5月 05, 2022

Eurex Asia

【期货期权】VSTOXX®股指波动率指数期货(FVS)三月市场动态

VSTOXX®股指波动率指数期货(FVS)三月市场动态

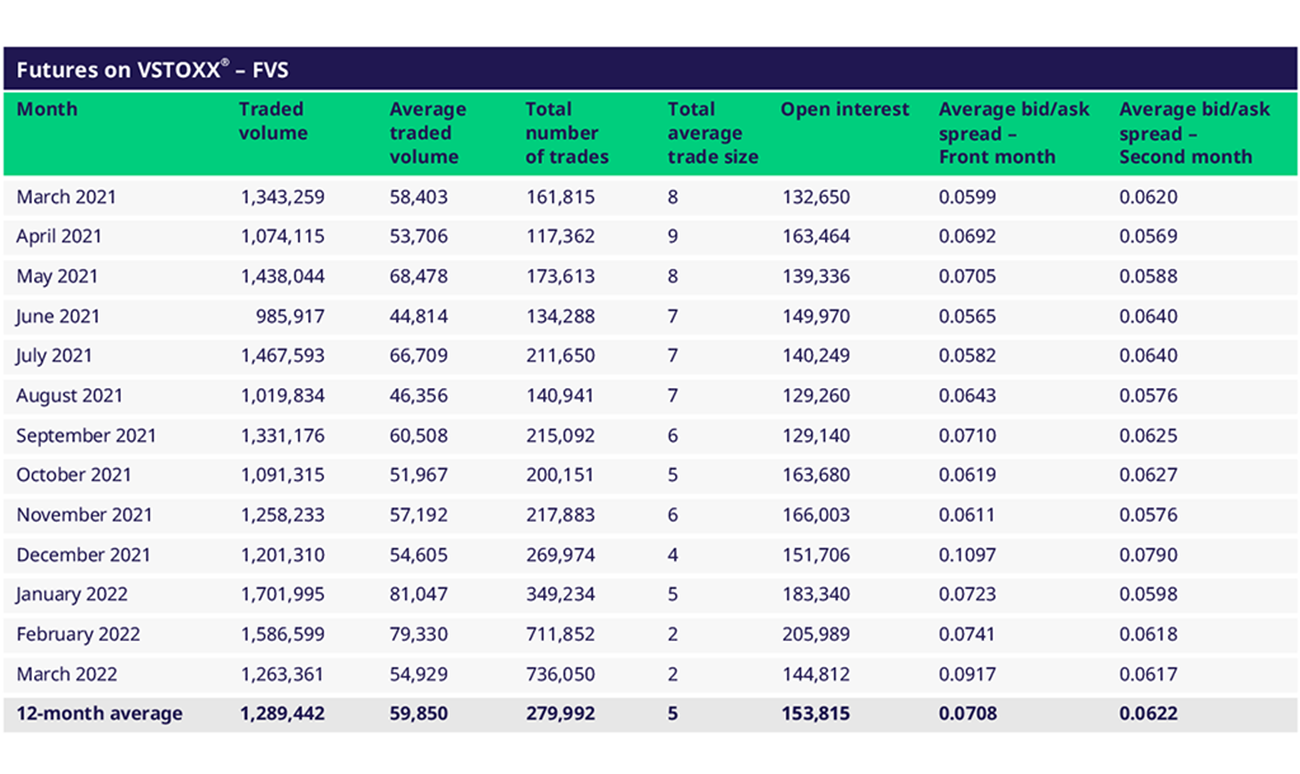

VSTOXX®股指波动率指数期货(FVS) - 2022年3月

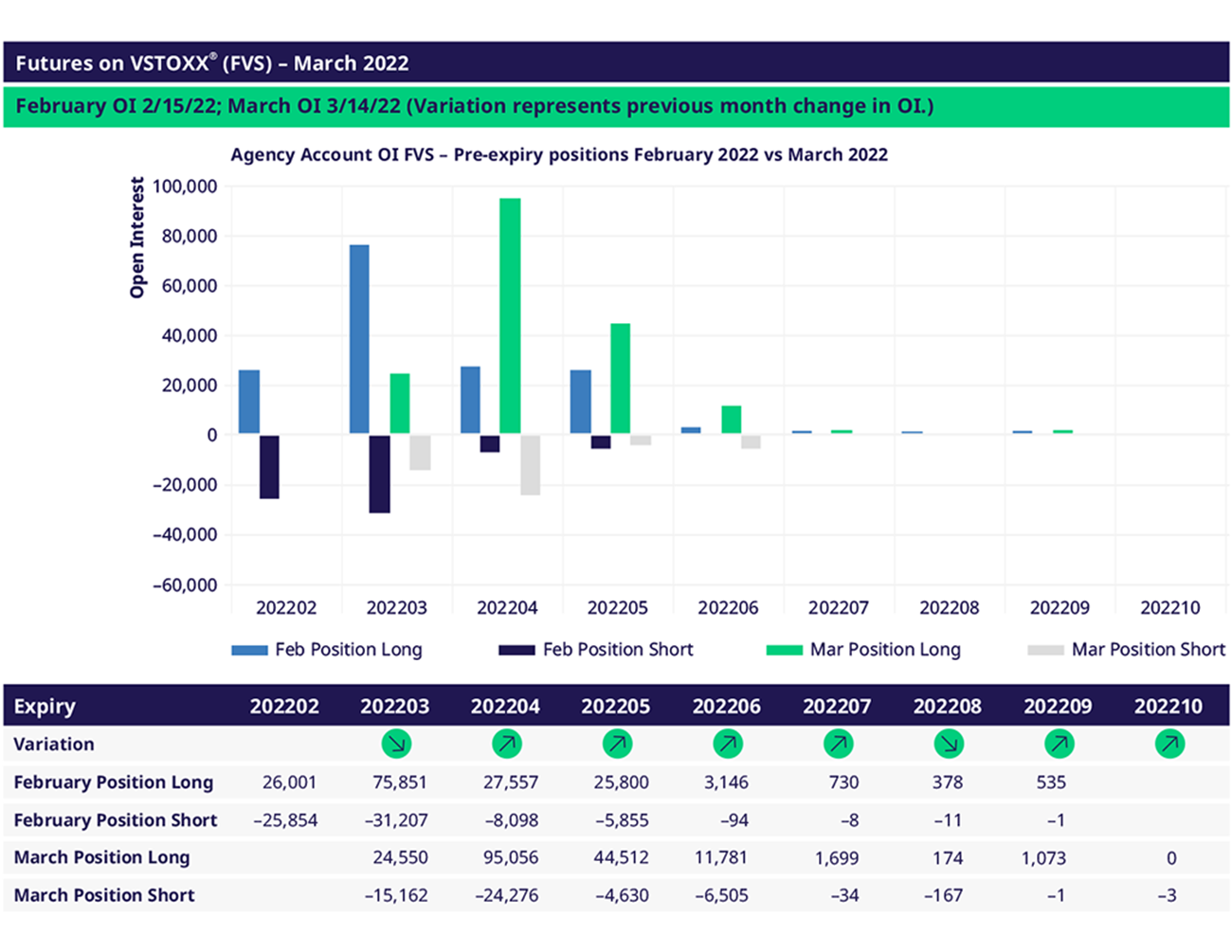

客户账户 FVS 持仓量- 2月15日与3月14日到期前持仓仓位对比

