1月 30, 2022

Eurex Asia

【固收月報】2021年12月固定收入市場簡報

作者:Lee Bartholomew,Eurex固定收益產品研發主管

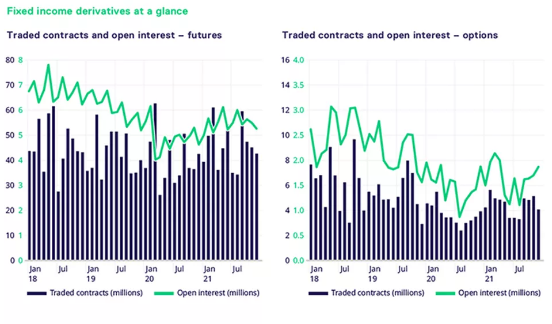

首先,在開始回顧2021年之前,我想先用一點時間來感謝我們的成員和終端客戶在這一年中對我們的支持。正是因為你們對我們現有的投資組合和新激勵方案的持續支持,才為我們創造了2021年紮實的業績。去年有著一個非常不錯的開始,公債殖利率曲線的長端為投資者提供了許多早期的機會。德國長天期國債(Buxl)期貨和期權出現了兩位數的增長,同比分別增長了47.3%和478.6%。

與2020年相比,期貨相關產品的交易量年增率增長了13.6%;而德國長期國債(Bund)和德國中期國債(Bobl)期貨分別增長了16.2%和17%。相對於殖利率曲線的其他部分,曲線的近端表現不佳,德國短期國債(Schatz)期貨的交易量年環比下降了9.6%。意大利和法國板塊有著持續穩健的同比增長,10年期板塊年環比增長分別為21.3%和28.3%。意大利曲線近端的交易量與2020年相比增長了15.6%。目前來看2022年面臨的主要問題與2021年一致,通貨膨脹仍然是一個棘手的難題,所以中央銀行會加速實施收緊政策。這給各國央行帶來了加息的壓力,英國在2021年末加息,而美聯儲預計將在2022年加息。這種分歧,再加上潛在的股價回測的風險,增加了市場上的波動性。

隨著市場價格漲跌互見,沒有明顯的走勢,和央行之間的分歧支撐了我們期權組合在整個2021年的交易量。隨著上半年10年期與30年期利率s掉期的快速扁平化和長天期殖利率出現很高的價格波動率,Bund和Buxl期權在2021年持續有著出色的表現。與2020年相比,交易量分別增加了32.1%和478.6%。 Bund的每周到期期權出現了58.6%的增長。隨著殖利率的反彈,曲線的中段受益最大,Bobl期權的交易量有著106%的增長。意大利和法國板塊的表現不如期貨那樣強勁,交易量分別下降了20%和58%。

2021年進一步為團隊提供了推動產品創新的機會,我們在9月成功推出了固定收益ESG衍生產品。在推出後的第一季度,我們交易的名義價值超過了3.5億歐元,僅在12月就交易了高達1.5億歐元的名義價值。順便說一下,最大的單筆交易(300手)也發生在12月。我們的團隊一直都在努力發展這一板塊,以確保我們可以在固定收益ESG衍生品這一板塊成為領先的流動性池。我們希望與我們的成員和客戶一起,在2022年為市場帶來更多的創新從而解決市場上的難題。

在此,我祝愿我們所有的成員和客戶有一個快樂、健康並繁榮的2022年。我們的團隊期待著在未來的日子裡與你們緊密合作。