VSTOXX® Futures (FVS) August Update

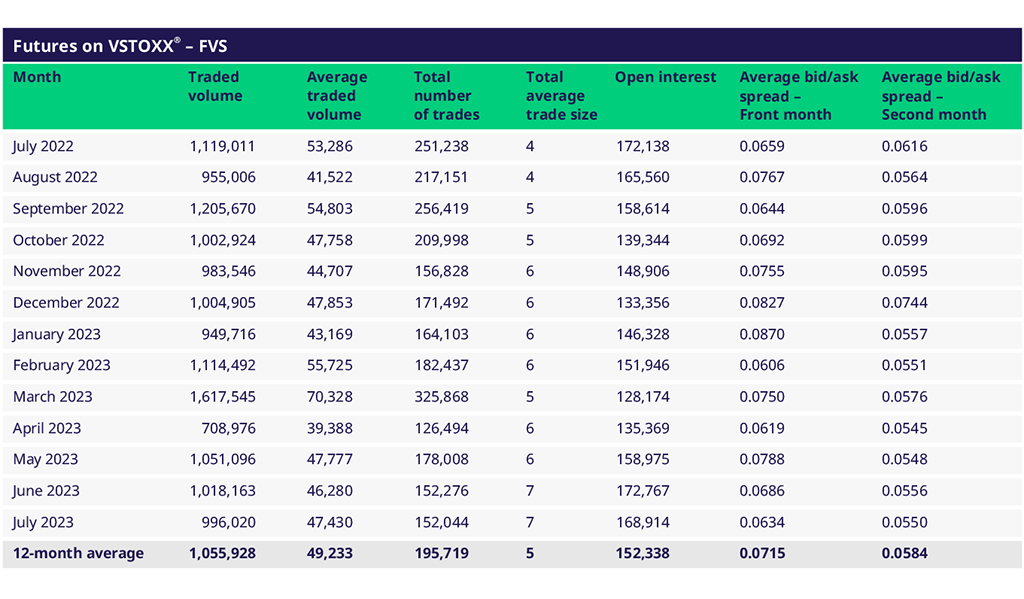

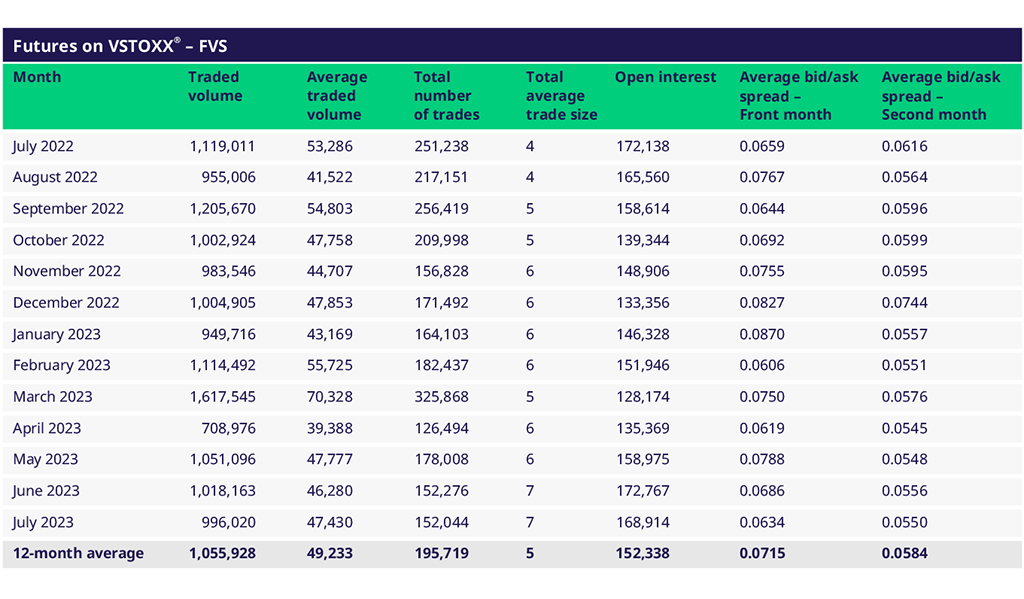

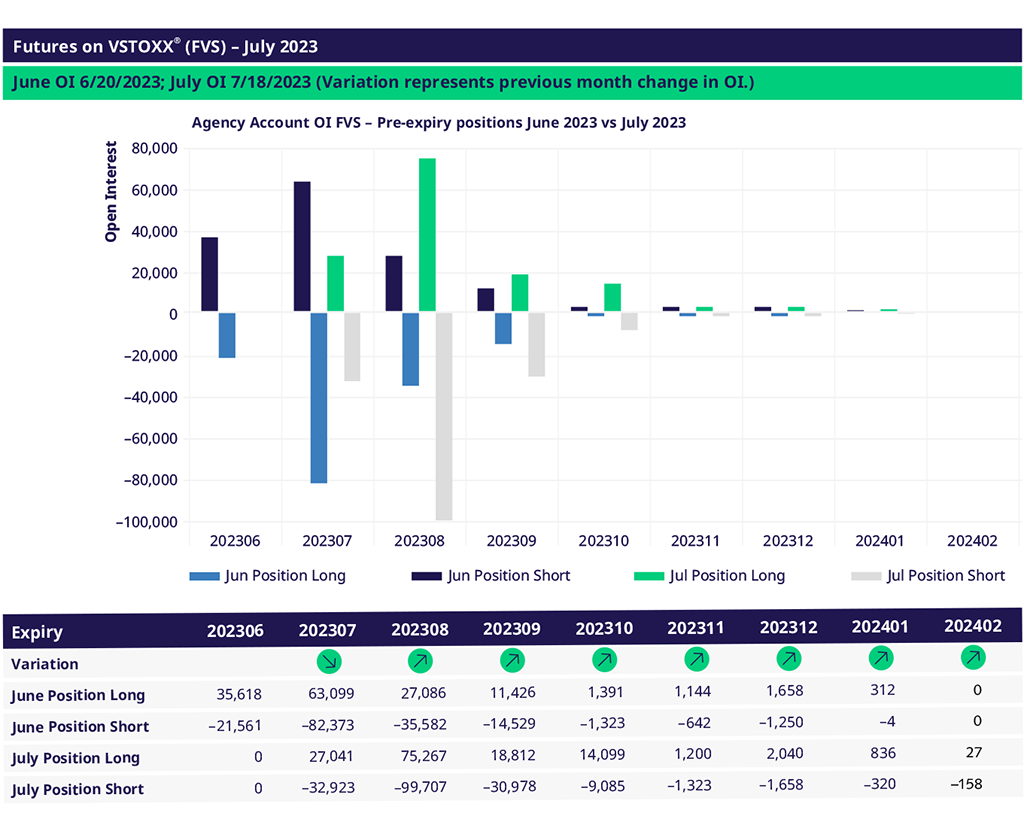

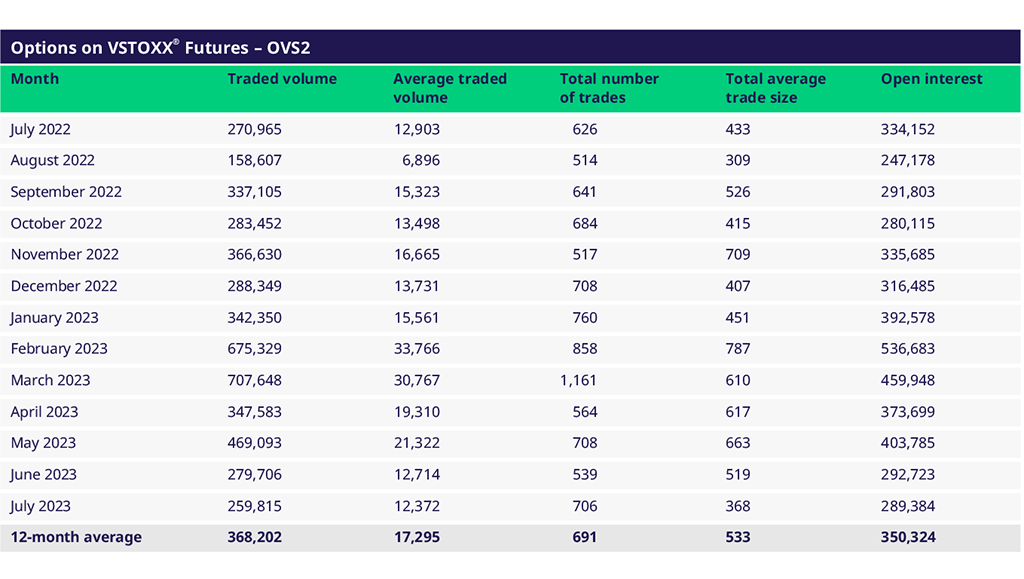

Trading activity in VSTOXX futures keeps trending sideways since May. The lower volatility levels overall dampened the trading activity in July. The VSTOXX spike to 20 in the beginning of August sparked trading again. Open interest moved also sideways between June and July.

