Feb 23, 2023

Eurex Clearing

Next Generation ETD Contracts: Amendments to the Clearing Conditions and the Price List of Eurex Clearing AG

1. Introduction

This circular contains information with respect to Eurex Clearing AG’s service offering and corresponding amendments to the Clearing Conditions of Eurex Clearing AG (“Clearing Conditions”) and Price List of Eurex Clearing AG (“Price List”) regarding to the following topics:

- A. Clarification of the provisions on the Clearing of Index Futures and Index Options in the Clearing Conditions,

- B. Market-on-Close Futures T+X (Basis Trading in MSCI Index Futures),

- C. Integration of Weekly Expiring Contracts on Product Level in Equity Options, Fixed Income Options and Index Options,

- D. Fee waiver for the delivery resulting from Single Stock Futures Contracts,

- E. Fee waiver for the transaction fees of MSCI Futures for the usage of the calendar spread instrument between Daily and Quarterly Futures.

The amendments for topic A. will come into effect on 27 March 2023.

The amendments for topic B. will come into effect on 24 April 2023.

The amendments for topic C. will come into effect on 15 May 2023.

The amendments for topic D. will be effective from 17 April 2023 until 31 October 2023.

The amendments for topic E. will be effective from 24 April 2023 until 31 October 2023.

2. Required action

Technical releases to support Next Generation ETD Product Initiatives (as mentioned below) were rolled out on 27 June 2022, as communicated in previous circulars of Eurex and Eurex Clearing AG (“Eurex Clearing”). Further checkpoints were presented in the course of 2022. As of 27 March 2023, all market participants are required to be able to handle sub-monthly expiring contracts.

3. Details

A. Clarification of the provisions on the Clearing of Index Futures and Index Options in the Clearing Conditions

In 2012, the Executive Board of Eurex Clearing decided to clarify the procedure for determination of the final settlement prices for STOXX® equity index derivatives.

In its circular 056/12, Eurex Clearing outlined the methodology of the final settlement price determination in case of trading interruptions in one or more components of the EURO STOXX 50® index. With integration of the weekly and month-end options (OES1/2/4, OMSX) into the main EURO STOXX 50® index options (OESX) this rule shall be applied for all expirations in EURO STOXX 50® index derivates as well as STOXX® index derivatives which include EURO STOXX 50® index components.

To reflect this decision in the legal framework of Eurex Clearing, the following provisions will be amended as outlined in the Attachment 1:

- Chapter II Part 2 Number 2.4.2 and Part 3 Number 3.4.3 of the Clearing Conditions

The amendments with regards to topic A. will become effective on 27 March 2023.

B. Market-on-Close Futures T+X (Basis Trading in MSCI Index Futures)

In accordance with Eurex Clearing Circular 006/23, the following provisions will be amended as outlined in Attachment 1 and Attachment 2:

- Chapter II Part 2 Numbers 2.1.2 and 2.4.2 of the Clearing Conditions

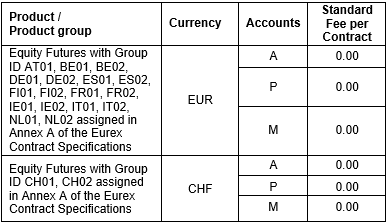

- Number 3.1 of the Price List

The amendments with regards to topic B. will become effective as of 24 April 2023.

C. Integration of Weekly Expiring Contracts on Product Level in Equity Options, Fixed Income Options and Index Options

In accordance with Eurex Clearing Circular 006/23, the following provisions will be amended as outlined in Attachment 3:

- Numbers 3.1, 3.2, 3.3, 3.7 and 3.8 of the Price List

The amendments with regards to topic C. will become effective as of 15 May 2023.

D. Fee waiver for the delivery resulting from Single Stock Futures Contracts

Effective from 17 April 2023 until 31 October 2023, Eurex Clearing will temporarily offer a fee waiver regarding the delivery fees in Single Stock Futures, pursuant to Number 3.9 of the Price List as follows:

As of 1 November 2023, the delivery from futures fee will apply according to Number 3.9 of the Price List.

E. Fee waiver for the transaction fees in MSCI Futures for the usage of the calendar spread instrument between Daily and Quarterly Futures

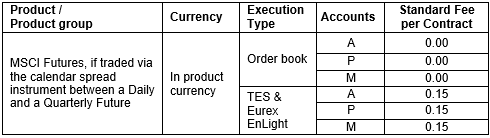

Effective from 24 April 2023 until 31 October 2023, Eurex Clearing will offer a fee waiver regarding the transaction fees in MSCI Futures, if traded via the calendar spread instrument between a Daily and a Quarterly Future. The fee waiver affects Number 3.1 of the Price List. The temporarily transaction fees per leg will be as follows:

Only as of 1 November 2023, the transaction fees according to Number 3.1 of the Price List will be charged.

Please refer to Eurex circular 014/23 for detailed trading-related information and the related amendments to the Rules and Regulations of Eurex Deutschland.

As of the effective date, the full version of the amended Clearing Conditions and Price List will be available for download on the Eurex Clearing website under the following link:

Rules & Regs > Eurex Clearing Rules and Regulations

The amendments to the legal framework of Eurex Clearing AG published by this circular are deemed accepted by each affected contractual party of Eurex Clearing AG, unless the respective contractual party objects by written notice to Eurex Clearing AG prior to the relevant effective date(s) as stipulated in this circular. In case of an objection by the respective contractual party pursuant the preceding sentence, Eurex Clearing AG is entitled to terminate the respective contract (including a Clearing Agreement, if applicable). Instead of submitting an objection, the respective contractual party may submit in writing to Eurex Clearing AG comments to any amendments of the legal framework of Eurex Clearing AG within the first 10 Business Days after the publication of the amendments. Eurex Clearing AG shall assess whether these comments prevent the published amendments from becoming effective taking into account the interests of Eurex Clearing AG and all contractual parties.

Unless the context requires otherwise, terms used and not otherwise defined in this circular shall have the meaning ascribed to them in the Clearing Conditions or FCM Clearing Conditions of Eurex Clearing AG, as applicable.

Attachments:

- 1 – Amended sections of the Clearing Conditions of Eurex Clearing AG (effective from 27 March 2023)

- 2 – Amended sections of the Price List of Eurex Clearing AG (effective from 24 April 2023)

- 3 – Amended sections of the Price List of Eurex Clearing AG (effective from 15 May 2023)

Further information

Recipients: | All Clearing Members, ISA Direct Clearing Members, Disclosed Direct Clients of Eurex Clearing AG, all FCM Clearing Members, vendors, and other affected contractual parties | |

Target groups: | Front Office/Trading, Middle + Back Office, IT/System Administration, Auditing/Security Coordination | |

Related circulars: | Eurex Clearing Circular 024/22, Eurex Circular 014/23 | |

Contact: | client.services@eurex.com | |

Web: | www.eurex.com/ec-en/ | |

Authorized by: | Jens Janka |