Nov 15, 2023

Eurex

Eurex Repo Monthly News October 2023

Market briefing: ''Substantial increase in term-adjusted volumes across all markets''

by Frank Gast- Managing Director, Member of the Management Board, Eurex Repo

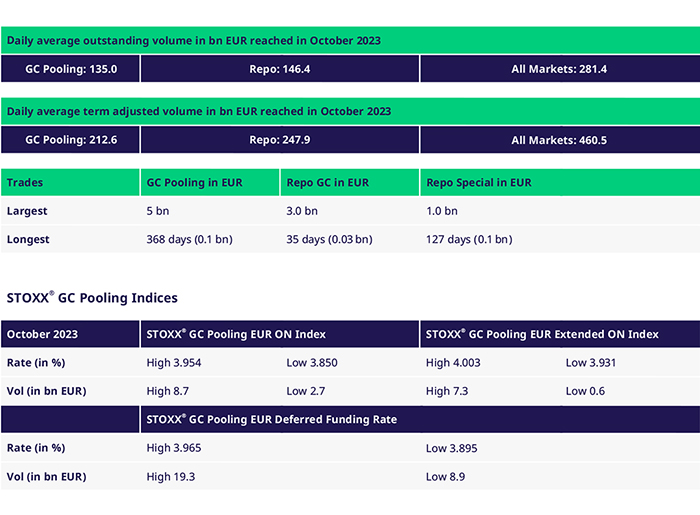

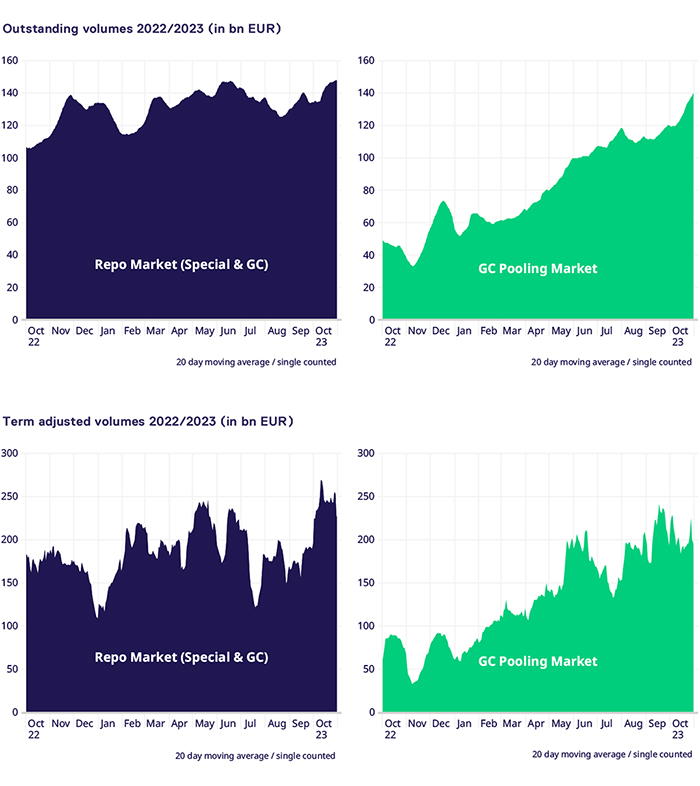

The first ten months of 2023 witnessed a substantial increase in term-adjusted volumes across all markets, surging to €357 billion, marking an impressive 70% growth compared to the same period last year. Year-to-date, average traded volumes almost doubled with GC Pooling volumes experiencing an astounding 243% surge, and GC & Special Repo volumes demonstrating strong growth at 32%. In October, the ECB’s Governing Council decided to maintain the three key ECB interest rates unchanged.

Outstanding Volumes

Average outstanding volumes across all markets showed robust growth year-to-date with an increase of 68%. GC Pooling stood out with an impressive 118% growth, while GC & Special Repo volumes grew by 45%.

Spreads and Collateral

The average spread between the GC Pooling EXT and the ECB Basket slightly decreased to 3 bps. Meanwhile, the average spread between the ECB Basket and €STR increased to approximately 3.5bps, while the EXT-€STR spread increased to 6.5 bps.

