Mar 07, 2024

Eurex

Focus on VSTOXX® Derivatives | February 2024 recap

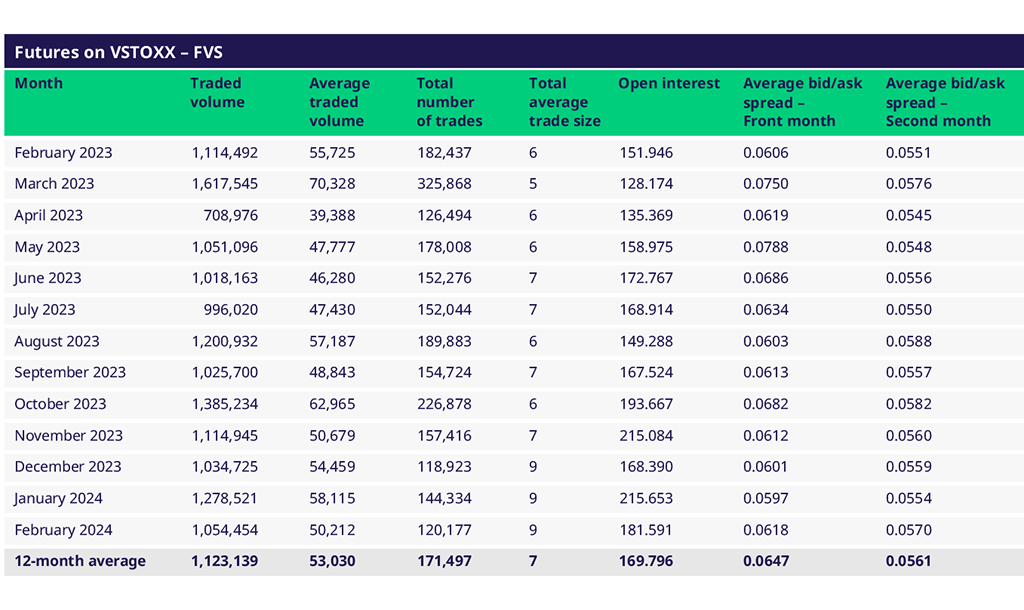

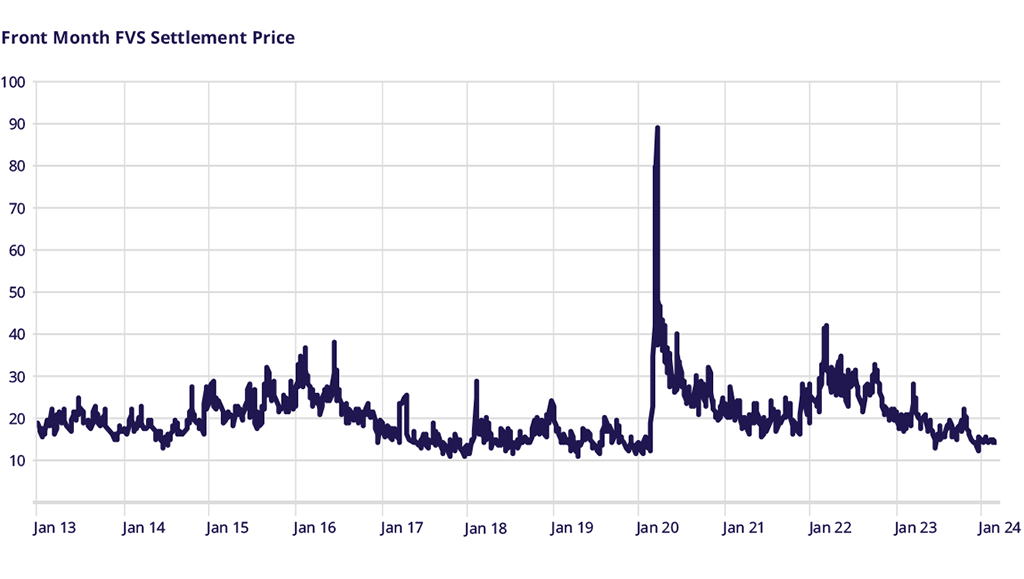

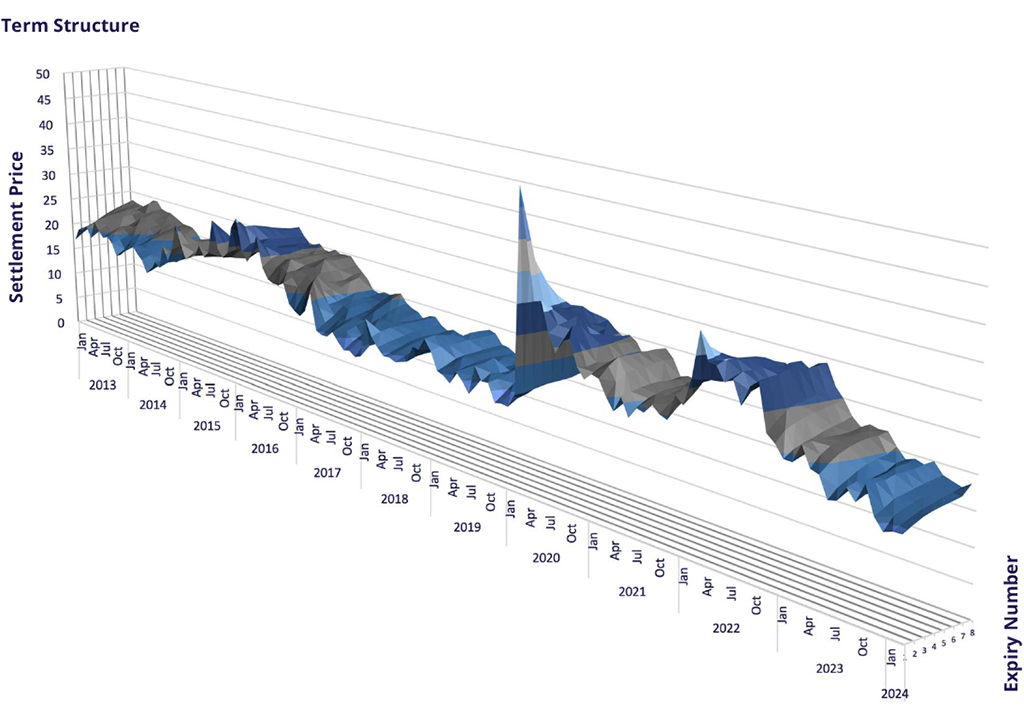

Activity in VSTOXX® Futures took a breather in February, with volumes and ADV ticking below the 12-month average. Open Interest remained elevated and screen markets remained exceptionally tight with the spread of the first- and second-month contract generally remaining just one tick wide. 13 February was the most active trading day of the month for futures, with almost 93,000 contracts traded. Eurex listed the Oct24 contract this month, accruing an early 3,300 contracts in Open Interest by month end as we enter global election season. A-account positioning was generally mixed across the board.