Most active day was 6 July with 97K lots traded.

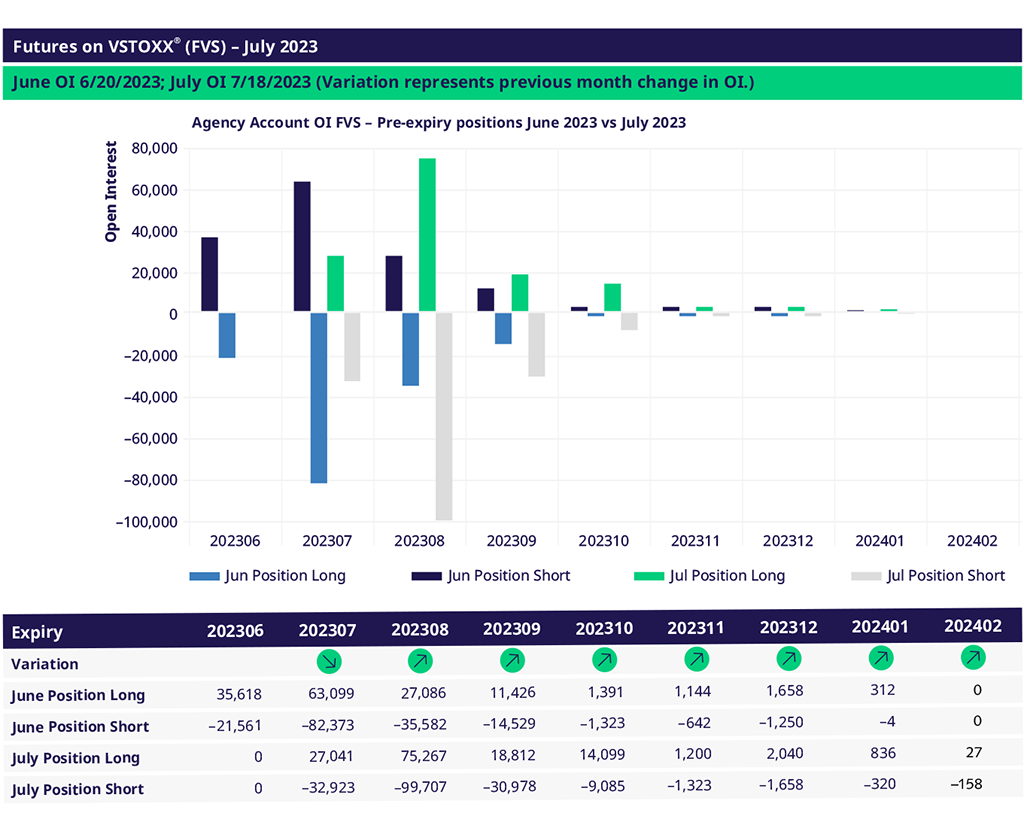

End clients increased their short positions in August and September. End clients bought and sold equivalent amounts of contracts, except for September were they bought more than they sold.

