VSTOXX® Futures (FVS) September Update

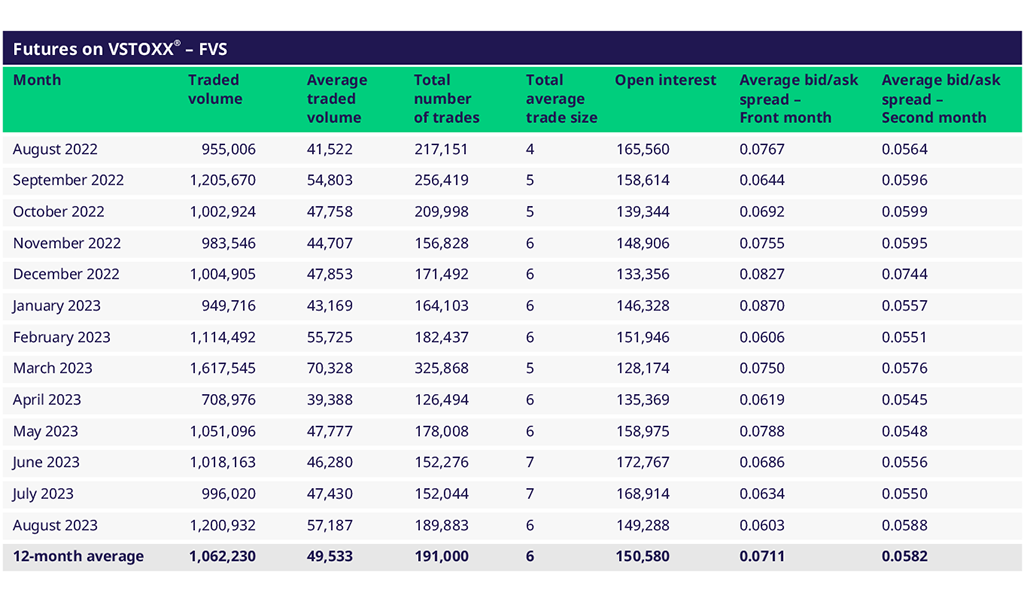

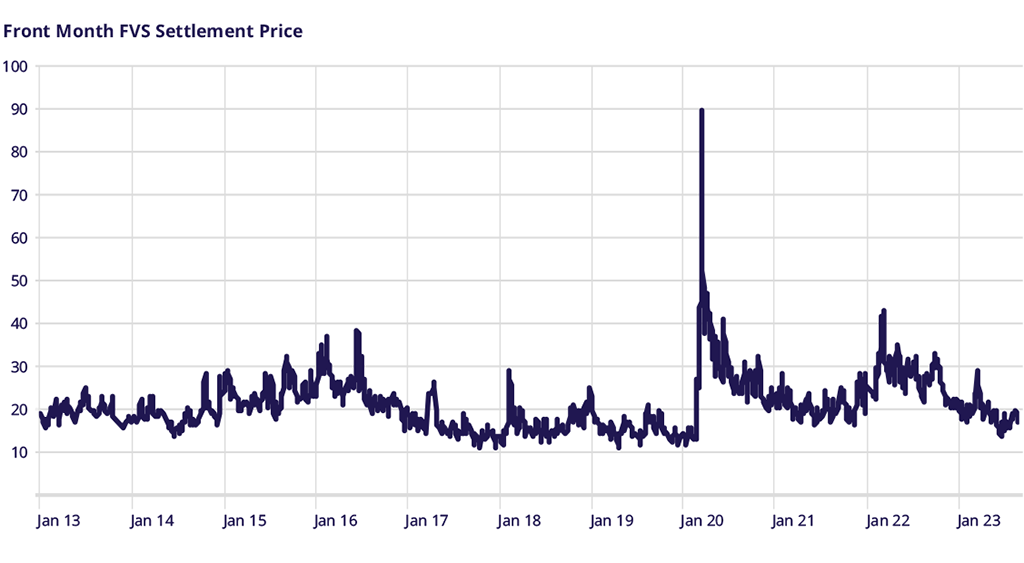

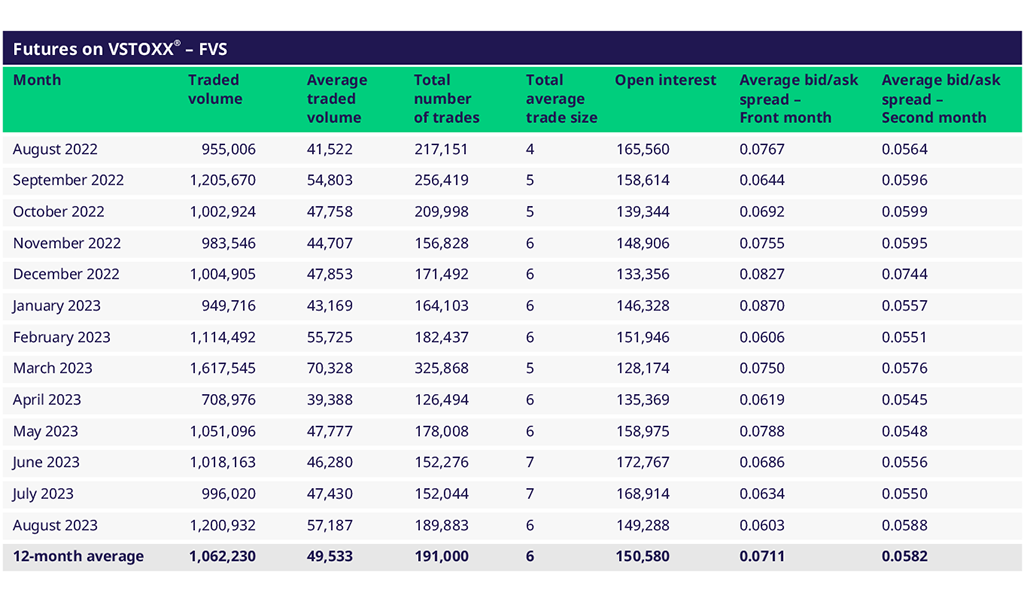

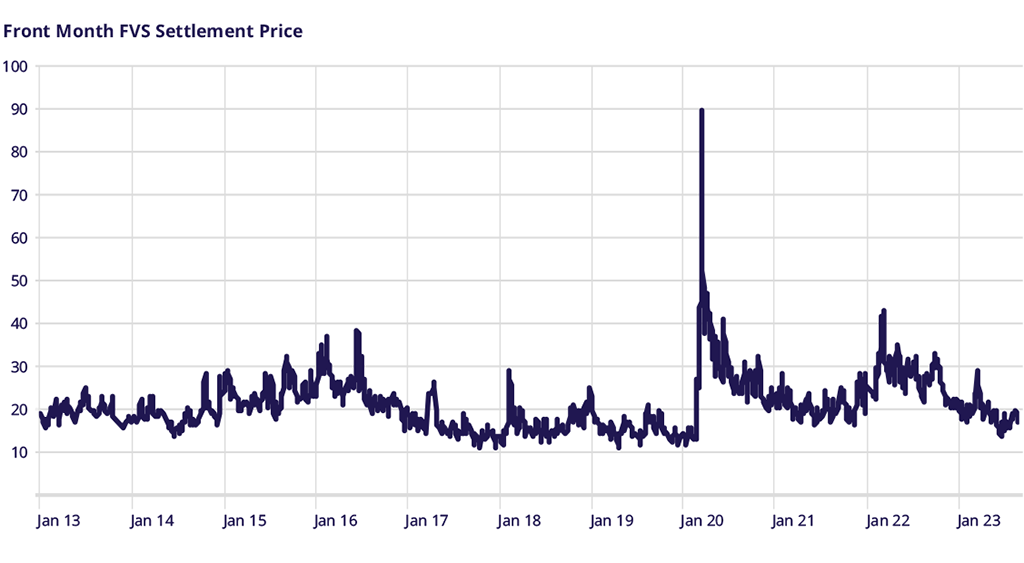

Trading activity in VSTOXX futures picked up again after a slow Q2. The sharp moves in the EURO STOXX 50® in the beginning of August with the VSTOXX® spike to 20 sparked trading again. Open interest dropped between July and August, however.

Most active day was 8 August with 96K lots traded.

