Jan 11, 2024

Eurex

VSTOXX® Monthly Update January 2024

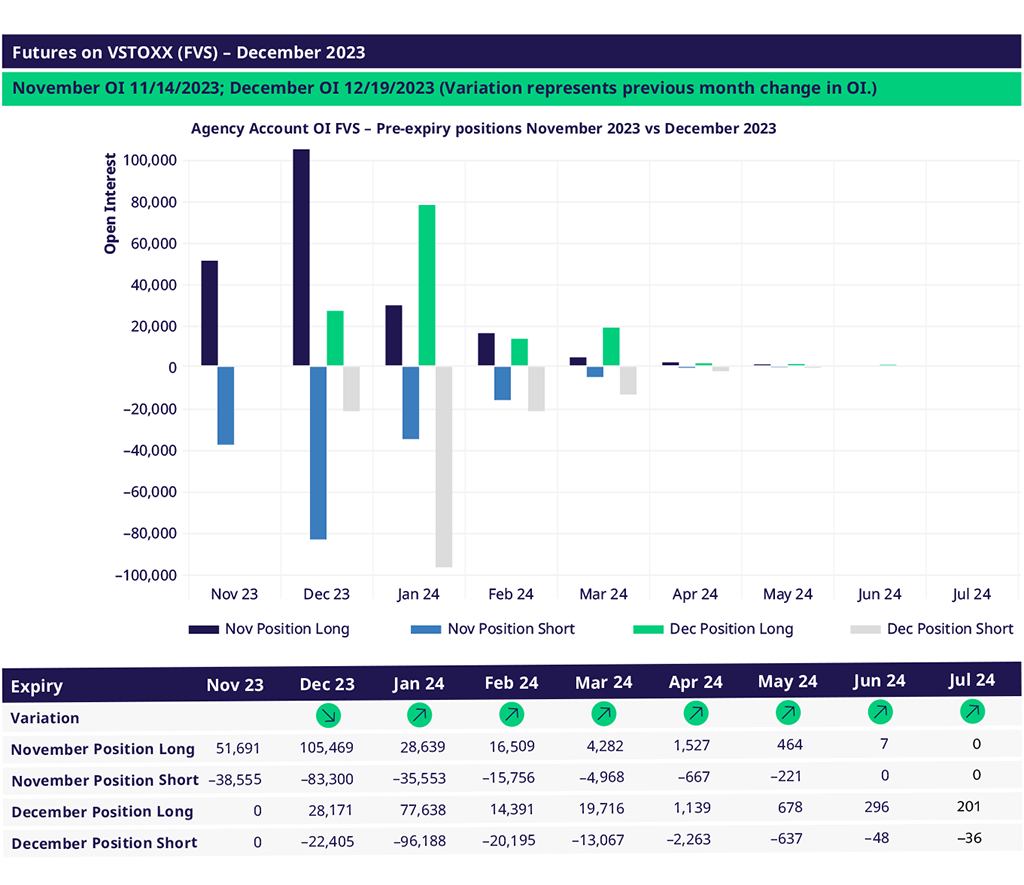

VSTOXX® Futures (FVS) January Update

While open interest in VSTOXX® Futures reverted towards the 2023 average after the DEC expiry, ADV remained marginally elevated in December with a notable uptick in the average trade size. In the front and second months, the average bid/ask spread remained roughly 1 tick wide in the orderbook. 14 December was the most active trading day for VSTOXX® Futures, trading over 110,000 contracts. Compared to November, the customer flow stayed net short in the JAN contract, flipped to net short in the FEB contract, and flipped to net long in the MAR contract.

