1月 31, 2022

【固收月报】2022年1月固定收入市场简报

作者:Lee Bartholomew,Eurex固定收益产品研发主管

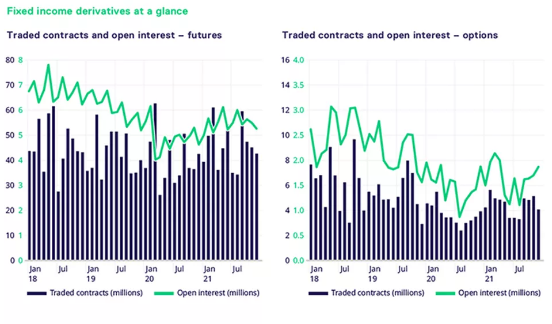

首先,在开始回顾2021年之前,我想先用一点时间来感谢我们的成员和终端客户在这一年中对我们的支持。正是因为你们对我们现有的投资组合和新激励方案的持续支持,才为我们创造了2021年扎实的业绩。去年有着一个非常不错的开始,公债殖利率曲线的长端为投资者提供了许多早期的机会。德国长天期国债(Buxl)期货和期权出现了两位数的增长,同比分别增长了47.3%和478.6%。

与2020年相比,期货相关产品的交易量年增率增长了13.6%;而德国长期国债(Bund)和德国中期国债(Bobl)期货分别增长了16.2%和17%。相对于殖利率曲线的其他部分,曲线的近端表现不佳,德国短期国债(Schatz)期货的交易量年环比下降了9.6%。意大利和法国板块有着持续稳健的同比增长,10年期板块年环比增长分别为21.3%和28.3%。意大利曲线近端的交易量与2020年相比增长了15.6%。目前来看2022年面临的主要问题与2021年一致,通货膨胀仍然是一个棘手的难题,所以中央银行会加速实施收紧政策。这给各国央行带来了加息的压力,英国在2021年末加息,而美联储预计将在2022年加息。这种分歧,再加上潜在的股价回测的风险,增加了市场上的波动性。

随着市场价格涨跌互见,没有明显的走势,和央行之间的分歧支撑了我们期权组合在整个2021年的交易量。随着上半年10年期与30年期利率s掉期的快速扁平化和长天期殖利率出现很高的价格波动率,Bund和Buxl期权在2021年持续有着出色的表现。与2020年相比,交易量分别增加了32.1%和478.6%。Bund的每周到期期权出现了58.6%的增长。随着殖利率的反弹,曲线的中段受益最大,Bobl期权的交易量有着106%的增长。意大利和法国板块的表现不如期货那样强劲,交易量分别下降了20%和58%。

2021年进一步为团队提供了推动产品创新的机会,我们在9月成功推出了固定收益ESG衍生产品。在推出后的第一季度,我们交易的名义价值超过了3.5亿欧元,仅在12月就交易了高达1.5亿欧元的名义价值。顺便说一下,最大的单笔交易(300手)也发生在12月。我们的团队一直都在努力发展这一板块,以确保我们可以在固定收益ESG衍生品这一板块成为领先的流动性池。我们希望与我们的成员和客户一起,在2022年为市场带来更多的创新从而解决市场上的难题。

在此,我祝愿我们所有的成员和客户有一个快乐、健康并繁荣的2022年。我们的团队期待着在未来的日子里与你们紧密合作。