Feb 23, 2023

Eurex

NextGen ETD Contracts: Introduction of new product initiatives

1. Introduction

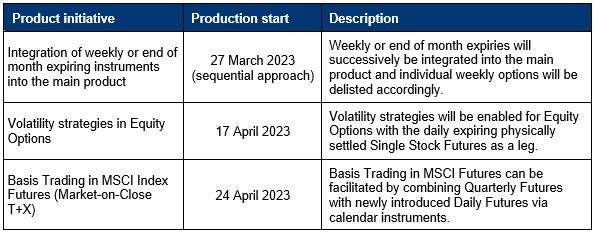

With the introduction of NextGen ETD Contracts (see Eurex Circulars 036/22 and 011/23), Eurex Frankfurt AG and Eurex Clearing AG (together: “Eurex”) have decided to introduce new product initiatives with effective dates as described below:

In order to reduce complexity for market participants, Eurex has decided to amend all relevant regulations with effect from 27 March 2023, irrespective of the date of implementation within the transition period.

Options contracts entered into before the production start on 27 March 2023 will remain tradable even after the production start until the respective expiration. In such cases, trading will be governed by the respective rules and regulations that had been valid prior to the production start.

This circular contains all information on the introduction of the new product initiatives and the updated sections of the relevant Rules and Regulations of Eurex Deutschland. For the detailed Contract Specifications for Futures Contracts and Options Contracts at Eurex Deutschland (“Contract Specifications”), please see Attachment 2. For the detailed Annexes to the Contract Specifications, please see Attachment 3. Additional information regarding the Liquidity Provider Programs is available in Attachments 4 and 5.

More information about the Next Generation ETD Contracts initiative is provided on the Eurex website www.eurex.com under the following link:

Support > Initiatives & Releases > Readiness for projects > Next Generation ETD Contracts

2. Required action

Technical releases to support NextGen ETD Product Initiatives were already rolled out on 27 June 2022, as communicated in previous Eurex circulars. Further checkpoints were presented in the course of 2022.

As of 27 March 2023, all market participants are required to be able to handle sub-monthly expiring contracts.

3. Details of the initiative

NextGen ETD was designed to enable new product initiatives for additional trading capabilities and more streamlined and direct processes.

A. Integration of weekly or end of month expiring instruments into main product

In the period prior to NextGen ETD, weekly or end-of month expiring options contracts are standalone products. With the production start of the new initiatives those contracts will be integrated into the main product. The initiative will facilitate the execution of the weekly calendar spread strategy trades and minimize the execution risk for banks, brokers and end customers.

To see the detailed overview of the weekly integration products in scope and the timeline on the sequential approach applied for delisting of old products, please refer to Attachment 1.

As a result of the integration of the weekly or end-of month expiring options contracts, the Liquidity Provider schemes will be amended (see Attachment 4).

B. Volatility Strategies in Equity Options

Daily (T+0) expiring physically settled Single Stock Futures are designed to enable market participants to exchange the cash instrument (a stock) via the listed derivative environment. In the pre-NextGen ETD period, in order to execute Equity Options volatility strategies, the participants would need to exchange the cash instrument between themselves in an OTC back-to-back transaction, facing a variety of administrative tasks such as know-your-client and counterparty risks.

With the new functionality, Trading Participants will be able to trade Equity Options volatility strategies on Eurex, using physically settled Single Stock Futures expiring on the day of trading (T+0). As a result, back-to-back exchange of the cash leg is replaced via the stock delivery resulting from the Single Stock Futures leg.

Please refer to Attachment 1 for the detailed overview of the products in scope.

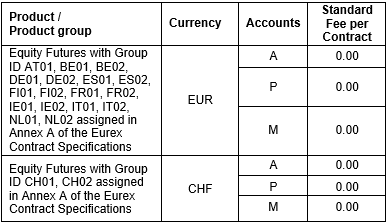

In addition, the usage of the new volatility strategies in Equity Options will be further incentivized via the fee structure (“fee waiver”). For the period from production start on 17 April 2023 until 31 October 2023, the delivery from futures fee, which arises due to the physical settlement of the daily Single Stock Futures leg of the trade, will be waived in its entirety:

Only as of 1 November 2023, the delivery from futures fee will apply according to the Price List of Eurex Clearing AG, Number 3.9.

C. Basis Trading in MSCI Index Futures (Market-on-Close T+X)

As of the production start of this initiative, three Daily Futures will be added to all available MSCI Index Futures. These Daily Futures always represent the next three trading days (T+0, T+1, T+2). By combining the Daily Futures with quarterly Futures via a calendar instrument, Basis Trading can be facilitated. In the calendar instrument the basis (=difference between Index and Futures level) becomes tradable, whereby the Daily Futures will deliver the Index level of the chosen day.

For a full list of all MSCI Index Futures for which Daily Futures will be added, please refer to Attachment 1.

In some of the MSCI Futures, incentives will be offered for Liquidity Providers for quotation of the basis. Therefore, the Liquidity Provider scheme for MSCI Index Futures will be amended accordingly (see Attachment 4).

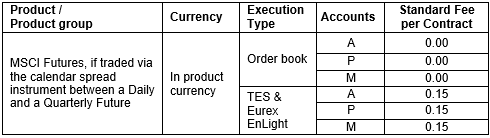

In addition, the usage of the new basis trading functionality will be further incentivized via the fee structure (“fee waiver”). For the period from production start on 24 April 2023 until 31 October 2023, the transaction fees per leg for trading of the calendar instrument between daily and quarterly futures will be the following:

Only as of 1 November 2023, the transaction fees according to the Price List of Eurex Clearing AG will be charged.

