9月 28, 2022

Eurex Asia

【新闻发布】日本野村资管在东京推出带汇率避险的EURO STOXX 50和DAX ETFs

日本对外国资产配置需求旺盛,野村推出两款日元版欧洲旗舰基准股指基金产品

野村证券资产管理公司在日本推出两支汇率对冲开放式指数证券投资基金(以下简称ETF),分别跟踪STOXX欧元蓝筹50(EURO STOXX 50®)和DAX德指蓝筹(DAX®)指数,使日本国内投资者可直接接触欧洲蓝筹股。

作为日本最大的ETF发行商,野村证券于9月2日在东京证券交易所挂牌上市上述两支产品。产品报酬复制EURO STOXX 50®月度日元对冲滚动市盈率和DAX®月度对冲日元滚动市盈率,使日本投资者能够在欧洲交易时间之外购买和出售投资组合。这也写下第一个在东京挂牌上市的DAX ETF的新纪录。

数十年来,EURO STOXX 50指数和DAX指数一直是德国乃至欧元区无可争议的市场基准,同时也是ETF、共同基金、衍生品和结构性金融产品组成的完整金融生态系统的核心。这些产品基于客观、透明的方法论、以及确保可复制性和可交易性的指数标准。近期,作为前两只欧洲股指基准的指数发行商-Qontigo也推出了一系列ESG指数。

野村证券资产管理公司ETF业务部主管Osamu Okuyama:“我们很自豪与Qontigo一起推出这些ETF。我们的金融产品使日本投资者也能够投资欧元区公司。同时我们将继续致力于拓宽ETF市场,为国际多样化做出贡献。”

Qontigo指数和基准事业的首席产品官Axel Lomholt说到:“我们非常高兴能与野村证券团队合作。双方的两个旗舰基准指数能够更好为细分市场提供金融服务。EURO STOXX 50指数和DAX指数作为高流动性金融产品的基础,以其对德国和欧元区资本市场的精准洞察和对经济形势的动态追踪享誉全球。”

战略投资与结构性投资趋势

对于海外投资者而言,欧洲金融市场在经历了多年萎靡之后再现战略性投资窗口。2016-2021年,EURO STOXX 50指数的总回报率为53%,同期美国STOXX® 500指数收益率为137%。尽管在过去五年中日元对美元汇率大幅下跌,但同期日元对欧元汇率大抵持平,这使得欧洲资产对寻求地域多样化的日本投资者来说较美国资产更具吸引力。

日本投资的结构性趋势同样引人关注。近年来日本投资者改变了其偏爱国内资产的一贯态度,其海外资产持有量持续增长。根据日本财政部提供的数据,去年7月日本投资者所持海外股值达到自2005年以来最高值1。

聚焦大型股、关注股票流动性

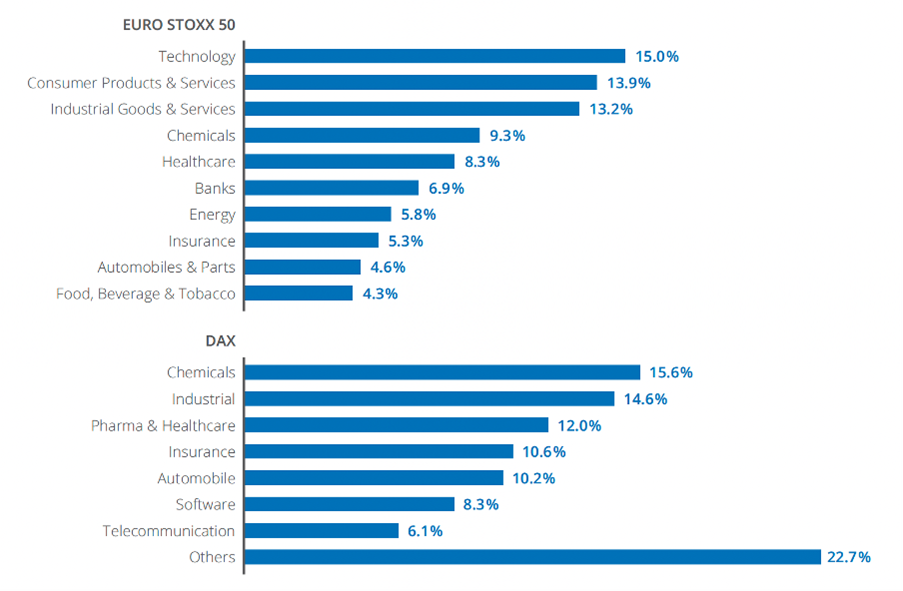

EURO STOXX 50指数涵盖了欧元区大部分行业,目前共包含八个国家的成分股。它选择20个超级行业类别(Supersectors)中各行业市值最大的股票形成了多样化的投资组合(见图1)。其成分股市值合计约为2.7万亿欧元,约占欧元区总股票市值的55%。

