11月 21, 2022

Eurex Asia

【特约专稿】中国邮储银行推出首个与 STOXX 股指挂钩的 ESG 理财产品

中国邮政储蓄银行与 Qontigo 首次合作,将为该行客户提供一个中国大盘股票投资组合,其股票根据可持续性评分精挑细选,并经过优化,以限制风险和行业配置偏离基准。

作为亚洲最大的银行之一,中国邮政储蓄银行 (PSBC) 推出首款 ESG 理财产品,追踪经 Qontigo 优化的 STOXX 股指。

该产品的股票部分跟踪了 STOXX® 中国邮政储蓄银行 A 股 ESG 股指,该股指从 STOXX® 中国 A 股 900 股指自由流通市值最大的 300 只股票中优选持续性表现卓越的股票。该股指排除了不符合联合国全球契约原则及相关规范的公司,或涉及有争议武器、烟草或动力煤的公司。中国邮政储蓄银行的投资产品包含单独的固定收益部分。

股指

STOXX 中国邮政储蓄银行 A 股 ESG 股指针对高可持续性的投资组合,同时寻求保持与基准相似的风险特征。使用 Axioma 的投资组合优化软件确定选股与权重,确保在可预测风险、可交易性和多样化约束条件下,最大化股指的总体 ESG 评分。

中国ESG 投资的基准

过去中国在 ESG 方面一直落后于先驱国家,但如今受客户需求和监管驱动,中国开始奋起直追。中国政府持续加大力度,要求企业报告披露可持续发展资质。

“这是我们与中国邮储银行的首次合作。中国邮储银行是中国财富管理行业的顶级机构,能与他们合作我们感到非常高兴,我们将携手为中国市场提供独一无二的解决方案。”Qontigo 亚太区销售总经理 Rick Chau 表示。 “STOXX 中国邮政储蓄银行 A 股 ESG 股指有效强化了投资组合的 ESG 配置,并且避免了过多的风险、成交量或行业偏见。我们预计该股指将成为中国头部企业 ESG 表现的基准,并促进投资者管理。”

在去年三月北京的一次活动中,中国邮政储蓄银行副行长徐学明表示,“ESG 投资,特别是那些基于客观和定量评估的投资,是促进经济“绿色”发展的关键。他补充说,基于股指的解决方案还有助于各方评估企业的 ESG 表现,有助于改善企业实践。”

提高交易效率

STOXX 中国邮政储蓄银行 A 股 ESG 股指的具体限制条件包括:投资组合 ESG 总分必须至少比基准股指高出 20%;预测风险必须等于或低于基于Axioma 中国中期基本面因子股票风险模型计算的基准风险;必须持有且不低配 ESG 评分前三分之一的股票,可以持有但不高配评分后三分之一的股票(针对这一要求进行了优化);没有 ESG 评分的股票不得入选;

对单支股票和 ICB行业相对于基准的权重设有上限;最后,为确保有效的可跟踪性和可交易性,对投资组合成交量设有限制,并对流动性设有阈值。

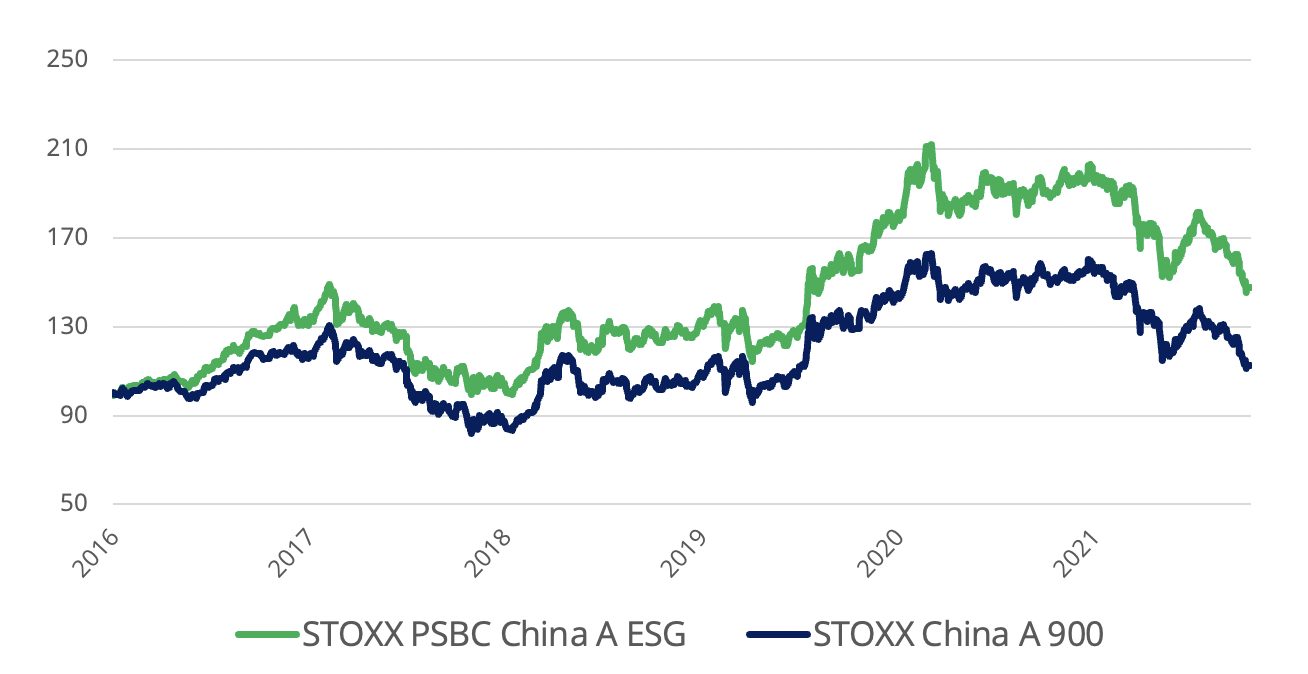

回溯测试数据显示,STOXX 中国邮政储蓄银行 A 股 ESG 股指过去 6 年的回报率比 STOXX 中国 A 股 900 股指高出 35 个百分点(表 1)。

表1 - 股指表现

来源:Qontigo。 2016 年 12 月 19 日至 2022 年 10 月 7 日,总回报率(美元)。

截至 2022 年 10 月7 日,STOXX 中国邮政储蓄银行 A 股ESG 共纳入 123 支股票。

有关股指的中文信息,请访问专门页面。