Cross Margining Support

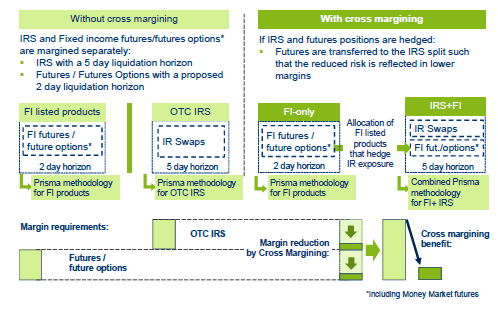

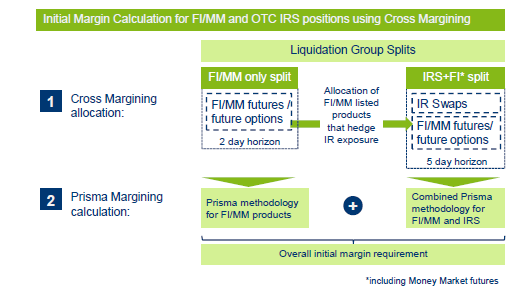

Cross margining (XM) allows a combined initial margin calculation between fixed income listed (i.e. FI ETD) and OTC IRS positions.

FAQ

- Delivers collateral efficiency through margin offsets between OTC IRS and FI ETD positions.

- Detailed and further explanations can be found in chapter 1.1 “Benefits for the Clearing Members and the Clearing House” in the Cross-Margining User-Guide.

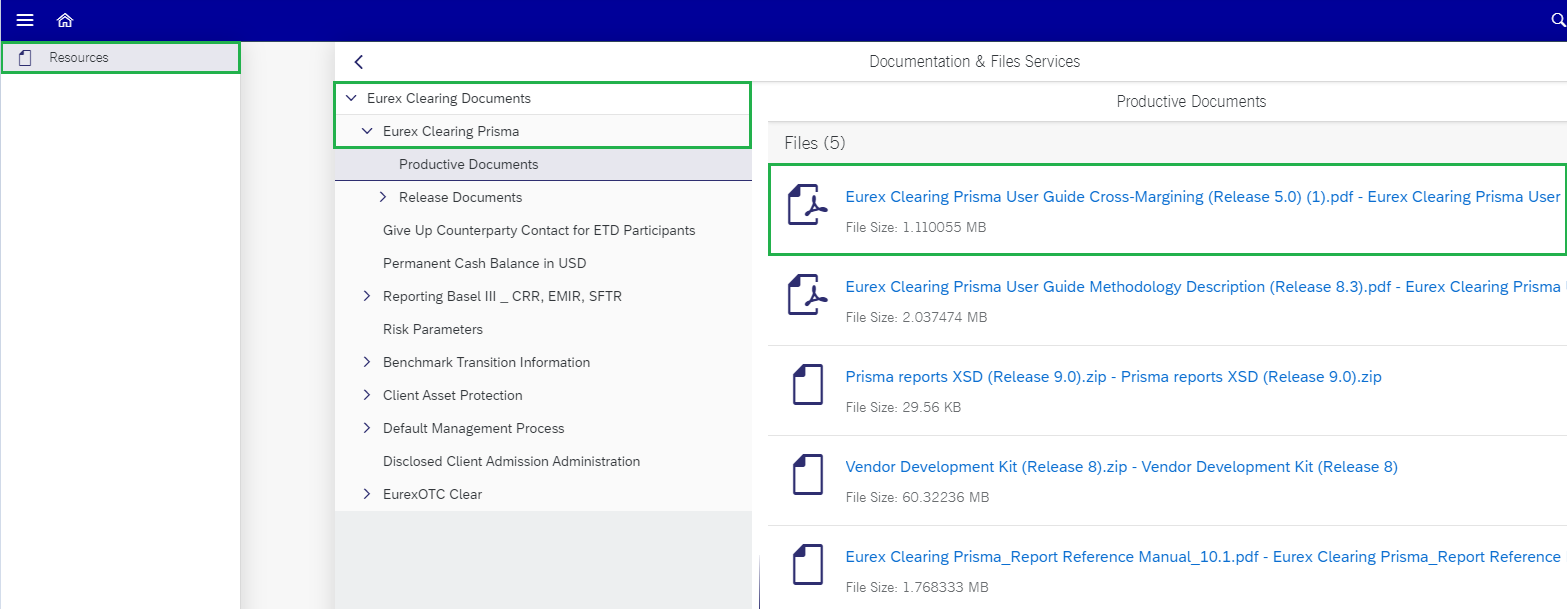

- The User Guide can be found on the Member Section via: Resources > Eurex Clearing > Documentation & Files > Eurex Clearing Documents > Eurex Clearing Prisma > Productive Documents.