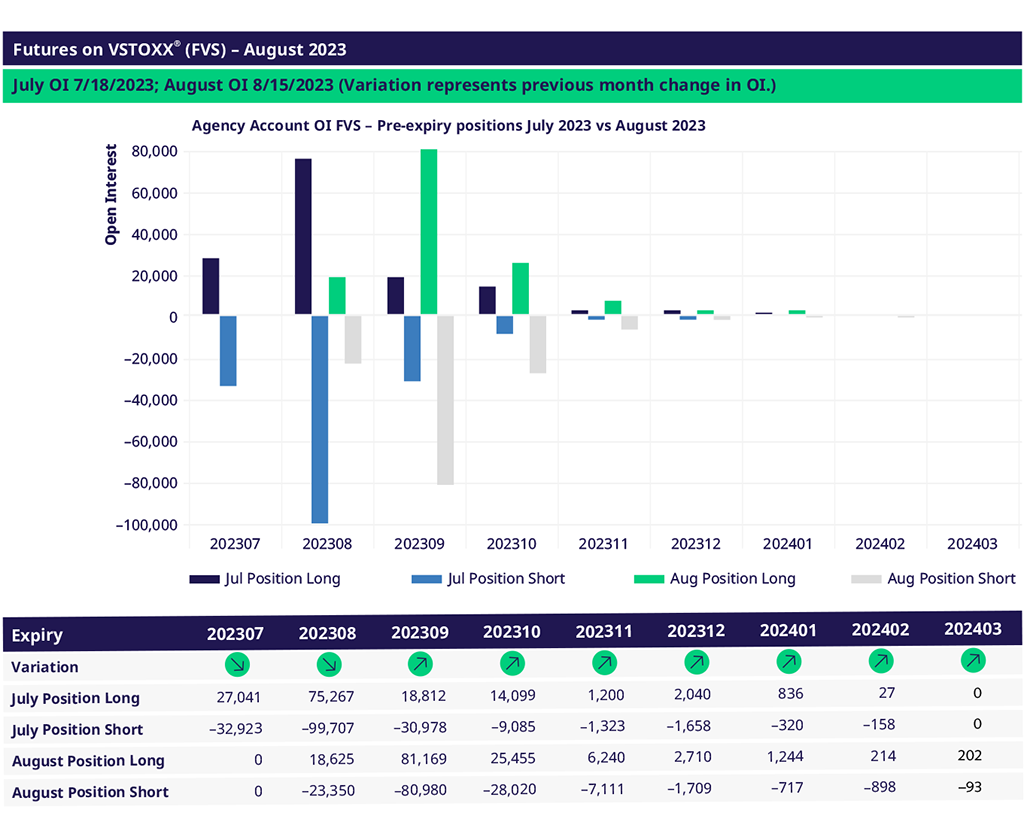

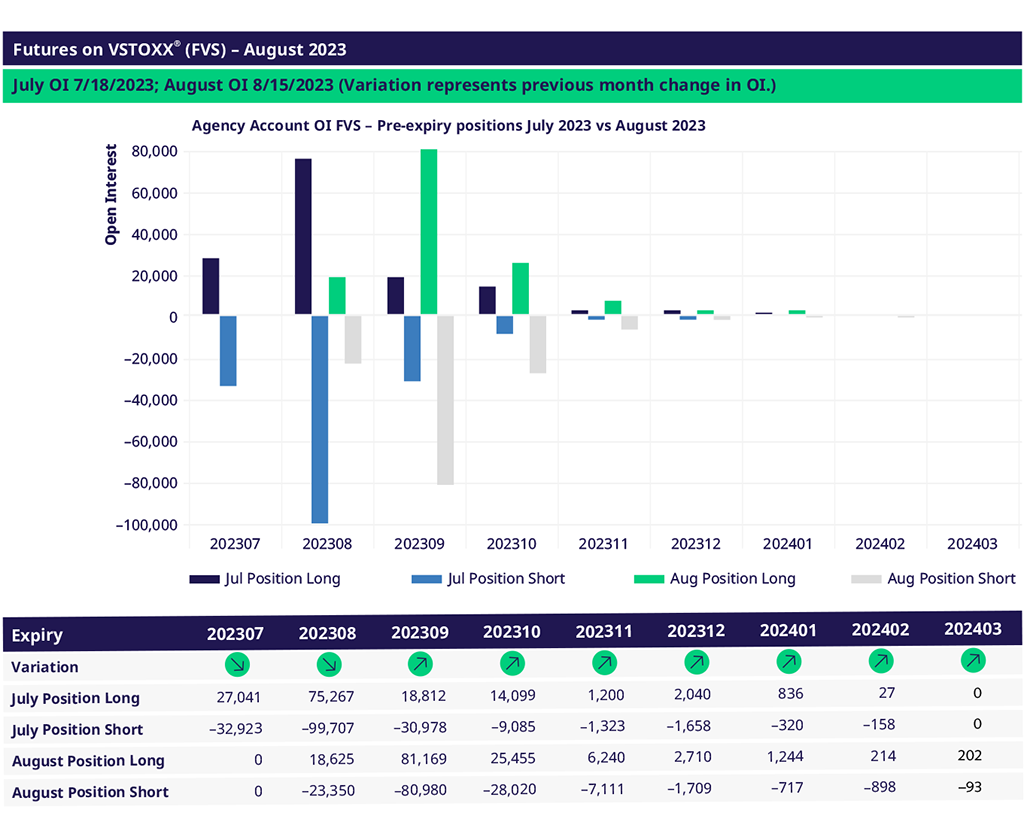

End clients reduced their short positions in between July expiry and beginning of September. During August, they sold front month, bought October and bought and sold equivalent amounts of the remaining expiries.

Overall, end clients became more cautious in their direction of trading and positioning. The likelihood of higher volatility levels going forward seems to increase.

