Nov 14, 2022

Eurex

FIC Credit Market Snapshot November 2022

Correlations in Credit ETFs increase amid bearish performance

- Corporate credit markets exhibited bearish performance due to negative macroeconomic factors, shifts in the yield curves and deteriorating balance sheets.

- In Europe, increasing solvency issues offset relative gains based on lower duration for HY vs. IG, while U.S. HY and IG were largely driven by duration.

- Correlations across global debt ETFs increased amid yield curves moving upwards and worldwide monetary tightening.

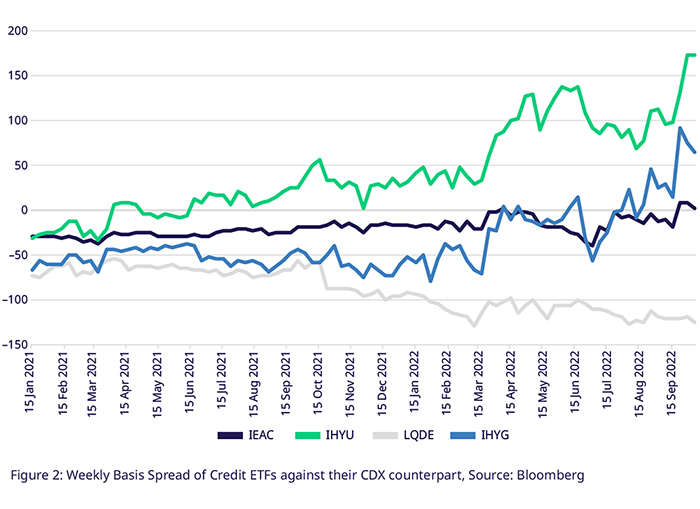

- CDX spreads continue to deviate from neutral, exposing a growing mismatch between credit risk expectations on OTC & cash markets.

It has been a tough year for corporate credit globally as primary and secondary markets faced numerous challenges such as geopolitical woes, rising yields, monetary tightening and compressing profit margins due to exploding production costs. Until May 2022, global credit markets grew to over $17 trillion. This growth was due to a decade-long falling rate environment and loose monetary policy, allowing corporations to immensely reduce their costs of capital. Rising rates in sovereign markets and widening credit spreads erased the gains made and uncovered the risk embedded in leveraging corporate balance sheets.

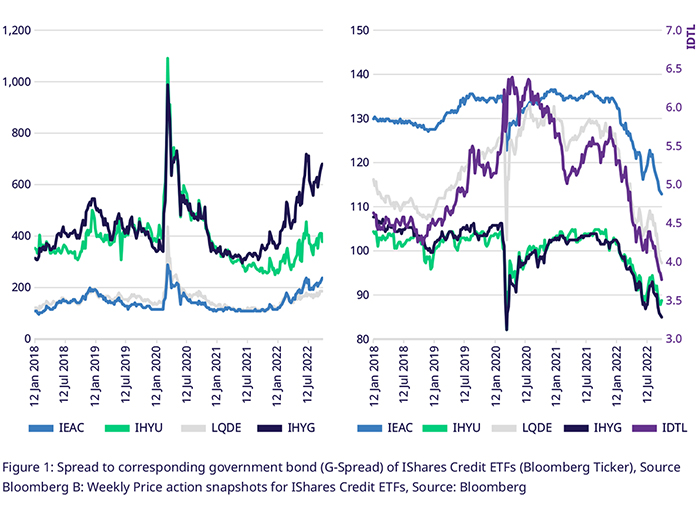

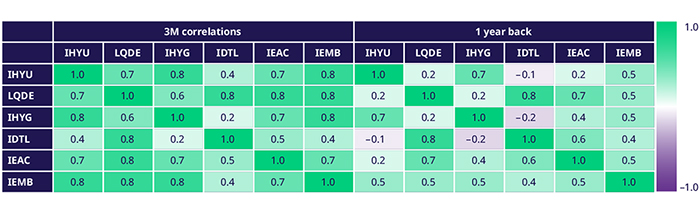

As duration drives large parts of the PnL in credit positions, correlations between developed markets’ credit sectors increased. Specifically, European and U.S. high yield credit is now highly correlated (.8), as well as investment grade bonds in both jurisdictions.

Curves in Europe shifted upwards YTD but did not invert. This led to short duration outperforming long duration on a relative basis. IHYG (Euro high yield) has a lower holding duration than IEAC (Euro Investment Grade) at 2.95 and 4.01, respectively, making interest rate moves more impactful for IEAC. This has been counteracted partly by the G-spread in high yield debt rising much faster than in IG.

Options on IHYG increasingly look rich compared to costly Europe Crossover CDX for insuring the portfolio against downside risk via synthetics since the basis spread of the ETF has widened considerably in recent weeks. This relative cheapness adds to the fit of the ETF onto real-life portfolios, which suffer from the same duration-driven losses covered in a put option.

In the U.S., the IG ETF LQDE outperformed the high yield IHYG from a price action perspective. As the U.S. yield curve bear flattened and inverted, short-term yields grew faster than long term yields. Additionally, investors preferred safety over risk, as the G-spread of LQDE stayed in line with its Europe counterpart IEAC, while the U.S.-oriented IHYG diverged from the European IHYU.

The CDX Basis spread points to U.S opportunities in both directions. In LQDE, the basis is increasingly negative, so IG CDX has less risk priced in than the ETF. Conversely, the IHYU CDX basis has grown ever more positive in the last months, similar to its European counterpart. This means more risk expectations are baked into the ETF, reducing the price tag.

Macro factors, Dollar strength and decreasing global liquidity, keep pushing EM credit markets into negative territory. For IEMB specifically, the developments in China regarding the Zero Covid Policy, as well as the ongoing property crisis and the crackdown on tech firms like Ali Baba and Tencent, are relevant as Chinese credit is a large portion of positions held.

Trade now at Eurex

Has this inspired you to put on a trade? Consider limiting your downside with Eurex Options on Fixed Income ETFs while fully benefitting from the upside of your positions. Whether you want to hedge your existing portfolio against duration and credit risk, alleviate pressures in credit markets, create upside potential with limited downside risk, or structure some premium through advanced option strategies, our market makers are ready to provide prices at competitive spreads.

Contacts