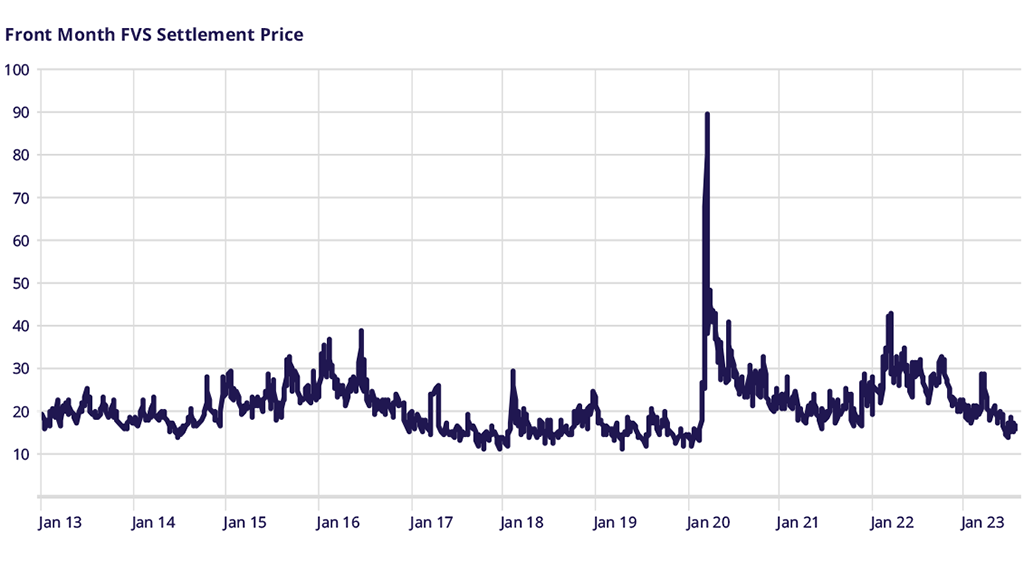

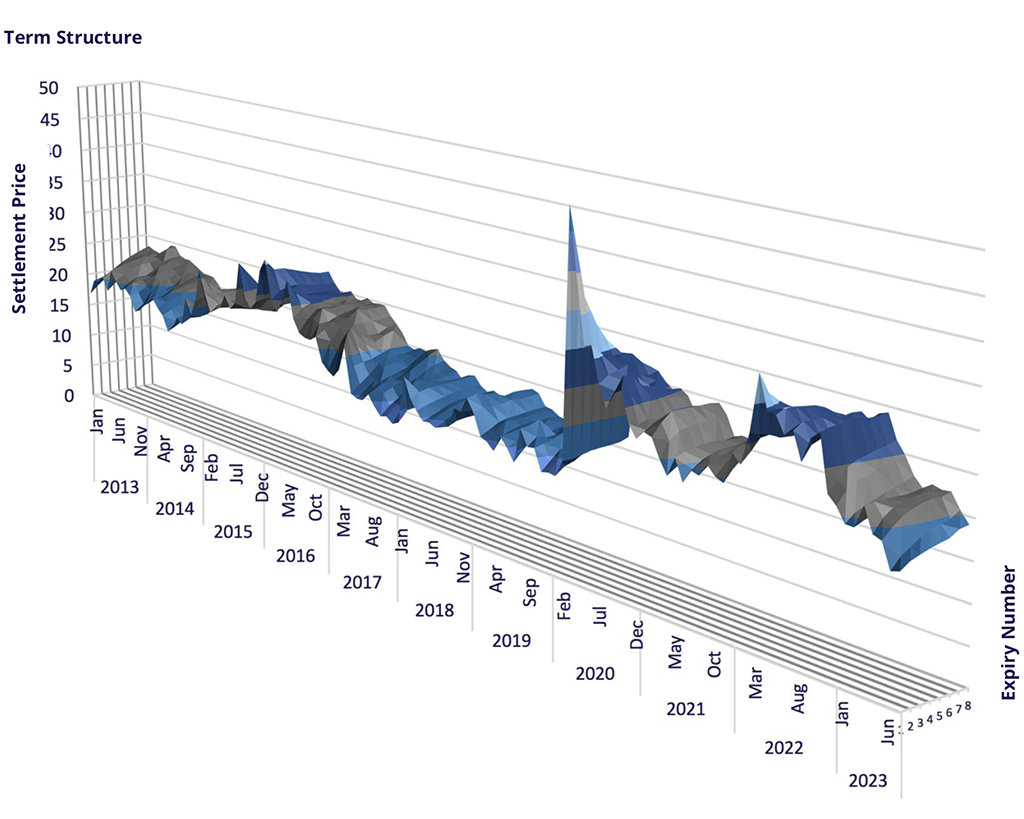

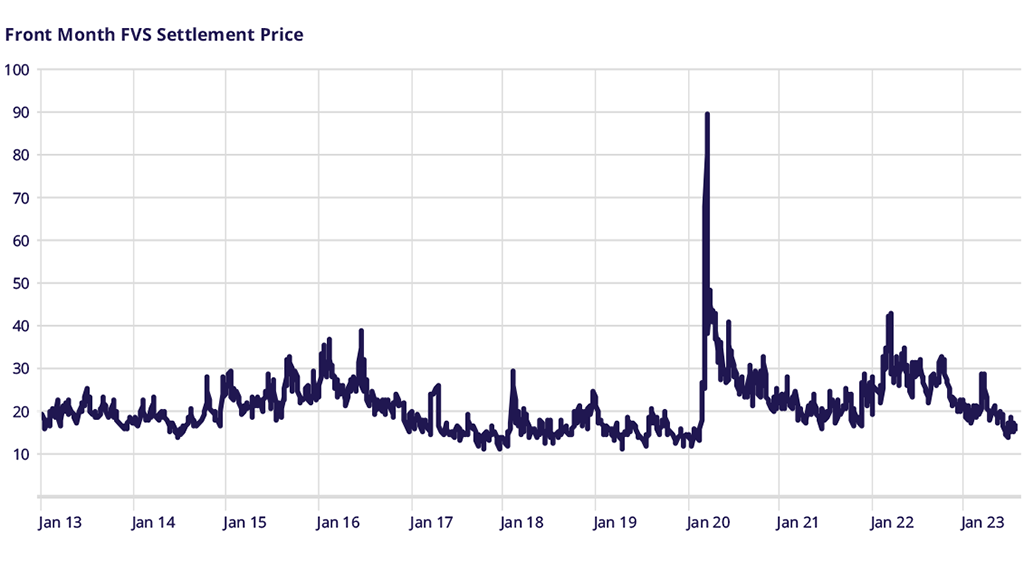

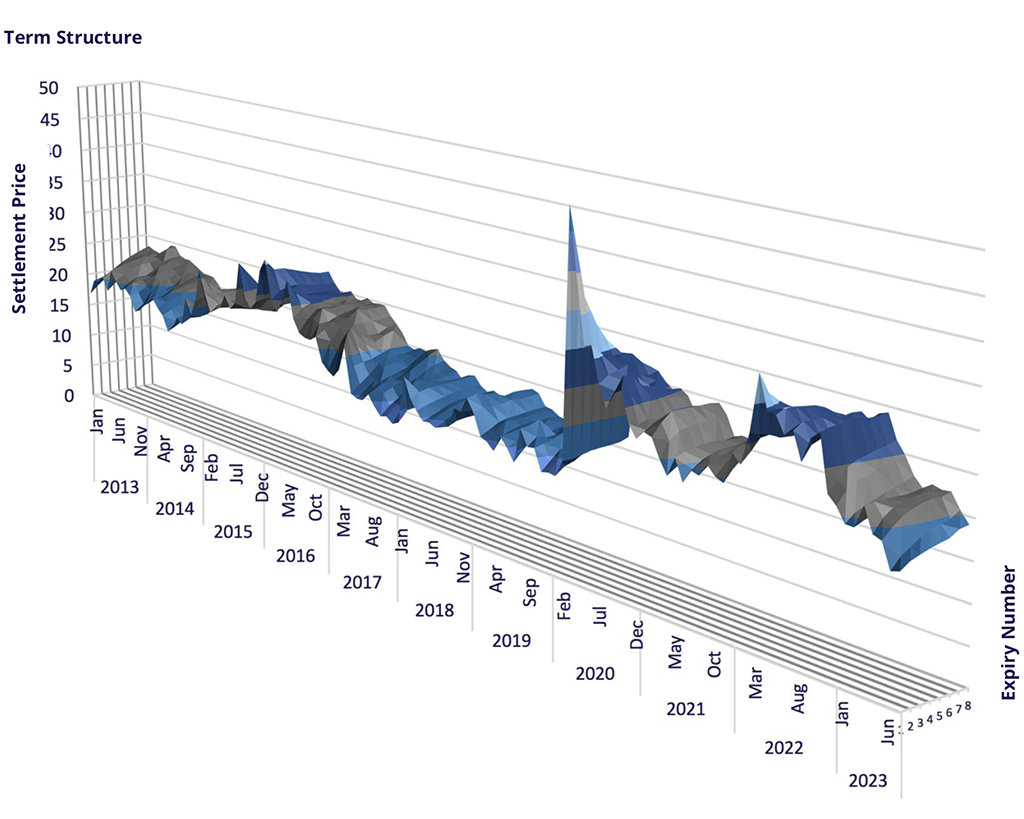

The VSTOXX index moved around 15 in July with a brief spike up to 18 on 7 July. It quickly returned to 15 levels and remained there until 3 August when it spiked again to 20. The term structure went a little steeper to 1 point between front- and last expiry (after 0.5 points last month). December already shows the usual dip that reflects the lower number of trading days around Christmas.

