Feb 02, 2026

Eurex

EURO STOXX 50® Daily Options: Improving order book quality and launching further expiries

To kick off 2026, Eurex has introduced new measures to make EURO STOXX 50® Daily Options (OEXP) even more attractive to investors. With most volumes traded on-screen, a high-quality order book is essential. Leveraging experience from regular EURO STOXX 50® options (OESX), Eurex has implemented a new liquidity provider scheme for market makers and added a second week of daily expiries.

To explain the rationale behind these changes, we spoke with Dorte Carlsen, Sales EMEA, and Strahinja Trenkic, Quantitative Analyst, Market & Liquidity Analytics at Eurex.

What is the main objective of the updated Liquidity Provider Scheme?

The goal is to improve order-book reliability and tighten bid/offer spreads, making EURO STOXX 50® Daily Options more compelling. Since launch in August 2023, trading volumes have grown significantly, with ADV reaching around 34k contracts in 2025.

Yet, there is still considerable growth potential. Tighter spreads, combined with fee reductions for buy-side investors, should make cost‑sensitive strategies more viable. We expect increased activity from systematic approaches such as Quantitative Investment Strategies (QIS) and retail investors.

Why introduce additional expiries?

Investor demand for more flexibility has been clear from the start. Adding a second week of expiries supports systematic strategies and gives discretionary traders greater positioning options around events and macroeconomic announcements. Initially, we held back to focus on building liquidity in the first week . With strong adoption now proven, expanding expiries is the logical next step.

What are the key changes participants should be aware of?

As Dorte mentioned, one of the crucial targets for the new liquidity provider scheme is the quality of the quoted spreads. Therefore, Eurex has restructured its incentive package to reward actual time‑weighted spread performance as well as passive volume contribution. By focusing the competitive components of the scheme on the front six daily expiries, where volumes are expected to be concentrated, and by providing up to 100% order-book fee rebates for the best liquidity providers, we have opened the door for comparative advantages and individual excellence.

How do these changes benefit market participants?

Based on experiences gathered from weekly and monthly EURO STOXX 50® options, having a reliable and broad strike coverage not only increases volumes but also provides visibility into price formations across the curve, supporting our trading community with crucial data. A high coverage requirement for Liquidity Providers (85%) combined with a demanding delta range (0.05 ≤ Δ ≤ 0.75 and –0.02 ≥ Δ ≥ –0.75) ensures that screens are available, when clients need them.

