1月 22, 2021

Eurex Asia

【期货期权】Eurex 2020年第四季度股指市场与年终回顾简报

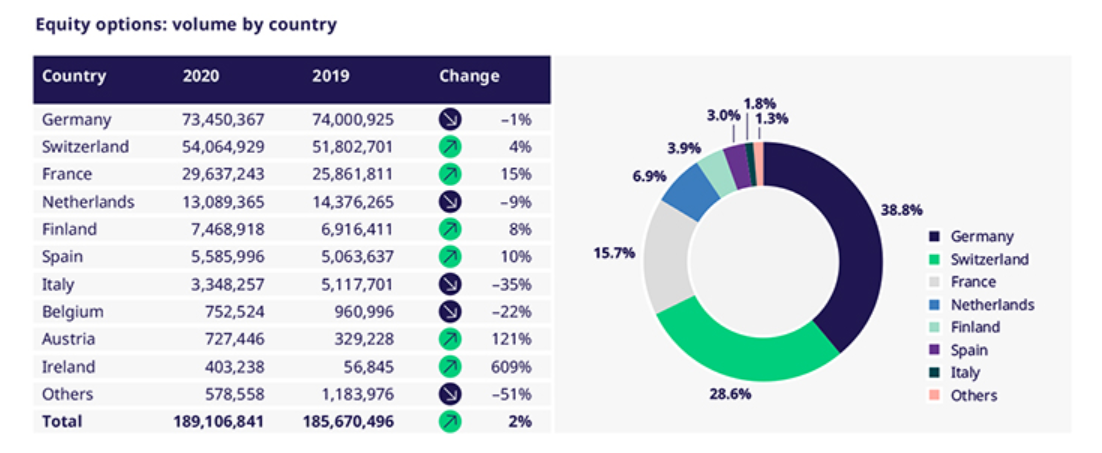

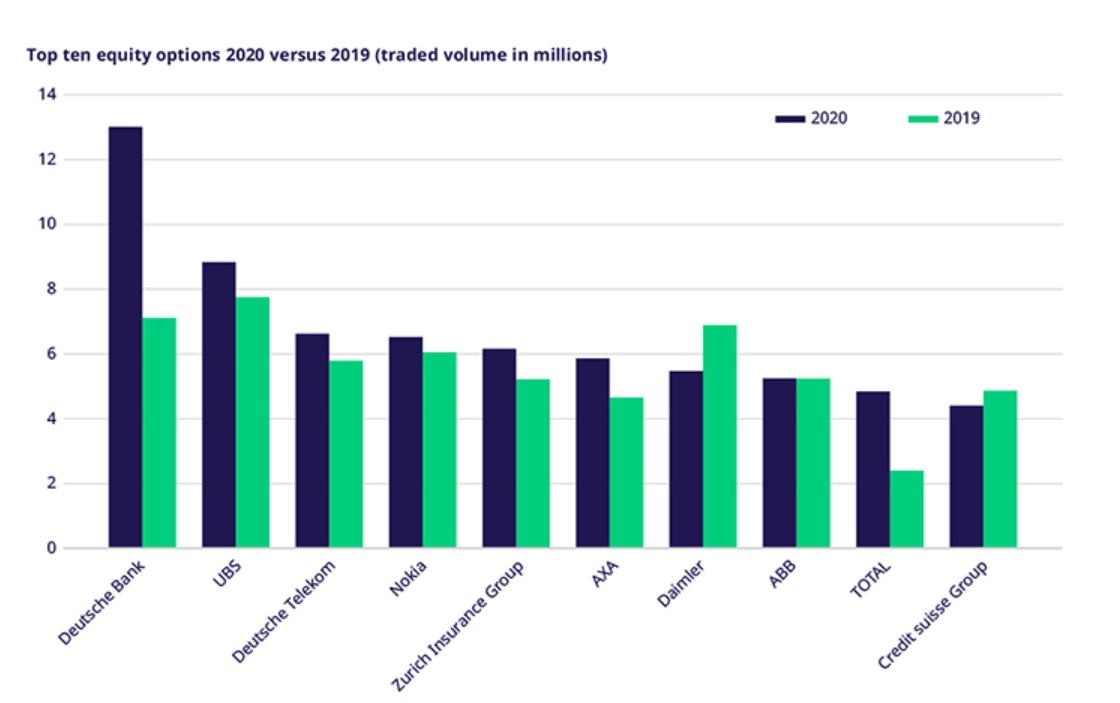

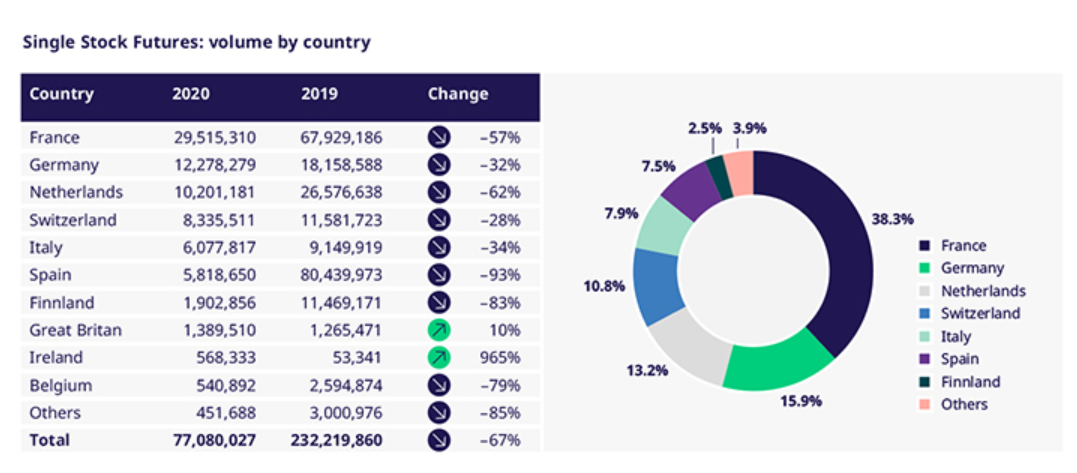

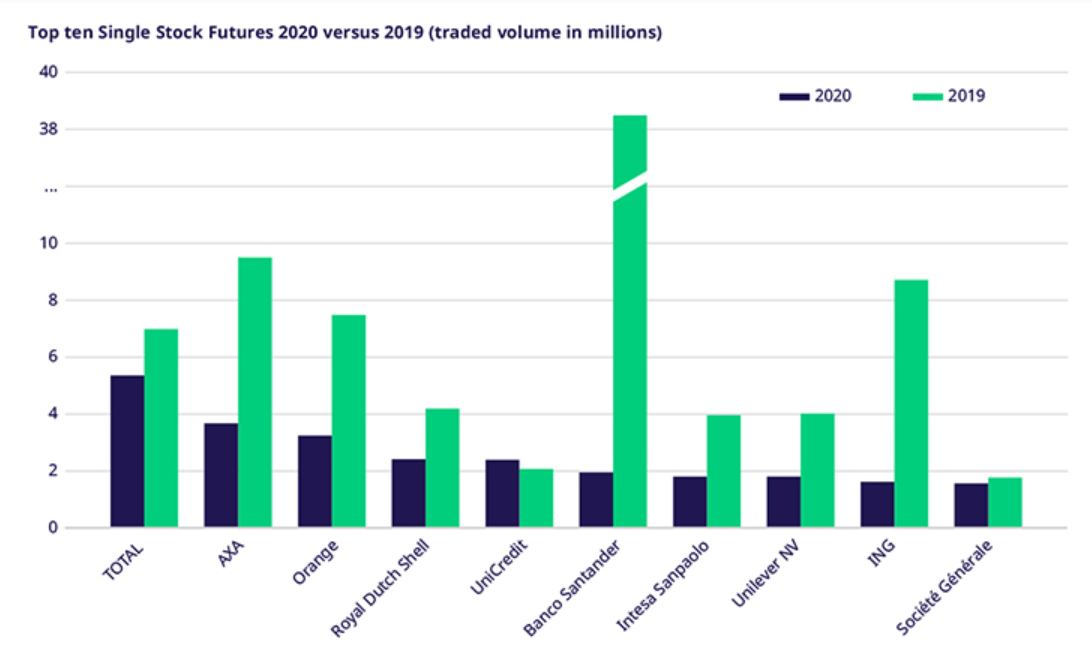

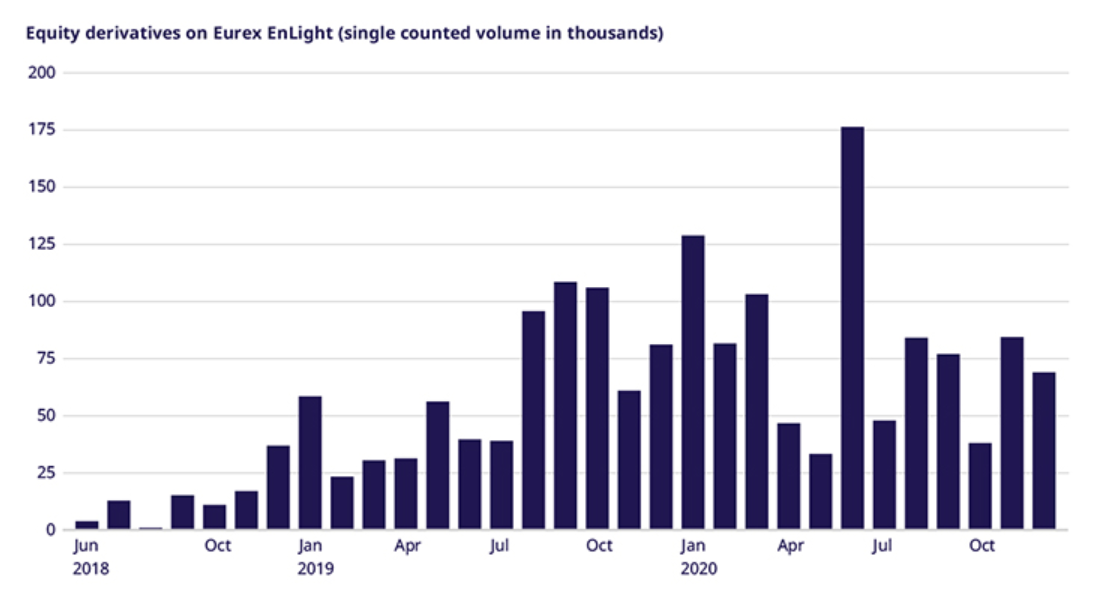