Overall, direction of trading, positioning and the term structure do not point to an expectation of higher volatility in the near term.

The EURO STOXX 50® index realized 14.52 volatility between June VSTOXX and July EURO STOXX expiries. Versus a Final Settlement price of the VSTOXX futures in June of 13.21, the volatility risk premium was negative 1.31 vol points. After 2.56 (May/ June) and 7.61 between April and May.

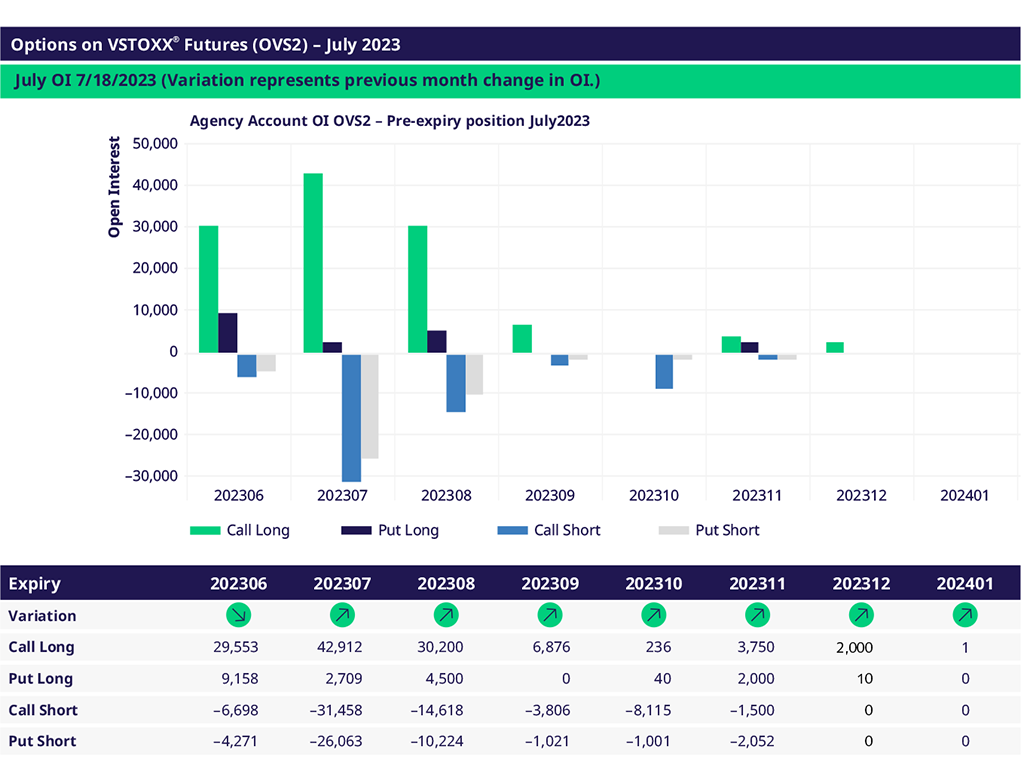

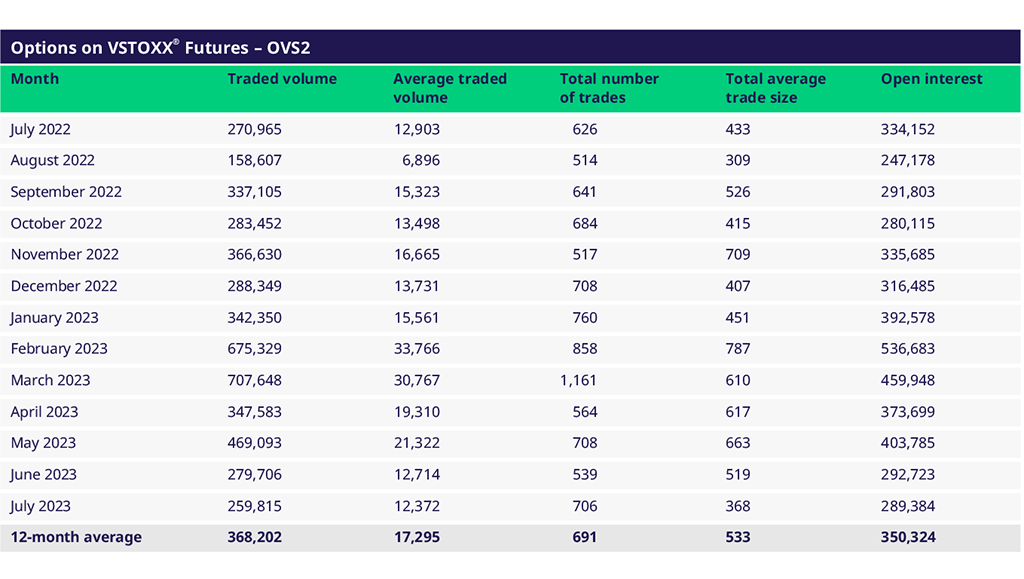

Options on VSTOXX® Futures (OVS2) August Update

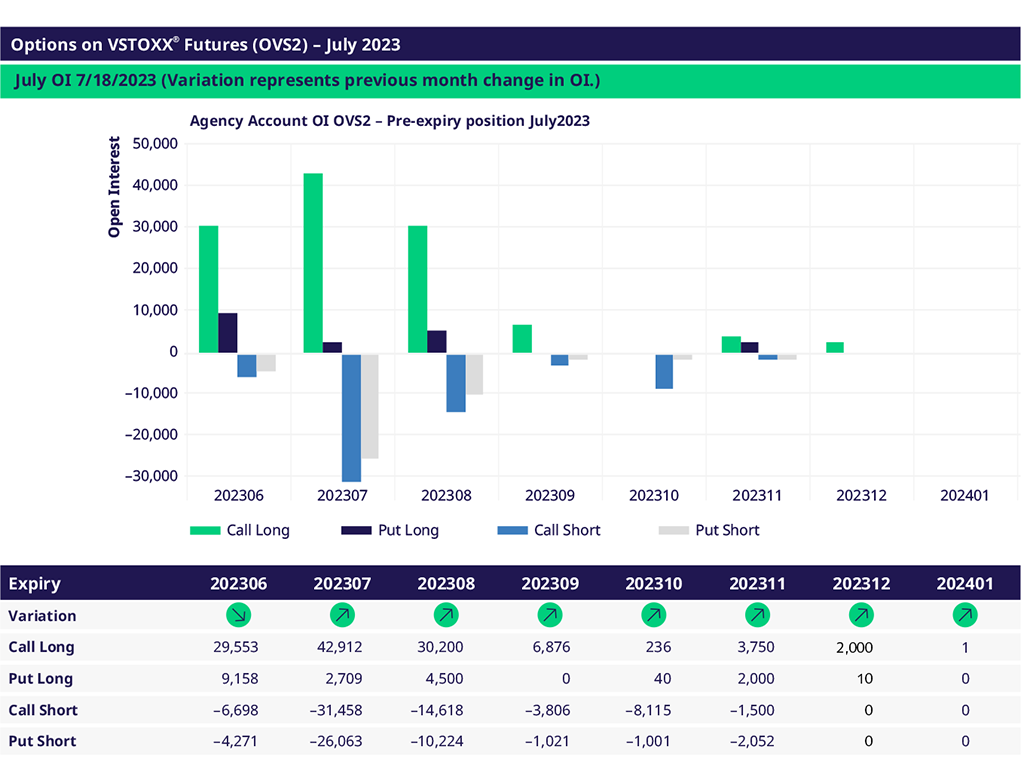

Trading activity in the options remains subdued. VSTOXX around 15 and no upcoming event don’t spark the need for macro hedges. The positioning in the futures corresponds to the modest activity in the options. Most active day was 12 July with 46K lots traded.

Also, the trading behavior is now in line with the futures: end client sold more calls and bought more puts. In previous months, they were still net buyers of calls and net sellers of puts.

In the beginning of August, end clients are still long call and short put. The trading activity in July has reduced this exposure, though.

For more information, please visit the website or contact:

Americas: Eugen Mohr or T +1 312-544-1084

Europe: Matthew Riley or T +44 (0) 207 8 62-72 13