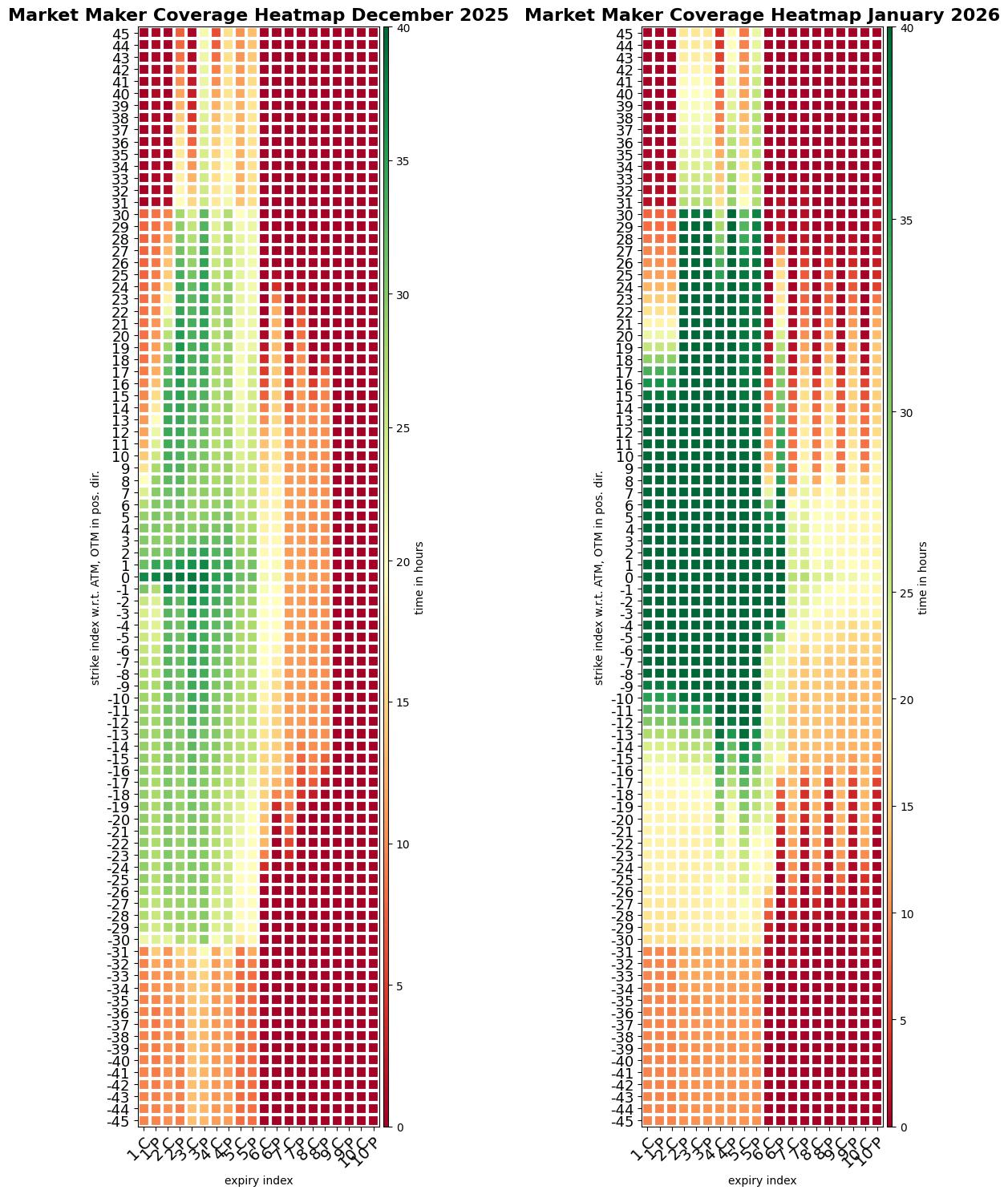

The charts below show market maker presence measured in hours of compliant coverage across expiries (1st to 10th expiry of each call and put) and moneyness (45 strikes around the money, with positive value direction being deeper out of the money calls and puts).

On the chart to the right, we see the coverage heatmap building in the second week of expiries, and a deeper and firmer picture in low delta options of the first week. This closely tracks the trading patterns observed in the product. In total, almost 600 newly quoted strikes are available to our clients for trading per day.

