Collateral Management Support

Eurex Clearing offers various Client Asset Protection (CAP) models where it is possible to segregate a Clearing Member’s own collateral assets from its clients’ assets or separate clients’ assets from other clients’ assets. For more information on the different segregation models please refer to: Segregation Models.

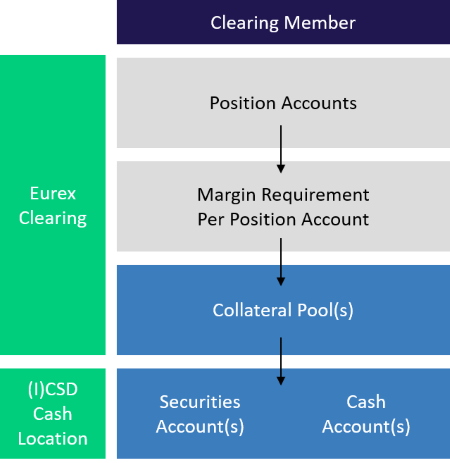

CAP is achieved through the concept of collateral pools in the collateral application.

A collateral pool holds securities and/or cash collateral used to cover the margin requirements associated to that pool as demonstrated in the image below:

- Security collateral is held in dedicated securities accounts at the respective (I)CSD and it is pledged or title transferred to Eurex Clearing. Alternatively, it can be provided via the triparty collateral management systems CmaX (CBL).

- Cash collateral is provided to Eurex Clearing by way of full title transfer. Because all cash transactions are transferred into a single account at Eurex Clearing, segregation is achieved on the clearing house level using the record-keeping of Eurex Clearing.

For more information, please refer to: Collateral.

The collateral management functions are performed via the C7 Clearing GUI, CMS Menu Switch.

FAQ

These are the segregation models supported by Eurex Clearing:

- Omnibus segregation

- Individually Segregated Accounts and

- LSOC segregation

For more information, please refer to:

In general, the collateral is evaluated every 10 minutes throughout the day during the clearing hours.

The cut-off time for collateral deposits and recall are the following:

Cash Collateral

Eurex Clearing accepts cash in four currencies as cash collateral to satisfy intraday margin calls: EUR, CHF, USD, and GBP.

JPY can be provided as an additional cash collateral currency with T-2 pre-advice; no intraday margin calls will be issued in JPY.

Different processes will be triggered depending on the Auto Repay and Permanent Cash Balance Set-Up for each collateral pool.

FAQ

Cash collateral deposits can be initiated via the C7 Clearing GUI, a member's cash deposit request in the C7 Clearing GUI triggers a debit from his cash account and a credit to Eurex Clearing’s account. Upon receipt of cash collateral on Eurex Clearing's account, the collateral balance for the respective collateral pool is updated.

- Cash collateral withdrawals can be initiated via the C7 Clearing GUI. For cash withdrawals, the approval of the clearing house is always required as the member’s collateral must be sufficient to cover margin requirements at all times.

- Upon a member's withdrawal request in the C7 Clearing GUI, Eurex Clearing checks that the withdrawal would not result in a shortfall. If this is the case, Eurex Clearing will release the requested cash withdrawal and update collateral balances accordingly. Eurex Clearing instructs a cash payment to the member's cash account.

Interest rates on cash collateral: The daily interest rate can be found in the Member Section as well as in reports CD230/CD231. Customers are debited/credited on the 2nd Business Date of each month with the total interest amount for the previous month (incl. Cash handling Fees)

The PCB is the pre-defined cash amount per pool that a member wants to hold with Eurex Clearing. Activation of the PCB might lead to automated cash movements in the morning:

- Mandatory cash call if the cash balance in the respective collateral pool and currency falls below the predefined PCB - regardless of collateralization level.

