Dec 06, 2022

Eurex

FIC Credit Market Snapshot December 2022

G-spreads increase as PnL driver for EU and US credit

- Risk-on sentiment in global markets extends to credit markets in recent weeks.

- European credit is now more driven by G-spreads compressing, while U.S. markets rallied on the Treasury curve.

- Credit provides attractive carry compared to Equities in Europe and the U.S.

- Credit break-evens have risen and the ratio between EUR HY and IG is at the lowest point in years.

Although it has been a tough year for corporate credit globally, recent hopes for a slowing of the tightening pace of central banks and a potential relaxation of strict covid measures in China supported the segment in recent weeks. Markets continue to weigh the Feds reaction function higher than traditional valuation inputs such as earnings yield. Both U.S. CPI and PPI prints came in lower than expected and showed decreases in year-on-year and month-on-month terms.

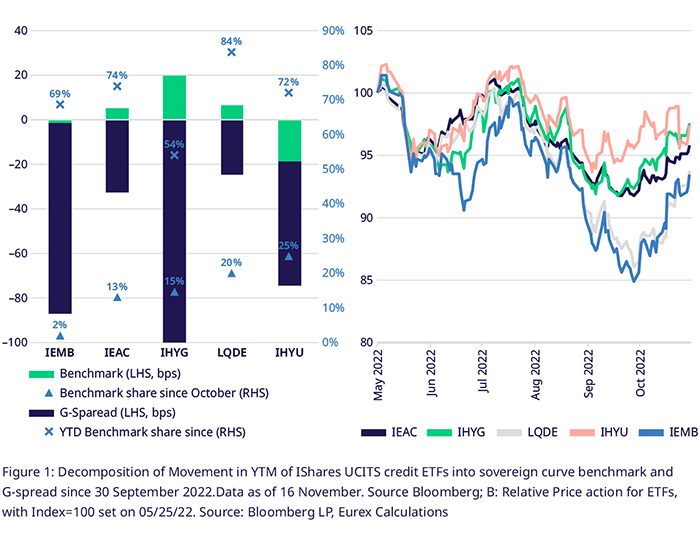

Credit markets participated in the risk-on rally, but drivers of the appreciation varied throughout geographies. As of 16 November, U.S. credit continues to be mainly driven by shifts in the Treasury curve, with 63% (year-to-date 84%) of the yield movement in IG (LQDE) and 75% (72% year-to-date) in HY (IHYU) being driven by sovereigns. In Europe, the recent price movements came without a clear direction in the benchmarks’ movements, leading to only 4% (74% year-to-date) of IG (IEAC) and 10% (56% year-to-date) of HY (IHYG) driven by the sovereign curve.

Credit continues to provide attractive carry compared to equity markets. On 16 November, the EURO STOXX® 600 current earnings yield was at 6.82%, with one-month ATM options implying volatility levels of 17.82, while the S&P 500 had a current earnings yield of 5.18%. Against those numbers, European (IHYG) and US (IHYU) High Yield credit yielded 7.66% and 7.43%, with implied at-the-money put volatilities of 12.52% and 13.9%, respectively. Those differences should only intensify with a deepening recession pushing earnings down further.

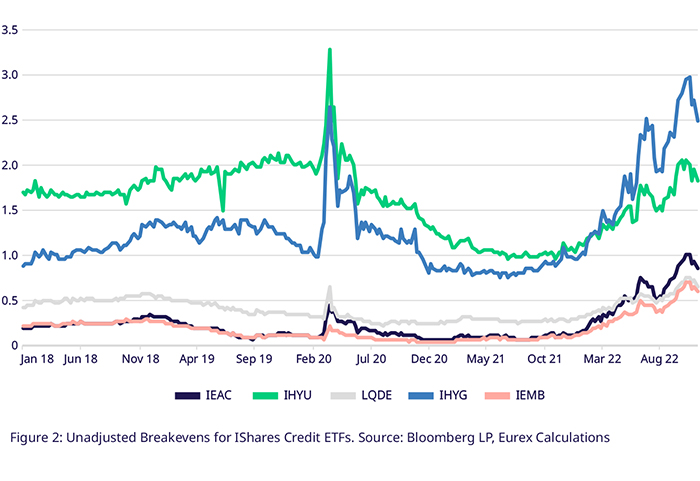

Total return in credit markets is now well secured against both G-spreads and yield curves rising. Unadjusted break-evens, meaning yield-to-maturity (YTM) over duration, are close to levels last reached at the height of the 2020 crash. Break-evens give an indication of the amount of yield movement a fixed income asset can tolerate in a year before total return turns negative. US High Yield (IHYU) is the only sector that remains at pre-pandemic levels.

