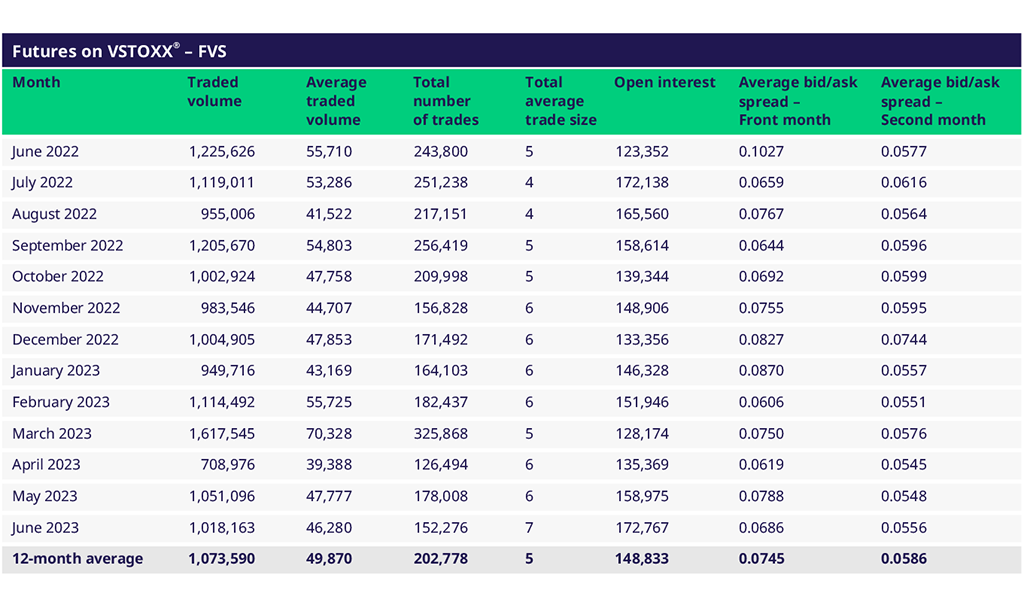

VSTOXX® Futures (FVS) July Update

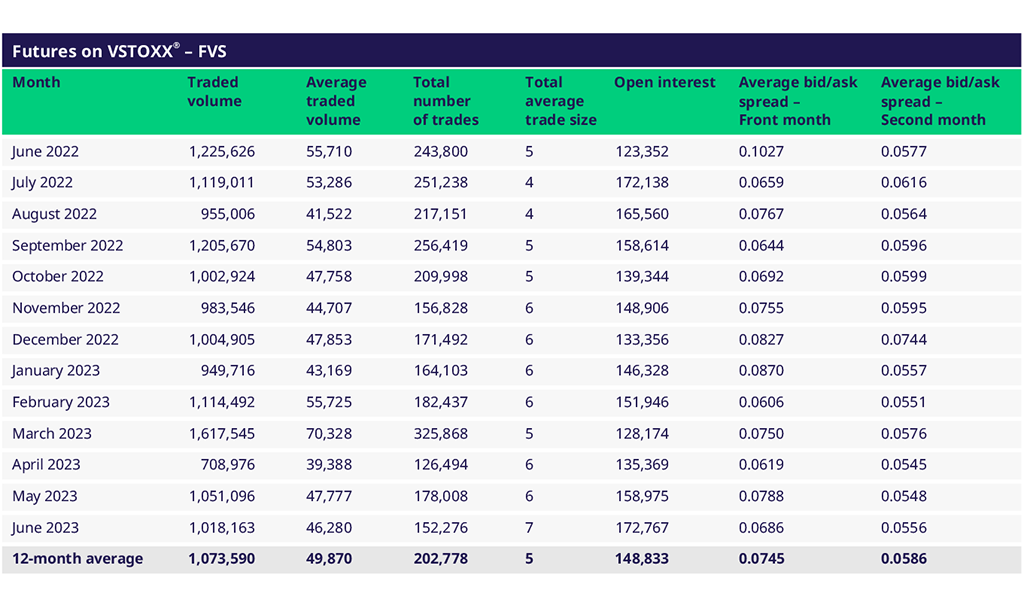

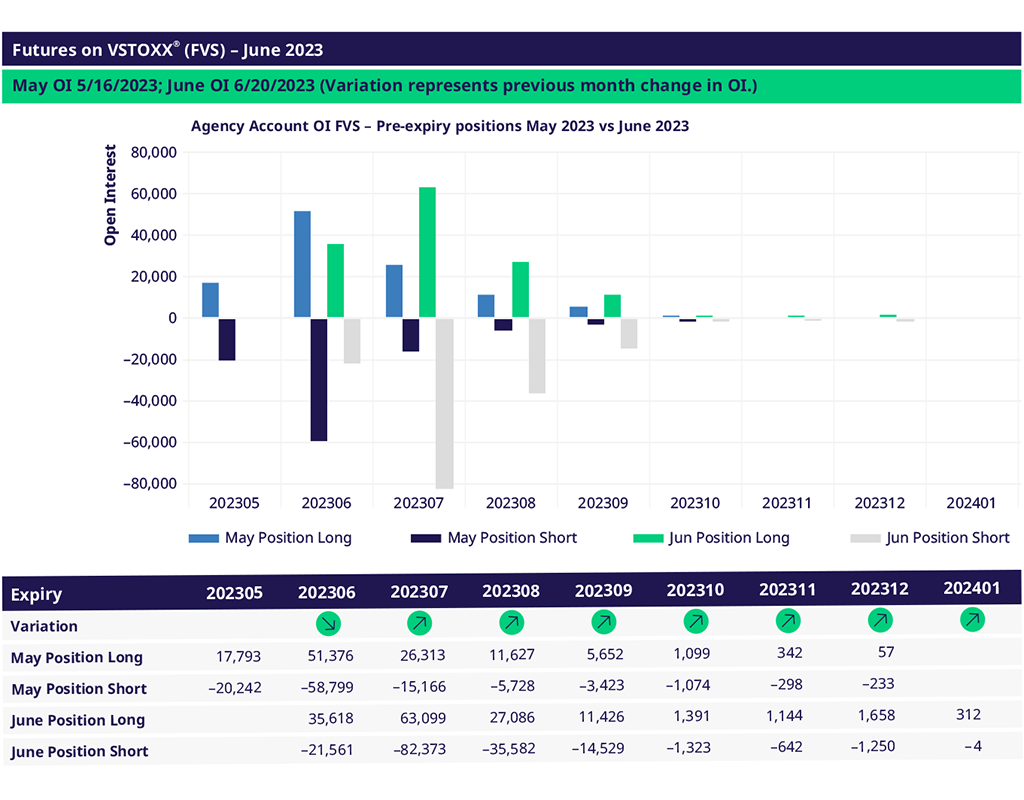

Trading activity in VSTOXX® Futures trends sideways since May. The lower