Nov 17, 2025

Eurex

Eurex Repo Monthly News October 2025

Market briefing: ''Sustained growth in October – GC Pooling drives new highs in Eurex Repo Markets''

by Frank Gast and Carsten Hiller, Eurex Repo

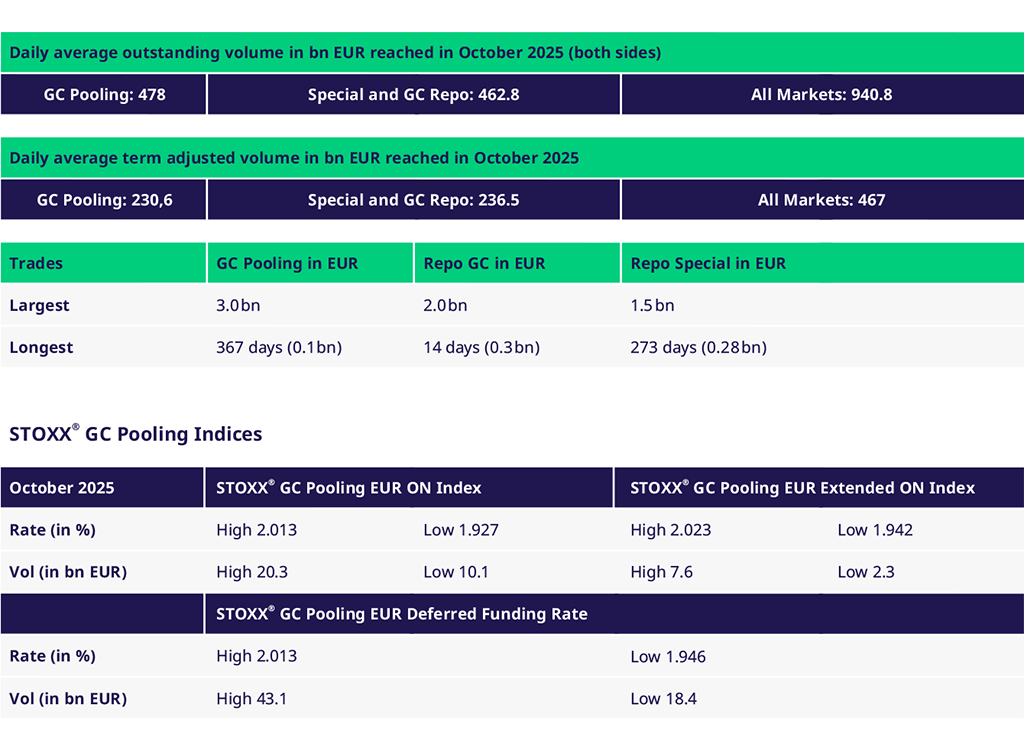

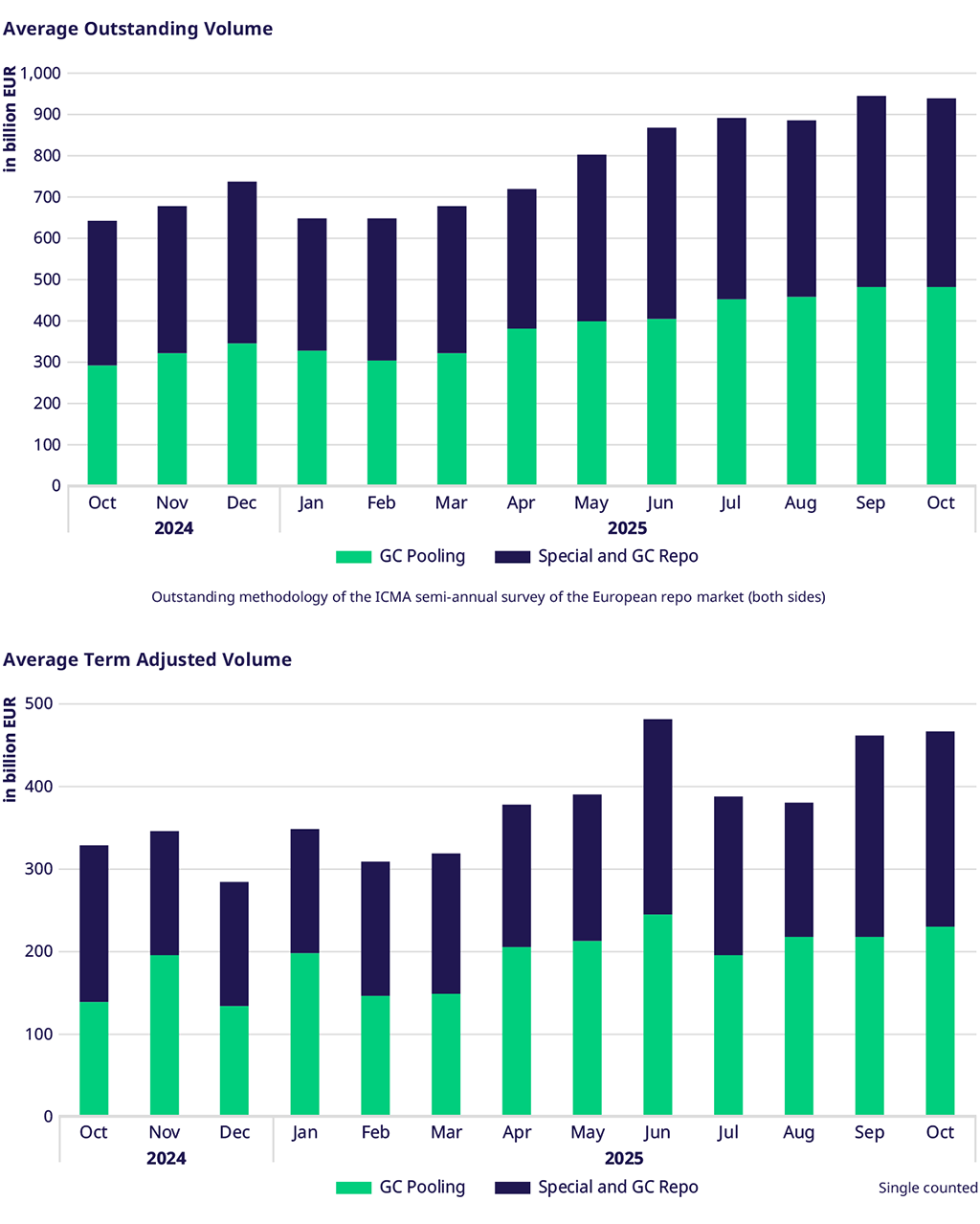

In October 2025, Eurex Repo continued its strong momentum in secured funding and financing. Average term-adjusted volumes rose by 42 percent year-on-year to EUR 467.0 billion, with the GC Pooling segment leading the way with a remarkable 67 percent increase. The Repo Market segment also expanded, posting a 24 percent gain. These results underscore Eurex Repo’s ongoing upward trajectory in the market.

On a year-to-date basis, average term-adjusted volumes increased by 16 percent across all markets, with GC Pooling up 34 percent and the Repo Market segment up 1 percent compared to the period from January to October 2024. Compared to September, overall average term-adjusted volumes remained stable, with a 1 percent increase. This was driven by a 6 percent rise in GC Pooling, while the Repo segment saw a slight decline of 3 percent.

Outstanding and Traded Volumes

Outstanding volumes set another record in October. Compared to October last year, outstanding volumes across all market segments grew by 47 percent, with GC Pooling up 64 percent and the Repo Market segment up 32 percent, driven by term transactions in EUR government bonds over year-end.

Year-to-date, all segments grew by 17 percent, mainly driven by GC Pooling, which increased by 31 percent, while Repo rose by 5 percent.

Overall average traded volumes increased by 5 percent year-to-date and by 2 percent compared to September, again supported by GC Pooling, which was up 12 percent year-to-date and 14 percent versus September.

GC & Specials

