General information

1. Corporate structure and governance

Please click here to find comprehensive information.

Please click here to find comprehensive information.

No.

2. Treasury

Eurex Clearing has access to the intraday credit facility of the Deutsche Bundesbank.

Yes. Eurex Clearing has adequate credit facilities with a number of investment grade rated banks in place which, together with other liquidity sources, cover Eurex Clearing's intraday and overnight financing needs.

3. Regulation

On 10 April 2014, Eurex Clearing received a permission from the German Federal Financial Supervisory Authority to perform clearing services pursuant to Article 17 of Regulation (EU) No 648/2012 of the European Parliament and of the Council of 4 July 2012 on OTC derivatives, central counterparties and trade repositories (European Market Infrastructure Regulation, EMIR). The authorisation as EMIR-compliant CCP also determines Eurex Clearing as a qualifying CCP under Capital Requirements Regulation (CRR).

Eurex Clearing is also a credit institution under the German Banking Act and fulfils the requirements under the European legislation, in particular Capital Requirements Regulation (CRR) / Capital Requirements Directive (CRD IV).

Eurex Clearing is registered with the Commodity Futures Trading Commission (CFTC) as a Derivatives Clearing Organisation (DCO) for clearing OTC interest rate swaps for US Clearing Members in accordance with the Commodity Exchange Act.

Eurex Clearing AG has been recognized by the Swiss Financial Market Supervisory Authority FINMA as a foreign central counterparty and is considered by the Swiss National Bank as a systemically important financial market infrastructure for the stability of the Swiss financial system.

As a consequence, the list of the relevant authorities can be found below:

BaFin

Marie-Curie-Str. 24-28

60439 Frankfurt

Deutsche Bundesbank

(Central Administrations Center Frankfurt / Main)

Taunusanlage 5

60313 Frankfurt am Main

Deutsche Bundesbank

(Head Office) Wilhelm-Eppstein-Str. 14

60431 Frankfurt am Main

Swiss National Bank (SNB)

Börsenstr. 15

CH-8022 Zürich

Swiss Financial Market Supervisory Authority FINMA

Laupenstr. 27

CH-3003 Bern

Financial Conduct Authority (FCA)

25 The North Colonade, Canary Wharf

London E14 5HS

Yes, Eurex Clearing provides reporting to regulators due to different regulatory prescriptions and in different time periods.

Eurex Clearing reports to the following public authorities

- the Federal Financial Supervisory Authority (BaFin),

- the German Central Bank (Deutsche Bundesbank),

- the Swiss Financial Markets Authority (FINMA),

- Commodity Futures Trading Commission (CFTC),

- the Swiss National Bank (SNB).

For further information, please contact our regulatory section.

4. Compliance

Eurex Clearing AG is audited by an external auditor. The auditor is PricewaterhouseCoopers (PwC) and the audit takes place on a yearly basis.

Eurex Clearing AG rules are stipulated in the Clearing Conditions which are part of the general terms and conditions. Eurex Clearing AG reserves the right to amend the Clearing Conditions at any time; those amendments and additions shall be announced via electronic circular to the Clearing Members, Basic Clearing Members and/or other customers ("Affected Customers") at least fifteen (15) business days (Regular Notification Period) prior their effective date fixed in the relevant notice.

If Special Provisions are to be changed or amended, Eurex Clearing AG will carry out a Consultation and invite all Affected Customers to submit comments to the proposed changes and amendments and/or to express their desire for the application of a Prolonged Notification Period within one month after the publication of the relevant invitation. In case three or more Affected Customers request the application of a prolonged notification period, the notification period will be extended to three (3) months (“Prolonged Notification Period”).

Each Affected Customer accepts each amendment and addition to the Clearing Conditions, unless it objects by written notice to Eurex Clearing AG within the Regular Notification Period or the Prolonged Notification Period, Unless otherwise provided in the Clearing Conditions, all information to be published according to these Clearing Conditions shall be displayed for at least three business days, available here.

Every employee and external service provider of Deutsche Börse Group is obliged to adhere to the “Guideline for Keeping Professional and Banking Secrecy”. Professional Secrecy is the obligation for any employee to treat information obtained pursuant to professional activities confidential. Banking Secrecy is derived from this by adding specific provisions while limiting its application to employees of regulated entities. All information received within the conduct of professional activities must therefore be treated in the strictest confidence by employees and external service providers and must not be disclosed to any unauthorized party.

The adherence of client confidentiality is ensured by the implementation of diverse control systems like the Internal Control System (ICS), Group Compliance and Internal Auditing.

For further information please see also our annual report.

5. Services, membership and admission

Please click here to find comprehensive information.