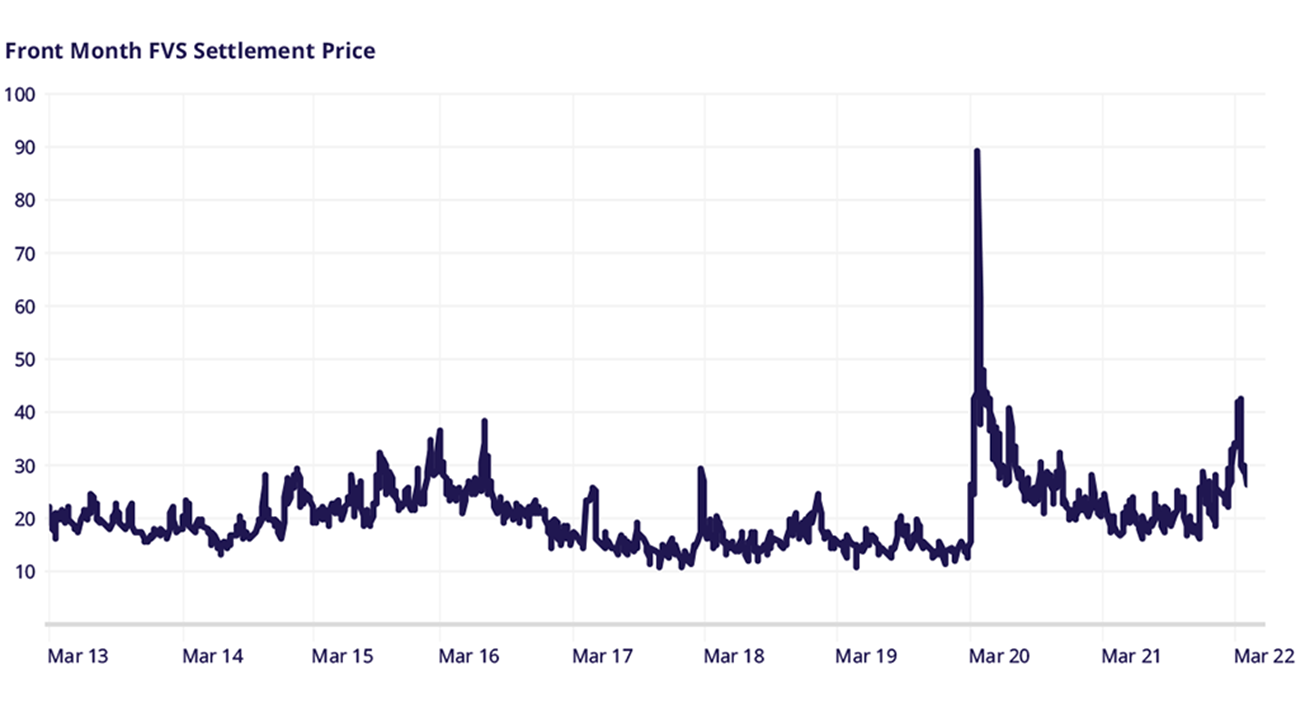

VSTOXX®股指波动率指数期货交易在2月底和3月上半月非常活跃。乌克兰战争将波动率指数推高超过40%以上,并加剧了期限结构的逆价差。最活跃的一天是3月4日,有14万份交易合约。3月下半月交易活动放缓。

终端客户大幅将3月份净多头头寸继续展仓到4月份合约,并同时相当程度增加5月份合约的多头头寸。它暗示了对更高波动水平的更长时期的预期。然而,终端客户开始在4月和3月的净持仓开始转成净卖出,将部分净多头头寸获利了结,这类交易持续到了3月底。但在3 月底,终端客户仍持有4月、5月和 6 月期货的净多头。

EURO STOXX®50指数在VSTOXX®股指波动率指数2月份(FVS)期货和EURO STOXX® 3月(OESX)期权的到期日实现了43.5点的历史波动率。与2月份的VSTOXX®股指波动率指数期货最终结算价25.67相比,这意味着17.83个波动点的负波动风险溢价。

