Jan 26, 2026

Eurex | Eurex Clearing | Eurex Repo

GC Pooling: buy-side access, volume growth and deepening liquidity as the ECB changes course

This article presents the case for how buy-side firms can benefit from Eurex cleared repo markets in practical terms. It evaluates current conditions in Eurex Repo’s GC Pooling for buy-side investors, considers the internal and external obstacles to adoption, and the market forces suggesting that cleared repo is an important addition to any liquidity and risk management program. In 2026, key themes in funding and financing will focus on the ECB’s new approach to providing liquidity, which will affect all market participants and may lead to a sharp increase in repo activity.

With no mandates for repo clearing in Europe, central counterparties (CCPs) must compete on the merits of their access models, cost efficiencies and operational ecosystems to draw in participants. At Eurex, buy-side firms in 2025 have shown their engagement to access liquidity, better pricing or risk diversification. This is an important development for the growth of European capital markets and comes at the same time that the European Central Bank (ECB) is changing its perspective on the provision of liquidity across the eurozone.

The historical demand for repo CCPs on the buy-side has been based on price improvement and operational efficiencies. Dealers have additional benefits by clearing their repo transactions with lower capital costs due to balance sheet netting opportunities and lower RWA. The thinking has been that dealers should share some of their gains with their clients. In practice however, sometimes dealers pass on these economic benefits and sometimes not. Why then should buy-side firms entertain CCP participation?

Buy-side participation in GC Pooling is growing and the reasons go beyond price improvement to include benefits in liquidity and operational efficiency, as well as access to a variety of bespoke access models. Rather than working to squeeze all buy-side entities into one operating arrangement, Eurex is looking at the heterogenous buy-side the way it actually works, and is responding in kind.

The numbers show that this approach has had positive results. Buy-side participation in GC Pooling now stands at about 10% compared to interdealer business at 90%, according to Eurex, with the majority of business coming from cash providers like corporates and pensions. Michael Jahn, Global Product Lead for Repo D2C, says that “GC Pooling access models have successfully changed some of the culture in Europe that used to prefer unsecured short-term investments.” Over 170 institutions, including corporate treasurers, now use the marketplace on a daily basis as direct Eurex clients.

While variety works, multiple access models mean that both dealers and clients do not always know the right path to access the markets. An excess of cash providers is a great outcome, but the market also needs collateral providers such as commercial and investment banks, hedge funds and others looking for financing to balance out liquidity. Meanwhile, major regulatory shifts are still on the horizon.