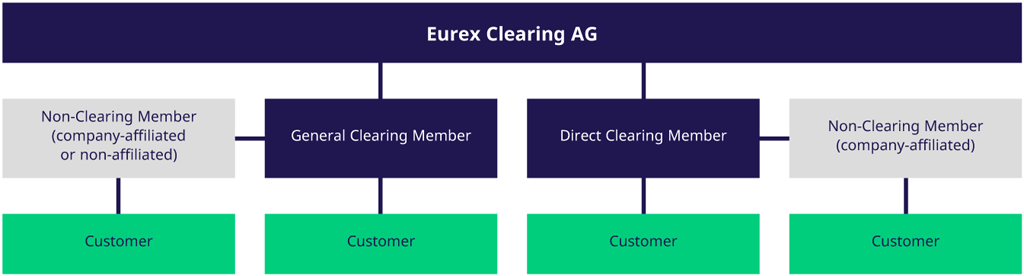

Membership comes in two categories at Eurex Clearing - General Clearing Membership and Direct Clearing Membership.

- A General Clearing Member (GCM) may clear its own transactions, those of its customers, as well as those of trading participants that do not hold a clearing license (known as Non-Clearing Member - NCM).

- A Direct Clearing Member (DCM) is entitled to clear only its own transactions, those of its customers, and those of its corporate affiliated NCMs. Only a Clearing Member - GCM or DCM - may be a counterparty of Eurex Clearing in a transaction.

As a result, legal relationships are essentially concluded between Eurex Clearing and a given Clearing Member, and in turn between that Clearing Member and the respective NCM.

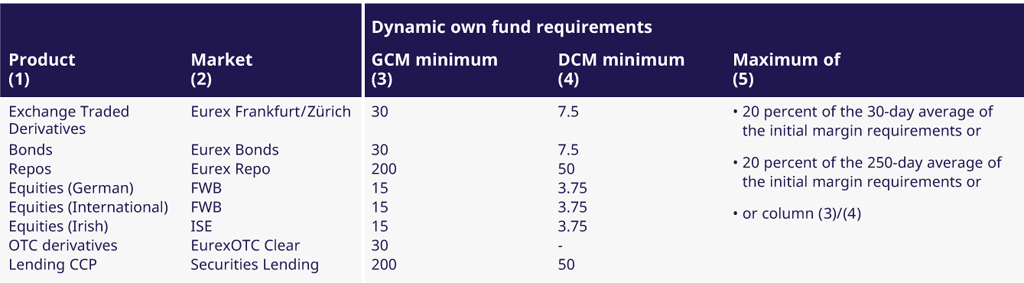

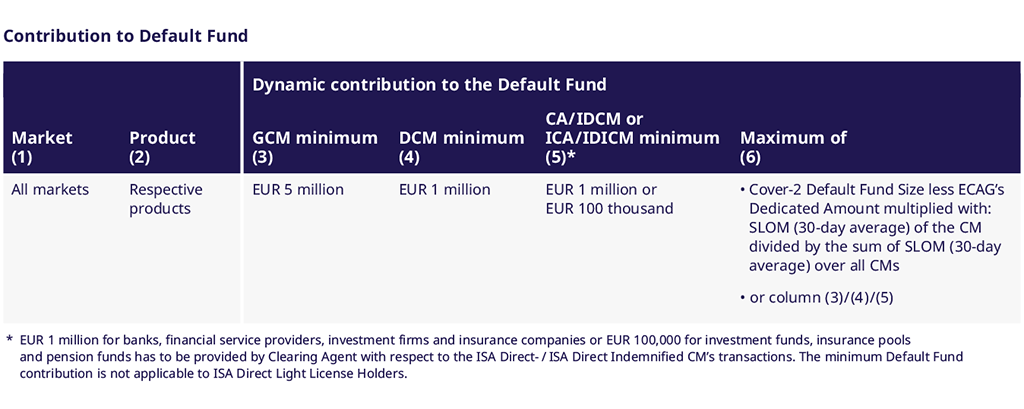

Applicants must be authorized and entitled by their respective regulatory authorities to operate in the custody and loan business as well as to accept receipt of margins in the form of cash and/or securities. In addition, Clearing Members must show evidence of a certain minimum level of own funds and must pay a contribution to Eurex Clearing’s Clearing Fund. Both the level of contribution to the Clearing Fund and the level of own funds depend on the status of the Clearing Member (GCM or DCM).

Own fund requirements, in EUR mn

Contribution to Clearing Fund, in EUR mn

*Initial margin corresponds to the sum of futures spread margin and additional margin.

Additional admission requirements for all our Clearing Members include different accounts that they need to set up. Every member must hold accounts at a central securities depository for the deposit of collateral and execution of settlement related payments. Further, we require evidence of cash accounts for clearing related payments, e.g. premiums.