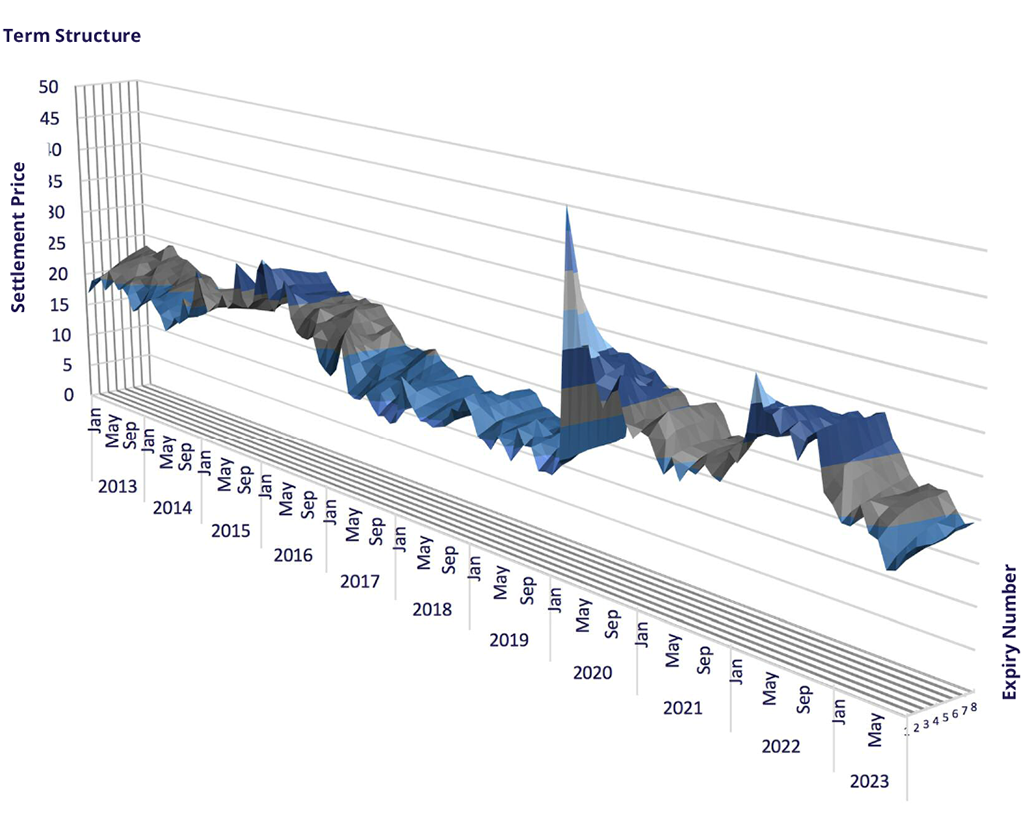

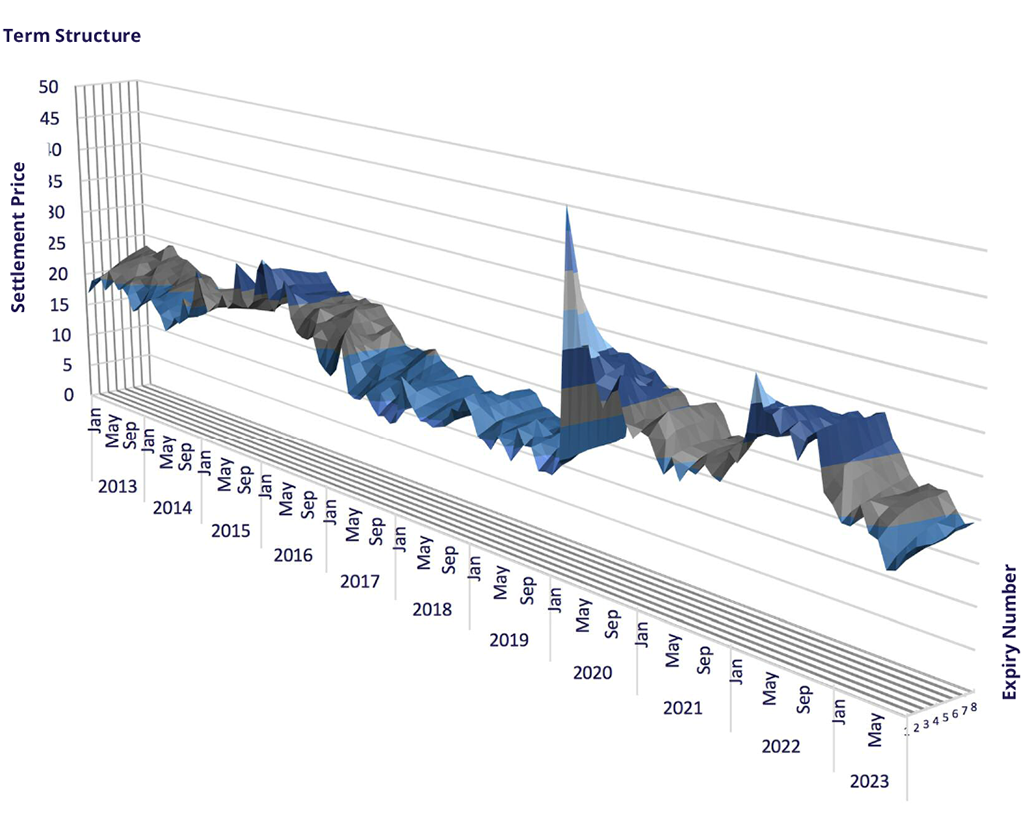

The VSTOXX® index moved between 20 in the beginning of August and 16 towards the end of the month. The term structure went significantly steeper to 3 points between front- and last expiry (after 1 point last month). December already shows the usual dip that reflects the lower number of trading days around Christmas.

The EURO STOXX 50® index realized 15.72 volatility between July VSTOXX® and August EURO STOXX® expiries. Versus a final settlement price of the VSTOXX® Futures in June of 15.81, the volatility risk premium was negative 0.09 vol points. After negative 1.1 (June/ July) and 2.56 between May and June.

