Key Benefits

- Internationally recognized German benchmark product

Blue-chip index for the German stock market – one of the most liquid derivative products at Deutsche Börse - Access to Germany

Gain exposure to the top German stocks such as Daimler, Allianz, Volkswagen, Adidas, Deutsche Bank and SAP - Price transparency

Compelling alternative to the OTC market due to its price transparency benefits - Exchange-traded benefits

Important exchange-based trading, clearing and risk management functionalities help to reduce counterparty risks and increase margin efficiencies - Trading and clearing across all time zones

Extended trading hours create more trading and hedging opportunities for market participants in all time zones - Asia, Europe and the U.S. - Variation of DAX indices

The DAX index family also consists of specific category indices such as Manufacturing, Technology and Dividend

Market Prices

Contract Specifications

Click on the Eurex product code to view further contract details, such as price charts and trading parameters.

Min. Price Change | Product ID | Trading Hours | Maturity / Expiration Months | |

Points | Value | |||

1 | EUR 25 | 01:10 –22:00 CET 02:10 – 22:00 CEST | Up to 36 months: The next twelve quarterly months of the March, June, September and December cycle. | |

0.1 | EUR 5 | 08:50 –17:30 CET 09:50 –17:30 CEST 08:50 –19:00 CET | Up to 60 months: The three nearest successive calendar months, the ten following quarterly months of the March, June, September and December cycle thereafter and the two following annual months of the December cycle thereafter. | |

Click on the Eurex product code to view further contract details, such as price charts and trading parameters.

Min. Price Change | Product ID | Trading Hours | Maturity Months | |

Points | Value | |||

1 | EUR 5 | 01:10 –22:00 CET 02:10 – 22:00 CEST | Up to 36 months: The next twelve quarterly months of the March, June, September and December cycle. | |

Click on the Eurex product code to view further contract details, such as price charts and trading parameters.

Min. Price Change | Product ID | Trading Hours | Maturity / Expiration Months | |

Points | Value | |||

1 | EUR 1 | 01:10 –22:00 CET 02:10 – 22:00 CEST | Up to 9 months: The three nearest quarterly months of the March, June, September and December cycle. | |

1 | EUR 1 | 08:50 –17:30 CET 09:50 – 17:30 CEST | Up to 12 months: The three nearest successive calendar months and the three following quarterly months of the March, June, September and December cycle thereafter. | |

Click on the Eurex product code to view further contract details, such as price charts and trading parameters.

Min. Price Change | Product ID | Trading Hours | Maturity / Expiration Months | |

Points | Value | |||

5 | EUR 5 | 07:50 –22:00 CET 08:50 – 22:00 CEST | Up to 9 months: The three nearest quarterly months of the March, June, September and December cycle. | |

0.1 | EUR 0.1 | 08:50 –17:30 CET 09:50 –17:30 CEST 08:50 –19:00 CET | Up to 24 months: The three nearest successive calendar months, the three following quarterly months of the March, June, September and December cycle thereafter, and the two following semi-annual months of the June and December cycle thereafter. | |

Click on the Eurex product code to view further contract details, such as price charts and trading parameters.

Min. Price Change | Product ID | Trading Hours | Maturity / Expiration Months | |

Points | Value | |||

0.5 | EUR 5 | 07:50 –22:00 CET 08:50 – 22:00 CEST | Up to 9 months: The three nearest quarterly months of the March, June, September and December cycle. | |

0.1 | EUR 1 | 08:50 –17:30 CET 09:50 –17:30 CEST 08:50 –19:00 CET | Up to 24 months: The three nearest successive calendar months, the three following quarterly months of the March, June, September and December cycle thereafter, and the two following semi-annual months of the June and December cycle thereafter. | |

Click on the Eurex product code to view further contract details, such as price charts and trading parameters.

Min. Price Change | Product ID | Trading Hours | Maturtiy / Expiration Months | |

Points | Value | |||

0.05 | EUR 10 | 01:10 –22:00 CET 02:10 – 22:00 CEST | Up to 9 months: The three nearest quarterly months of the March, June, September and December cycle. | |

0.01 | EUR 2 | 08:50 –17:30 CET 09:50 –17:30 CEST 08:50 –19:00 CET | Up to 24 months: The three nearest successive calendar months, the three following quarterly months of the March, June, September and December cycle thereafter, and the two following semi-annual months of the June and December cycle thereafter. | |

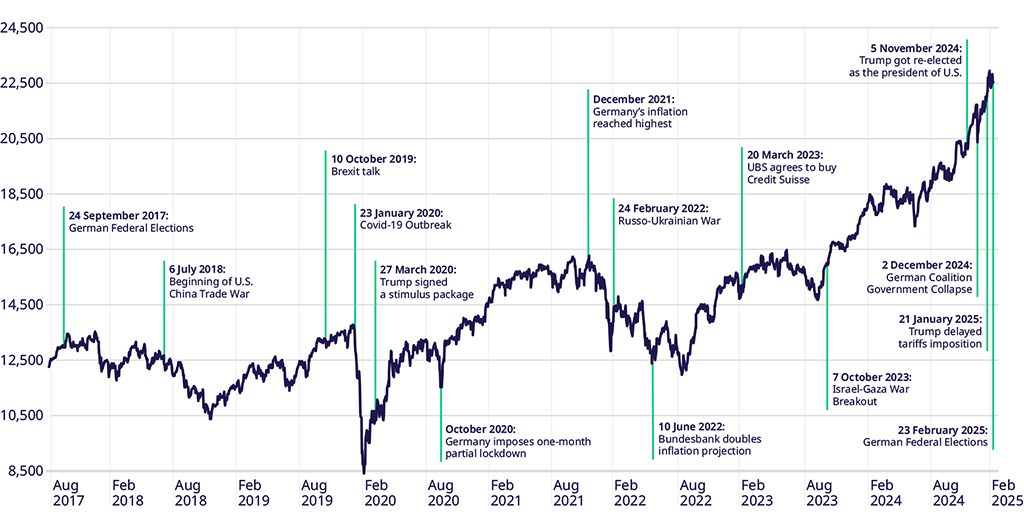

Historical Price Movements

Source: Eurex (updated as of 4 April 2025)