volatility levels overall dampen the trading activity in June. Open interest moved further up by another 10% after 20% between May and April.

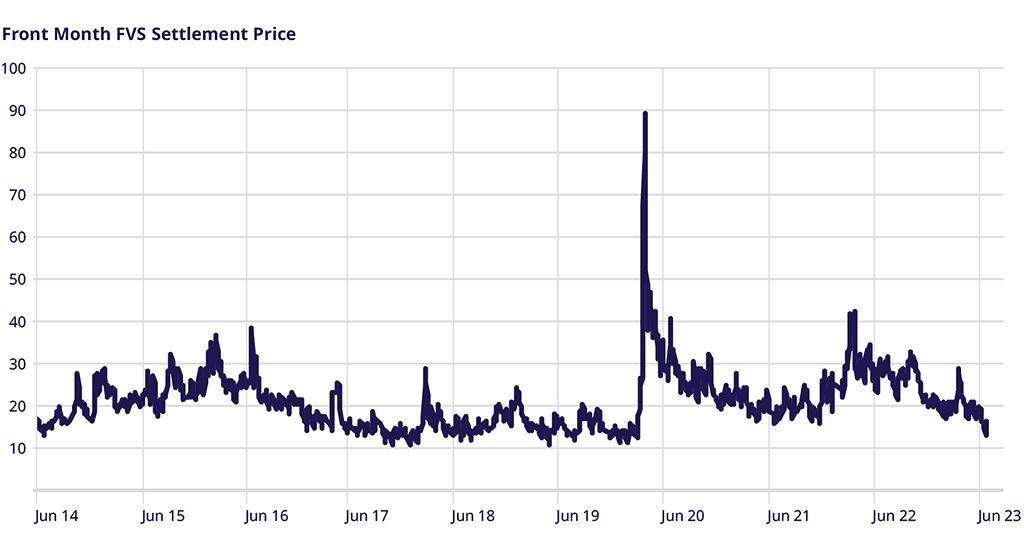

Most active day was 16 June with 92K lots traded.

