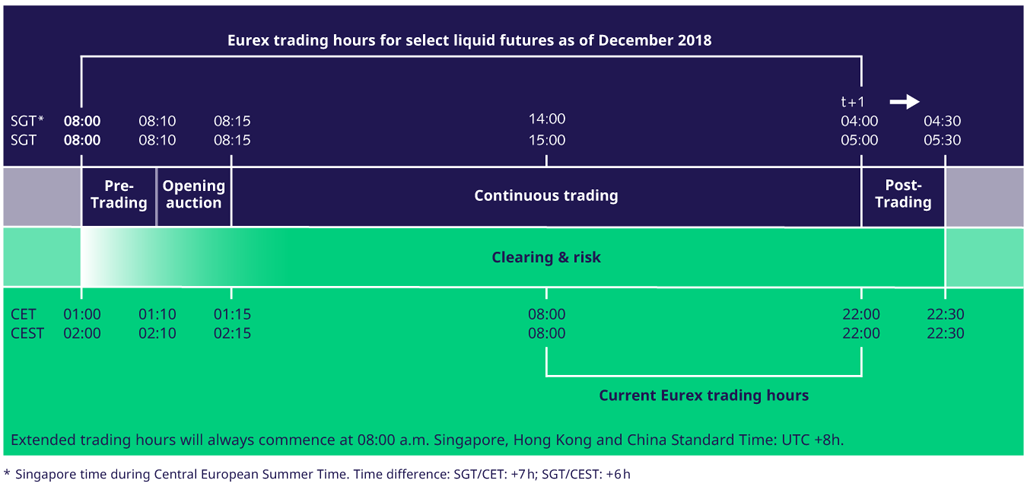

The trading system T7 is available daily from Monday to Friday at 1.00 a.m. CET (2.00 a.m. CEST). The markets will close at 22.00 CET, and the Eurex Clearing C7 is available through 22.30 CET.

Products

Global benchmark products available in all time zones