With our fee model, we encourage our members to conduct business at Eurex Clearing in multiple markets by taking advantage of economies of scale. For a first membership, applicants are charged a one-off admission fee as well as an annual membership fee. If a company wishes to become a Clearing Member for additional markets that we clear, no additional admission or membership fees are levied. In line with the markets that we serve, companies may apply for one or more of the following clearing licenses:

- Eurex Exchanges

- Eurex Repo

- Frankfurt Stock Exchange

- EurexOTC Clear

- Securities Lending

For further information, please also consult our webpage. Click here.

All forms necessary for the registration to the various Eurex Clearing service offerings can be found on our webpage under here.

We charge applicants a one-off admission fee of EUR 50,000 to become a Clearing Member, as well as an annual membership fee of EUR 25,000. We designed our fee model to encourage Members to take advantage of all the markets that we serve. For this reason, if you wish to become a Clearing Member for any of the other markets we clear we do not charge any additional admission or membership fees.

Additional fees with regard to different connection components and transaction volumes can be found on the Eurex Clearing Price List.

Please click here to find comprehensive information.

Please click here to find comprehensive information.

6. Risk

- What model is used to calculate initial margin?

Please click here to find comprehensive information.

- How is the default fund calculated for each member?

Please click here to find comprehensive information.

- Are there any intra-day calculations and if so is this called for?

Please click here to find comprehensive information.

- Are there any offsets against other products?

Eurex Clearing Prisma calculates combined risks across all markets cleared by Eurex Clearing. Cleared products that share similar risk characteristics are assigned to the same so-called Liquidation Group, which results in more comprehensive risk calculations enabling cross margining across positions within any Liquidation Group. Our margining method and default management process are closely aligned.

Please click here to find comprehensive information about liquidation group setup.

7. Collateral

Collateral deposit

The Clearing Member delivers the securities to the relevant account directly within the system of the chosen (I)CSD i.e. Clearstream Banking Europe (CEU), Clearstream Banking Luxembourg (CBL) or SIX SIS. All deposits are reflected near-time within the collateral management system of Eurex Clearing® C7. If a deposited ISIN cannot be accepted (due to ineligibility of the security or breach of concentration limit), Eurex Clearing instructs a near-time transfer back to the member's redelivery account.

In case a tri-party collateral management system is used, the Clearing Member needs to instruct an increase of a Collateral Claim.

Collateral withdrawal

Securities withdrawal instructions are entered using the “Collateral Transaction Entry” window of the Eurex Clearing® C7 system. Once confirmed by Eurex Clearing Operations that the margin requirement is still covered without the securities requested, the securities are transferred from the respective collateral account into the member's redelivery account. If a withdrawal request leads to an under-collateralization in the member’s account, the transfer of the requested securities is optionally postponed until the next business day or intraday until the appropriate amount of funds is in the account to fully cover the margin requirements.

Collateral Claim decreases need to be instructed via the tri-party collateral management system of the respective depository. Once confirmed by Eurex Clearing Operations that the margin requirement is still covered with the reduced claim amount, the tri-party collateral management system will move securities with a value up to the free amount to the respective source account.

Information about collateral

The Clearing Member may manage collateral on several windows on the Eurex Clearing® C7 GUI.

- Collateral Transaction Input / Collateral Transaction - Mass Input

The Collateral Transaction Input window is used for collateral withdrawals and deposits by a member and by Clearing Operations on behalf of a member. Members may withdraw securities or deposit/withdraw cash through this window. The Collateral Transaction – Mass Input window allows a fast entry of cash deposits or withdrawals for multiple pools at the same time. - Four Eyes Principal – Collateral

The Four Eyes Principal window for the collateral management allows the approval or rejection of

- transaction input/cancellation

- Permanent Cash Balance amendments.

The member can define on user level whether the four eyes principal feature is to be used. - Collateral Transaction Overview

The Collateral Transaction Overview window provides a variety of filter options to search for all or specific transactions that have been entered for a pool. Transactions generated out of the Mass Input can as well be found here. After settlement/cancellation any transaction can be historically enquired for approx. 60 days. - Collateral Transaction Details

The Collateral Transaction Details window provides detailed status information for a single collateral transaction including its entire history (status updates). After settlement/cancellation transaction details can be historically enquired for approx. 60 days. - Collateral Position Details

The Collateral Position Details window provides a variety of filter options to search for all or specific collateral positions (in cash, securities or claims) that are held in a pool. - Collateral Pool Status Overview

The Collateral Pool Status Overview window provides an overview of the overall values of cash, securities or claims in a pool and its current excess/shortfall. - Permanent Cash Balance (PCB) Maintenance

The PCB Maintenance window allows the member to define a minimum cash balance per currency that shall remain as cash collateral and hence will not be swept out in the end of day processing. - CSD Account Maintenance

The CSD Account Maintenance window allows the member to inquire all accounts that are setup for a respective pool.

Please click here to find comprehensive information.

8. Clearing operations

At Eurex, position limits exist according to § 14.7 of the Exchange Rules of Eurex Deutschland. The size of the respective limits can be learned from the product specifications on the Eurex Exchange website.

