9月 26, 2022

Eurex Asia

【期货期权】9月股指市场简报

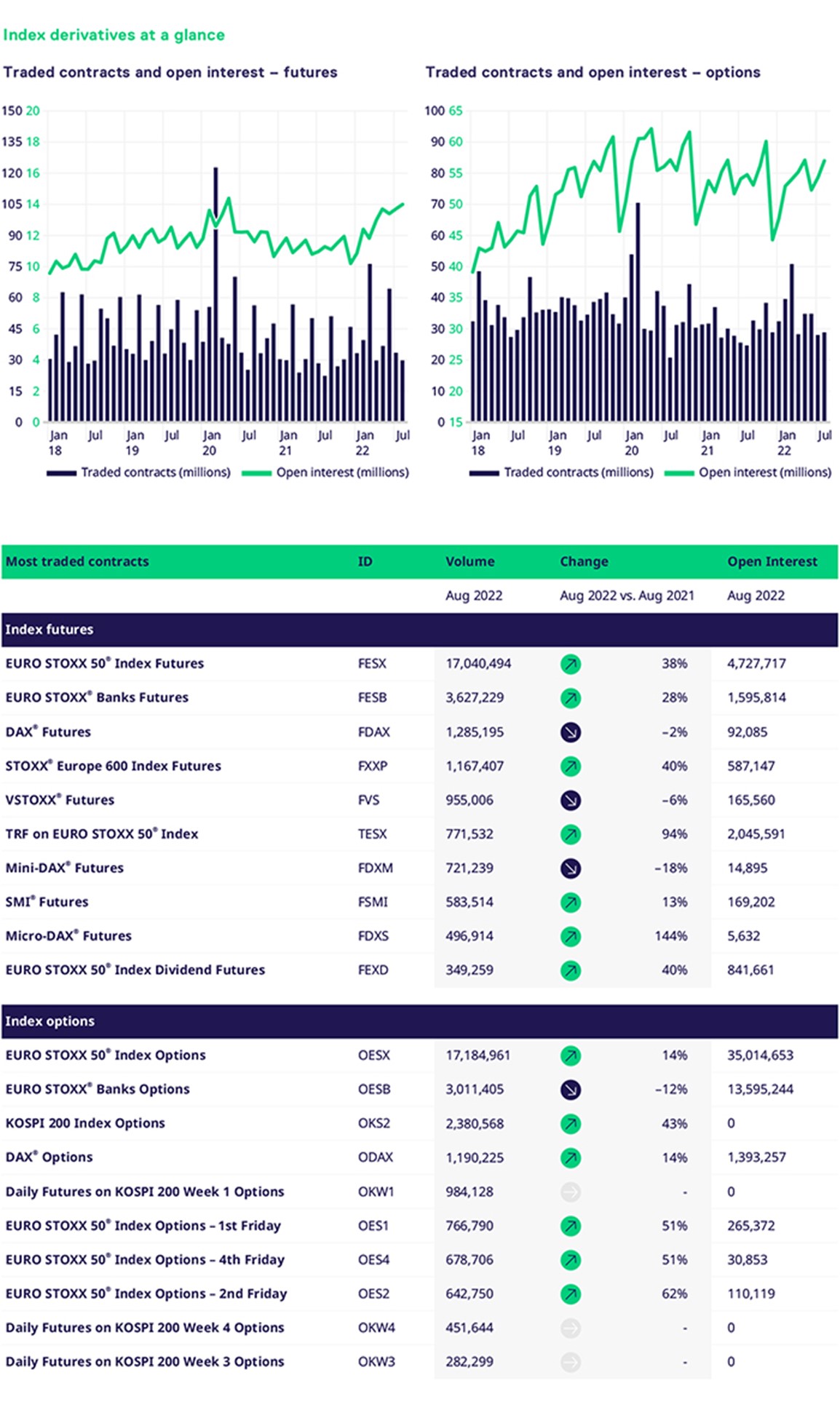

欧洲期货交易所的股指基准产品的交易量强劲

当今世界摆在我们面前的诸多挑战,可能使我们无法沉浸于8月的恬静休假时光。阳光、沙滩、海洋,美景背后是残酷的现实;旷日持久的俄乌冲突、全球性干旱与洪涝灾害、席卷全球的高温热浪以及由此滋生的森林大火、迫在眉睫的能源危机。这种悲观的前景同样在市场中有所体现:在经历了月中短暂的回弹后,债券和股票的基准指数表现持续低迷。

在这样的大环境下,欧洲期货交易所的衍生品表现依然强劲。我们富时指数板块的增长显著,市场参与者越来越多地接受富时100总回报指数期货来实现持有英国股票市场的风险敞口,而不需要另外参考影响远期定价而且日益不稳定的英镑短期利率期货叠期市场。尽管近期媒体围绕ESG投资的优势展开了激烈辩论,我们的EURO STOXX 50®和DAX ESG每周指数期权交易量依旧处于高位。与去年同期相比,我们的MSCI衍生品板块的未平仓合约水平再居高位,亚洲新兴市场、世界、摩根全球所有国家指数期货和新兴市场期权的表现良好。行业指数期货交易也较为活跃,其中银行、石油和天然气、汽车和电信公司的交易量最高。

由于第三季度末、第四季度初是股市交易的疲软期,各国央行面临着巨大的政治压力:或奉行紧缩政策抑制通胀,或旁观萎靡的消费需求并稍加引导。无论采取何种方式,都需要欧洲期货交易所的深度和流动性的衍生品市场以满足对冲需求。