Dec 16, 2025

Eurex

Eurex Repo Monthly News November 2025

Market briefing: ''November momentum – Record volumes and year-end dynamics in Eurex Repo Markets''

by Frank Gast and Carsten Hiller, Eurex Repo

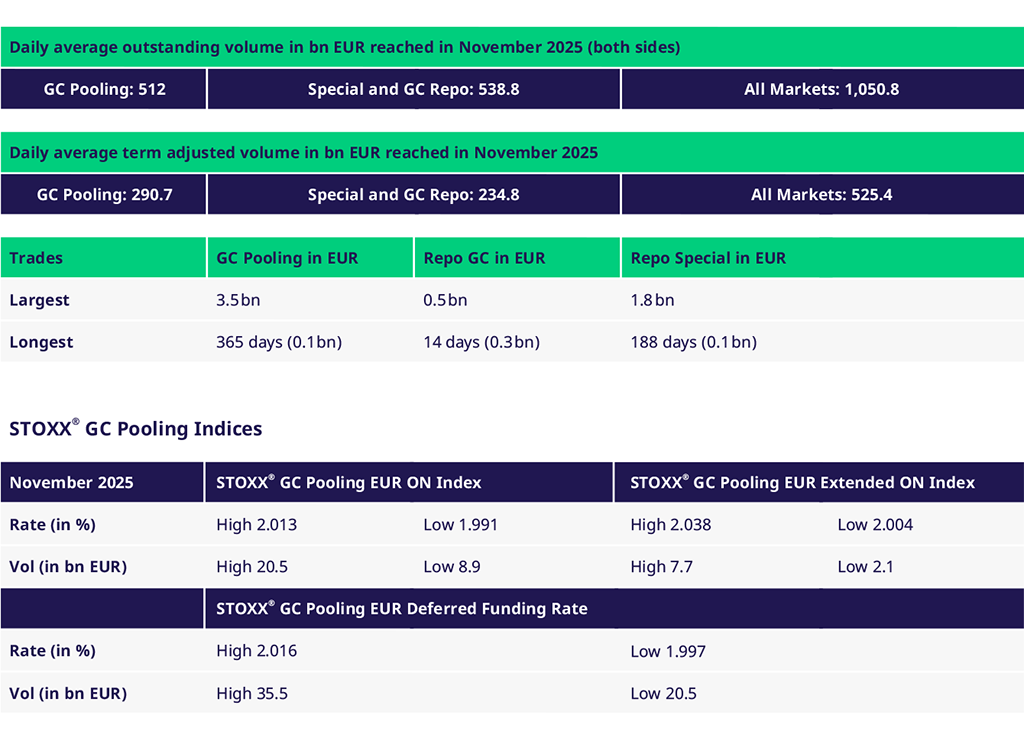

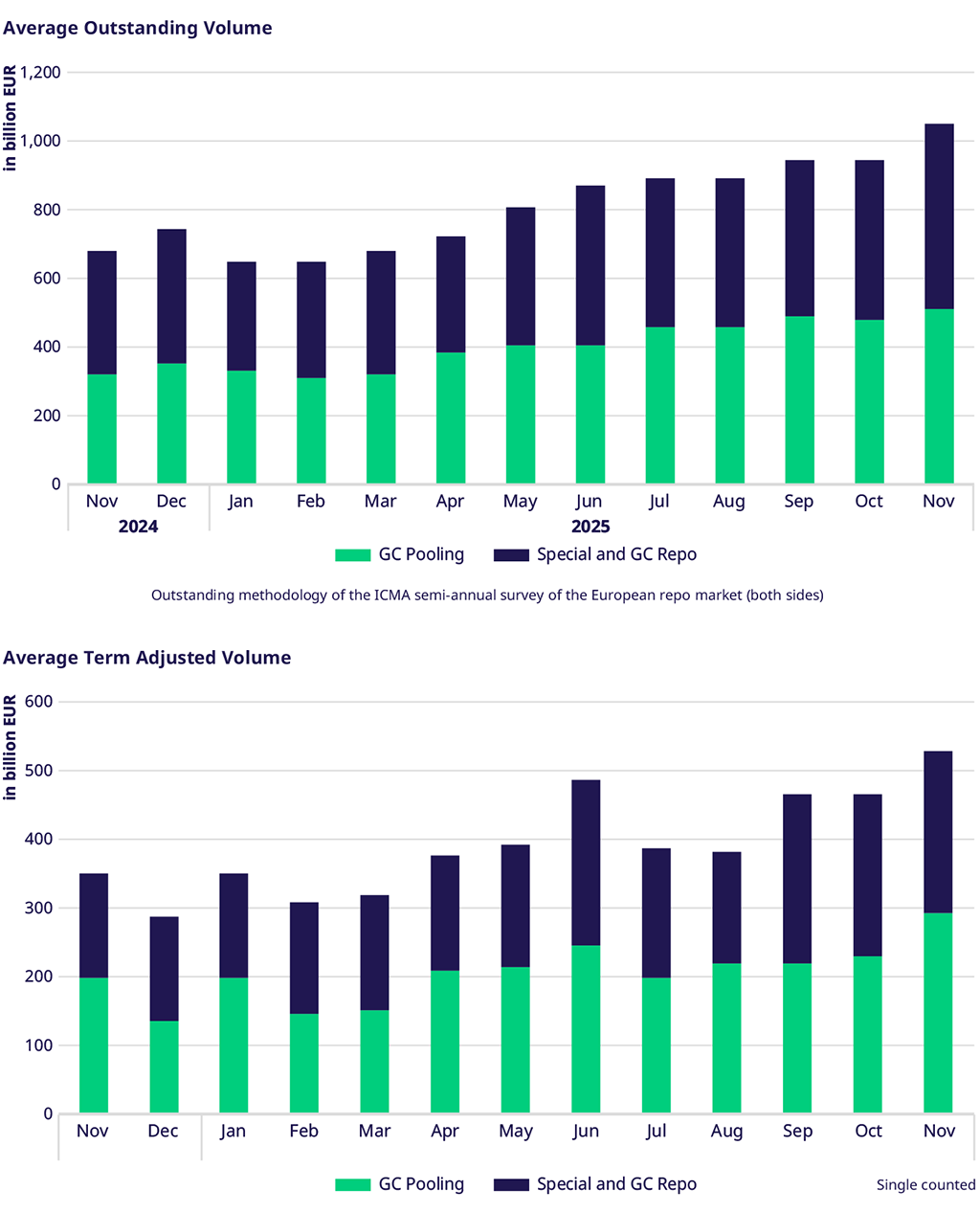

Eurex Repo markets sustained their strong momentum in November, with overall term-adjusted volumes (TAV) rising by 12% compared to October. GC Pooling led the growth with a 26% increase, while Specials remained flat and GC volumes declined by 30%. Compared to November 2024, overall volumes surged by 51%, with GC Pooling up 49% and the Repo segment up 54%. Year-to-date, total volumes are up 19%, driven by a 35% increase in GC Pooling and a 5% gain in the Repo market segment.

Outstanding and Traded Volumes

Outstanding volumes continued to set new benchmarks, with year-to-date growth of 20% across all segments. GC Pooling outstanding volumes rose 34%, and Repo outstanding volumes increased by 9%.

On 28 November 2025, Eurex Repo set a new all-time high in daily traded volume across all markets. The record volume was approximately 66% above the average daily traded volumes.

Average daily traded volume in November was up 8% versus October, with Repo activity surging by 26.3% due to higher trading activity in Specials which increased by 29%. GC Pooling was slightly lower by 1%, and GC volumes dropped 39%. Compared to November 2024, average daily traded volumes were up 31%, with GC Pooling increasing 29% and the Repo market segment by 35%..

GC & Specials

EUR Government Bonds

November’s trading in government bonds reflected varied dynamics across countries. German government bonds saw average daily traded volumes climb 30% versus October and 22% compared to November 2024, though year-to-date volumes remain 5% lower due to subdued demand in the first half of the year. Bunds traded at an average rate of 2.01% across all maturities, with some transactions over year-end until early January 2026 trading at 1.95%. The pure turn over the year-end period (31 December to 2 January) was transacted at 2.02%. French government bonds experienced a remarkable 64% increase in volumes, with GC short dates trading around 2.01%. Spanish government bonds recorded a 28% decline in volumes, although GC short dates traded at 2.01%, and year-end trades starting in November and December until 2 January were executed around 2.02%. Italian government bonds posted a 13% increase in volumes, with GC short dates at 2.03% and year-end trades at 2.02%.

