Dec 19, 2023

Eurex

VSTOXX® Monthly Update December 2023

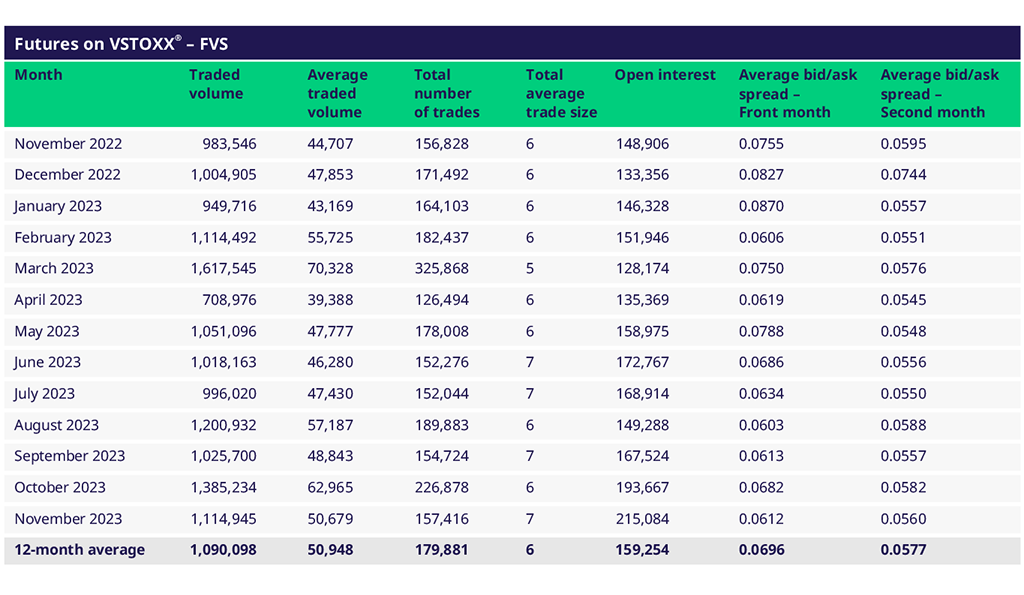

VSTOXX® Futures (FVS) December Update

After a very busy October, VSTOXX® Futures retreated in November to their average daily volume for 2023. The most active day was 14 November, with 114k lots traded. Trading in VSTOXX® Futures calmed down a little bit in the second half of November. The Open Interest remains at higher levels, well above 200k. Clients hold on to their positions rather than trading in and out.