Trading Surveillance Eurex Deutschland is monitoring the adherence of the position limits intraday and is informing the Börsenaufsichtsbehörde Hessen as well as the Executive Board of Eurex in case of breach of the Exchange Rules. They then decide on whether to forward the statement of affairs to the sanction committee of Eurex Deutschland. In succession, the sanction committee is able to impose sanctions up to an amount of EUR 250.000 and/or to impose a temporary or definite expulsion from trade.

9. Disaster recovery/ IT-security

Yes, Deutsche Börse Group has implemented a formal crisis management process with defined responsibilities. The process applies Group-wide for all activities and organizational or legal entities, including Eurex Clearing AG.

The Crisis Management Team is composed of the Incident and Crisis Managers from the different divisions of Deutsche Börse Group. It is their role to ensure a coordinated incident response, including internal and external communication.

Yes, the BCM plans address the unavailability of systems, workspace, staff and suppliers. Supplier unavailability preparedness is regularly reviewed and generally addressed by service level agreements or multiple vendor arrangements.

All Systems except Xetra® are set up with an automatic fail-over process which makes the takeover immediate. Xetra® is set up fault tolerant, but disaster recovery requires a restart of the system at the back up site, which typically should be done within an hour. However, the general recovery time objective of Deutsche Börse Group in case of a disaster is 2 hours.

10. Business continuity

In case of technical issues emergency information is provided via the following media:

- System Newsboard

- SMS Service

- E-mail

Information on technical issues is distributed immediately if impact on members of Eurex has been recognized.

The responsibilities of Eurex and Eurex Clearing in an outage scenario are described within Section 12 on “Technical Problems” of the Technical Implementation Regulations of Eurex Deutschland and Eurex Zürich Concerning Technical Equipment.

French financial transaction tax (French FTT)

General aspects

The French Financial Transaction Tax (French FTT) is applicable on the acquisitions of shares traded on a regulated market (French or foreign) issued by French entities (Headquarters are located in France) with a market capitalization of more than EUR 1 billion on 1 December of the previous year (acquisitions may also result from corporate actions).

Only acquisitions are taxed, while sales are not in scope. The list of French companies (in-scope equities) with a market capitalization value on 1 December of each year greater than EUR 1 billion will be published before 31 December of the same year by the French Tax Authority on the FTA's website.

The French FTT applies to transactions in equity securities and assimilated securities, such as shares (ordinary/preferred), investment and voting certificates, convertible/exchangeable bonds, and depositary receipts (e.g., ADRs) representing in-scope equities; furthermore, the acquisition of underlying shares/equities upon exercise/exchange of options, derivatives, conversion of bonds or other marketable securities may also trigger the FTT, unless the delivered shares/equities are newly issued.

Which transactions are affected?

There are three types of transactions that are liable to French Financial Transaction Tax (FTT):

- Purchasing transactions in French equities or comparable securities (Equity FTT),

- High frequency-trading transactions in equities (HFT FTT), and

- Purchasing transactions in uncovered CDS in European Union sovereign debts (CDS FTT).

Which is the tax rate and what is the tax base for French FTT?

The French FTT is computed at a 0.3% rate based on the acquisition value of the in-scope companies and their equity securities and assimilated instruments. However, starting with effective date April 1st, 2025, following the publication of Finance Law for 2025 in the Official Journal on 15 February 2025 through Law N°2025-127 dated 14 February 2025, the French FTT rate will increase from 0.3% to 0.4% (art.98). The transaction amount is the basis for the tax calculation:

- For the tax applicable to the transfer of listed shares, the taxable basis would be the price of acquisition which shall not be lower than the fair market value of the shares acquired at accrual date.

- For speculative high frequency transactions, the taxable basis will be the positive difference in the same day and for the same company shares, between the total amount of cancelled or modified orders and percentage (to be determined) of the total amount of transfer orders.

- For the CDS, the taxable basis will be the notional value established in the contract.

Who is liable to tax?

Finally, the person is liable to tax, who has initiated the transaction:

- The French FTT is payable by the buyers regardless of their nationality or place of residency and regardless of the trading venue;

- The French FTT on high-frequency trading (HFT) will be payable by French companies engaging in proprietary HFT;

- The French FTT on transaction in uncovered CDS on sovereign debt is payable by French individuals or legal entities that acquire these contracts for reasons other than to hedge existing assets or commitments.

What is the meaning of "acquisition"?

Transactions are taxable if and when they generate a transfer of ownership (“acquisition”), that means:

- The transfer of ownership takes place by crediting the relevant shares in the purchaser’s securities account

- Tax is applicable based on settlement date

- Intraday transactions are subject to tax only for resulting net buying position at the end of the business day

The transfer of an in-scope equity or assimilated instrument as collateral is not subject to tax.

Are there any exemptions from the financial transaction tax in equities?