相信大家都会记住2020特别的一年。从市场和股票衍生品的角度来看,2020年可以分为两部分。在上半年,我们体验了一个高波动率和交易运营管理方式的瞬间转变的特别市场环境。对于股票期权业务而言,更具破坏性的当然是年度股东大会的推迟,以及伴随而至的负面影响和股息的减少所带来的不确定性。下半年主要由股票市场的大规模回升主导,首先是由科技板块推动的,在疫苗获批之后又受到周期性和金融板块的支持。在股票期权领域,所有这些市场发展都提供了很多机会,这反映在Eurex 2020年的总交易量增长2%。同时,非常感谢为我们场内外流动性提供商的大力支持,以及他们的突出业绩。多亏了他们,我们才确保了市场秩序井然,良好运转。尽管交易环境很艰难,但仍然吸引了投资者进行大量交易。

2021年的开端我们即将推出新的期权板块,既以在法兰克福交易所的Xetra交易系统上挂牌交易的的美国基准股票为标的股票期权,以欧元计价。包括以下股票期权:特斯拉(Tesla)、脸书(Facebook)、苹果(Apple)、亚马逊(Amazon)、谷歌(Google)、奈飞(Netflix)和微软(Microsoft)。这些产品让客户能够在欧洲时段内,在受监管的欧洲交易平台上交易美国股票期权,以及优享交叉保证金效率,我们非常高兴获得流动性提供商的支持为该板块积极提供报价。

