Transaction and Position management of listed derivatives

Eurex Clearing offers a wide range of position and transaction management services for the listed derivatives market. These services enhance the speed and flexibility of back-office clearing and settlement processes.

Transaction Booking and Position Building

The position keeping system for options and futures contracts enables Members to inquire about their current positions and make adjustments to both transactions and positions. Each transaction in the same contract, transaction account and with the same basket ID is booked into one position. Transaction adjustments are possible for a limited period only (i.e., until T+5 – also known as transaction duration). Members can perform position adjustments until their expiration.

Transaction Management Functionalities

Members can split a single transaction into multiple legs using transaction separation.

Technically, the number of splits is unlimited, but functionally it is limited by the transaction quantity.

Each leg will retain the original trade price.

Members can change the open/close flag for a specific transaction by performing an open/close adjustment.

Members can move transactions within their own transaction accounts. Technically, the transfer of a transaction is possible between all accounts.

Please note that quotes are an exception and cannot be transferred via a transaction account transfer.

Value Based Average Pricing (VBAP)

The Value Based Average Pricing (VBAP) functionality allows Members to group transactions and to create average priced transactions out of the group in a flexible manner.

Based on the group value members can "create" average priced transactions and allocate them at the current system calculated or a tailor-made average price.

Transactions can be added to a group, re-assigned to another group and subsequently removed from a group. Members can request grouping via GUI or FIXML.

Members can request the cancellation of wrongly created average price transactions.

If you want to learn more about VBAP Standardization, please read the DMIST Annual Report 2024 and Average Pricing Standard.

Classic Average Pricing (To be Decommissioned 2026)

The classic average price processing functionality allows merging of multiple transactions into one transaction with an average price calculated by Eurex Clearing. Average priced transactions can be de-merged.

The general transaction adjustment is used to modify

- text fields

- Member and beneficiary information for cooperation products

- Own Reference ID

The Give-up functionality allows members to transfer transactions to other members.

For the transfer to be valid, the receiving member must accept (Take-up) the incoming transaction. The Give-up/Take-up process also requires the approval of the corresponding Clearing Member. Clearing Members may specify an auto-approval for a faster processing.

If required and as long as the process status is pending, the initiating Member can cancel the Give-up and the accepting member can reject it.

Pending Give-up processes are not cancelled during the end of day-processing. They will be automatically reallocated on the next business day (certain restrictions apply).

Position Management Functionalities

To rectify erroneous open/close transaction designations, members can perform Position open/close adjustments to increase/reduce the open long and short position equally (fees may apply).

Previously closed-out positions can be re-opened.

Please note, the option to reopen positions is available for five business days.

Eurex Clearing also provides the option to transfer positions. This includes internal transfers (between own accounts) and external transfers (to another member).

Internal position account transfer

Positions can be fully or partially transferred to a different account of the same member. Internal position transfers are executed immediately. However, positions that have been exercised or assigned cannot be transferred.

External position transfer (to another Clearing Member)

All external position transfers are immediate and can optionally carry a cash amount. When transferring a position, members have the choice to adjust the position transfer price and/ or to transfer a cash amount.

Processing of external position transfers

External position transfers require the approval/acceptance of the initiating and receiving member, as well as their respective Clearing Members. In certain specific cases, a formal application may be required for the transfer.

If the position transfer has not been approved by all relevant parties, it remains pending until the end-of-day processing or until the request is either cancelled by the initiator or rejected by one of the related parties.

Exercise

A holder of a long option position can exercise their right to:

- Buy or sell the underlying asset against payment

- Open a short or long position in the underlying futures

- Receive a cash settlement

American-style options can be exercised on any business day, whereas European-style options are only exercisable on the last trading day.

Automatic exercise facility

Open long option positions are automatically exercised on expiration day, when the defined minimum in-the-money amount is met.

Eurex options have a default minimum in-the-money amount set for automatic exercise.

Abandon

On expiration day, Members may exclude individual positions, either fully or partially from automatic exercise by utilizing the abandon functionality.

Assignment

A holder of a short option position may be assigned to fulfill their obligation to:

- Buy or sell shares of the underlying equity on any business day

- Take a short or long position in the underlying futures contract

- Settle in cash

Eurex Clearing uses a random procedure to assign exercise notices to option seller from all open short positions of the same option series.

