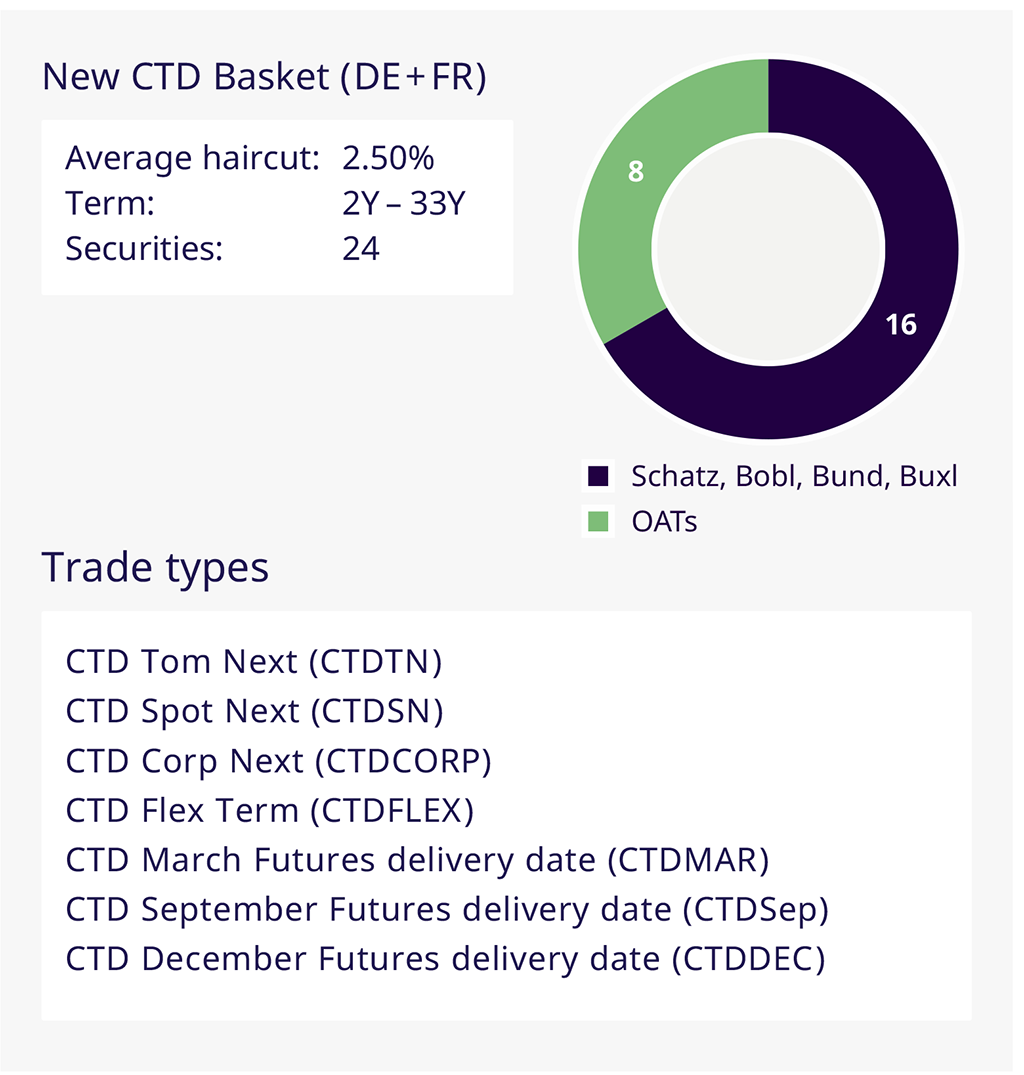

CTD Basket at a glance

- Applicable futures products

Bund, Bobl, Schatz, Buxl, OAT. - Basket scope of futures deliverables

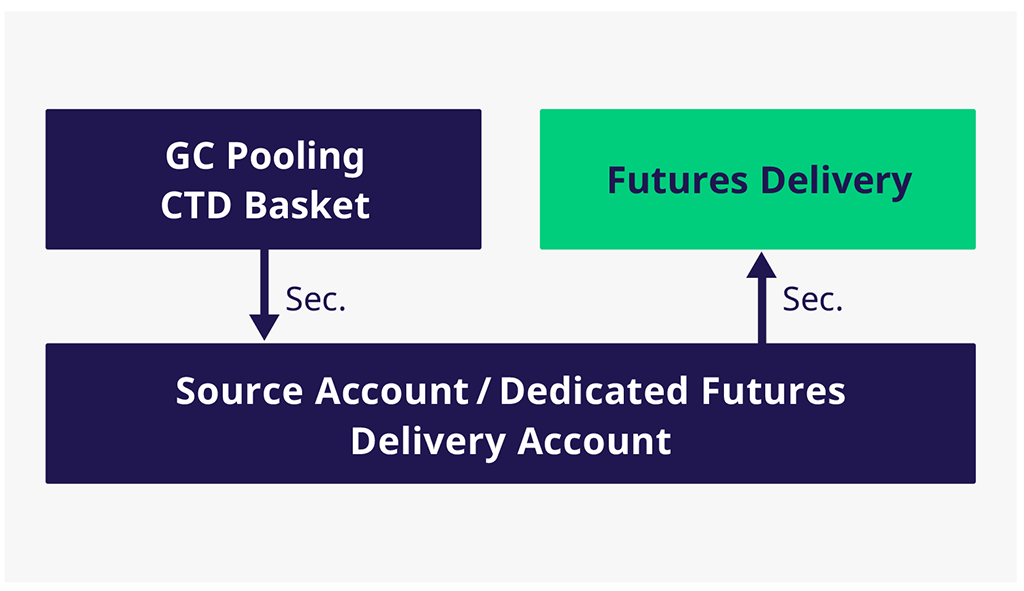

Automatically updated in case of an inclusion or exclusion of a deliverable security enabling continuous trading until delivery day. - Ring-fenced basket

Collateral is ring-fenced in the GC Pooling environment. - Re-use not allowed

Re-use of the received collateral will not be allowed. The collateral giver/cash taker will be able to substitute collateral - Early settlement at 07:00 a.m.

All trades in this basket will settle early on the Front leg and the Term leg and will be nettable on the basket level ensuring in-time delivery - Attractive repo rates

Rates for cash providers are likely to be more attractive

Optimized Trading Types