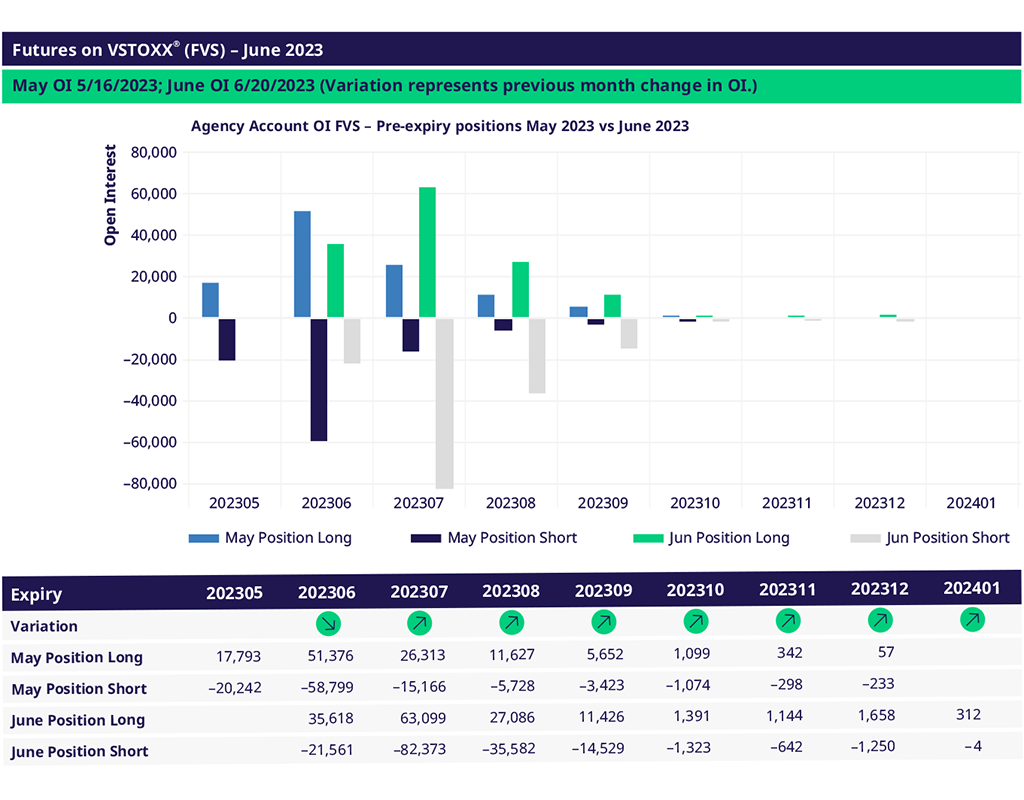

End clients increased their front months positions with focus on short vol exposure. Accordingly, end clients were net sellers of June, July and August, expecting a quiet summer ahead.