Notification

The holder of a short position in certain physically settled products (such as fixed-income futures contracts) may indicate their preferred "deliverable" from a basket by entering a delivery notification into the system on the expiry date.

Allocation

The securities nominated in the delivery notification are randomly allocated to the holders of long position in physically settled products. Clearing Members are informed of the allocations on the same business day.

Entitlement and Availability

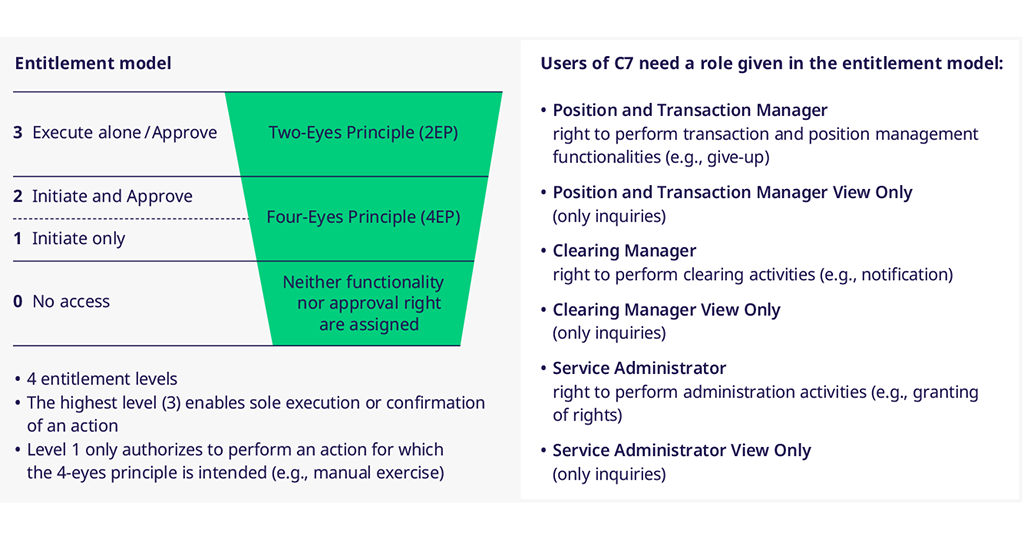

Entitlement is a mechanism that grants Members and their Users access to transaction and position management functionalities within the C7 clearing system.

The entitlement model uses roles to streamline the assignment of activities (privileges). These roles are assigned to a Member, and the Member's Service Administrator can then allocate the roles to the appropriate users. Each role includes specific privileges.

Every privilege defines access to a specific activity (e.g., 'Add Give-Up'). A user's request can only be processed if they have been assigned the corresponding privilege.

Eurex Clearing provides a streamlined outsourcing solution for back-office functions through FIXML and the C7 Derivatives Clearing GUI.

This simplified outsourcing service is exclusively available to Clearing Members (CMs) who are insourcing back-office functions for their Disclosed Clients (DCs) and DC Market Participants.

A user of the Clearing Member can log into the GUI using its own Member ID/User ID and initiate requests for transaction or position management from the DC Market Participants’ position account.

To apply for simplified outsourcing, the Announcement of Outsourcing of Back-Office Functions for Eurex Clearing DC Market Participants can be requested via the appropriate forms.

Transactions are adjustable for a limited period; this is referred to as the transaction duration. During the transaction duration, adjustments are possible based on the current product phase. The following product phases are differentiated by the C7 system:

Clearing phase

During the Clearing phase, all clearing activities are permitted.

No Position Move phase

This product phase allows all clearing activities but restricts the transfer of quantity to other participants via Give-up or External Position Transfer.

No Settlement phase

This product phase allows all clearing activities, but Exercise, Abandonment from Automatic Exercise or Notifications are not allowed.

Restricted Access phase

When a product is in the Restricted Access phase, position and transaction management are not possible.

Please be aware that on the expiration day for certain products, the timings for the front month may vary. These variations, along with any intraday schedule changes, are not included in the CSV file. The times listed in the CSV file are in CET/CEST.