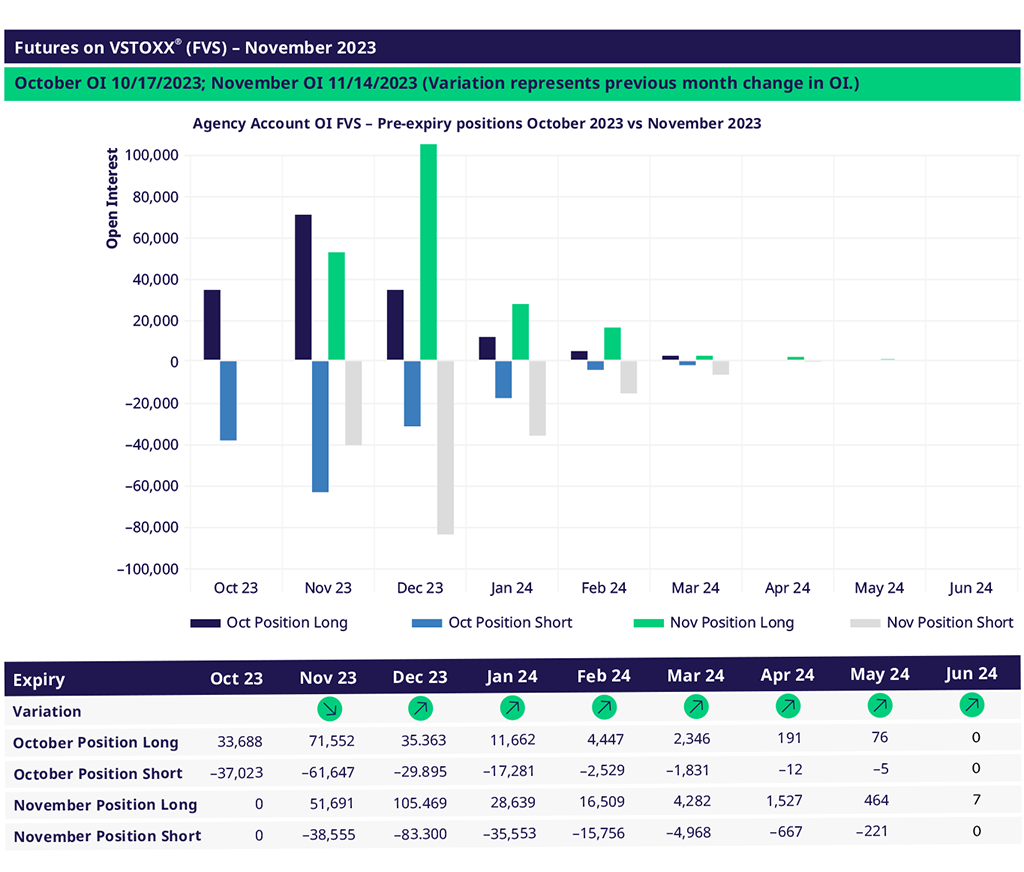

End clients bought and sold equivalent amounts of futures in November across all expiries. They sold a few more November futures and bought a few more in JAN to APR.

Since the September expiry, end users gradually changed their positions from net short to net long. Since the October expiry, end clients further increased their net long exposure in the front month from 10k to 30k futures. On 8 December, they were long DEC, slightly short JAN and FEB and slightly long MAR. Most of their overall position is in the December expiry with 30k net long.

The VSTOXX® fell, almost gradually, from 23 points on 20 October to 14 over the course of November and into December. The term structure went further into Contango with 4 points between the front- and last expiry (after 2.3 points last month and 1.5 in October). The gap between DEC and JAN is quite high, with 1.7 index points. The time decay of the January EURO STOXX 50® options gets bigger as we approach the Christmas bank holidays. This translates into a higher discount in the December VSTOXX® Futures.

The EURO STOXX 50® Index realized 14.25 volatility between October VSTOXX® and November EURO STOXX® expiries. The volatility risk premium was 6.16 vol points, versus the final settlement price of the VSTOXX® Futures in October of 20.41. Compared to 1.26 in September /October and 8.68 between August and September.