近月FVS期货结算价

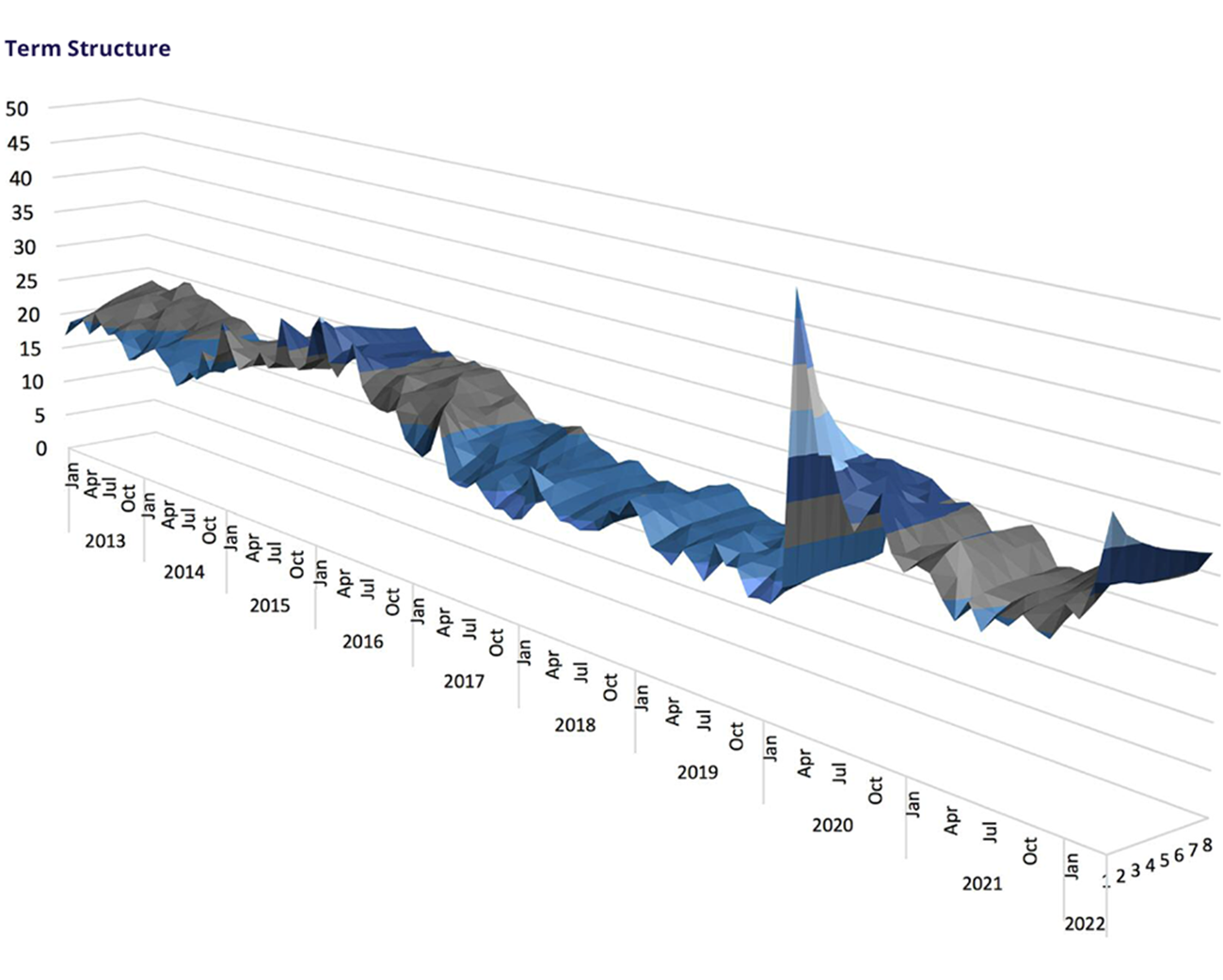

期限结构

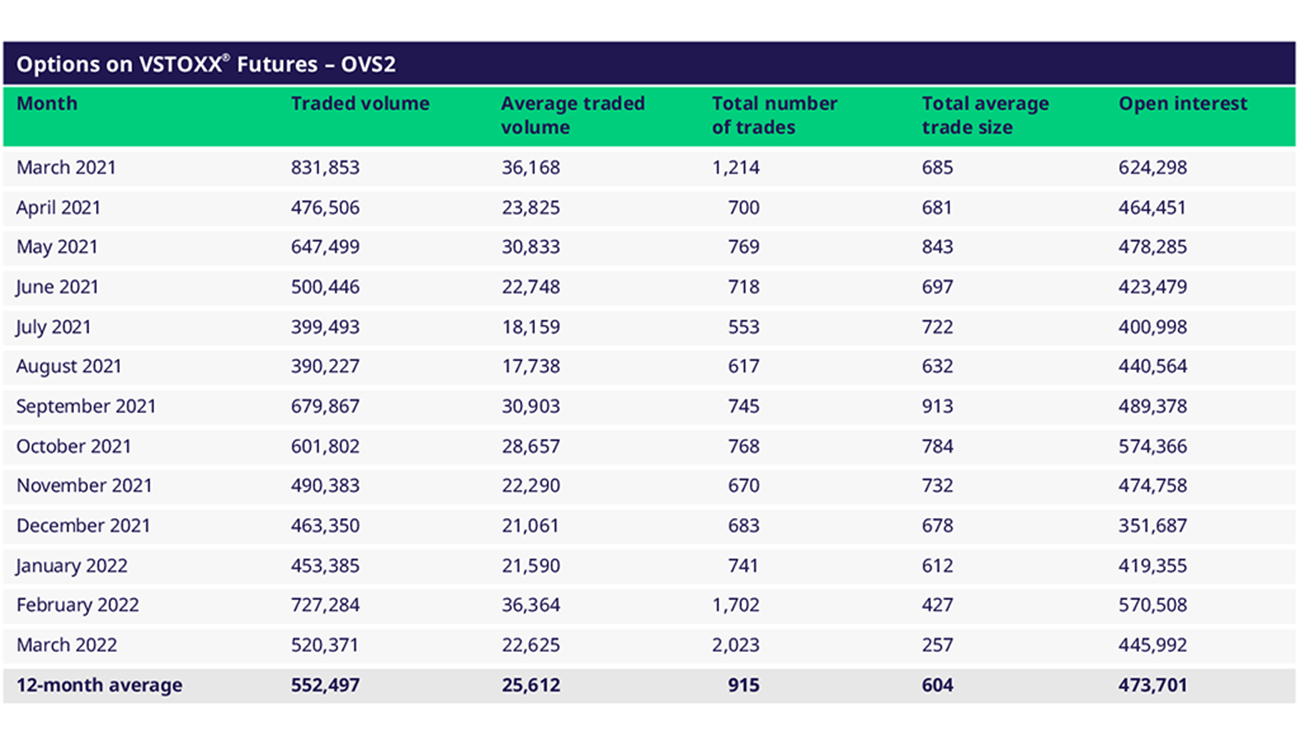

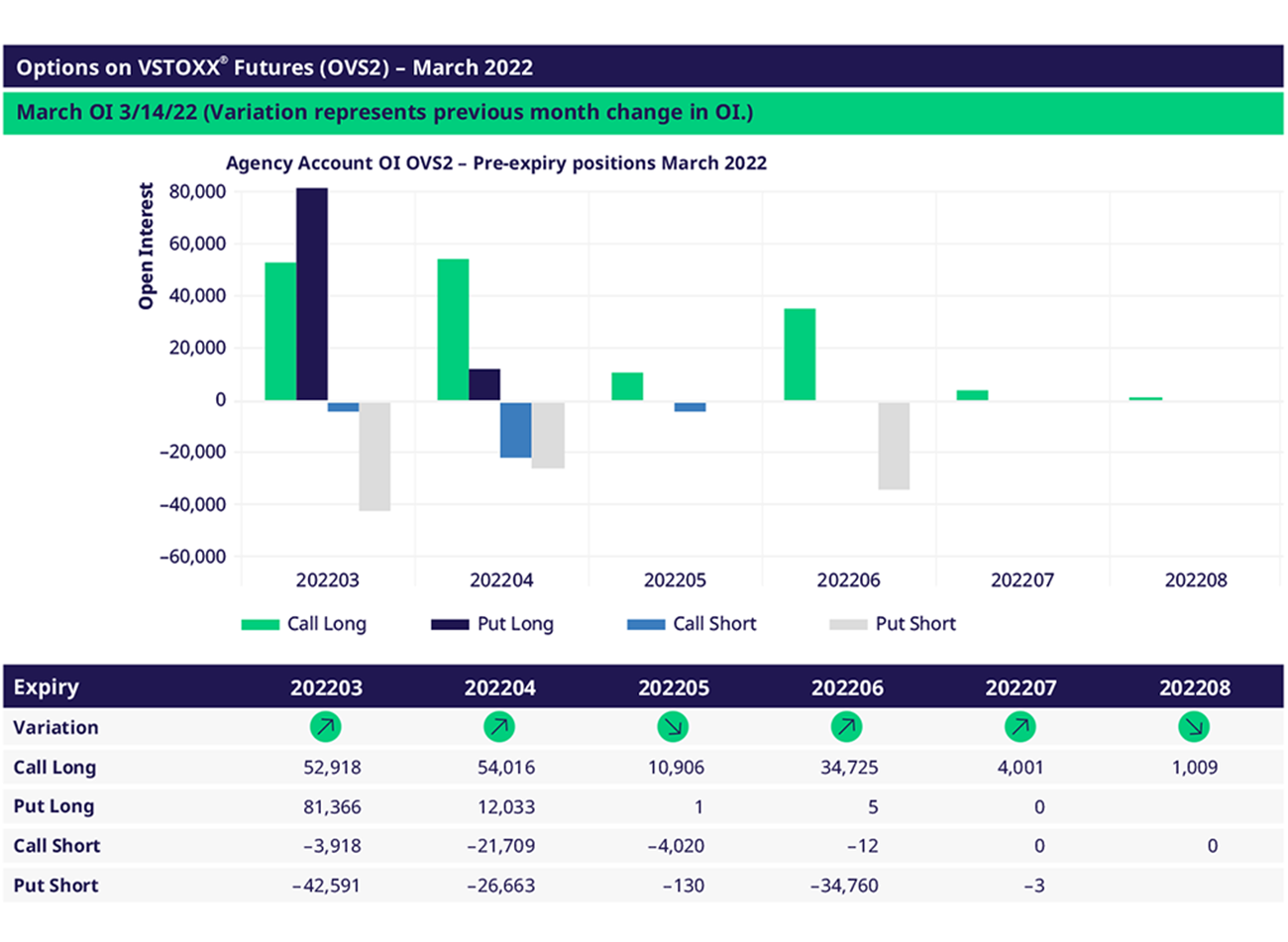

VSTOXX®股指波动率指数期权(OVS2)三月表现

VSTOXX®股指波动率指数期权交易量恢复到前几个月的水平。最活跃的一天是3月1日,交易量为9万手。当天,终端客户卖出6月份行权价为23点看跌期权,买入6月份行权价为60点的看涨期权。一些客户还持有大量3月份看涨期权和多头看跌期权直到到期,并没有展期。到3月底,终端客户交易策略为4月份持有净多头看涨期权以及小幅多头看跌期权的头寸,并在6月份进行23/60风险逆转的持仓策略,60点的看涨期权作为配对交易其中一端多头的那条腿。