Aug 09, 2023

Eurex

ETF derivatives: Introduction of options on mid- and short-duration US Treasury UCITS ETFs

1. Introduction

The Management Board of Eurex Deutschland took the following decision with effect from 4 September 2023:

- Introduction of options on mid- and short-duration US Treasury UCITS ETFs pursuant to Attachment 1

The Executive Board of Eurex Frankfurt AG took the following decision with effect from 4 September 2023:

- Inclusion of the new products in the existing Liquidity Provider scheme pursuant to Attachment 2

Production start: 4 September 2023

This circular contains all information on the introduction of the new products and the updated sections of the relevant Rules and Regulations of Eurex Deutschland.

2. Required action

For trading the new products, Trading Participants are required to be assigned the clearing capacity “Physical ETFs USD”. There is no action required from Trading Participants who are already participating in options on USD-denominated ETFs.

If there are any further questions, please get in touch with your Key Account Manager or via e-mail to: client.services@eurex.com.

3. Details

Introduction of options on mid- and short-duration US Treasury UCITS ETFs

With the launch of options on mid- and short-duration US Treasury UCITS ETFs, Eurex Deutschland aims to expand the range of its Fixed Income ETF derivatives to help European investors manage their exposure to US Treasuries.

The products in scope for the launch are options on the iShares USD Treasury Bond 7-10 Year UCITS ETF (ODTM) and options on the iShares USD Treasury Bond 1-3 Year UCITS ETF (ODBT). These options will give market participants a valuable investment vehicle to trade various points on the US treasury curve.

The versatile nature of these options will enable investors to take long or short positions in puts and calls, and hence either hedge US duration risk held in their investments, overlay their existing holdings in the underlying ETFs with options strategies or take additional exposure via an ETF-linked product which broadly represents this tenor on the US treasury curve.

A. Contract specifications and product parameters

Contract Specifications for the Options on mid- and short-duration US Treasury UCITS ETFs follow the contract standards of existing Options on 20yr+ US Treasury UCITS ETFs in terms of trading hours and trading calendar, last trading day, settlement and determination of the daily and final settlement prices.

For the detailed Contract Specifications, please see Attachment 1.

The full version of the updated Contract Specifications for Futures Contracts and Options Contracts at Eurex Deutschland will be published on the Eurex website www.eurex.com as of start of trading under:

Rules & Regs > Eurex Rules & Regulations > 03. Contract Specifications

B. Admission to the Eurex T7 Entry Services (TES)

The new products will be admitted to the Eurex T7 Entry Services (TES). You can find the minimum block trade sizes on product level in the attached Contract Specifications.

An overview of the Eurex T7 Entry Services available for the products as well as detailed information on single product basis with regard to availability, possibility of utilization and minimum entry size for the various Eurex T7 Entry Services is available on the Eurex website under the link:

Data > Trading files > T7 Entry Service parameters

C. Risk parameters

As of start of trading, risk parameters of the new products will be published on the Eurex website under the link:

Data > Clearing files > Risk parameters and initial margins

and on the Eurex Clearing website www.eurex.com/ec-en/ under the following link:

You will also find an updated list with details regarding Prisma-eligible Eurex products under this path.

D. Excessive System Usage Fee and Order to Trade Ratio

The Excessive System Usage Fee and the Order to Trade Ratio for the new products are determined in line with the existing products (FINX). For detailed information, please refer to the Eurex website under the following links:

Rules & Regs > Excessive System Usage Fee

Rules & Regs > Order-to-Trade Ratio

E. Mistrade parameters and position limits

Mistrade ranges and position limits for the new products will be published as of start of trading on the Eurex website under the link:

Markets > Product Overview

Data > Trading files > Position Limits

F. Transaction fees

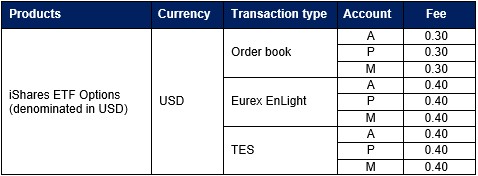

The new options on mid- and short-duration US Treasury UCITS ETFs will be subject to the following transaction fees:

For details, please refer to the Price List of Eurex Clearing AG on the Eurex Clearing website www.eurex.com/ec-en/ under the link:

Rules & Regs > Eurex Clearing Rules & Regulations > 3. Price List

G. Vendor codes

As of start of trading, vendor codes for the new products will be published on the Eurex website under the link:

Markets > Product Overview > Vendor Codes

Inclusion of the new products in the existing Liquidity Provider scheme

To support the launch of the options on short- and mid-duration US Treasury UCITS ETFs, they will be included in the Product Specific Supplement (PSS) “Equity 04 – ETF Options” with effect from start of trading on 4 September 2023.

Please note the new quotation requirements in aforementioned PSS in Attachment 2.

Market participants will be entitled to receive monetary incentives in the form of fee rebates and net revenue sharing upon fulfilling the orderbook quoting requirements specified in the PSS in Attachment 2.

The new quotation requirements will be valid from 4 September 2023 until 31 December 2023.

The PSS will also be provided as single PDF file on the Eurex website under the following path:

Trade > Market-Making and Liquidity provisioning

Attachments:

- 1 – Updated sections of the Contract Specifications for Futures Contracts and Options Contracts at Eurex Deutschland

- 2 – Updated Product Specific Supplement “Equity 04 – ETF Options"

Further information

Recipients: | All Trading Participants of Eurex Deutschland and Vendors | |

Target groups: | Front Office/Trading, Middle + Backoffice, IT/System Administration, Auditing/Security Coordination | |

Contact: | leon.von.essen@eurex.com, vassily.pascalis@eurex.com, client.services@eurex.com | |

Web: | www.eurex.com | |

Authorized by: | Jonas Ullmann |