How can you reduce funding costs?

1. Reduce your margin requirements

Reduce your margin levels with Eurex Clearing Prisma. This offers portfolio margining across all products in the same liquidation group and with the same holding periods (Margin Period of Risk), such as Euro-Schatz Futures and EURIBOR Futures. Furthermore, market participants can benefit from Eurex Clearing’s cross-product margining service and take advantage of margin offsets between OTC IRD and our listed fixed income Futures and Options. Find more information here Eurex Clearing Prisma.

Eurex Clearing Prisma calculates risks across all derivatives markets cleared by Eurex Clearing. Cleared products with similar risk characteristics and aligned default management processes are assigned to the same liquidation group and its splits, resulting in more comprehensive risk calculations and enabling portfolio margining across positions within a split in the same liquidation group.

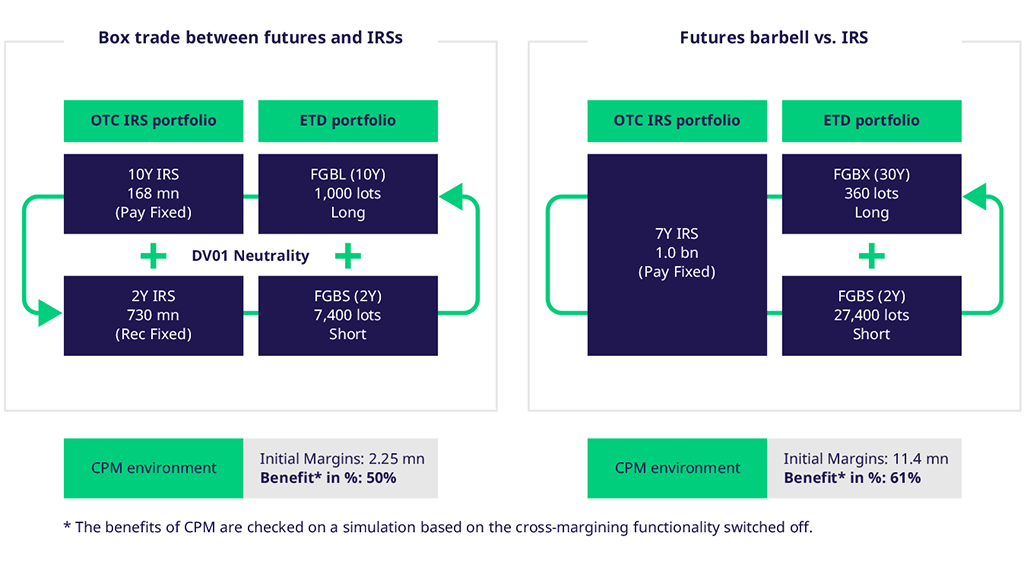

Our enhanced cross-product margining algorithm allows us to better capture the offsetting relationship of holding long and short positions in correlated fixed income asset classes. The examples below show that the strategies applied on the OTC IRS side and the fixed income listed futures side are always offsetting in DV01 terms. The new enhancements allow our algorithm to recognize the DV01-neutrality of these structured trades and calculate an initial margin reflective of the reduced risk embedded in their offsetting nature. These capital charge reductions are not exclusive to structured trades but are also seen in real-life portfolios of hundreds of long and short positions across OTC swaps and listed fixed income futures.

2. Get one of the best returns on euro cash margin collateral among CCPs

Eurex Clearing’s reference rate for remuneration of euro margin collateral is ECB Deposit Rate minus 10bps. Eurex keeps a handling fee of 20bps to manage the cash exposures. The net return on euro cash is superior compared to other globally relevant CCPs. Read more here: Interest Rates with respect to Eligible Margin Assets and Default Fund Contribution in form of Cash.

3. Minimize financing costs of Futures CTDs

Maximize your funding efficiency with Eurex's Repo CTD Baskets — designed specifically to minimize the costs associated with the physical delivery of futures. This secure, ring-fenced basket streamlines financing for Cheapest-to-Deliver (CTD) obligations … eliminating the need for internal “boxing” and unsecured funding. Read more here: GC Pooling Baskets (eurex.com)

4. Experience positive alpha on cash investments via Reverse Repos

Eurex cleared reverse repos offer the potential for positive alpha on your cash investments, outperforming other money market instruments. In, Q2/2025, the average overnight rate in the GC Pooling ECB basket was 7 basis points above the €STR rate. For further information go to GC Pooling Repo (eurex.com)

5. Take advantage of our broad collateral range

Benefit from the broad collateral range reducing your funding opportunity costs: We accept approximately 10,000 securities / ISINs that are admissible as collateral by the European Central Bank or the Swiss National Bank. On top, approx. 850 government bonds from non-EU countries (AU, CA, JP, US), selected equities (constituents of the DAX®, SMI® and EURO STOXX 50® Index) and selected ETFs complete the admissible collateral spectrum. For further information go to Collateral management.

6. Re-use collateral to cover margin requirements arising from any product cleared by us

Invest cash securely via CCP-cleared reverse repo at attractive rates and re-use received collateral to cover derivatives as well as repo margin requirements, provided that both products use the same clearing license. This is true for purchases of specific securities and collateral received in GC Pooling® Baskets transactions. This allows participants to simultaneously improve their rate of return of their cash holding and meet their margin obligations more efficiently. Find more information here: Collateral management.

7. Consider funding intra-day VM with securities

Intra-day variation margin (VM) requirements can be funded with cash collateral or securities. If there is a margin shortfall on a client account under a Clearing Member, we will issue and process individual margin calls for the collateral pool in which the margin shortfall has occurred. Participants can instruct us to process a direct debit in any eligible currency or deliver security collateral to the collateral pool in shortfall. Read more at Margin settlement.