GC Pooling’s rapid growth in 2025

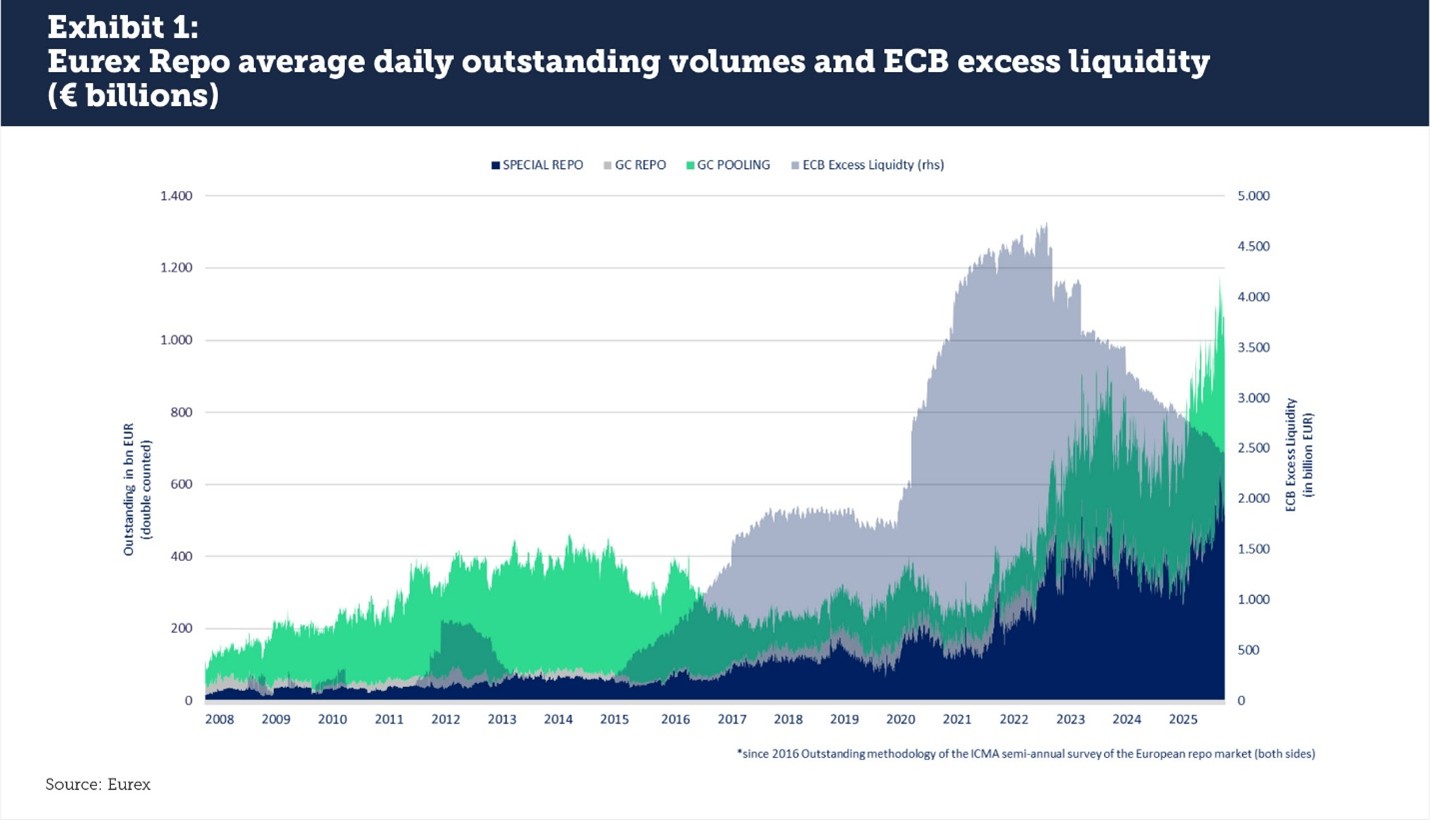

Eurex’s cleared repo markets have had a big year, primarily driven by GC Pooling, which reached an all-time high of €1.2 trillion in total daily outstanding volumes in 2025 (see Exhibit 1). There is a long-standing pattern that, as ECB excess liquidity declines, European repo volume increases, and this held true in 2025 as well. Year-over-year, GC Pooling volumes were up 35% from 2024 while the repo segment grew by 12 %. Overall growth across all segments has been about 22%.