- Yes, you need to actively enable cross-margining.

- Please contact your Clearing Key Account Manager or client.services@eurex.com so that they can request it for you with all necessary forms relevant for the setup.

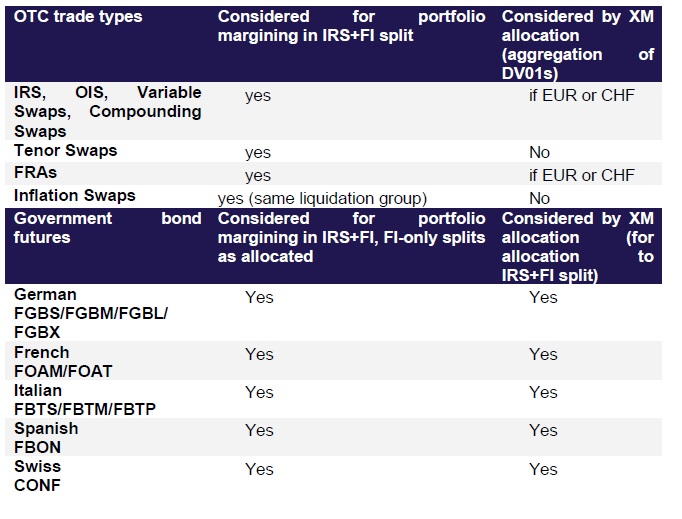

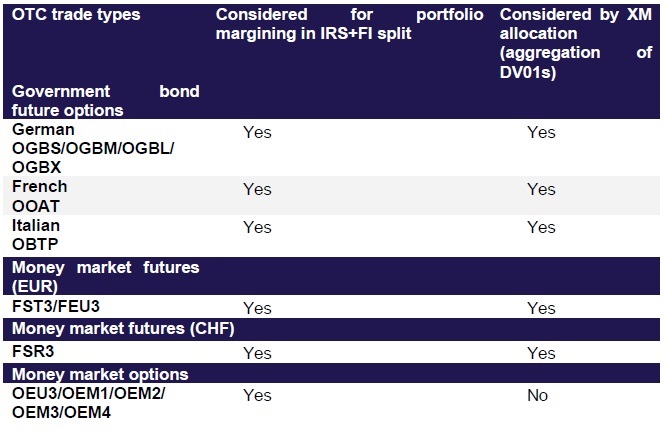

An overview on all OTC and listed products eligible for XM can be found below as well as in the Cross-Margining User-Guide under the following path: Resources > Eurex Clearing > Documentation & Files > Eurex Clearing Documents > Eurex Clearing Prisma > Productive Documents.

XM can only be enabled for EUR and CHF denominated instruments (trades).

