Jun 15, 2021

Eurex

Equity index derivatives: Tradability of STOXX® Industry Neutral Ax Factor Index Futures for Participants in the U.S.

1. Introduction

With effect from 21 June 2021, the following additional products will be activated for tradability in the U.S.:

- STOXX® Europe 600 Industry Neutral Ax Low Risk (EUR, Net Return) (FAXL)

- STOXX® Europe 600 Industry Neutral Ax Multi-Factor (EUR, Net Return) (FAXA)

- STOXX® Europe 600 Industry Neutral Ax Momentum (EUR, Net Return) (FAXM)

- STOXX® Europe 600 Industry Neutral Ax Quality (EUR, Net Return) (FAXQ)

- STOXX® Europe 600 Industry Neutral Ax Size (EUR, Net Return) (FAXS)

- STOXX® Europe 600 Industry Neutral Ax Value (EUR, Net Return) (FAXV)

- STOXX® USA 500 Industry Neutral Ax Low Risk (USD, Net Return) (FUAL)

- STOXX® USA 500 Industry Neutral Ax Multi-Factor (USD, Net Return) (FUAA)

- STOXX® USA 500 Industry Neutral Ax Momentum (USD, Net Return) (FUAM)

- STOXX® USA 500 Industry Neutral Ax Quality (USD, Net Return) (FUAQ)

- STOXX® USA 500 Industry Neutral Ax Size (USD, Net Return) (FUAS)

- STOXX® USA 500 Industry Neutral Ax Value (USD, Net Return) (FUAV)

Learn more about Eurex topics! To help Trading Participants keep up with all Eurex updates, all support information is now available via Eurex Support and on the go via the personalized Eurex App.

2. Required action

There is no action required for participation in trading in these products.

3. Details

Eurex Deutschland has submitted an application for certification to the “Division of Market Oversight” of the “Commodity Futures Trading Commission” (CFTC) to offer trading of STOXX® Industry Neutral Ax Factor Index Futures in the U.S. The CFTC has certified these contracts so that they can be made available for trading in the U.S.

According to Eurex Deutschland's registration as "Foreign Board of Trade", STOXX® Industry Neutral Ax Factor Index Futures can be offered or sold to persons in the U.S. via Eurex terminals with direct access in the U.S.

A. New Capacity Group

The corresponding new Capacity Group for the products is: "CASH/PHYSICAL EUR – CFTC" (previously: Cash/Physical EUR”) or „Cash USD CFTC“ (previously: “Cash USD“), respectively.

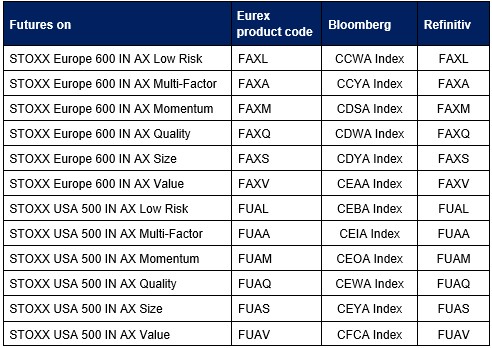

B. Vendor codes

Please find below a table with the vendor codes from Bloomberg and Refinitiv for all STOXX® Industry Neutral Ax Factor Index Futures:

Further information

Recipients: | All Trading Participants of Eurex Deutschland and Vendors | |

Target groups: | Front Office/Trading, Middle + Backoffice, IT/System Administration, Auditing/Security Coordination | |

Contact: | Product R&D Equity and Index, Christine Heyde, tel. +49-69-211-1 56 98, christine.heyde@eurex.com; Equity & Index Sales, Rachna Mathur, tel. +1-212-3 09 93 08, rachna.mathur@eurex.com | |

Web: | www.eurex.com | |

Authorized by: | Randolf Roth |