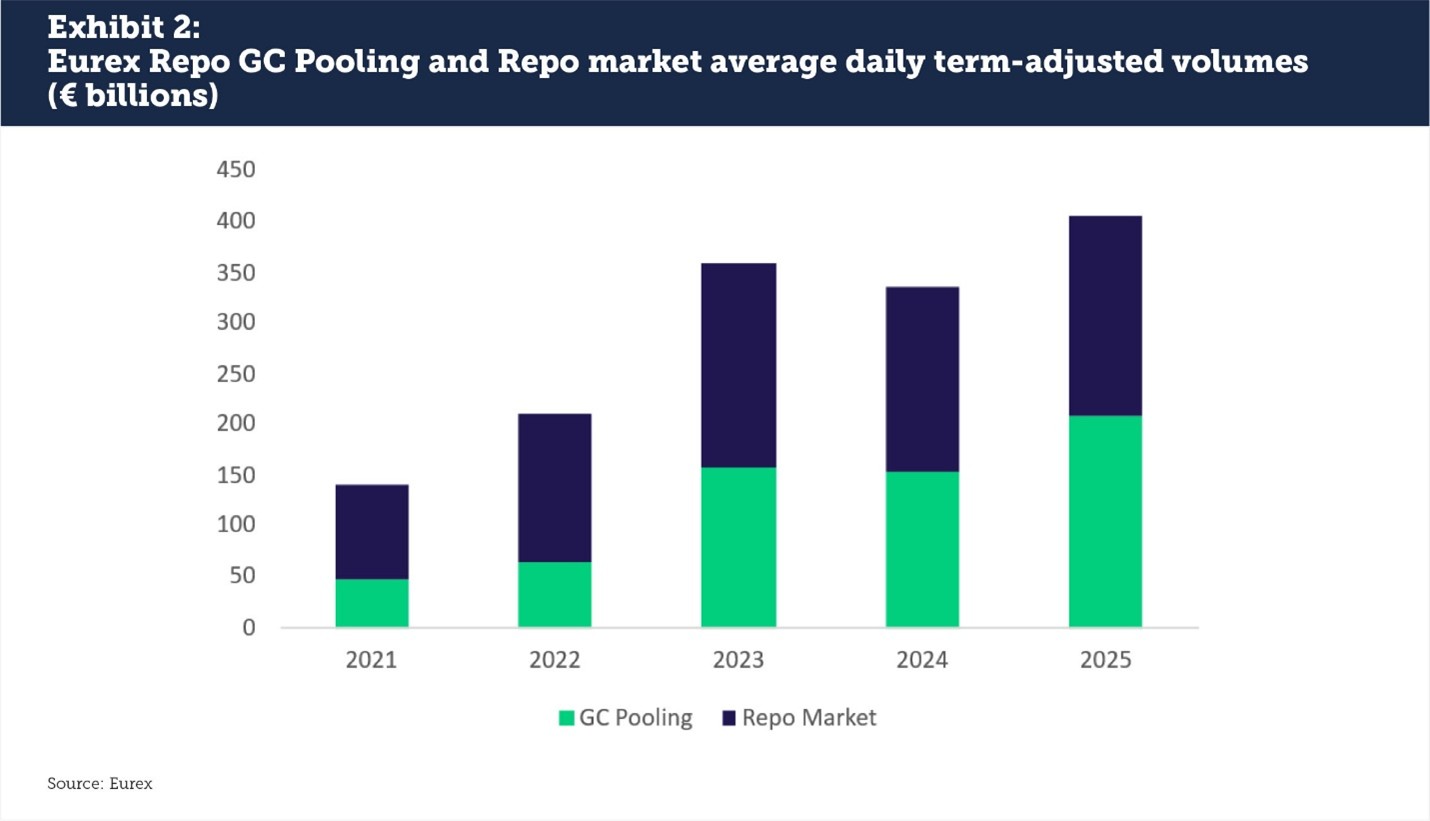

GC Pooling growth has outpaced the repo segment for the last five years, showing both the importance and attraction of this segment for market participants (see Exhibit 2). In 2021, Repo Market trading activity was almost double that of GC Pooling, with average daily term-adjusted volumes at €92 billion versus €48 billion respectively. In 2024, the gap was narrowing, at €154 billion for GC Pooling vs. €183 billion for the Repo Market, a difference of 16%. In 2025, GC Pooling averages were €209 billion compared to €197 billion for the Repo Market; GC Pooling was 6% higher than the Repo Market segment and for the first time in almost ten years, exceeded it in terms of average daily term-adjusted volumes.

GC Pooling for both overnight and term trades has become a regular fixture of European financing markets, driven by the benefits of a broad liquidity pool and clearing that offers balance sheet benefits to regulated entities. As European market participants’ views of funding and financing evolve and more financial activities gravitate towards market-based financing instead of private secured or unsecured lending, GC Pooling has taken on a greater importance in financial services infrastructure.