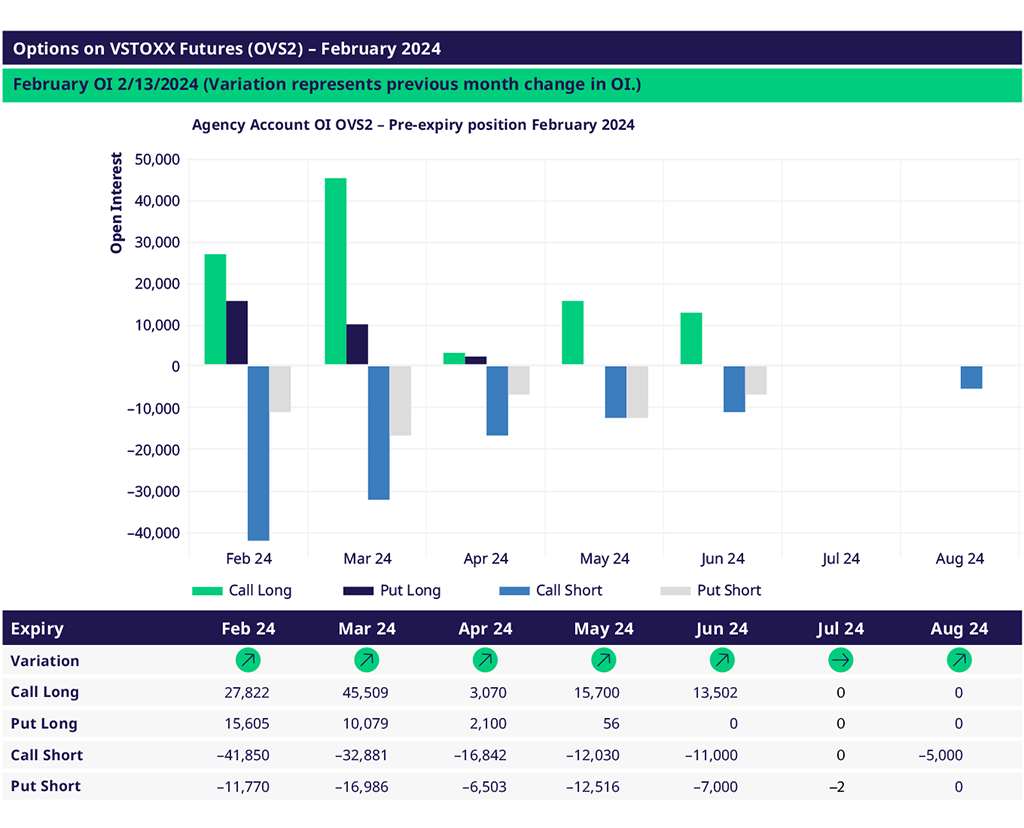

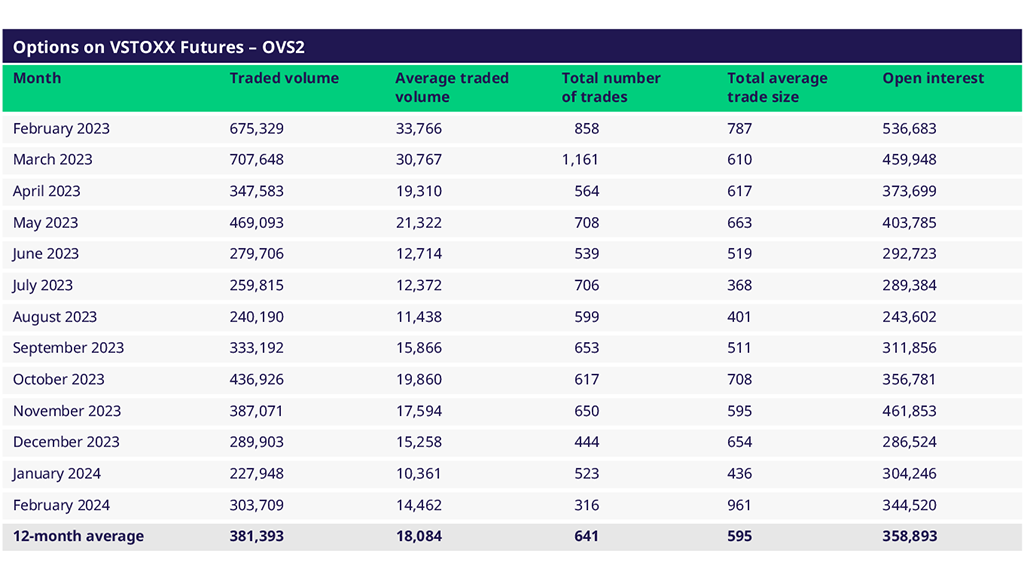

On 1 February, revised market making requirements went into effect, which meant that Options on VSTOXX® Futures screens are now ~50% tighter. Traded volumes recovered meaningfully in February, with the average trade size almost double the 12-month average. The 1-year average ADV is now roughly 18,000 contracts, with 5 February being the most active day of the month with over 42,000 contracts traded.

VSTOXX Futures (FVS)

Options on VSTOXX Futures (OVS2)

Trade the European volatility benchmark

Explore this year's macro events and find an overview of dates.

VSTOXX 101: Understanding Europe’s Volatility Benchmark

Discover the latest STOXX whitepaper today to learn more about the VSTOXX® core methodology, historical performance analysis, and more.

Contacts