12月 14, 2022

Eurex Asia

【期貨選擇權】歐交所ESG集中撮合訂單簿流動性相關問答集

歐交所ESG衍生品推出距今已有三年半的時間,其交易量、交易合約的流動性均傲居ESG期貨之首。然而一些投資經理仍然擔心市場流動性是否能夠滿足其交易需求。以下關於市場流動性的關鍵數據、主要驅動因素和重要指標,相信能很好回應仍在觀望的市場交易者。在機構投資決策過程中,研究特定合約背後的流動性情況對於做出市場投資決策至關重要。

ESG衍生品的發展——未平倉合約和日均成交量

2022年歐交所ESG衍生品在股指和固收領域的總交易額超過465億歐元(約合人民幣3358億元),日均交易量(ADV)達到2.4億歐元(約合人民幣17億元)。截至2022年9月,ESG衍生品股指和固收未平倉合約總額分別為44億歐元(約合人民幣318億元)和8億歐元(約合人民幣58億元)。截至目前,2022年合約交易量已達220多萬份。

ESG集中撮合訂單簿流動性答疑

集中撮合訂單簿交易的活躍客戶數達到新高

集中撮合訂單簿交易活躍——訂單簿交易與場外大額交易平分秋色

目前歐交所已掛牌超過28檔ESG股指衍生品,而這些合約的交易逾趨活躍,截至2022年9月,43%的ESG股指衍生交易都是通過我們的集中撮合訂單簿進行交易。可見集中撮合訂單簿交易和場外大額交易旗鼓相當,凸顯了成熟商品會具備的集中市場流動性的特色。

STOXX®和MSCI ESG指數的ESG衍生品有力地證明了這一點,二者通過集中撮合訂單簿交易的合約年環比分別增長54%和294%。

此外,在一些ESG旗艦合約領域(如STOXX®歐洲600 ESG Exclusions期貨),大宗商品流動性提供商的競爭十分激烈。為贏取ESG相關訂單,流動性提供商競爭漸趨白熱化。

穩定價差——ESG衍生品合約訂單簿流動性持續增加。

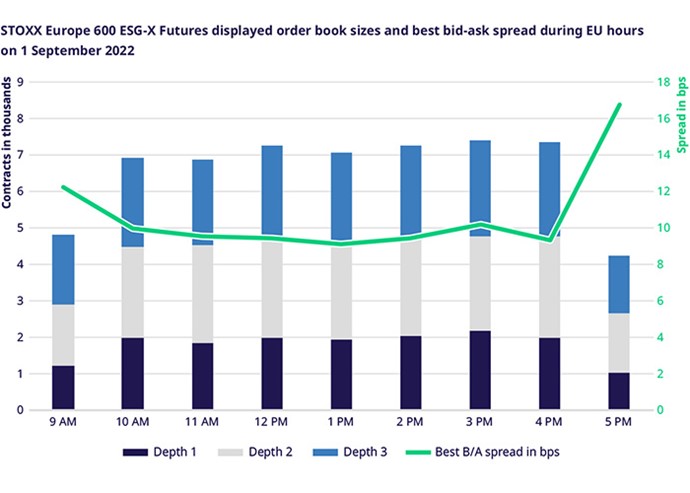

集中撮合訂單簿的不同最佳買賣盤規模下的穩定價差是體現合約流動性的另一指標。 STOXX®歐洲600 ESG-X期貨、EURO STOXX 50® ESG指數期貨、MSCI美國ESG Screened期貨和MSCI新興市場ESG Screened期貨在此方面尤為突出。

上圖顯示了STOXX®歐洲600 ESG-X期貨三個不同買賣盤級別的訂單簿深度(各價格點的要價或出價訂單數量)和以基點計量的最佳買賣價差。在歐盟交易時間內,交易者平均可以在最佳買賣價格水平上交易約2000份合約(其名義價值約為3000萬歐元),訂單簿深度的前三個級別包含約7000份合約(其名義價值約為1.03億歐元)。最佳買賣價差基本保持在10個基點以內。