In principle, equity purchasing transactions are subject to the French FTT unless one or more of the nine exemptions to the financial transaction tax in equities named in the law are met:

- Purchases linked to an issue of securities (primary market) — no matter if the new issue will be purchased directly or via an investment service provider

- Purchases made by a clearing house or a Central Securities Depositary (CSD)

- Purchases linked to Market-Making activities

- Purchases linked to liquidity contract

- Intra-group transactions

- Securities lending and repos

- Acquisitions by employee mutual funds, employee open-ended investment funds or by employees directly

- Acquisitions for employee saving schemes (including purchase of company shares)

- Acquisitions of bonds exchangeable or bonds convertible in shares (the purchase of the bonds is tax-exempt, the conversion of the bonds into shares is taxable)

Foreign persons who carry out activities or transactions governed by foreign law may be exempted if they are similar to exempt transactions carried out by French persons or governed by French law.

What is an accountable party/statutory taxpayer based on Legal Definition?

An accountable party/Statutory Taxpayer is an institution which is legally obliged for providing tax declaration, assessing and paying the French FTT, and which shall be

- the investment service provider or broker (regardless of its location), which has executed the transactions on its own behalf or on behalf of its clients, or

- the securities account holder of the investor (regardless of its location) when the transaction is not executed by a broker, e.g. OTC transaction, (e.g., executed by an institution and acting as the custodian).

Statutory Taxpayer should generally identify and document their counterparties/clients.

Does Eurex Clearing AG deduct the tax amount directly?

The French FTT has to be paid by the accountable party/Statutory taxpayer after reporting the taxable transactions.

Eurex Clearing AG as a clearing house is exempt from the French FTT. However, as part of the transaction chain, Eurex Clearing AG is obliged to provide required information for the reporting to the Statutory Taxpayer, which provide the French Tax Authority on a monthly basis with the mandatory data, based on the legal requirements out of the French Tax Code.

Disclaimer

Eurex Clearing AG (ECAG) explicitly states that it does not offer legal and/or tax advice related to the French Financial Transaction Tax. Compliance with all legal obligations, including reporting requirements, notifications, and payments, is the sole responsibility of each Clearing Member. ECAG assumes no liability for the completeness, accuracy, or timeliness of the information provided. For binding information, please consult a legal or tax advisor. Nothing contained here should be used as a substitute for the advice of competent legal or tax counsel.

All written and oral communication in this context is not considered to be tax advisory services. In case of questions, unclarity or comments we kindly ask you to align with your internal tax department and/or your tax advisor.

Spanish Financial Transaction Tax (Spanish FTT)

General aspects

Spain imposes a financial transaction tax (hereinafter, "Spanish FTT") exclusively on the acquisitions of shares of Spanish companies with a market capitalization (considered on 1 December of the year prior to the acquisition) over EUR 1 billion. Those shares are admitted to trading on the Spanish market, or on a regulated market of another EU Member State or on an equivalent third-country market.

Which transactions are affected?

The taxable event is the acquisition of Spanish securities

- of a company with a market capitalization of more than 1 billion EUR1;

- admitted to trading on a regulated market, which may be a Spanish market, a market of another European Union Member State, or an equivalent market in a third country;

- acquisitions for valuable consideration of depositary receipts representing the shares (e.g., ADRs, ADS etc.), regardless of the place of establishment of the issuer of such securities;

- acquisitions of securities meeting the criterions in the previous sections and that are resulting from the execution or settlement of obligations (e.g., Convertible / exchangeable bonds, derivative financial instruments, or any other instrument of financial agreement, etc.).

Which securities are in scope of the Spanish FTT?

The Spanish FTT is applicable on the acquisitions of securities traded on a regulated market (Spanish or foreign) issued by a Spanish entity with a market capitalization of more than EUR 1 billion at 1 December of the previous year (acquisitions may also result from corporate actions).

Which transactions are affected?

The Spanish FTT concerns shares as defined in Article 92 of the Capital Corporation Law:

- In-scope examples: shares, depositary certificates representing shares, for example ADRs of Spanish shares.

- Out-of-scope examples: debt instruments, units of Collective Investment Vehicles, units in Exchange-Traded Funds, derivatives, voting rights.

Please consider, that Derivatives are not themselves in the scope of the Spanish FTT. However, the physical settlement of a derivative in in-scope shares is regarded as a taxable acquisition. Similarly, bonds exchangeable or convertible into shares are not themselves in the scope either, but only at conversion.

Are there any exemptions from the financial transaction tax in equities?

Eurex Clearing AG's transaction as a CCP and clearinghouse are treated as to be exempted from Spanish FTT but required to report exempted acquisition transactions per calendar month. In general, each transaction has to be reported individually. There is neither a minimum reporting requirements in the number of shares nor the amount paid. For reporting and payment purposes, the relevant information on a transaction-by-transaction basis should be provided to the Spanish Tax Authority (via Iberclear).