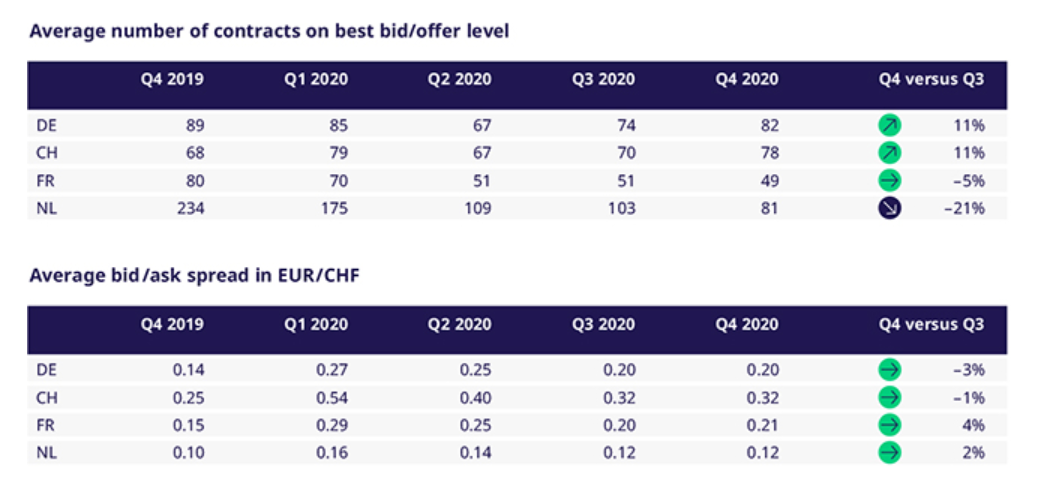

除了去年3月份和 4月份中其中几周的流动性枯竭之外,场内流动性在2020年期间已经相对保持了稳定性。尤其是德国和瑞士市场的最佳买卖价(BBO)报单量已回到与上一年高点接近的水平。

2020年年终回顾

在2020年里从与我们的会员和客户交流中发现,大家的态度较为乐观,普遍相信我们很快能够忘记2020年的紧张与压力,并期盼较为正常的市场环境。在2020年载入历史史册之前,我们先简要回顾一下过去一年中Eurex成功的业绩。投资者对Eurex新推出的MSCI新兴市场ESG标准筛除法(Screened)股指期货(和MSCI科威特股指期货都产生了浓厚兴趣。基于此,各个区域的MSCI股指期货交易量表现都非常出色,如MSCI亚洲新兴市场、全球(已开发市场)、欧洲、全球指数(ACWI),拉丁美洲新兴市场和太平洋地区以及亚洲、日本、沙特阿拉伯、卡塔尔、加拿大、中国自由(交易)、澳大利亚、墨西哥、台湾、印度、泰国、俄罗斯、美国、印度尼西亚、马来西亚和菲律宾等。Eurex提供了全面配套的MSCI衍生品投资组合板块,可以满足市场投资者多样化选择的各种需求。相应的投资组合保证金优惠,以及提供的交易时间延长,进一步促进了在Eurex交易MSCI衍生品的强烈需求。

Eurex基于斯托克欧洲600(STOXX Europe 600®)股指期货和期权的基础上研发并推出了相应的ESG衍生品合约,使ESG产品板块更加完善。该细分市场中,DAX 50 ESG和欧元斯托克50 ESG股指期货(EURO STOXX 50® ESG)在上市初期马上就有交易需求。在动荡的一年中,市场自然出现向流动性靠拢的趋势,因此客户交易标的转向Eurex具有良好流动性的旗舰产品:EURO STOXX 50®、STOXX银行类股指、STOXX® Europe 600、小型德指(Mini-DAX)和瑞士股指(SMI)的表现均高于正常水平。与这些旗舰股指产品相关的股息和股票回购市场也成为了关注焦点,因为股息支付的不确定性持续了一整个年度,这导致投资者大量参与交易了以EURO STOXX 50®股指为标的的总收益期货和股息期货。

除了新产品推出之外,我们还实施了一些旨在提高订单簿深度以增强稳定性和流动性的措施。包括有产品针对性的最小变动价位的调整,大额交易门槛规模修订和流动性提供商优惠计划的优化。强劲的场内流动性的关键要素是我们的会员不断提供被动报价。因此在这里,我们想公开的诚挚感谢会员们在市场几次震荡时期中所展现的能力,能够承受超高交易量并管理风险。正如我们今年所规划的那样,客户可以再次期待激动人心的崭新规划,包含即将推出的新产品以及提高其它功能,来改善与我们与市场互动时的客户体验。