1988年推出的DAX指数,反映了在法兰克福证券交易所(FSE)上市的40家市值最大的公司股价走势(同时需满足特定企业质量和盈利能力要求)。EURO STOXX 50指数和DAX指数编制都对股票流动性设置门槛要求。

EURO STOXX 50指数和DAX指数都是基于市值这一公开透明的标准制定,这也为为跟踪指数提供了极大的稳定性和可预见性。指数搭建和定期审查建立在既定的规则之上,不存在自由裁量的余地。

图1:行业分配

数据来源:Qontigo。EURO STOXX 50指数的数据截至2022年7月29日,并根据行业分类基准。DAX指数的数据截至2022年6月30日,并根据DAX商业分类。

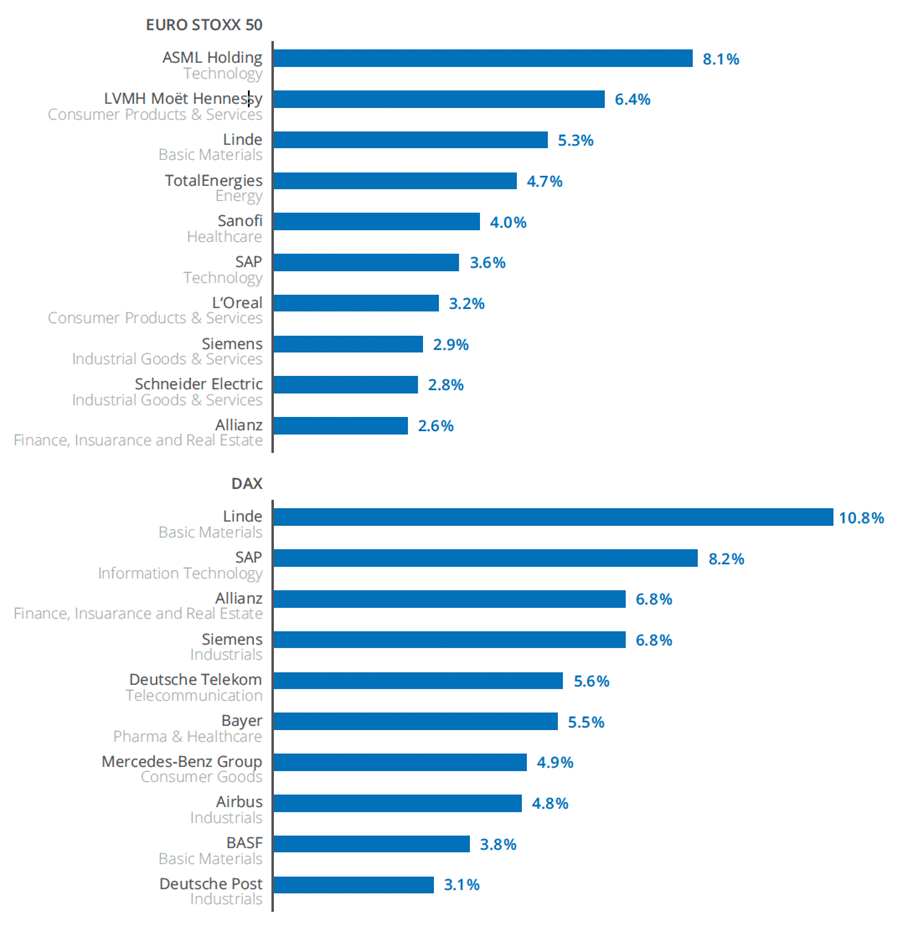

图2:前十名持股公司

数据来源:Qontigo。EURO STOXX 50指数的数据截至2022年7月29日, DAX指数的数据截至2022年8月22日。DAX超级行业基于DAX分类。

货币对冲产品

汇率对冲类型的指数旨在保护指数投资收益免受外汇风险(通过对外汇远期合约的滚动投资)。因此,投资者以潜在货币收益为代价来消除汇率波动的风险。在月度对冲版本中,远期对冲每月设置一次,并在下次重置前保持不变。

EURO STOXX 50月度对冲日元滚动市盈率和DAX月度对冲日元滚动市盈率使用三菱日联银行有限公司提供的的电汇中间汇率(TTM)的即期和远期利率作为锁定汇率。

流动性

蓝筹股指数以简洁、高流动性的方式,使投资者能够参与全球股票市场。在东京挂牌上市的EURO STOXX 50指数和DAX ETF指数将使日本投资者能够以较低成本进入德国和欧洲这两大世界经济体的金融市场。

1 路透社,《日本投资者是7月海外股票最大买家》,2022年8月8日。