The Spanish FTT does not apply to:

- Appropriate functioning of secondary market:

- Purchase or loan by CCP or CSD: Acquisitions deriving from purchase or loan transactions by a central counterparty (CCP) or a central securities depository (CSD) in the exercise of their respective duties;

- Liquidity agreements: Purchase by financial intermediaries as liquidity suppliers;

- Market Making: Acquisitions performed during market-making activities

- Further exemptions:

- Intragroup transaction:

- Purchase of shares between entities of the same group on the terms of article 42 of the Commercial Code.

- Acquisition of own shares or shares of the parent company of the group, made in the context of a repurchase program with the sole purpose of: decreasing the share capital of the issuer, complying with obligations inherent to convertible financial instruments or complying of obligations derived from stock options or share plans of employees or directors of the group.

- Some business restructuring transactions: Purchase qualified for the special tax regime mentioned in Corporate Income Tax Law 27/2014 for mergers, spin-offs, contributions of assets, exchanges of securities and change of registered office; Purchase as a result of merger or spin-off transactions involving CIVs, or compartments or sub-funds;

- Securities financing: Repurchase, lending & borrowing, buy-sell back & sell-buy back, margin lending;

- Collateral transactions: Collateral transactions involving change of title;

- Intragroup transaction:

Disclaimer

Eurex Clearing AG (ECAG) explicitly states that it does not offer legal and/or tax advice related to the Spanish Financial Transaction Tax. Compliance with all legal obligations, including reporting requirements, notifications, and payments, is the sole responsibility of each Clearing Member. ECAG assumes no liability for the completeness, accuracy, or timeliness of the information provided.

For binding information, please consult a legal or tax advisor. Nothing contained here should be used as a substitute for the advice of competent legal or tax counsel.

All written and oral communication in this context is not considered to be tax advisory services. In case of questions, unclarity or comments we kindly ask you to align with your internal tax department and/or your tax advisor.

1 The ministry of Taxes will publish before 31 December of each year the list of Spanish companies with a capitalization value exceeding 1 billon EUR on 1 December of the current year

U.S. Taxation

1. Clearing of potential Section 871(m) IRC transactions - General aspects

The U.S. Tax Authority (“Internal Revenue Service, IRS”) introduced comprehensive reporting requirements regarding derivatives transactions of in-scope assets for sec.871(m) IRC, in order to cover relevant income amounts (“dividend equivalent payments/amounts” = “DEP”/”DEA”) on yearly basis. The respective requirements are to be considered for relevant derivatives transactions with non-U.S. citizens / persons / aliens including foreign entities/companies documented via the tax form W8-IMY.

A form W-9 from a U.S. domiciled Clearing Member would not trigger a sec. 871(m) IRC reporting by legal definition, U.S. citizens / persons /aliens are legally obliged to declare their income out of such transactions via dedicated tax forms on yearly basis with the U.S. Tax Authority. Eurex Clearing AG requires W9-tax forms for clearing of derivative transactions with U.S. underlying products/assets potentially in-scope for sec.871(m) IRC derivatives transactions to ensure clarity, that such Clearing Members have their legal seat in the U.S.

Under Internal Revenue Code (“IRC”) Section 871(m) and the final regulations definitions, a “dividend equivalent payment/amount” = “DEP”/”DEA” is treated as a dividend from sources within the United States for the purposes of taxing and withholding at source on non-U.S. citizens / persons / aliens including foreign entities/companies. A dividend equivalent amount/payment is treated as dividend income also for purposes of any provision regarding dividends in an income tax treaty.

The definition of derivatives for the purposes of sec. 871 (m) IRC is very broad and includes so-called notional principal contracts (i.e. certificates, swaps, etc.) as well as equity linked instruments (e.g. options, futures, forwards, contracts for differences, etc.).

An internal classification takes place at least once a year (beginning of calendar year) and will be considered valid during this period within the systems of Eurex Clearing AG. This classification is for internal purposes only. Clearing Members cannot derive any conclusions regarding their own classification of in-scope products from this information. In accordance with the legal requirements of the IRS, the classification of relevant and in-scope products for sec.871(m) IRC is the responsibility of the “determining/responsible party." Eurex Clearing AG acts in front of the IRS as “reporting party”.

Under Eurex Clearing AG internal assignment / classification purposes regarding sec.871(m) IRC currently two underlying criterions are considered:

a.) Derivatives such like options/futures on single stock products if

- the underlying securities are equities from an U.S. based/domiciled company

- if these U.S. equities are paying a dividend during the tax reporting period and

- if the derivatives have a delta equal to 1 (might be adopted beginning January 2027 to 0.81 )

b.) Derivatives such like options/futures on indices, baskets or Exchange Traded Funds (“ETF”) if they meet the conditions listed below:

- Does the index or basket contain at least 25 different investments or securities, regardless of whether they have a U.S. connection or not?