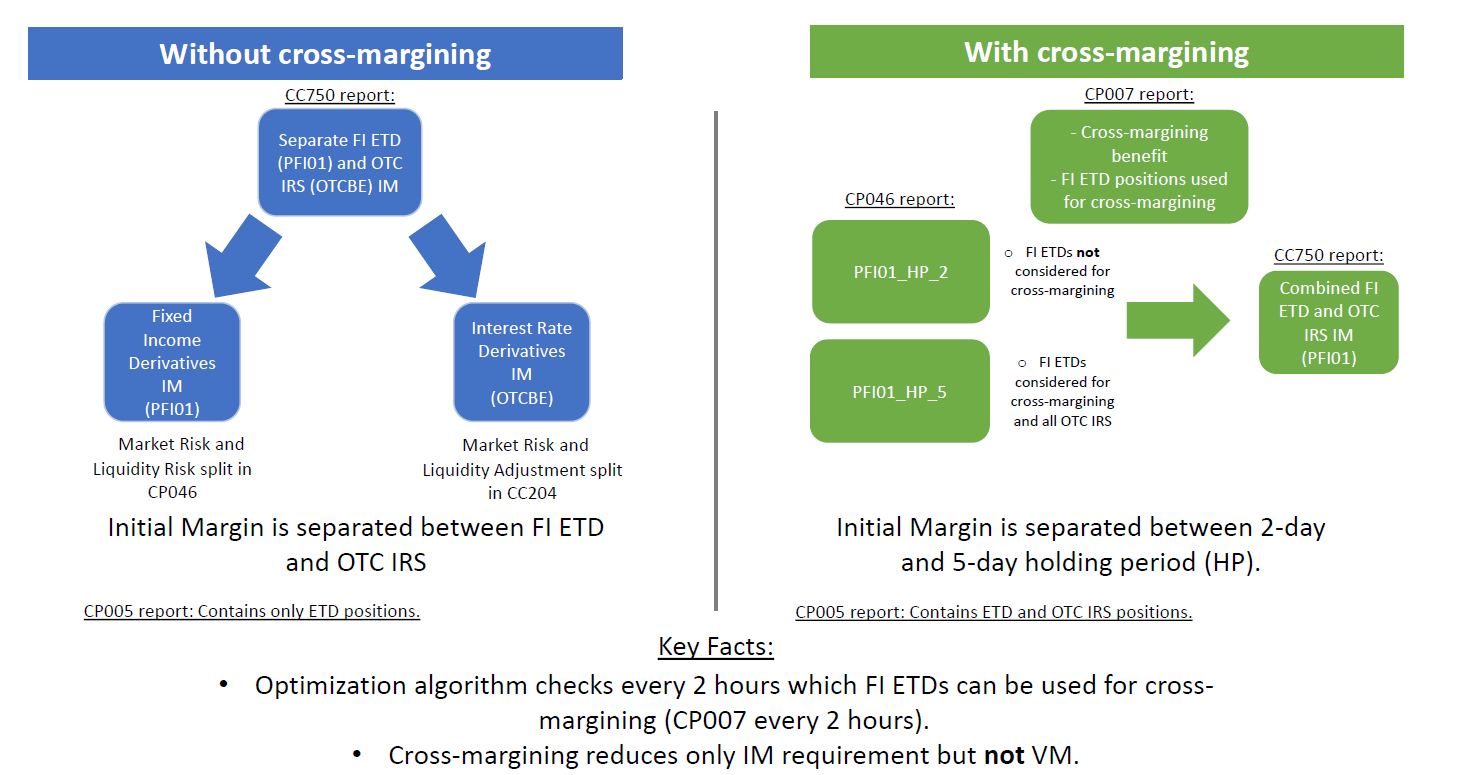

No, only the forward-looking parts, i.e. the Initial Margin (IM) requirement.

In general, ETD positions have a holding period of two days (HP2) and OTC positions have a holding period of five days (HP5).

- ETD positions from the HP2 group will be assigned to the HP5 group to allow for offsetting between IRS and ETD.

- For this, an algorithm runs every two hours to check whether / which ETD positions should switch to a HP5 in order to achieve the maximum XM benefit.

- A detailed description of the allocation procedure can be found in the Cross-Margining User-Guide (chapter 4.6 “Algorithmic description of Cross Margining allocation”).

Yes, the XM benefit can be calculated via:

- Prisma Margin Calculator

- Access to Eurex’ production / simulation environment is needed.

- Can be used for a What-If analysis (against already existing positions) via GUI or API connection.

- Cloud Prisma Margin Estimator

- Openly accessible

- Provides highly accurate estimation and helpful to get a general idea about the margin.

- Availability cannot be guaranteed (Eurex Cloud PME Terms of Use apply here).

- General information can be found on our website.

