Oct 11, 2024

Eurex

Fixed Income market briefing October 2024

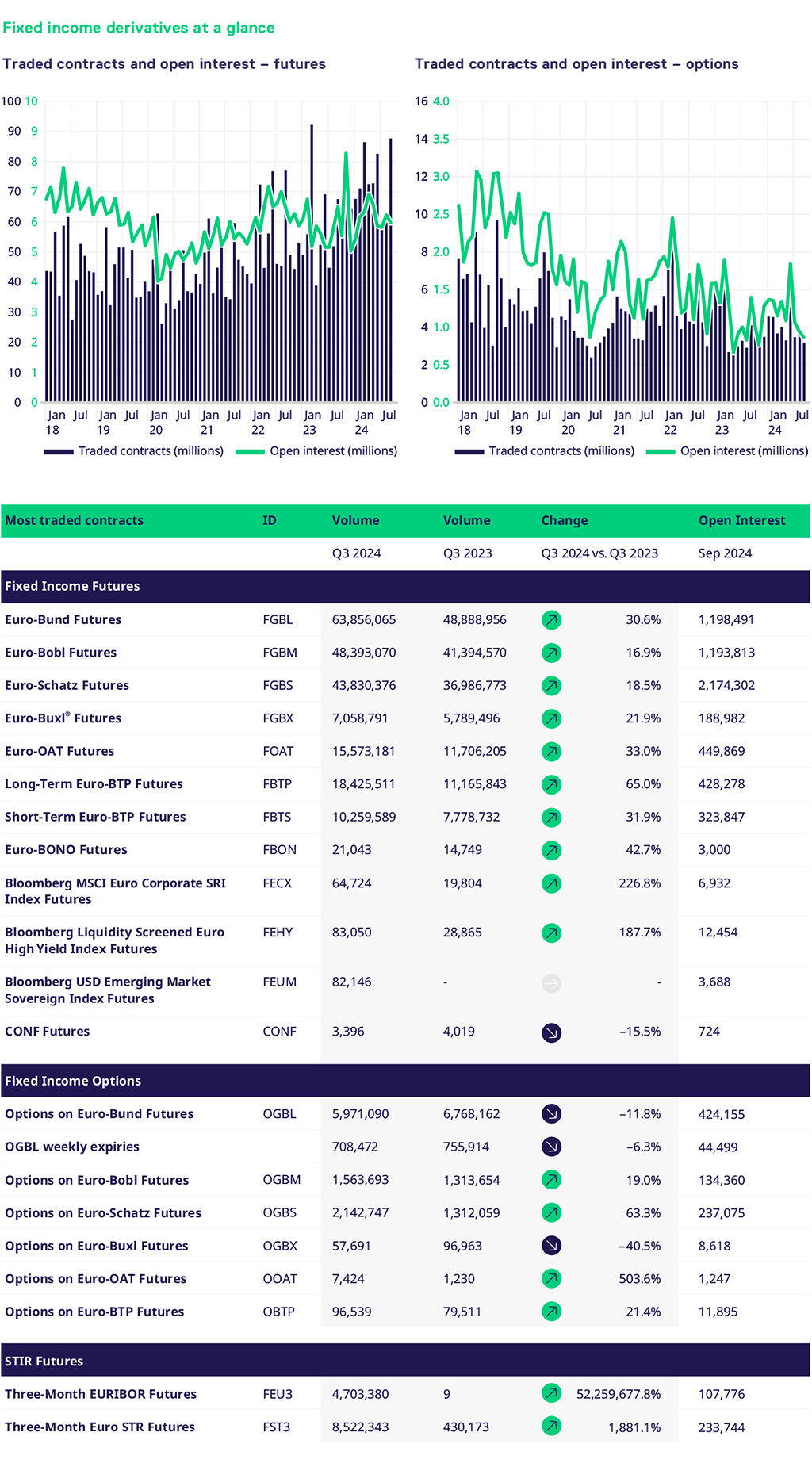

September provided new records with interest rate derivatives up by 30% year-to-date

September 2024 was a busy and solid month for the FIC portfolio, continuing to provide new records with interest rate derivatives up by 30% year-to-date. Despite the US Labor Day and the UK bank holiday at the beginning of the month, September began with an accelerated outperformance of traded contracts through the roll period. This translated into an all-time high of 12.8 million Fixed Income Futures contracts traded on 3 September 2024. The roll proceeded smoothly and without hiccups, completing within a few days. Generous rate cuts by the Federal Reserve and the European Central Bank further stimulated market activity and boosted Eurex volumes.

The German futures segment rose by 24%, OAT Futures increased by 39%, and the Italian segment topped it with a 55% volume rise. Options on OAT futures have experienced a slight revival since the snap elections in the summer, with 36k contracts traded so far in 2024. A similar positive effect can be observed for Spanish Bono futures, which show a gradual increase in liquidity. While there is still a long way to go before becoming a new benchmark, every contract traded contributes to liquidity growth.

Credit Index futures had another strong month, trading over 142k, with 50k in the Euro High Yield Index futures. Our credit futures team further extended the offering on 23 September 2024 with two new USD Credit Index futures: Bloomberg US Corporate Index Futures and Bloomberg US High Yield Very Liquid Index Futures. Launching these new futures underscores our ambition to build a truly global portfolio of credit index futures. For more information please visit our Credit Index Futures website.

In STIRs, €STR futures averaged c.146k contracts per day, up 19% from August. Open interest continues to grow at a healthy pace, increasing by 19% for the month to reach 234k contracts and over 40 times higher since the beginning of the year. Euribor futures recorded an average daily volume (ADV) of 51k contracts per day, slightly below August’s numbers. However, open interest has increased more than tenfold since the beginning of the year and now stands at 104k lots.

FX markets experienced a higher volatility environment in September. Recent rate cuts impacted interest rate differentials, and the EUR/USD currency pair appreciated significantly over the past few months. At Eurex, the Foreign Exchange segment continues to grow with a 64% year-to-date increase in volume. Open interest was also up 91% (€ 7.6 billion) compared to 2023. September volumes rose 101% year-on-year, marking a positive trajectory and recording the second-largest roll month ever (second only to the June 2024 roll), with 329k contracts traded. The Emerging Markets currency pairs show increasing potential and positive signs for continued growth, with over three times as many contracts traded since January this year.