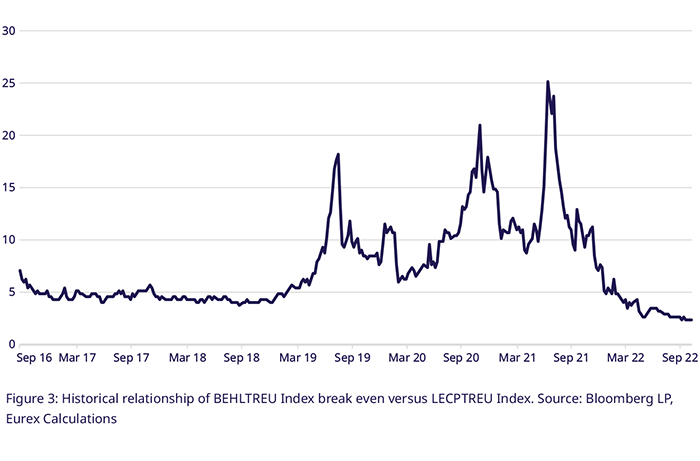

European Investment Grade adjusted break-even (i.e., Yield to Worst over Option Adjusted Duration against Sovereign) is particularly cheap relative to the high yield counterpart. The Ratio between Bloomberg’s BEHLTREU Index (High Yield) and LECPTREU Index (Investment Grade) break-even stood at 2.62. This is only slightly higher than the level of 2.48 from 11 November, the lowest value recorded since September 2016. LECPTREU, the benchmark of IEAC, is almost perfectly correlated with the RECMTREU Index, underlying the Euro Investment Grade index futures (LXYA index) at Eurex. On the high yield side, BEHLTREU is the index underlying the new Euro High Yield contract (Bloomberg ticker: AHWA Index).

Although recent sentiment across markets has been risk-on, prospects of further tightening financial conditions, the ongoing war in Ukraine and rising energy costs persist and cloud the economic outlook. According to a recent Bloomberg Intelligence survey, European high yield managers hold record levels of cash. Further, according to Bloomberg Intelligence research, the European junk bond market is under stress, as 33% of the constituents of the Bloomberg Junk Index are now at stressed or distressed price levels after more than 1.5 years of no defaults.

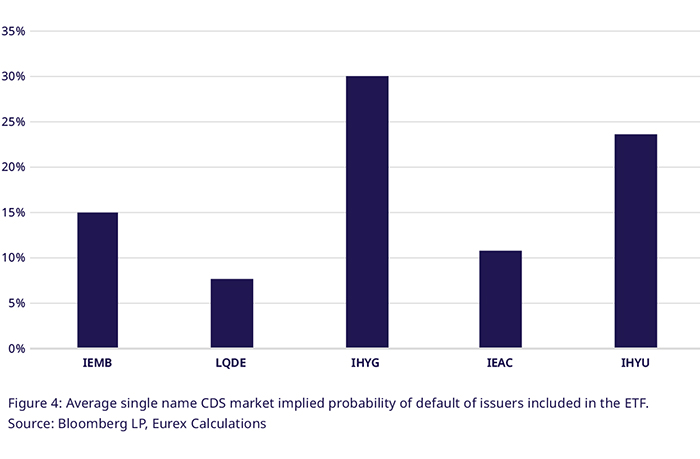

OTC markets confirm this view via the pricing of single-name CDS. European High yield in IHYG is viewed riskier than Investment grade credit in IEAC, pricing in a 30% probability of default of the issuer in the next five years versus the latter’s 11%. Those values are comparable to levels in 2012-2013 and at the height of the pandemic spike in risk aversion. It is noteworthy that Credit default swaps indices price in only 7% default probability for Investment Grade credit in Europe via the ITRAXX Europe Index and 30% for High Yield via the ITRAXX Crossover Index, where the differential is most likely due to composition.

U.S. high yield and EM sovereign and quasi-sovereign debt is considered safer than European high yield credit. IHYU components price a 5-year default probability of 24% via single-name CDS, while emerging market debt as captured IEMB has an average of 15%. LQDE has the lowest out of the observed, at 8%, in line with CDX expectations.

Ideas for market positioning in Eurex Credit Futures & Options

Eurex Credit Futures and Options enable you to hedge existing portfolios against duration and credit risk in one go. Market neutral credit spread trades between EUR IG and HY are now also possible at Eurex with our Bloomberg MSCI Euro Corporate SRI Index Futures (LXYA index) and Bloomberg Liquidity Screened Euro High Yield Bond Index Futures (AHWA Index). Eurex Options on Fixed Income ETFs allow for directional positioning while limiting options premium paid with options spreads or more tailored option strategies. Be it to position for a rally in credit markets or in search of alpha in a specific sector, our market makers are ready to show you prices at competitive spreads both in the order book and in broker-facilitated phone market trading. Reach out to the team for more insights and execution guidance.

Contacts