Mar 02, 2015

Eurex

Growing liquidity in options on iShares ETFs

The extension of our pro rata matching algorithm to the ETF options segment together with the introduction of a new Market-Making program resulted in a high level of activity in our options on iShares ETFs based on EURO STOXX50® and DAX®. With Susquehanna quoting actively, institutional investors managing exposure in ETFs are ensured to meet a liquid hedging background.

Select ETF options available at Eurex Exchange switched from the price/time allocation to the pro rata allocation. Under pro rata, best prices in the order book also match first as with price/time matching, but matching priority no longer depends on the timestamp difference between two identically priced orders. Instead, incoming order flow is matched against book orders in proportion to their order size versus the cumulative order size at that price level.

Additionally, our iShares options based on DAX® (Product ID: EXS1) and EURO STOXX 50® ETFs (Product ID: EUN2) are supported by a recently introduced Market-Making initiative. This has been well-received in the market place and forms a solid liquidity base for centrally cleared transactions.

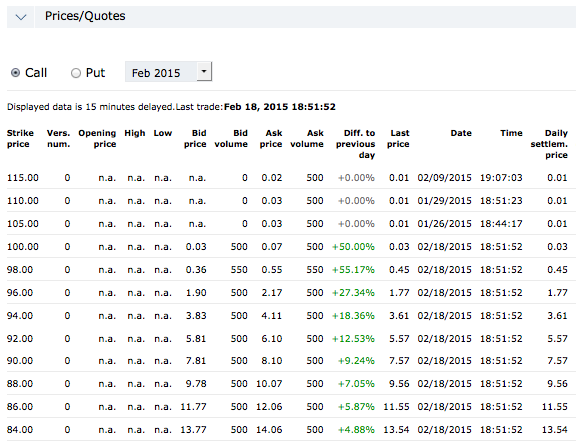

The extract of our order book above illustrates the liquidity levels for a trading day in February.

To follow up on recent developments, please click here:

for options on iShares DAX® ETFs

for options on iShares EURO STOXX 50® ETFs

OTC opportunities within reach

At Eurex Exchange, bilateral off-book trading is supported by our Eurex Trade Entry Services. Buyers and sellers can enter the trades that they previously arranged directly into our T7 system and benefit from transparent and reliable clearing processes.

To closer align them with the minimum Block Trade size of the DAX® and EURO STOXX 50® Index Options, the minimum number of tradable contracts for the Eurex Trade Entry Services for iShares ETF options was increased to:

• 2,500 contracts for options on iShares DAX® ETFs and

• 5,000 contracts for options on iShares EURO STOXX 50® ETFs

About Susquehanna

Founded in 1987, Susquehanna International Group (SIG) are a leading Market Maker in both the U.S. and European markets, and currently has over 1,500 employees worldwide. The European entity acts as a Designated Market Maker across all major European exchanges, publishing 2-way prices to screens during market hours. Last year, SIG interacted with over 11 percent of all listed options traded (both on screen and OTC), making them one of the largest options Market Makers in Europe.

Susquehanna are also the largest ETF Market Maker in Europe, so Market-Making ETF options is a natural move for the operation. As well as trading on screen and in the broker market, the options sales desk allows clients to contact SIG directly for a tradable price.