D. Determination of mistrade ranges in Options on Euro-Bund-Futures post integration of weekly expirations with NextGen ETD

A distinction between weekly and monthly expirations will be done following NextGen ETD with the contract names for each expiration. The mistrade ranges in weekly and monthly expirations will continue to differ according to the current parameters. These are published on the Eurex website under the following path:

Markets > Interest Rates > Fixed Income Options > OGBL > Specifications > Mistrade Ranges

Selected standardized and non-standardized options strategies as well as option volatility strategies may include varying expirations, for example options calendar spreads. The mistrade ranges for combinations featuring leg instruments with weekly and monthly expirations will be determined based on the mistrade range of the leg instrument with a weekly expiration.

For avoidance of any doubt, for all other products except the ones defined in this section 3.D. of this circular, the weekly or monthly expiration will not be a differentiator of mistrade ranges.

E. Changes to Product Specific Supplements (PSS) and other implications on Liquidity Provisioning with regards to NextGen ETD

Due to the introduction of new product initiatives, the following changes to the Liquidity Provisioning Framework are envisioned:

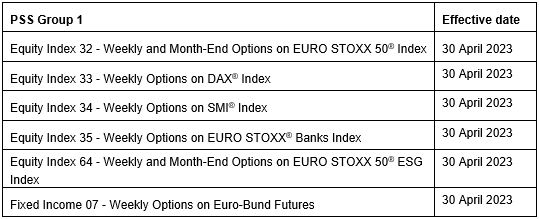

The following Product Specific Supplements will be terminated as of Effective Date 30 April 2023 (PSS Group 1):

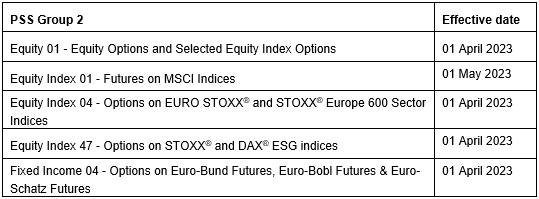

The following Product Specific Supplements will be modified and expanded to include details on Liquidity Provisioning Schemes in the new product initiatives (PSS Group 2):

The modified Product Specific Supplements (PSS Group 2) can be found in Attachment 4 to this Circular. The PSS will be amended with effective dates shown in the attachments and outlined above. The amendments will be deemed to have been approved unless objected to by Eurex Frankfurt AG and Eurex Clearing AG within a period of two weeks after notification of this circular pursuant to Number 4 (2) of the Liquidity Provider Agreement.

Fulfilment rules during the integration phase

For avoidance of doubt, during the integration phase, between the creation of the first new contract style (YYYYMMDD) and the termination of the last old contract style (YYYYMM) from trading, the following fulfilment rules will apply in the affected schemes mentioned above.

Rules from 27 March 2023 until 30 March 2023:

Any liquidity provisioning rebate eligible volume traded in the new contract paradigm (YYYYMMDD) will be rebated based on fulfilment of schemes outlined in PSS Group 1 during the month of March 2023.

Rules from 1 April 2023 until 30 April 2023:

Both the new schemes (PSS Group 2) and the old schemes (PSS Group 1) in Equity Index Options, Equity Options and Fixed Income Options will be available and scores will be measured according to the details outlined in the respective supplements. However, Eurex will not require the fulfilment of both old and new schemes. To make the integration phase as easy as possible for the liquidity providers, only one of the two scheme fulfilments (PSS Group 1 or PSS Group 2) will be sufficient to gain the respective liquidity provisioning rebates in the old and new contract styles for the month of April 2023.

Fulfilment rules from 1 May 2023 until 31 May 2023:

Only the new schemes (PSS Group 2) will be applied and measured in the daily market-making performance reports. Based on fulfilment of the scheme ESX-WE outlined in Attachment 4 PSS “Equity 01 - Equity Options and Selected Equity Index Options”, any remaining liquidity provisioning rebate relevant volume in the YYYYMM contracts of OES1, OES2, OES4, OMSX will be rebated.

F. Changes to the daily parameter file 90FILMMPARPUBLIYYYYMMDDXEUR.XML

In order to provide Trading Participants with additional clarity regarding which quoting parameters refer to the schemes defined in PSS Group 2, changes were made to the structure of the daily parameter file 90FILMMPARPUBLIYYYYMMDDXEUR.XML and accompanying .csv versions of the same file. All details pertaining to these changes can be found in Attachment 5 to this circular and will be published on the Eurex website under the following path:

Trade > Market-Making and Liquidity provisioning > MMPM Parameters on Common Report Engine

The parameter file as described in Attachment 5 will become effective in production on 27 March 2023.

For further convenience the full .xsd schema of the new 90FILMMPARPUBLIYYYYMMDDXEUR.XML file will be maintained daily on the Eurex website under the following path:

Trade > Market-Making and Liquidity provisioning > XSD schema for 90FILMMPARPUBLIYYYYMMDDXEUR

Attachments:

- 1 – Product initiatives overview

- 2 – Updated sections of the Contract Specifications for Futures Contracts and Options Contracts at Eurex Deutschland

- 3 – Updated sections of the Annexes to the Contract Specifications for Futures Contracts and Options Contracts at Eurex Deutschland

- 4 – Product Specific Supplements (PSS Group 2)

- 5 – MMPM Parameters on Common Report Engine, as of 27 March 2023

Further information

Recipients: | All Trading Participants of Eurex Deutschland and Vendors | |

Target groups: | Front Office/Trading, Middle + Backoffice, IT/System Administration, Auditing/Security Coordination | |

Related circulars: | Eurex Clearing Circular 008/23, Eurex Circulars 036/22 and 011/23 | |

Related Eurex News: | ||

Contact: | client.services@eurex.com | |

Web: | Support > Initiatives & Releases > Readiness for projects > Next Generation ETD Contracts; | |

Authorized by: | Randolf Roth |