Oct 24, 2023

Eurex

T7 Release 12.0: Announcement on Eurex T7 functionality activations after Release Date

1. Introduction

As announced in the Eurex Release Notes for T7 Release 12.0, the following functionalities will be activated in Production after the official Release Date 20 November 2023:

A. New Crossing Procedure and Pre-Arranged Trade Entry:

- Simulation: Already activated

- Production: 27 November 2023*

B. Enhancements to the Maximum Order Value check:

- Will be activated at a later point in time and communicated separately

C. Automatic Setting of SMC Fast Market

- Simulation: Already activated

- Production: envisioned December 2023

D. Delta Trade-at-Market

- Simulation: Already activated

- Production: envisioned Q1 2024*

* The introduction is subject to the approval of a change to the Exchange Rules of Eurex Deutschland or the Conditions for Trading at Eurex Deutschland.

Learn now more about T7 Release 12.0 on our dedicated initiative page under the following link: Support > Initiatives & Releases > T7 Release 12.0. System documentation, circulars, timeline and much more information is available there for you.

2. Required action

A. Trading Participants active in cross or pre-arranged trades are encouraged to make use of the new functionality. The current functionality will still be offered in parallel.

B. Will be communicated separately.

C. The activation of the automated setting of Stressed Market Condition Fast will have no direct impact on the trading activity of Eurex Trading Participants.

D. Trading Participants interested in Total Return Futures trading are encouraged to test Delta Trade-at-Market in simulation.

3. Details

As announced in the Eurex Final Release Notes for T7 Release 12.0, the following functionalities will be activated in Production after the official Release Date 20 November 2023:

A. The new crossing procedure and pre-arranged trade entry functionality will be activated for all products as of 27 November 2023. In simulation, all products currently support the new functionality. It will be offered in parallel to the currently existing functionality for cross and pre-arranged trades. The parameter set for the new functionality will be set as such that after the automated announcement to the market, a waiting period of minimum one second will be applied in line with the Conditions for Trading at Eurex Deutschland which will have a randomized end. After this waiting period, both orders will be entered subsequently according to the sequence determined in the entered request.

B. The enhancements to the Maximum Order Value check will be activated at a later point in time and communicated via a separate Eurex circular. With this enhancement Eurex will also amend the currently applied exchange limits for the Transaction Size Limit Functionality as well as for the Maximum Order Value. New exchange limits with be communicated via a dedicated Eurex circular.

C. With T7 Release 12.0, it is possible for Eurex to set Stressed Market Conditions (SMC) Fast Market automatically in T7 once predefined thresholds are reached. The functionality will be activated shortly after production start of Release 12.0 for single stock options as well as options and futures on VSTOXX as the first batch and might also be enabled for other asset classes at a later point in time. With this enhancement, the setting of SMC Fast will become a more automated and transparent process which will help Eurex to act quicker upon increased volatility in the market, especially in the equity space, and support Market Makers in providing liquidity during such circumstances.

Among other decision criteria, the underlying movement against previous day’s close price is considered as deciding trigger that is set as follows:

- For single stock options, when the underlying share price moves up or down for more than 6 percent against previous day’s closing price.

- For VSTOXX futures and options: either the underlying index moves up or down for more than 10 percent than previous day’s closing price or the Euro Stoxx 50 option (OESX) is in Stressed Market Conditions.

These parameters are subject to change after evaluation.

Apart from the above-mentioned automation, manual setting of SMC Fast for cases and products that are not covered by the scope for automation or specifically requested by Trading Participants will still be conducted by Eurex Trading Operations. The automatically detected Stressed Market Condition (Chapter 7.8 in Functional Reference) applying to equity index futures, single stock futures and ETF futures as well as their respective options will stay unchanged.

D. As of today, the Eurex simulation environment already supports the Delta Neutral Total Return Futures trade entry (DeltaTAM) for the combination of TESX (EURO STOXX® 50 Index Total Return Futures) versus FESX (Futures on the EURO STOXX® 50 Index).

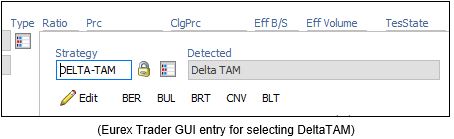

When using the Eurex Trader GUI for entry of the DeltaTAM, the T7 entry service for block trades must be selected and the strategy must be set to “DELTA-TAM” via the strategy wizard button (Type, at the bottom) in order to specify the Total Return Future and the Index Future component for trade entry.

The exact date for the production launch of the DeltaTAM functionality is not yet agreed upon and will be communicated separately in the following months.

Further information

Recipients: | All Trading Participants of Eurex Deutschland and Vendors | |

Target groups: | Front Office/Trading, Middle + Backoffice, IT/System Administration | |

Contact: | client.services@eurex.com | |

Web: | Support > Initiatives & Releases > T7 Release 12.0 | |

Authorized by: | Jonas Ullmann |