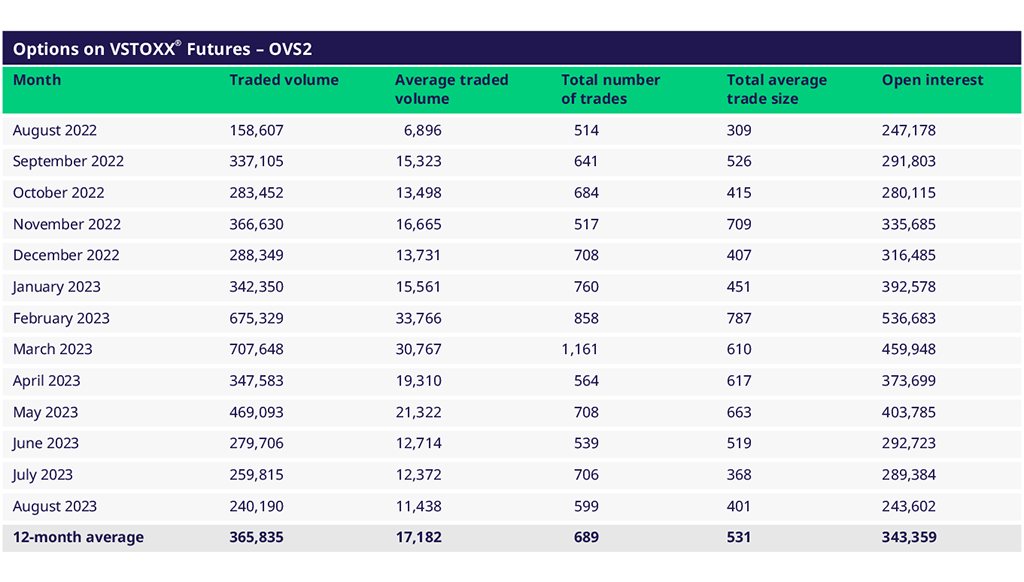

Options on VSTOXX® Futures (OVS2) September Update

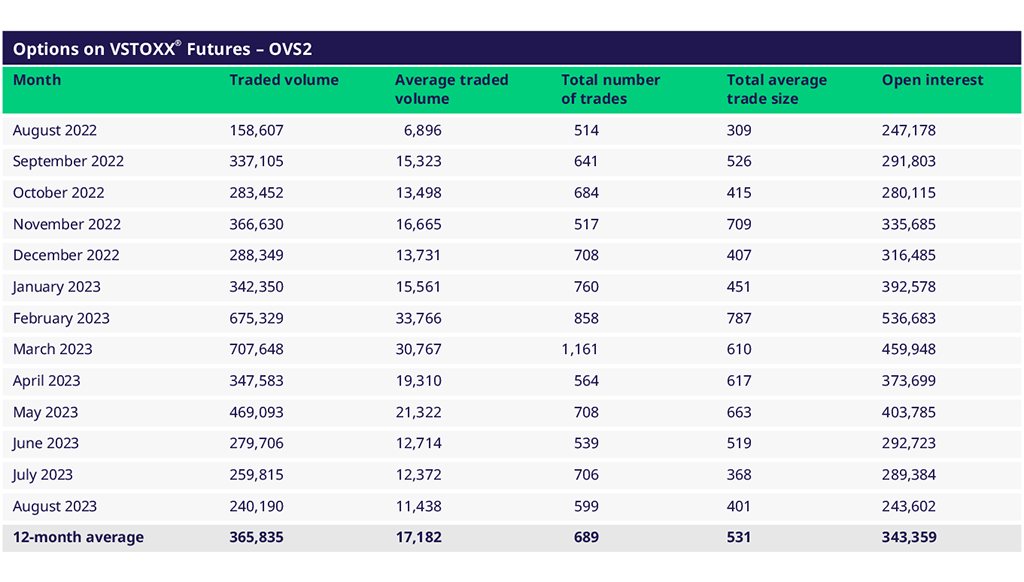

Other than in the futures, trading activity in the options didn’t pick up. The spike in volatility couldn’t translate to volumes. Most active day was 3 August with 39K lots traded.