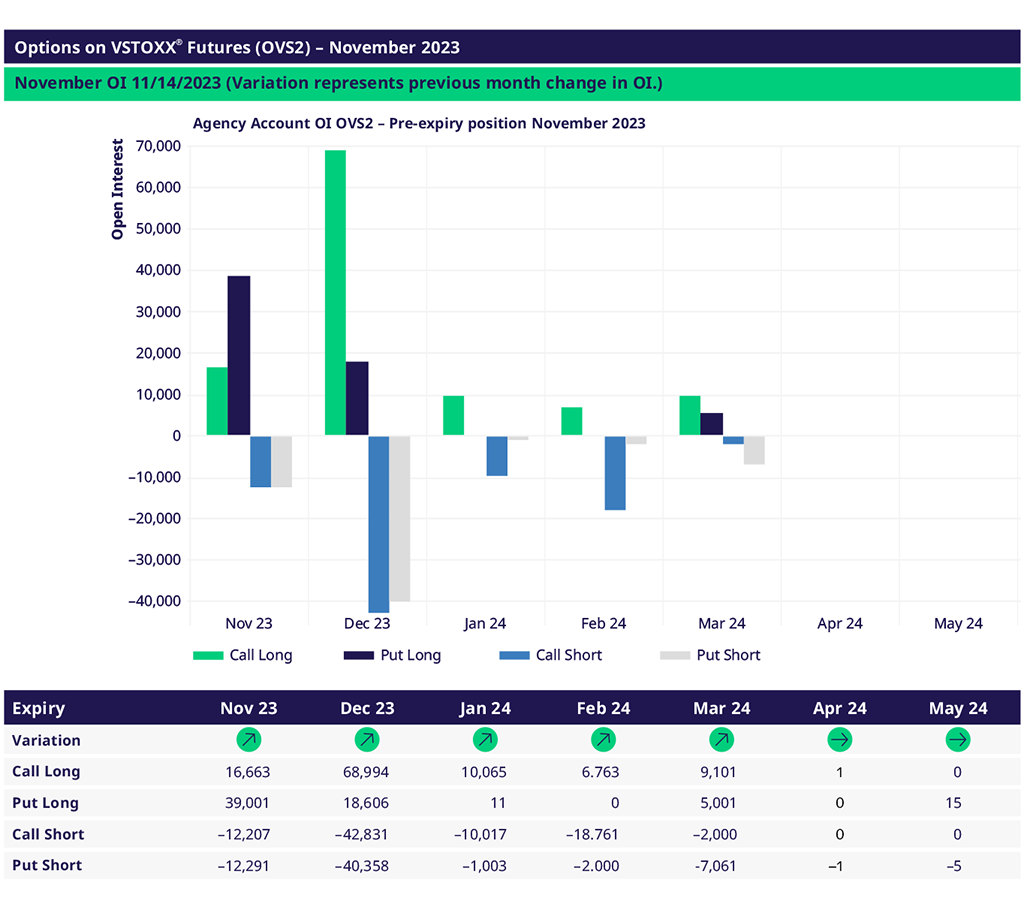

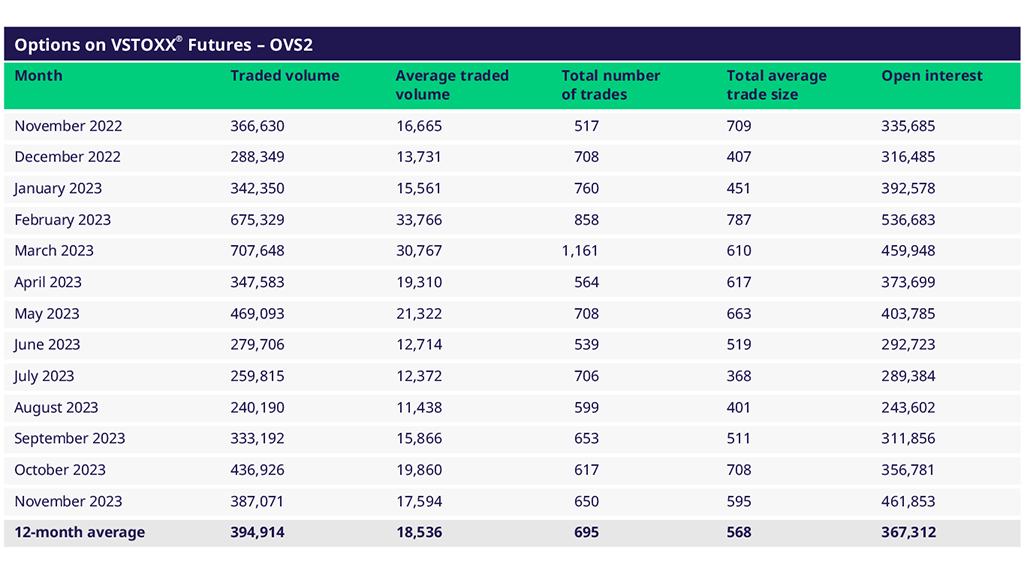

Options on VSTOXX® Futures (OVS2) December Update

Options on VSTOXX® Futures volume almost stabilized in November around their average in 2023. Open Interest further increased from 350k last month to more than 460k.

The most active day was 27 November with 56k lots traded, followed by 15 and 16 November with 33k and 49k traded contracts, respectively.

End clients were net buyers of calls and net sellers of puts in November with a focus on December and January expiries. The buy call/ sell put trading activity was concentrated on the DEC expiry, JAN was more balanced in terms of buying and selling options.

In the beginning of December, end users were long call (by 30k) and short put (by 12k) in the DEC expiry. In January, end clients are short call and short put (by 3.5k each) as well as in February with net short calls of 10k and short put by 5k. In March, we see lang call and short put positions again. More than half of the end user Open Interest is in December.

Even though end clients are net short options overall, their exposure in the front month is long volatility. This is different from last month, where end clients did not have an accentuated exposure to volatility. This time around, the options and futures positions of end clients point into the same direction in the front months.

Americas: Eugen Mohr or T +1 312-544-1084

Europe: Matthew Riley or T +44 (0) 207 8 62-72 13