Becoming an ISA Direct Clearing Agent (CA)/Indemnifying Clearing Agent (ICA)

Existing clearing members are able to easily extend their current clearing licenses to include the ISA Direct or the ISA Direct Indemnified Model. If they are already an OTC IRD or Repo General Clearing Member then they may also become a Clearing Agent for those markets by following the below steps.

Extending your existing licence by

entering, i.e. signing a new clearing agreement with Eurex Clearing and the ISA Direct Member (IDCM) / ISA Direct Indemnified Clearing Member (IDICM).

In case securities are considered to be pledged as margin collateral with respect to an IDCM/IDICM additionally a new pledge agreement needs to be signed.

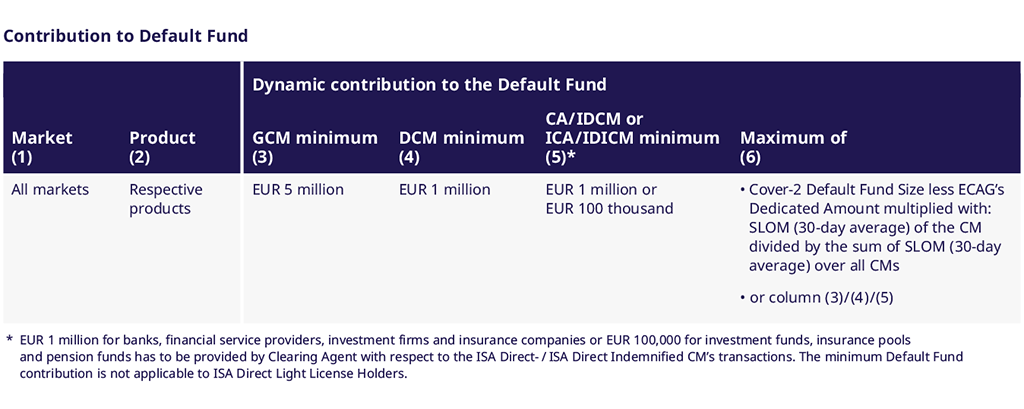

It is the Clearing Agent's responsibility to post the default fund to Eurex Clearing with respect to the IDCM/IDICM transactions. Contribution to the Default Fund depends on the relative risk exposure brought to the Eurex Clearing system by each IDCM/IDICM.

For further information on the Default Fund click here.

In the ISA Direct Indemnified Model, it’s the obligation of the Indemnifying Clearing Agent to provide an indemnity ensuring the fulfilment of the ISA Direct Indemnified CM contractual obligations towards the CCP in a default scenario.

Following services or business functions can be either fulfilled by the Clearing Agent/Indemnifying Clearing Agent, the ISA Direct Clearing Member/ISA Indemnifying Clearing Member or a third party (e.g. custodian) in case eligible:

Collateral infrastructure

- Pledged security account (not needed if using cash only)

- Cash accounts for margin payments dependent on the Clearing currency i.e EUR, CHF or GBP. Please see webpage for accepted payment banks

- Optional cash accounts in further currencies that you wish to trade in, e.g. USD, GBP, JPY (OTC IRD only)

Business Functions

- Fulfilment of payment obligations (amongst others overnight margin calls, transaction and variation margin payments, excluding intraday margin calls)

- Intraday risk management (amongst others risk monitoring and intraday margin call)

- Delivery of securities margin collateral

- Trade and position management

- Delivery management (Repo Special/GC and GC Pooling only)

Whatever operational set up you decide upon between you and your IDCM/IDICM, you will agree the set up using the Clearing Agent Limitation Notice.