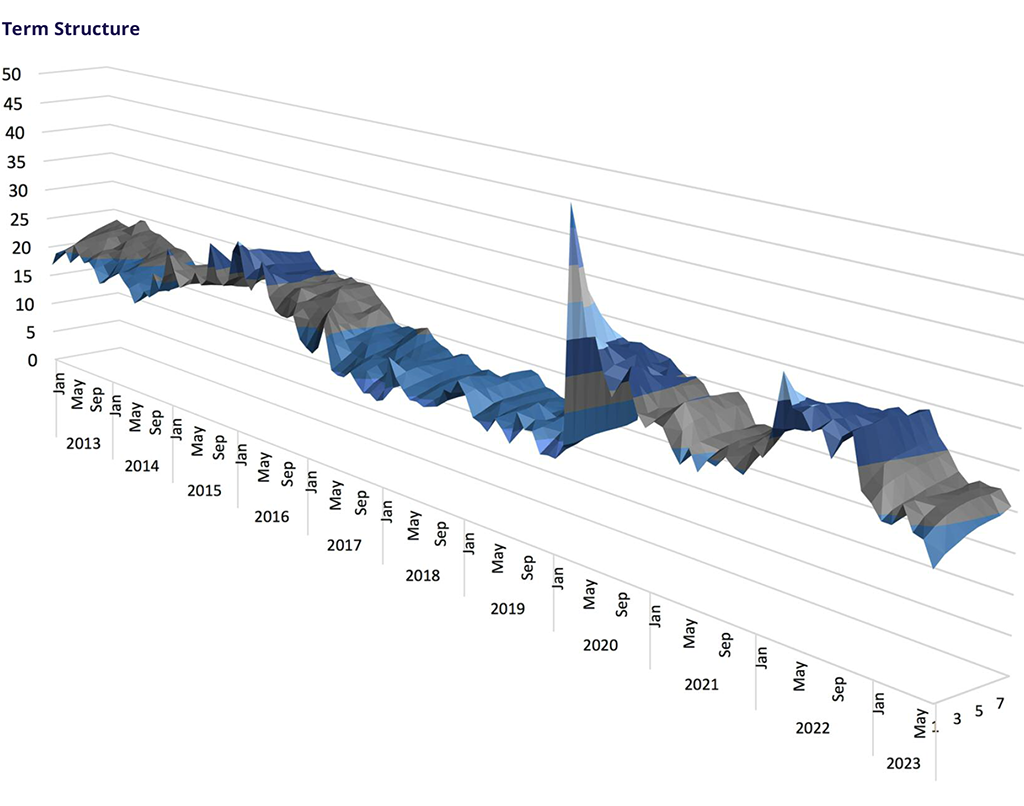

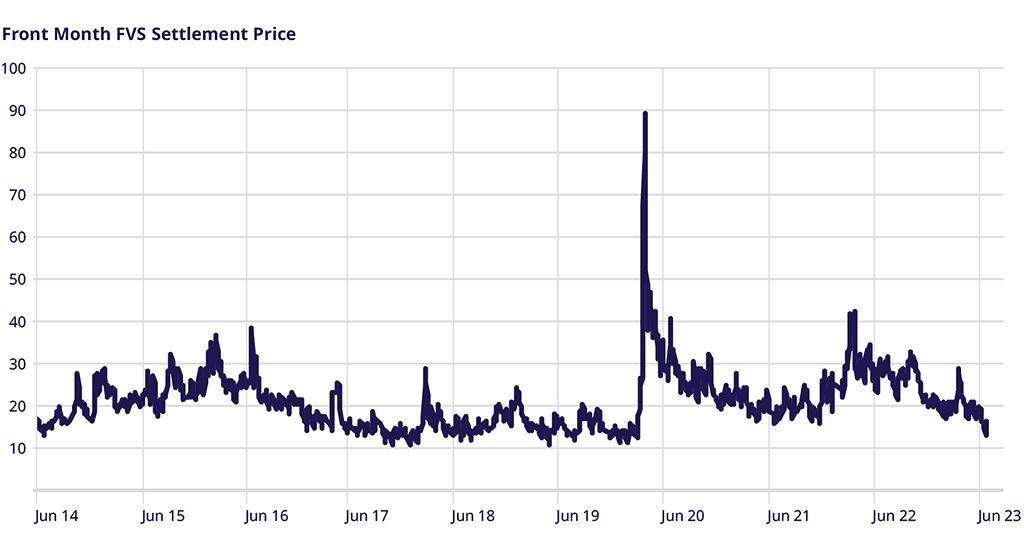

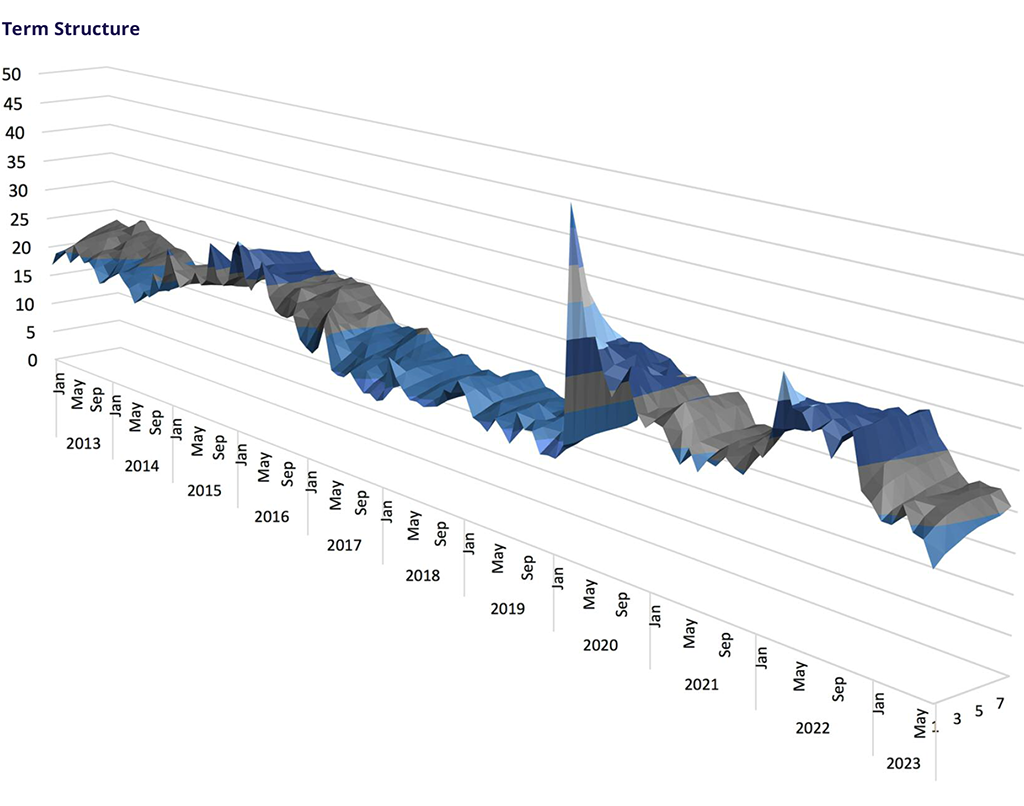

The VSTOXX® index fell 5 points in June from 18 to 13 before it spiked back up to 18 on 6 July. The term structure went flat to 0.5 points between front- and last expiry (after 4.7 points last month).

The EURO STOXX 50® index realized 14.17 volatility between May VSTOXX® and June EURO STOXX® expiries. Versus a Final Settlement price of the VSTOXX® Futures in May of 16.73, the volatility risk premium was 2.56 vol points. After 7.61 (April/ May) and 11.8 between March and April.