Government Bonds

Year-to-date, daily traded volumes in Bunds increased by about 10%. Overall, daily traded volumes in Government Bonds registered a significant increase of over 30%, primarily driven by substantial growth in French and Spanish bonds.

EU Bonds/SSAs

The volume of EU bonds remained consistently high, with a remarkable 48% increase compared to October 2022. There was also a notable increase in EU bonds allocated in GC Pooling in recent months. Year-to-date, EU bond repo volumes recorded a remarkable 112% increase. The average monthly traded volume in Supranationals & Agencies from January to October surged by 39% compared to 2022, driven by the strong increase in EU bonds.

Eurex – Home of Term Repo

The average term-adjusted volumes in GC Pooling experienced a remarkable year-to-date growth of 143.4%, while GC & Special term business increased by 37%.

Robust term business in standard terms in GC Pooling, particularly in 6, 9, and 12 months, continued, along with significant volumes in non-standard terms extending over year-end. The longest trades are set to mature at the end of April 2025.

Year-end activity commenced in Special Repo with substantial volumes traded in Government Bonds, primarily Bunds, French, and Spanish bonds. These trades have break dates beginning in January 2024, with some maturing in February and April 2024.

Video series

Trading on Eurex Repo in a Changing Interest Rate Environment: New Times Call for New Strategies

Changing interest rates in the Eurozone have created new trading dynamics on Eurex Repo. Some traders are seeing positive interest rates for the first time in their careers, leading to questions about trading strategies, risk management and how to best access Eurex Repo as buy-side clients and relative to bilateral options. To help traders understand new opportunities, Eurex has created a series of training videos on repo in a changing interest rate environment.

Industry events

Save the date: GFF Summit 2024 | 30 January - 1 February

We are thrilled to announce that the Global Funding and Financing (GFF) Summit will be back on 30 January to 1 February 2024 in the European Convention Center in Luxembourg.

Interested in joining? We will inform you as soon as registration opens, but make sure to save the date and mark your calendar already today.

Can’t wait? Follow #GFFSummit on LinkedIn to stay up to date and to have a look at our past events or tune in to the GFF podcast, available on all your favorite streaming platforms.

We look forward to seeing you in Luxembourg!

Volumes

Participants

View the current Participant List Repo and GC Pooling.

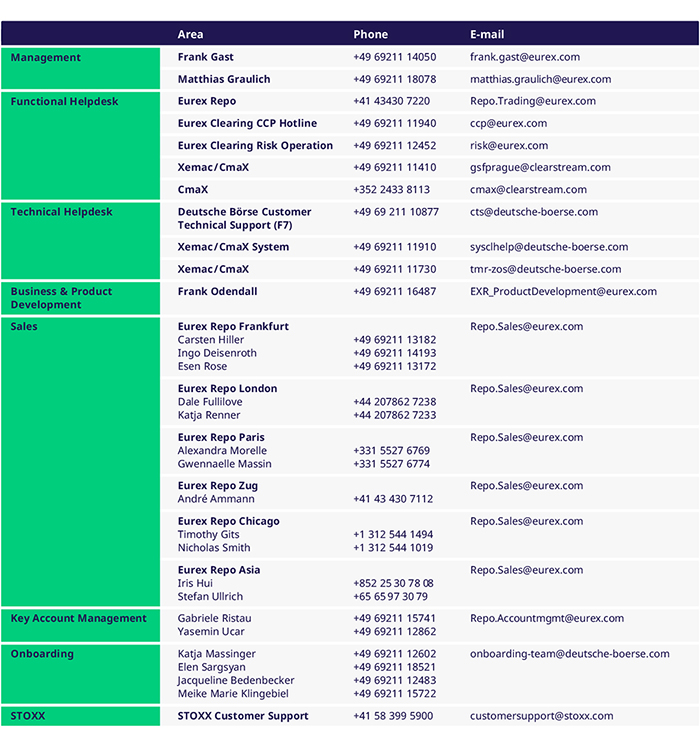

Contacts

For more information, please visit the websites of Eurex Repo and GC-pooling or contact: