Jan 31, 2022

Eurex

EURO STOXX® 50 Index Futures: Change of minimum price gradation (tick) for outright futures contracts

1. Introduction

The Management Board of Eurex Deutschland decided to increase the minimum price change (tick) in outright contracts in EURO STOXX® 50 Index Futures (FESX) with effect from 21 March 2022.

The new tick will be 1.0 index points (currently: 0.5 index points). The tick value will increase from EUR 5 to EUR 10.

For implementation of the decision, the Contract Specifications for Futures Contracts and Options Contracts at Eurex Deutschland will be amended with effect from 21 March 2022, as outlined in the attachment.

Simulation start: 11 February 2022

Production start: 21 March 2022

2. Required action

All Trading Participants of Eurex Deutschland and Vendors will be affected by the changes.

Please note that all orders and quotes in product FESX will be deleted on 18 March 2022, after the close of trading, and, where required, have to be re-entered into the order book.

3. Details

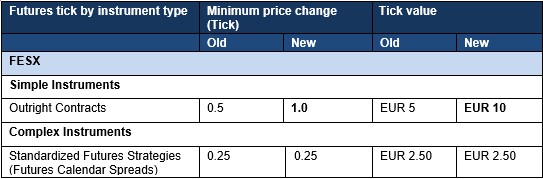

Effective 21 March 2022, the tick size for outright contracts in EURO STOXX® 50 Index Futures (FESX) will change and thereby the tick value will increase. The following table gives and overview of the various instruments of the contracts and their ticks:

Technical distribution of product and instrument configuration

The new price gradation will be applicable for all outright instruments. It will be distributed via instrument snapshot in the Reference Data Interface (RDI). The instrument attributes are as follows:

Attributes | FESX |

InstrumentPricePrecision | 2 |

MinPriceIncrement | 0.01 |

MinPriceIncrementAmount | 0.1 |

The respectively applicable price gradation for limit orders in the various instrument types and trade types can be retrieved from the field “TickRules“ in the product snapshot.

Attachment:

- Updated sections of the Contract Specifications for Futures Contracts and Options Contracts at Eurex Deutschland

Further information

Recipients: | All Trading Participants of Eurex Deutschland and Vendors | |

Target groups: | Front Office/Trading, Middle + Backoffice, IT/System Administration, Auditing/Security Coordination | |

Contact: | Tobias Ehinger, Equity & Index Product Design, tel. +49-69-211-1 23 13, tobias.ehinger@eurex.com | |

Web: | www.eurex.com | |

Authorized by: | Randolf Roth |