- Are all investments or securities (U.S. domiciled) held, and the income recognized as the beneficial owner (so-called “Long Party”)?

- If the part of each of the investments or securities (U.S. domiciled) is a maximum of 15% measured against the value of the index or basket (so-called weighting)?

- Can the proportion of up to 5 combined investments or securities (U.S. domiciled) only be changed based on prescribed and published criteria?

- Did the index or basket provide a dividend yield of a maximum of 1.5 times the dividend yield of the S&P500 in the immediately preceding calendar year?

- Is the index or basket used as the underlying value of futures and options, which in turn are traded on a recognized exchange or market from a US perspective?

In addition, the criteria of the “safe harbor” rule must also be taken into account accordingly:

- Is the index or basket widespread, frequently used, but not individually agreed upon?

- The part of all U.S. investments or U.S. securities is a maximum of 10% of the total value of the index or basket (so-called weighting)?

- The index or basket was not created to reduce or avoid U.S. tax?

1 Please refer to the IRS publication “Extension of the Phase-in Period for the Enforcement and Administration of Section871(m)” Notice 2024-44, dated 22 May 2024

- Equity Derivatives (Single Stock Futures and Single Stock Options)

- Futures and options on indices/baskets/ETFs

The legal obligations for sec.871(m) IRC derivatives shall be considered, regardless of physical delivery of the assets or of a cash delivery out of the execution of such derivatives.

Eurex Clearing AG is acting as Qualified Intermediary (QI) and Qualified Derivatives Dealer (QDD) in front of the U.S. Internal Revenue Service (IRS). The mandatory required legal agreement with the IRS is in place.

Eurex Clearing AG is legally defined as “reporting party” in front of the IRS and is therefore obliged to report the relevant derivatives transactions between the respective Clearing Member and Eurex Clearing AG out of a tax year via the tax form 1042-S on behalf of the respective Clearing Member towards the IRS within the mandatory deadline 15th March of the following year.

The Clearing Member as “determining / responsible party” regarding the definition of potential in-scope products for sec. 871(m) IRC derivatives transactions and in this capacity must provide until the 10th of the following month whether or not any derivative/s transaction is in-scope for sec. 871(m) IRC and, hence, is subject to reporting the calculated dividend equivalent payment/amount out of such transactions to Eurex Clearing AG (i.e. a nil reporting of assigned Clearing Member is mandatory).

2. Impact of Section 871(m) IRC derivatives transactions towards the Clearing Members

Non-U.S. domiciled Clearing Member

Eurex Clearing AG has limited the accessibility for clearing of potential in-scope products for sec.871(m) IRC derivatives transactions to certified QI’s assuming primary chapter 3 and chapter 4 withholding tax obligations or QDD’s.

Based on the contractual relationship between Eurex Clearing AG and its Clearing Member/s, Eurex Clearing AG is requesting from each Clearing Member, which would clear potential in-scope products/assets for sec.871(m) IRC derivatives transactions with Eurex Clearing AG, a valid W8-IMY tax form with the respective certification confirming at least one of the aforementioned options (e.g. QI/QDD). The relevant account number (Client Account/s, Proprietary Account/s, Market Maker Account/s) for which the potential transactions shall be cleared should be stated in Line 10 of the form, before any clearing in derivatives transactions could take place. Within the provided tax form W-8IMY the Clearing Member confirms his status as QI and / or QDD assuming primary withholding responsibilities for any U.S. withholding tax obligations.

The Clearing Member is obliged to ensure the valid and complete tax form/s with Eurex Clearing AG, in case of changes such like changes in legal structure, address, or other relevant changes the Clearing Member need to ensure the presentation of the up-to-date tax form.

Such documented Clearing Member/s shall be marked in the Eurex Clearing AG system with a respective “Capacity Flag” in order to ensure the permission for clearing derivatives products/assets, potentially in-scope for sec.871(m) IRC.

Eurex Clearing AG have established within an internal assessment the classification of potential in-scope products/assets for sec.871(m) IRC derivatives at the beginning of the calendar year and marked applicable products with a “capacity flag” for clearing with documented Clearing Member.

U.S. domiciled Clearing Member

Such Clearing Member need to provide Eurex Clearing AG with a valid tax form W9 form (including the U.S. Tax Identification Number) before any transaction shall be initiated.

The Clearing Member need to share with Eurex Clearing AG all relevant reportable data (e.g. tax form 1042/1042-S, tax form 1099), which are filed with the IRS and are reflecting business with Eurex Clearing AG within a tax reporting year. The information shall be shared before the IRS filing deadline 15th March of the following year.

The Clearing Member is obliged to ensure the valid and complete tax form/s with Eurex Clearing AG, in case of changes such like changes in legal structure, address, or other relevant changes the Clearing Member need to ensure the presentation of the up-to-date tax form.