SSAs and EU Bonds

The market for SSAs and EU Bonds remained strong. SSAs recorded an 8% increase in traded volumes, while average daily traded volumes rose by 24%. Year-to-date, SSA volumes are up 65% compared to 2024. EU Bonds setting another record high despite three fewer trading days than in October with traded volumes rising by 5%, while average daily traded volumes jumping 21%. Year-to-date, EU Bonds volumes have increased by an impressive 118% versus 2024.

Term Business: GC Pooling

Term business continued to be active, with substantial volumes in Italian and Spanish government bonds for two-month maturities until mid-February, trading at levels around 2.05% and 2.04%. Italian government bonds traded until April with breaks, while French government bonds saw good size until May. GC Pooling activity was particularly strong over year-end, especially in the ECB Basket, with significant business until February at around 2.05%, and trades until July at 2.06%. One-year terms traded at 2.08-2.09%, with the average spread in the one-year ECB basket versus €STR OIS at about 18bps. The six-month spread widened from 9 to 14bps. In the EXT basket, a highlight was a three-year trade of several hundred million euros with break dates at 2.30%. INT MXQ activity remained focused on two-month transactions at 2.07%.

Year-End Dynamics

Collateral availability remained robust, with cash in high demand. Bunds pure turn traded at 2.02%, and compared to previous years, there were no issues placing cash – raising cash and refinancing inventory were more in focus. Italian and Spanish government bonds traded out of November and December until 2 January at around 2.02%. GC Pooling ECB baskets saw pure turn trades of several billion euros at 2.00%, with other terms until early January trading between 2.01% and 2.05%, reflecting uncertainty about repo and money market rates over year-end. EXT basket trades until early January were also seen at 2.00%.

Volumes

| |||

|

Participants: 166