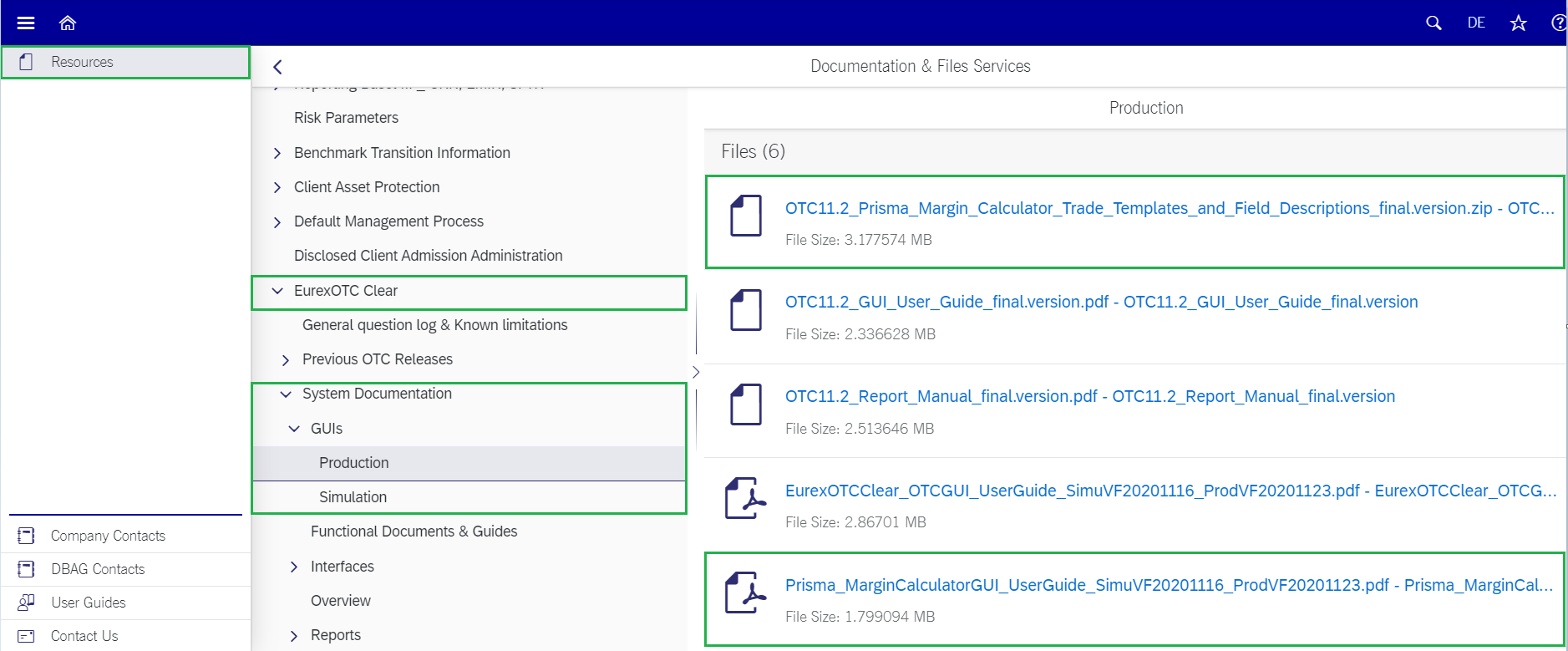

- A more detailed margin calculator user guide as well as templates and field descriptions for the upload files can be found on the Member Section via: Resources > Eurex Clearing > Documentation & Files > Eurex Clearing Documents > EurexOTC Clear > System Documentation > GUIs.

- CP046 (Aggregated Prisma Margins Report):

Shows the total margin requirement per liquidation group and its splits (HP5 for XM positions and HP2 for non XM positions) - CP005 (Sub Portfolio Report):

Shows all active OTC and ETD positions split by holding period

and gives an indication which positions were used for XM - CP007 (XM Allocation Report):

Shows all FI ETD positions enabled and used for XM and the IM with and without XM - CP020 (Margin Drilldown Report):

Shows a drill down of the margins computed at sub-portfolio level to positions in various business types i.e. listed and OTC IRS - CC750 (Daily Margin Report):

Shows the IM requirement per margin class

and OTC related figures will be visible within margin group PFI01 if XM is enabled - CC204 (Overall Margin Report):

Shows the IM split for OTC IRS with all subcomponents

and will not be generated if XM is enabled

- IM is calculated forward-looking on portfolio level.

- Positions with similar risk characteristics and asset class (liquidation group) will be considered together.

- In this liquidation group:

- IM will be calculated on sub portfolio level: Liquidation group splits by time to expiry and liquidation horizon.

- OTC IRS and Fixed Income money market futures and in the same liquidation group but have different liquidation horizons.

Liquidation horizon | Liquidation Group |

5-day | OTC IRS products |

3-day | Listed Equity Derivatives |

2-day | Listed Fixed Income and money market futures, FX derivatives |

Process changes:

Report changes:

- Further information is available in the Eurex Clearing Prisma User Guide: Cross-Margining

- You can find it on the Member Section via: Resources > Eurex Clearing > Documentation & Files > Eurex Clearing Documents > Eurex Clearing Prisma > Productive Documents

Contact us

Eurex Frankfurt AG

Customer Technical Support

Service times: Monday to Friday 01:00 - 22:00 CET

Contact your Technical Account Manager via your VIP number found in the Member Section.

T +49-69-211-VIP / +49-69-211-1 08 88 (all)

Eurex Clearing AG

Helpdesk Clearing Data Control

Service times: Monday to Friday 08:00 – 20:00 CET

T +49-69-211-1 24 53