Information is required from each Clearing Member acting as long party in such transactions for the purposes of tax form 1042/1042-S reporting and reporting reconciliation.

As the Clearing Member long party is legally obliged to determine whether a derivative transaction is to be considered as a sec. 871(m) IRC derivatives transaction, the calculation of the so-called “dividend equivalent payment/amount (“DEA/DEP”) during a reporting/tax period need to be taken into account and reported via the tax form 1042-S / tax form 1042 towards the IRS [please refer to the Treasury Regulations § 1.871-15(c) and follows].

The Clearing Member, acting as long party must provide until the 10th of the following month whether or not the derivative transaction and the resulting calculated dividend equivalent payment/amount is in-scope for sec. 871(m) IRC derivatives transactions and, hence, is subject to the reporting to Eurex Clearing AG (i.e. a nil reporting of documented Clearing Member is expected).

Please refer to the information published within the last circular 046/24 (U.S. Tax Reporting: Update on the clearing of sec.871(m) Internal Revenue Code (IRC) transactions through Eurex Clearing AG.)

Each Clearing Member, acting as Long Party should request from Eurex Clearing AG a tax form W8-IMY for documentation purpose.

Such request could be addressed to (Clearing Key Account Manager at the following email address: client.services@deutsche-boerse.com).

Please consider, that the Clearing Member is fully responsible for any U.S. withholding tax obligation, any payment of withholding taxes towards the IRS, and any reporting obligations out of derivatives transactions with their clients. Eurex Clearing AG is not in any case involved in this process.

Eurex Clearing AG is expecting its documented Clearing Member/s to provide all relevant data and information required via a standardized reporting template from Eurex Clearing AG, which can be found under Rules & Regs > Regulations > U.S. Taxation, and which need to be provided to the following E-Mail address reporting871m@eurex.com covering the reportable data.

The assigned Clearing Member need to report monthly the relevant calculated income amounts (Dividend equivalent payment/amount) out of “received dividend distributions out of the applicable assets for sec.871(m) IRC” together with the holding positions in in-scope products/assets on business day end on Eurex Clearing AG account level.

Eurex Clearing AG shall reconcile the received reportable data with the data classified within the internal database; afterwards Eurex Clearing AG shall report the final aligned data, covering the relevant tax year, via the tax form 1042/1042-S to the IRS by the latest of 15 March of the following year. Clearing Member, which have provided reportable data, will receive a copy of the filed form with the IRS.

Clearing Member/s must provide all information in form and substance on account level, on a monthly basis by the 10th day of the following month at the latest (i.e. for August 2025 on 10 September 2025).

Eurex Clearing AG have established an internal assessment, in order to ensure comprehensive reconciliation with the receivable data from the assigned Clearing Member within the tax period in consideration (tax year/calendar year).

Also “zero-reportings” from any documented Clearing Member/s is expected.

We kindly refer to our Clearing Conditions Chapter II Part 1 Number 1.7 Paragraphs (1) to (6).

Circulars from Eurex Clearing AG: No 028/2017, No 074/2017, No 021/2018, No 069/2018 and No 046/2024 under the following Link: https://www.eurex.com/ec-en/rules-regs/regulations/us-taxation

For further general information please refer also to the relevant publications from the Internal Revenue Service (IRS).

Eurex Clearing AG will prepare the tax form 1042-S for filing within the legal deadline towards the IRS and the assigned Clearing Member/s on basis of the received Clearing Member/s reportable data covering the calculations out of in-scope for sec.871(m) IRC derivatives transactions on tax reporting period basis.

In addition, Eurex Clearing AG shall prepare on calendar year basis the tax form 1042 covering the reporting obligations out of dividend equivalent payment/amounts in front of the IRS and ensuring a comprehensive reconciliation in conjunction with the filed 1042-S tax forms on Clearing Member level.

Please take into consideration, that Eurex Clearing AG will not report any transaction data out of the internal assessment, but in conjunction with the QDD Status of Eurex Clearing any potential deltas in filed tax forms 1042-S with the IRS and internal data of Eurex Clearing AG might be reported towards the IRS in accordance with section 7 out of the QI Agreement 2023 (please refer to 26 CFR 1.1441-1(e)(5) and (6), 2023 Qualified Intermediary Agreement, Rev. Proc. 2022-43).

Eurex Clearing AG (ECAG) explicitly states that it does not offer legal and/or tax advice related to the U.S Tax / U.S. Taxation. Compliance with all legal obligations, including reporting requirements, notifications, and payments, is the sole responsibility of each Clearing Member. ECAG assumes no liability for the completeness, accuracy, or timeliness of the information provided. For binding information, please consult a legal or tax advisor. Nothing contained here should be used as a substitute for the advice of competent legal or tax counsel.

All written and oral communication in this context is not considered to be tax advisory services. In case of questions, unclarity or comments we kindly ask you to align with your internal tax department and/or your tax advisor.