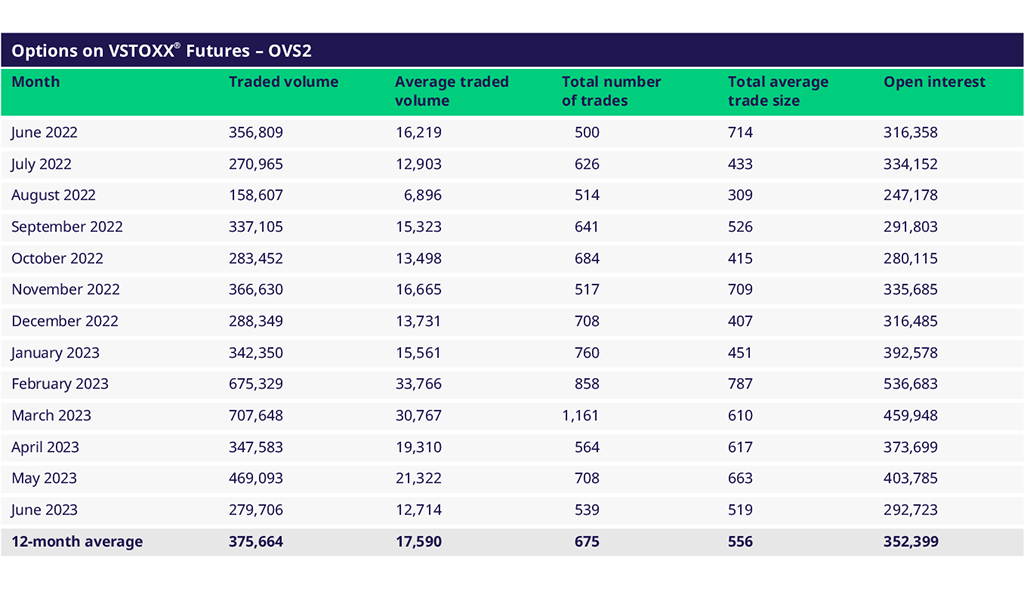

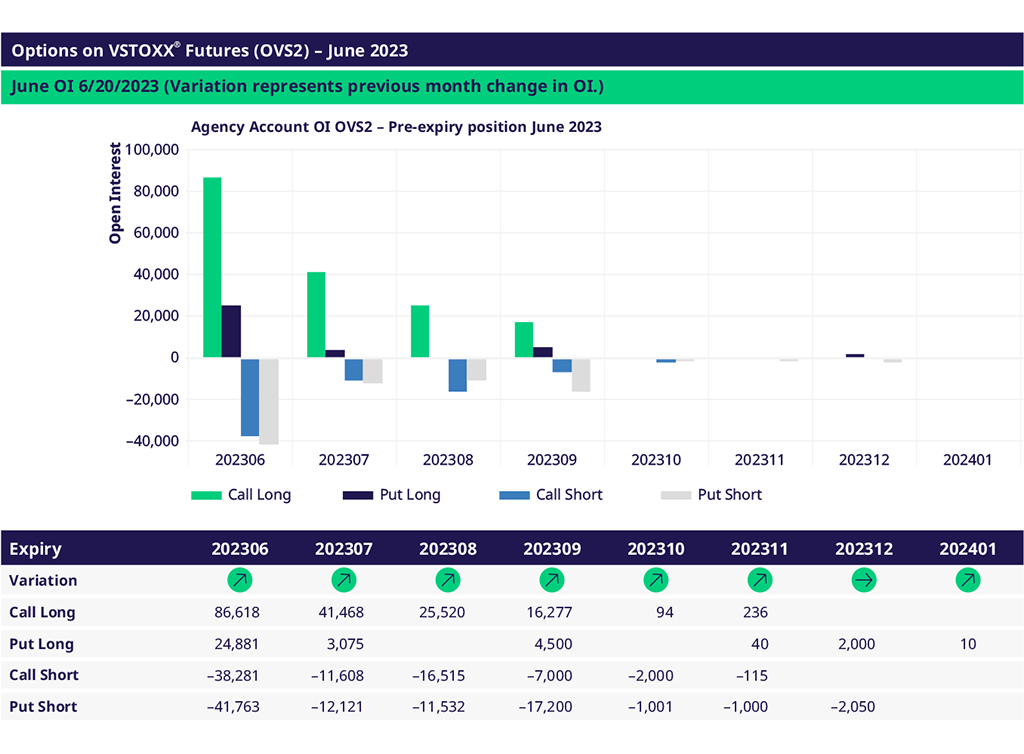

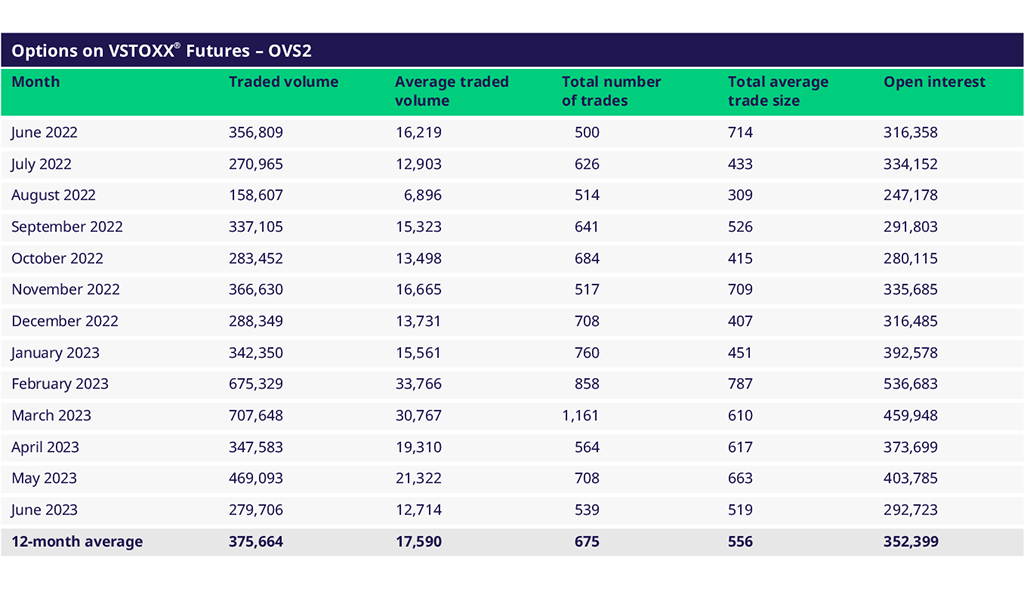

Options on VSTOXX® Futures (OVS2) July Update

Trading activity in the options is further declining. The low volatility levels and – expectations foster this trend. An upcoming event is missing which normally stimulates trading activity in the options. Most active day was 15 June with 41K lots traded.

