Mar 29, 2021

Eurex

Volatility index derivatives: Change to the Liquidity Provider schemes in VSTOXX® Futures

1. Introduction

The Executive Board of Eurex Frankfurt AG took the following decisions with effect from 1 May 2021:

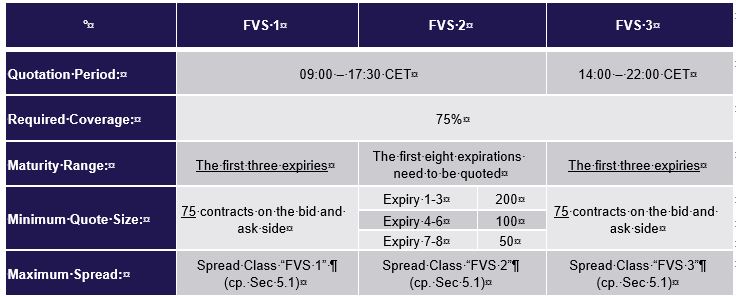

• Reduction of the maturity range to the first three expiries in schemes FVS1 and FVS3

• Change of the minimum quote size in both schemes to 75 contracts.

This circular contains all information on the introduction of the amended Liquidity Provider schemes.

Production start: 1 May 2021

2. Required action

The quote machines need to be adjusted in order to reflect the change in Liquidity Provider (LP) parameters.

3. Details of the initiative

Please refer to the amended Product Specific Supplement (PSS) “Equity Index 15 - Futures on VSTOXX® Index”, which is attached to this circular, and is also available on the Eurex website under the following link:

Trade > Market-Making and Liquidity provisioning

A. Changes to the quotation requirements

Changes are underlined:

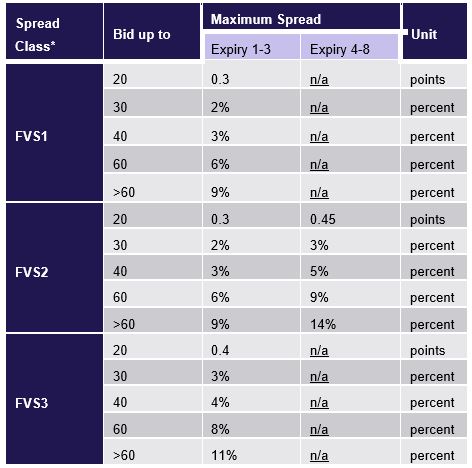

Spread Class

*Deviating from section 2.3.1.2 of the General Supplement to the LPA, the maximum BBB spread requirement shall be tripled during Stressed Market Conditions (SMC) pursuant to Section 2.2.1 of the General Supplement to the LPA.

Attachment:

- Product Specific Supplement “Equity Index 15 – Futures on VSTOXX® Index, valid as of 1 May 2021

Further information

Recipients: | All Trading Participants of Eurex Deutschland and Vendors | |

Target groups: | Front Office/Trading, IT/System Administration | |

Contact: | client.services@eurex.com | |

Web: | ||

Authorised by: | Randolf Roth |