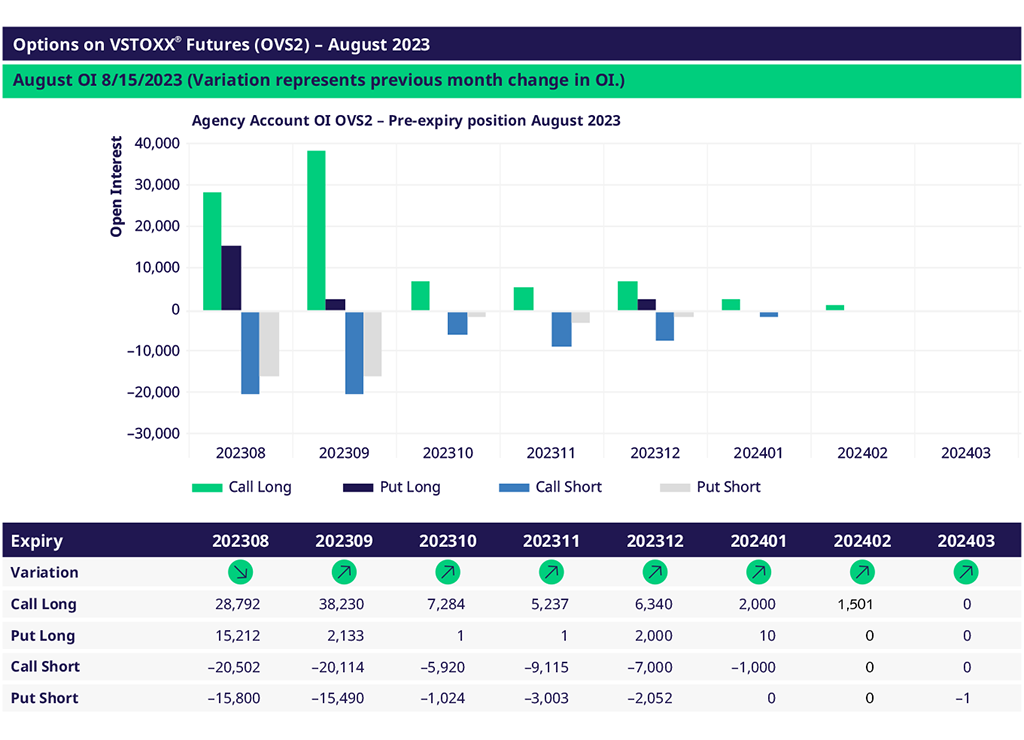

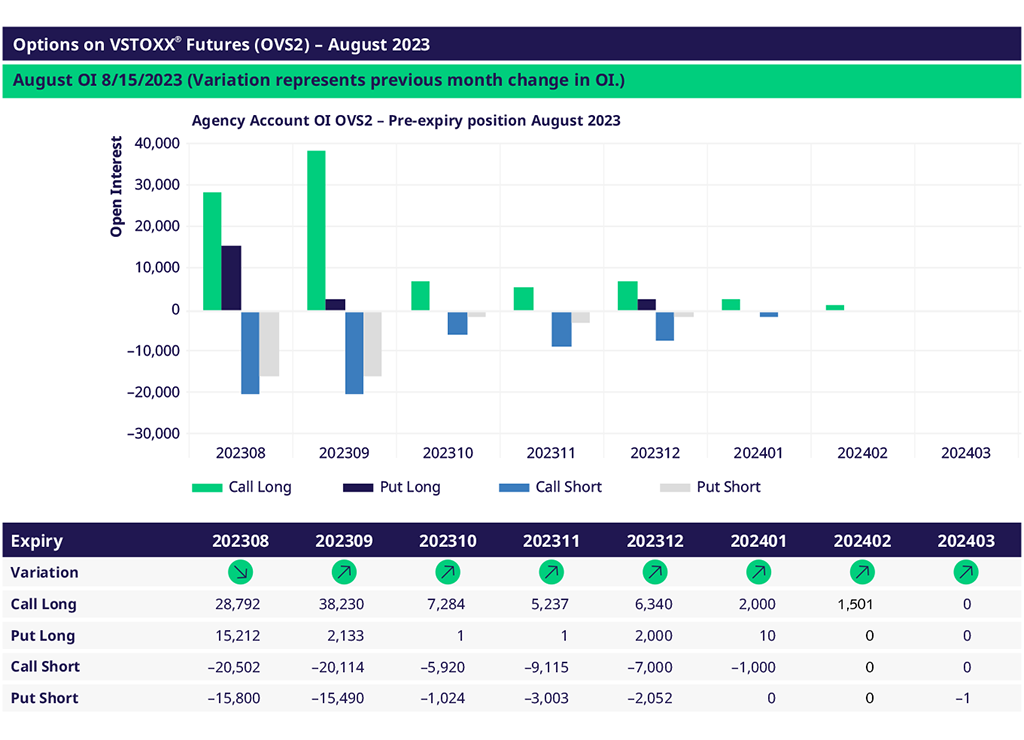

End clients were buyers of premium in August both, calls and puts. The focus was on the September expiry. In terms of moneyness, end clients focused on the 20-50% upside calls and ATM to 10% downside puts.

In the beginning of September, end clients remain long call and short put. The position is mainly in the front month. We see a larger long call position in December, in addition. The options position overall looks more defensive compared to the previous month.

For more information, please visit the website or contact:

Americas: Eugen Mohr or T +1 312-544-1084

Europe: Matthew Riley or T +44 (0) 207 8 62-72 13