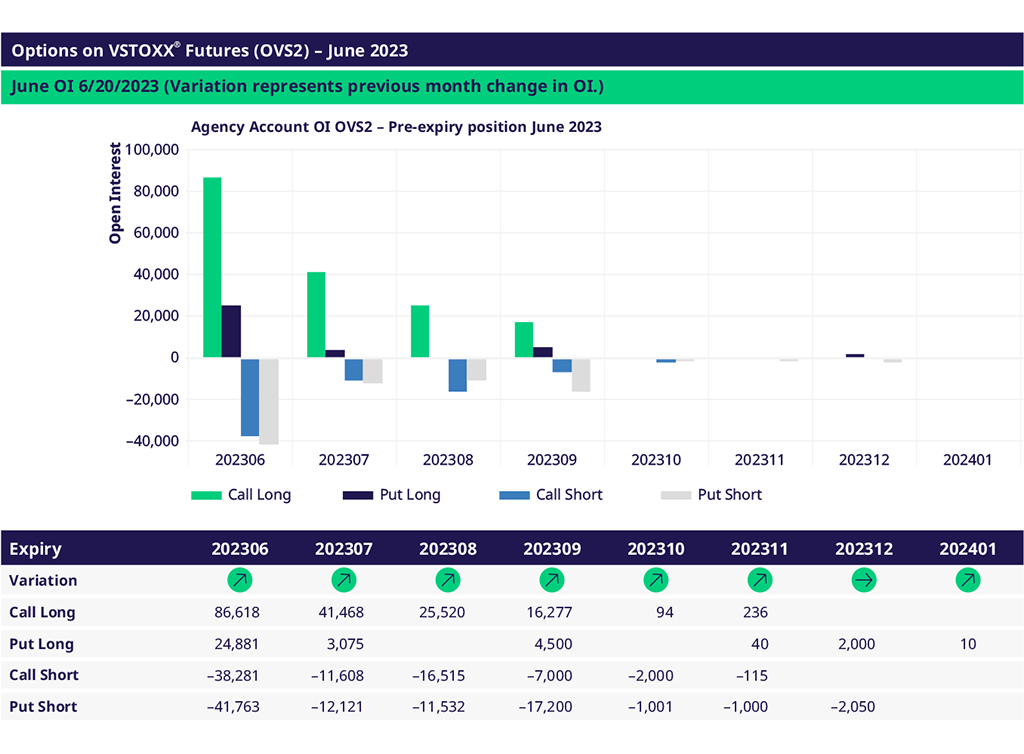

End clients were net buyers of calls in June and July expiries and added to their long call spreads in September.

Beginning of July, end clients are long 20-25 calls and short the higher strike calls in. Largest position is the 22 Calls in JUN.

For more information, please visit the website or contact:

Americas: Eugen Mohr or T +1 312-544-1084

Europe: Matthew Riley or T +44 (0) 207 8 62-72 13