Jan 05, 2017

Eurex Exchange

Introduction of CFTC-certified Options on VSTOXX® Futures

On February 1st 2017, Eurex Exchange will introduce a new CFTC-certified options on VSTOXX® Futures contract (OVS2). The VSTOXX® Futures volatility index will be the underlying market for the new options contract. OVS2 will have eight consecutive expiring months. The underlying equity market for VSTOXX® Futures is the EURO STOXX 50® Index.

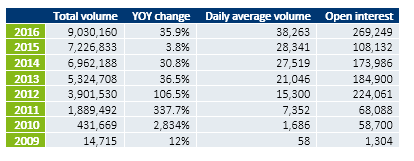

Since the inception of VSTOXX® Futures in 2009, volume and open interest continues to grow as noted in table 1. In 2016 VSTOXX® Futures experienced some days and months of large volume and open interest. The most salient example occurred around the Brexit referendum. Total contracts traded in June 2016 were 1.24 million. A 62.1 percent increase from a year earlier and a 62.4 percent increase from the previous month. The futures volume experienced another increase recently around the US election on 8 November 2016 and again leading up to Italy’s constitutional referendum on 4 December 2016 resulting in a 1.12 million contracts traded in November 2016 for a 120.7 percent increase from a year earlier and a 37.1 percent increase from the previous month.

Table 1: VSTOXX® Futures yearly volume and open interest as of November 2016

Source: Eurex Exchange monthly statistics

In 2012 Eurex began trading VSTOXX® options (OVS) with the VSTOXX® index as the underlying market. When OVS2 begins trading in February 2017, initially both option contracts will trade simultaneously. As of 1 February 2017, the listing of new expiration months for VSTOXX® options (OVS) will be discontinued.[i] As each new OVS2 expiration month is introduced, the OVS options will be gradually phased-out during the eight-month period.[ii] By the end of the eight months OVS will be completely replaced by OVS2.

Why replace VSTOXX® options with options on VSTOXX® Futures?

As appetite for European volatility continued to grow in 2016, US participants have expressed interest in accessing listed VSTOXX® options. The current version is under the jurisdiction of the SEC and not available to trade in the U.S. However, some U.S. market participants trade VSTOXX® options on the OTC market, making the Eurex listed VSTOXX® options a secondary market. Under the SEC “no action relief” VSTOXX® options are only available to a Qualified Institutional Buyer (QIB), not allowing for direct market access. The new CFTC-certified OVS2 will allow for wider market participation.

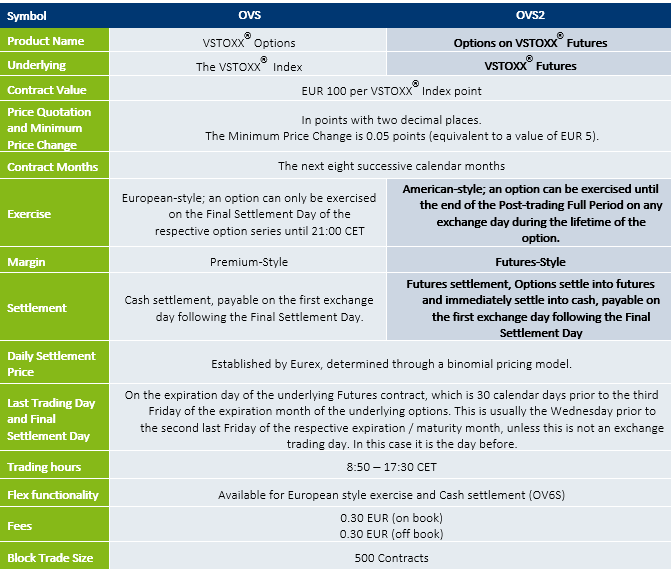

Highlights of the OVS2 contract specifications include:

- EUR denominated

- Currently the OVS contract has a European style exercise. OVS2 will be American style exercise, allowing the option to be exercised anytime during the life of the contract

- Currently the OVS is cash settled. The new OVS2 contract will be physically delivered to a VSTOXX® Futures contract that expires on the same day. VSTOXX® Futures are cash settled

Key Benefits:

- Investors with EUR denominated equity exposure do not have currency risk and exposure

- As a CFTC-certified product it is directly accessible to all U.S. traders and investors. Currently the OVS contracts are only available to QIBs

- It offers investors a targeted and leveraged channel to reflect their views on EURO STOXX 50® Index volatility

- As the research showed in my paper Utilizing a European volatility index for Pan-European volatility, VSTOXX® Futures may be employed for volatility of several European equity indexes and therefore options on VSTOXX® Futures could also be applied for the same goal

- In several articles, I’ve discussed the VSTOXX®/VIX spread. Now you can trade options on the VSTOXX® leg of the futures spread instead of only utilizing futures contracts

- OVS2 offers opportunities to deploy strategies that utilize both futures and options

- Options on VSTOXX® Futures features the same benefits of any exchange traded contract:

- Market-to-Market transparency

- Offering liquidity for hedgers and investors

- Regulated exchange and market

- Central clearing of transactions: reducing counter-party default risk

- Price discovery of the market

- Standardized trading hours and contract specifications

Table 2 notes a greater detail of comparison between the current OVS and the new OVS2 options

Table 2: Comparing contract specifications between VSTOXX® options (OVS) and options on VSTOXX® Futures (OVS2).

Per the BNP Paribas SA Eurozone Political Risk Index, political risk is increasing in Europe while the VSTOXX® index declined in the past several weeks.[iii] This plays into potential future macro events related to the upcoming European elections.