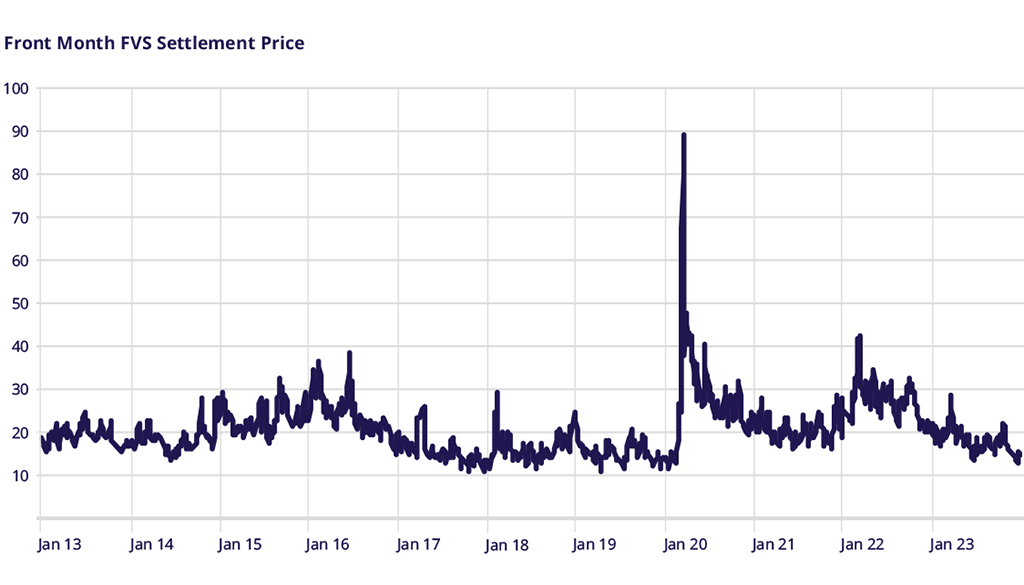

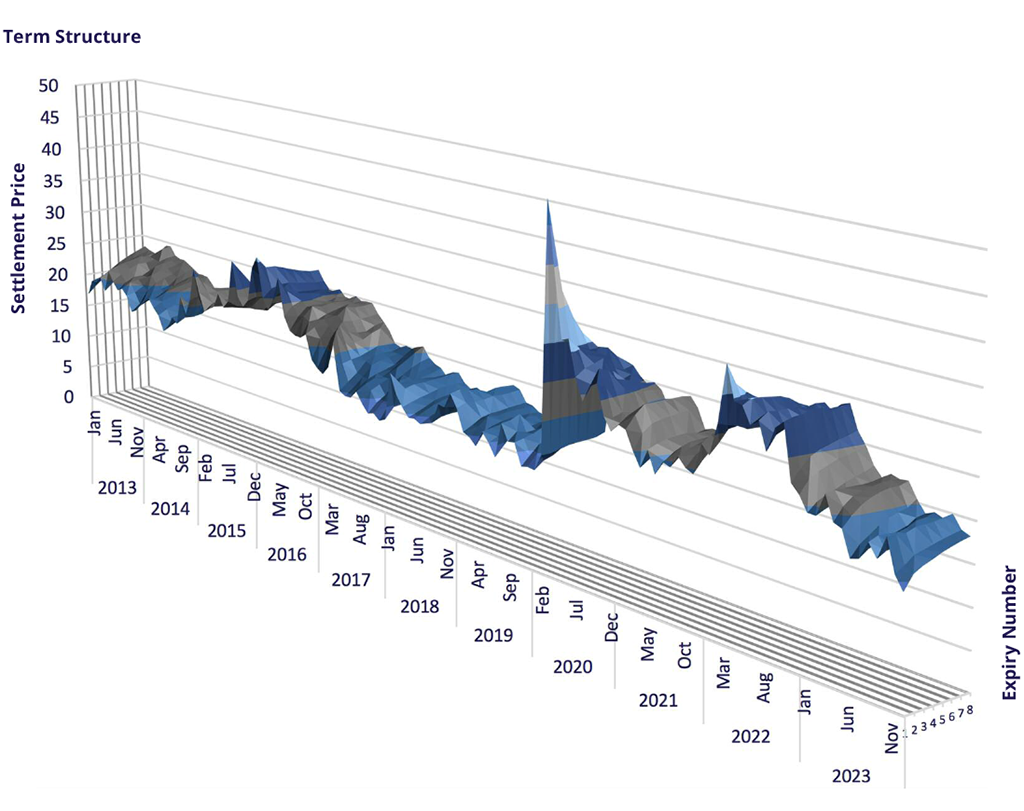

Term structure between the front and back months futures flattened slightly to 3.5 points between the start and end of the month. V2X remained range-bound in December ranging from 12-14 points, with the front month contract settling to close out the year at 14.85.