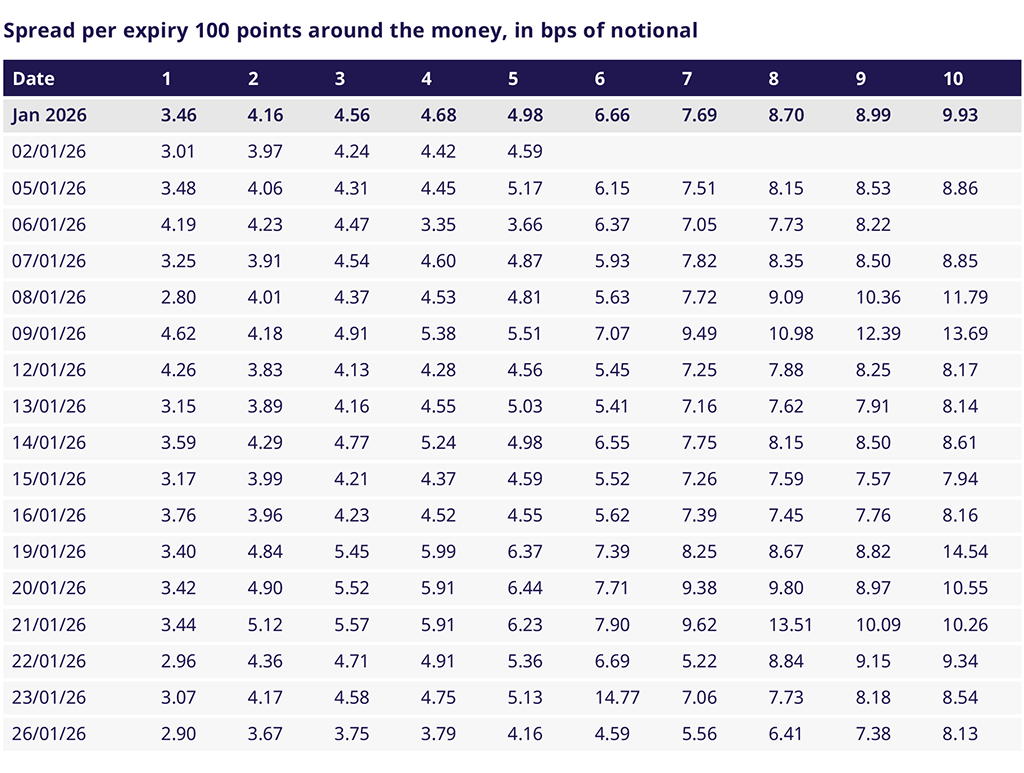

Qualitatively, we have seen competitive spreads in the first week of expiries, as well as tightening and stabilizing spreads in the newly listed maturities. The table below summarizes the time-weighted spreads in instruments 100-points around the money per expiry.

Has the new listing already materialized in more trading, and what do volume developments reveal about the start of the new year?

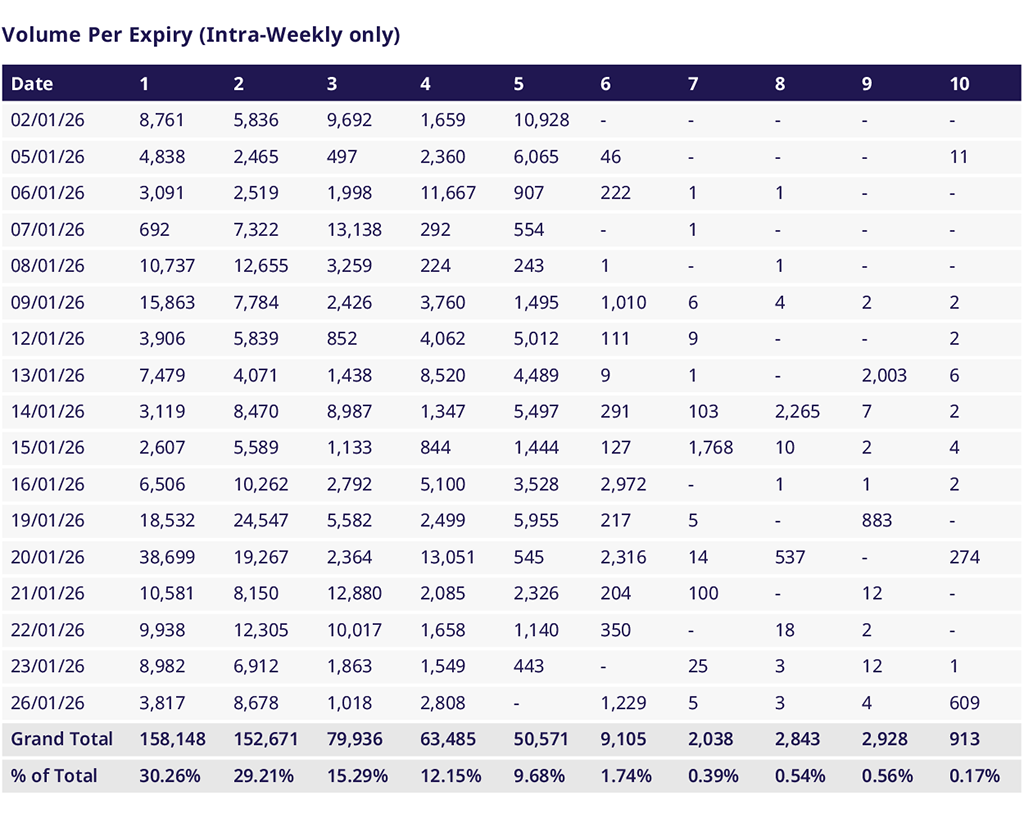

Whilst early days, we are pleased about the development in the first weeks of January. The table below outlines the trading per daily expiry.

Already, 3.41% of OEXP volumes come from the new expiries, which is a great start.

Overall, volumes are up 13% YoY and end client (A-Account) volumes are up by 42%, making the results achieved even more significant. In 2026 so far, A-account volumes make up a healthy 33% of total traded volumes. We expect to see even more client activation across the curve as liquidity improves, and more quoted data arrives to feed systematic trading strategies.

The improved order-book picture resulting from the new liquidity provider scheme will in combination with the extended expiry range, improved liquidity in Market-on-Close-futures and the 45% fee discount for end clients help to reduce trading costs, facilitate hedging needs, and promote further product growth. We are excited to see what 2026 brings.