Special average traded volumes declined by 16 percent compared to September, but robust term business limited the drop in average term-adjusted volumes to just 3 percent, benefiting from strong term activity over year-end in Spanish and Italian government bonds, particularly in flexible terms extending into May 2026.

SSA volumes reached their second-highest traded level since March, with traded volumes up 70 percent year-to-date compared to the same period last year.

EU Bonds achieved a new record high, with a 4 percent increase over the previous month’s peak, and traded volumes for January to October more than doubled versus 2024.

Bunds experienced a notable 14 percent decline in average traded volumes compared to September, reflecting lower demand and subdued year-end trading activity.

Average traded volumes in French government bonds also declined, while Italian government bonds saw a significant increase of 20 percent.

GC Pooling

GC Pooling continued its growth trajectory, with traded volumes up 14 percent compared to September and average term-adjusted volumes up 6 percent.

Term business was driven by strong activity in standard terms across the curve, up to twelve months, in the ECB and EXT baskets. There was also robust trading in flexible terms over year-end into early January 2026.

In the INT MXQ basket, significant activity continued, mainly in one- and two-month terms.

Spreads and Collateral

In overnight trading for the GC Pooling ECB basket, the average rate was 1.994 percent, about 0.6 basis points below the ECB’s deposit rate, with month-end seeing a slight dip to 1.927 percent.

The EXT basket traded overnight at an average of 2.005 percent, 0.5 basis points above the deposit rate, and at 1.942 percent at month-end.

The two-month spread versus €STR-OIS was between 9 and 10 basis points, the six-month OIS spread against the EXT basket was around 19 basis points, while the nine-month OIS spread was about 21 basis points.

Volumes

| |||

|

Participants: 166