In a 24 November 2016 ECB press release of their semi-annual Financial Stability Review discussing “systemic risks to financial stability over the next two years”, one of the four risks included financial contagion induced by increased “political uncertainty in advanced economies and continued fragilities in emerging markets”.[iv]

The November Centre-right primaries in France could be considered the beginning of the election season across the EU for the next year. Followed quickly by the Italian constitutional referendum and the Austrian Presidential election both held 4 December 2016. Over the course of the next year general elections will be held in the Netherlands, France and Germany. September 2017 a referendum is planned for Catalonia’s independence from Spain.[v]

2017 could see changes in European heads of state and controlling parties of various governments. Could this sustained uncertainty induce more volatility and nervousness into the European capital markets and potentially develop macro events? If so, how could these events or increased uncertainty impact VSTOXX® Futures and options on VSTOXX® Futures?

Potential ideas to think about regarding trading OVS2

The term structure of VSTOXX® Futures is frequently in contango (spot price is less than futures prices). As discussed in my article “Forward curves of European and U.S. volatility index futures” The first three months of VSTOXX Futures are in backwardation about 15% of the time.[vi]

When volatility begins to show up in the VSTOXX® index, it tends to experience greater moves in the spot, front and nearby futures months than what is often experienced in the back months as the curve moves from contango to backwardation (spot is priced higher than back months).[vii]

- An investor could buy calls in the front month and buy puts in the back months with the expectation of a larger move in the front month versus the back month if the market is in contango.

- An investor could buy calls in the front month and sell puts in the back months. Similar to strategy No. 1, but realizing the entire curve could move higher if the market goes from contango to backwardation allowing the investor to receive some premium for selling the put.

- The investor could sell puts in the front month to receive some premium and the expectation the front month may move higher.

- An investor could buy puts in the back months as the price of the back months may decline as they move closer to expiration assuming a contango term structure.

- If the futures term structure is in backwardation for an extended period of time, an investor may determine if they should either buy puts or sell calls in the front month or nearby month with the perspective of the VSTOXX® Futures potentially moving lower.

Chart 1 illustrates a general guideline how the VSTOXX® Futures term structure may shift from contango to backwardation. Even though the entire curve moved higher as market sentiment shifted towards more uncertainty, the implied volatility may move quickly in VSTOXX® spot and the front months of VSTOXX® Futures as discussed in my article “An analysis of why volatility indexes are relevant”

Chart 1: Evolution of the volatility regime shift of VSTOXX® spot and VSTOXX® Futures

Source: Shore Capital Research LLC

VSTOXX® spot is the first moment in Chart 3. The front month of VSTOXX® Futures is the second moment. The remainder of the term structure are three through nine.

During the summer of 2014, EURO STOXX 50® Index moved from a rallying market to choppy market and then selling off into the fall of 2014. The VSTOXX® Futures structure followed the views of the equity market. In June 2014, the VSTOXX® term-structure was in contango. By October 2014, VSTOXX® Futures term structure shifted to backwardation.

In summary, options on VSTOXX® Futures will allow for greater market participation and greater choices of strategies for hedgers and investors for directional trading, spreading or as a hedge to their portfolio and trading volatility.

[i] https://www.eurexchange.com/blob/2766088/12a844b3191c02d89d15bf094e920018/data/er16098e.pdf

[ii] http://www.eurexgroup.com/group-en/newsroom/vstoxx-outlook/New-U.S.-Approved-VSTOXX-Options-To-Launch-February/2774230

[iii] https://www.bloomberg.com/news/articles/2016-11-23/europe-stock-volatility-underprices-rising-political-risk-chart

[iv] http://www.ecb.europa.eu/press/pr/date/2016/html/pr161124.en.html

[v] http://www.marketwatch.com/story/all-the-potential-political-risks-looming-in-europe-in-one-chart-2016-11-14

[vi] http://www.eurexgroup.com/group-en/newsroom/vstoxx-outlook/689758/forward-curves-of-european-and-us-volatility-index-futures/?wt_mc=group.newsletter.editorial_vstoxx_en.vstoxx_outlook_2013_11_2013-11-05-21:43_690736

[vii] http://www.eurexgroup.com/group-en/newsroom/vstoxx-outlook/vstoxx-volatility-behavior-when-european-equities-rally/1176180/?wt_mc=ussm.LinkedIn.vstoxxnl.en.ms.vstoxxnl12172014

By Mark Shore, Founder www.shorecapmgmt.com

Mark Shore has more than 25 years of experience in the futures markets and managed futures, publishes research, consults on alternative investments and conducts educational workshops. His research is found at www.shorecapmgmt.com.

Mr. Shore is also an Adjunct Professor at DePaul University's Kellstadt Graduate School of Business where he teaches a graduate level managed futures/ global macro course. He is board member of the Arditti Center for Risk Management at DePaul Univeristy. Mr. Shore is a frequent speaker at alternative investment events. He is a contributing writer for Eurex Exchange, Reuters HedgeWorld, the CBOE Futures Exchange (CFE) and Micro-Cap Review.

Prior to founding Shore Capital, Mr. Shore was Head of Risk for Octane Research Inc ($1.1 billion AUM) in NYC, where he was responsible for quantitative risk management analysis and due diligence of Fund of Funds. He chaired the Risk Management Committee and was a voting member of the Investment Committee.

Prior to joining Octane, he was the Chief Operating Officer of VK Capital Inc, a wholly owned Commodity Trading Advisor unit ($250 million AUM) of Morgan Stanley. Mr. Shore provided research and risk management expertise on portfolio construction, product development and business strategy. Mr. Shore graduated from DePaul University with a degree in Finance. He received his MBA from the University of Chicago.

Past performance is not necessarily indicative of future results. There is risk of loss when investing in futures and options. Futures can be a volatile and risky investment; only use appropriate risk capital; this investment is not for everyone. The opinions expressed are solely those of the author and are only for educational purposes. Please talk to your financial advisor before making any investment decisions.