Matching the access path with the client type

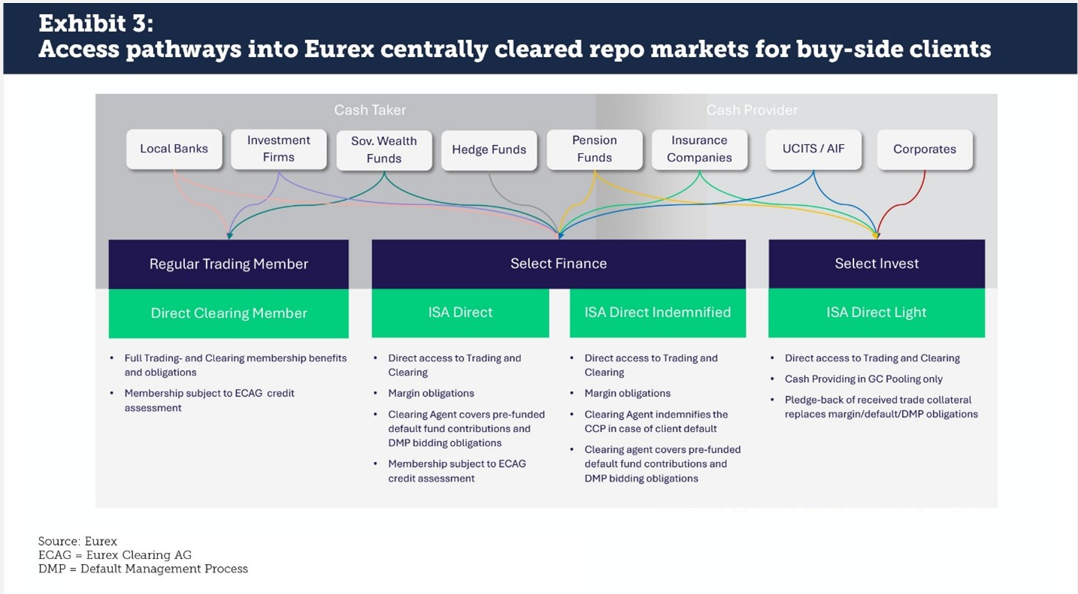

European repo clearing is complicated by a diversity of regulatory regimes surrounding each type of buy-side firm. There is not one all-encompassing model that can accommodate the eight main investor types. In response, Eurex Repo has created three broad access categories with four specific investor models (see Exhibit 3).

- Regular Trading Member: This works best for commercial banks and Sovereign Wealth Funds that have credit standing and ability to manage their own clearing membership obligations.

- Select Finance: This model is supported by a Clearing Agent that manages CCP-related activity and can be used by local banks, investment firms, Sovereign Wealth Funds, hedge funds, pensions, insurance companies and Undertakings for Collective Investment in Transferable Securities (UCITS) funds. Select Finance has two variations: ISA Direct and ISA Direct Indemnified. The difference is in the role of the Clearing Agent and whether the client’s CCP membership is subject to Eurex’s credit assessment.

- Select Invest: As an “ISA Direct Light model”, Select Invest is best suited for cash providers and provides access to Eurex’s GC Pooling platform for insurance, pensions and corporates. The client has no margin obligation but rather engages in a pledge-back of collateral to meet the CCP’s risk management criteria

Simplifying market access

Eurex Repo’s vision for buy-side participation is to make signing on a plug-and-play activity that aggregates custodians, sponsors, regulatory reporting and market access. This has been a historical challenge in Europe as multiple actors have been required to support client clearing, and not all may be ready at the same time.

To further simplify market access for buy-side clients, Eurex has introduced a new “custodian model” in partnership with State Street. Under this framework, State Street handles account openings and key operational functions for smaller buy-side clients, reducing the onboarding complexity and operational burden. In addition, ABN AMRO Clearing successfully launched its agency repo clearing model with the first client transactions completed in Eurex Repo markets in Q4 2025.

Katja Renner, Eurex Repo Sales Lead for Buy Side, says that “we have worked to make the go-live process as easy as possible. All the pieces are now in place for any buy-side firm to join the cleared ecosystem. Our next step is increasing accessibility for smaller pension funds and corporates, and outreach to money market funds and hedge funds.”

Launching into 2026

The biggest impact on Eurex Repo’s market in 2026, and European repo in general, will continue to be the actions of the ECB. According to Isabel Schnabel, ECB Executive Board Member, the central bank is changing its provision of liquidity from a supply-driven model to one that is demand-driven. This is expected to sharply increase the utilization of repo as a funding mechanism in the eurozone, as cleared repo creates a market-based solution for accessing funding and creates arbitrage opportunities against ECB funding.

In a November 2025 speech, Schnabel outlined the new approach as a way to remove excess ECB liquidity from financial markets and to use these tools as a means of managing interest rates; this is a welcome change for private sector actors after years of Quantitative Easing and collateral scarcity. Going forward, the ECB will provide liquidity as a marginal unit as part of Quantitative Normalization (QN). This is not a liquidity backstop, and it’s expected repo rates will rise until banks see greater value in sourcing ECB liquidity based on a 15 bps spread between the ECB’s Main Refinancing Operations and the deposit rate.

The QN policy ends the expectation that banks should turn to the ECB for liquidity first and markets second, if at all. This is an on-demand view on providing liquidity versus asset purchases, the latter of which tie up reserves for a longer period and may unintentionally create excesses in the monetary system.

According to Carsten Hiller, Eurex Repo Sales Lead for Sell Side, “the ECB’s change in perspective means that more market participants will need to seek funding in the repo markets. Eurex Repo is responding by working to ensure that as many market participants as possible can access our infrastructure and liquidity platform.” There are echoes as well of the Federal Reserve’s Standing Repo Operations that aim to provide just-in-time liquidity to banks when repo rates reach above certain ceilings, and where the combination of balance sheet costs and fees are greater than the Federal Reserve’s offer.

Concurrently, government debt levels are expected to continue to rise in the eurozone, creating more financing demand. Analysis by Amundi shows that net European debt issuance will rise by 5% in 2026 with the “free float” rising by 8%. Most of this will be in short-term debt as governments take advantage of lower interest rates to retire longer-dated debt. While issuing short-term debt to pay off long-term debt creates a potential future trap if interest rates rise before debt is repaid, this duration management trend is on the rise globally. More debt means more assets to buy and more required financing.

Market participants will also of be working on major regulatory changes, including T+1 and mandatory clearing in the US. While Eurex is supportive of US clearing efforts, there are greater hesitations about Europe adopting a mandatory framework. In a May 2025 white paper, Eurex noted that:

Unlike the US and UK, the European government bond repo market is heterogeneous in terms of domestic issuers and fragmented in terms of trading, clearing, and settlement infrastructure…. We are also acutely aware that with regulatory mandates, market participants have substantial development and implementation costs and divert scarce resources from new product initiatives and market innovations.

Eurex’s stance is that a European mandate at this time would “put the cart before the horse” and may lead to damaged liquidity without careful adjustments to other regulations and support for voluntary clearing as a starting point.

There are good reasons to expect that 2026 will bring greater changes to European repo markets and increased demand for clearing. Eurex continues to invest in its access models to support a broader range of investor types and is already engaged in conversations with hedge fund collateral providers about their participation. Both dealers and clients are advised to stay up to date with the latest changes from the ECB, their counterparties and infrastructures across the marketplace.

By Josh Galper, Managing Principal, Finadium

This article was commissioned by Eurex and first published on Finadium on January 22, 2026.