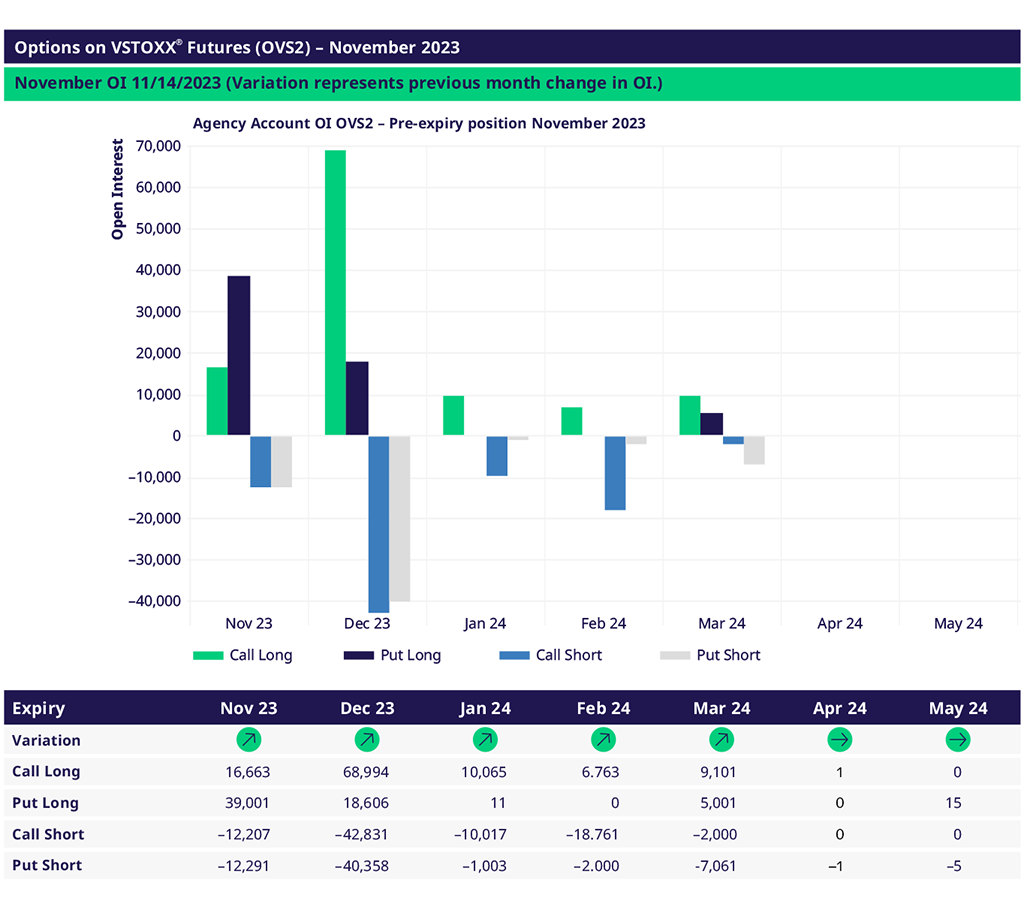

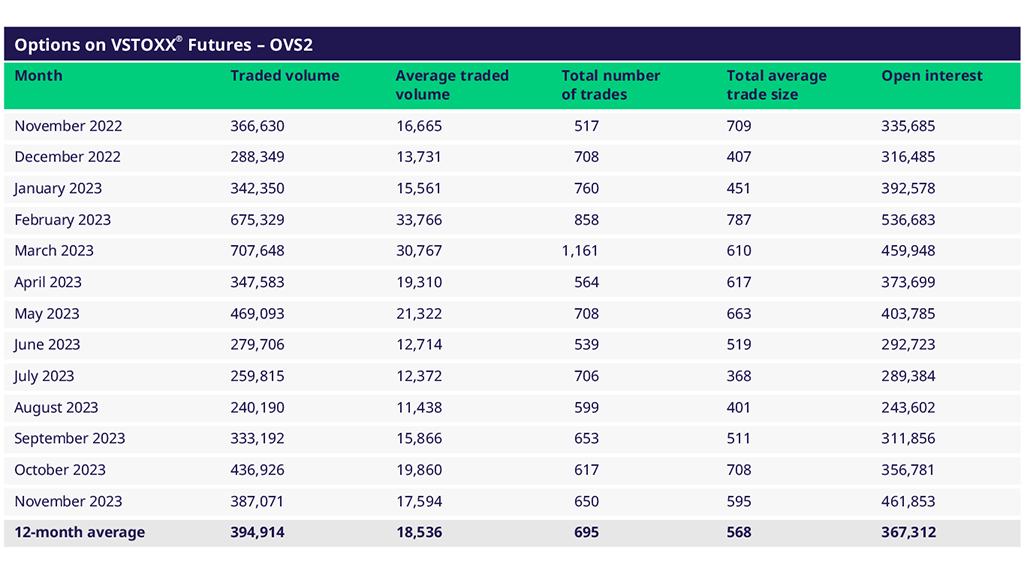

Options on VSTOXX® Futures (OVS2) January Update

Options on VSTOXX® Futures volumes were lighter than average in December. Open interest fell considerably after the DEC expiry following the build-up to multi-month highs. 1 December was the most active trading day of the month, with more than 70,000 options trading. End clients were net long calls at DEC expiry, with mixed positioning (net short puts in the JAN expiry, net short calls in April) out the curve.

Europe: Eugen Mohr or T +1 312-544-1084

Europe: Matthew Riley or T +44 (0) 207 8 62-72 13

USA : Matt Koren or +1 212.309.9314