- Auto-return of excess cash above the predefined PCB in the respective collateral pool in the clearing currency - only if no under-collateralization exists and auto-repay is set up to “Yes” (the sponsor is able to choose the set-up per collateral pool. Per default, Eurex Clearing sets up omnibus collateral pools with “Auto-repay Yes” and individual segregated collateral pool with “Auto-repay No”. The Standard pools always have auto-repay set to “Yes”).

Clearing Members can inquire and maintain their PCB for EUR, CHF and GBP in the C7 Clearing GUI Permanent Cash Balance window.

In addition, Clearing Members have the option to use Permanent Cash Holding functionality to keep with Eurex Clearing pre-defined USD, EUR, CHF, GBP and JPY balances in the chosen collateral pool overnight. Permanent Cash Holding can be instructed via the C7 Clearing GUI Collateral Transaction Input window with type of money “term”.

Further information please visit: Cash Collateral.

Securities Collateral

Eurex Clearing accepts a wide range of ISINs as security collateral. To get an overview of the eligible ISINs please visit our Risk parameters and initial margins section and open the file “Admissible securities”.

FAQ

Security deposits must be made through the corresponding collateral location ((I)CSD). The deposits will then be processed via communication between the (I)CSD and Eurex Clearing. After deposits have been received, Eurex Clearing will update collateral balances accordingly. If a deposit is not eligible, Eurex instructs its return.

- Security collateral withdrawals can be initiated via the C7 Clearing GUI. For security withdrawals, the approval of the clearing house is always required as the member’s collateral must be sufficient to cover margin requirements at all times.

- Upon a member's withdrawal request in the C7 Clearing GUI, Eurex Clearing checks that the withdrawal would not result in a shortfall. If this is the case, Eurex Clearing will release the requested security withdrawal, initiate the return of the security collateral to the member’s redelivery account at the (I)CSD and update collateral balances accordingly.

Please check file “Admissible securities” under Risk parameters and initial margins.

For security collateral fee please check:

- Security collateral fee

- Report CB235

Further information please visit: Securities Collateral.

Triparty Collateral (Claims)

Members using Clearstream's triparty collateral management system CmaX (CBL) can deliver securities collateral to Eurex Clearing by entering claim amounts in CmaX. CmaX automatically allocates securities collateral according to pre-defined eligibility criteria.

- Claim increases must be made directly in CmaX. The claim increases will then be processed automatically via communication between the CmaX and Eurex Clearing. After a claim increase has been received at Eurex Clearing, collateral balances will be updated accordingly.

- Claim decreases must be made directly in CmaX. For claim decreases, the approval of the clearing house is always required as the member’s collateral must be sufficient to cover margin requirements at all times. Upon a member's decrease request via Cmax, Eurex Clearing checks that the decrease would not result in a shortfall. If this is the case, Eurex Clearing will approve the requested claim decrease and update collateral balances accordingly.

For more information on collateral management topics please refer to the “C7 - Collateral Management Functional Reference Guide” on our website under: Support > Initiatives > C7 Releases > System documentation.

Further information please visit: Tri-party Collateral Services.

Contacts

Eurex Frankfurt AG

Customer Technical Support / Technical Helpdesk

Service times from Monday 01:00 – Friday 23:00 CET

(no service on Saturday and Sunday)

T +49-69-211-VIP / +49-69-211-1 08 88 (all)

Eurex Clearing AG | worldwide

Helpdesk Securities Clearing

Service times from 07:00 – 19:00 CET

(no service on Saturday and Sunday)

T +49-69-211-1 19 40

F +49-69-211-1 43 34

Eurex Clearing AG

Helpdesk Derivatives Clearing

Service times from 01:00 – 22:30 CET

(no service on Saturday and Sunday)

T +49-69-211-1 12 50

F +49-69-211-1 43 34

Eurex Clearing AG

CCP Risk Management / Risk Exposure Management

Service times from 01:00 – 22:30 CET

(no service on Saturday and Sunday)

T +49-69-211-1 24 52

F +49-69-211-1 84 40