Jun 19, 2023

Eurex

VSTOXX® Monthly Update June 2023

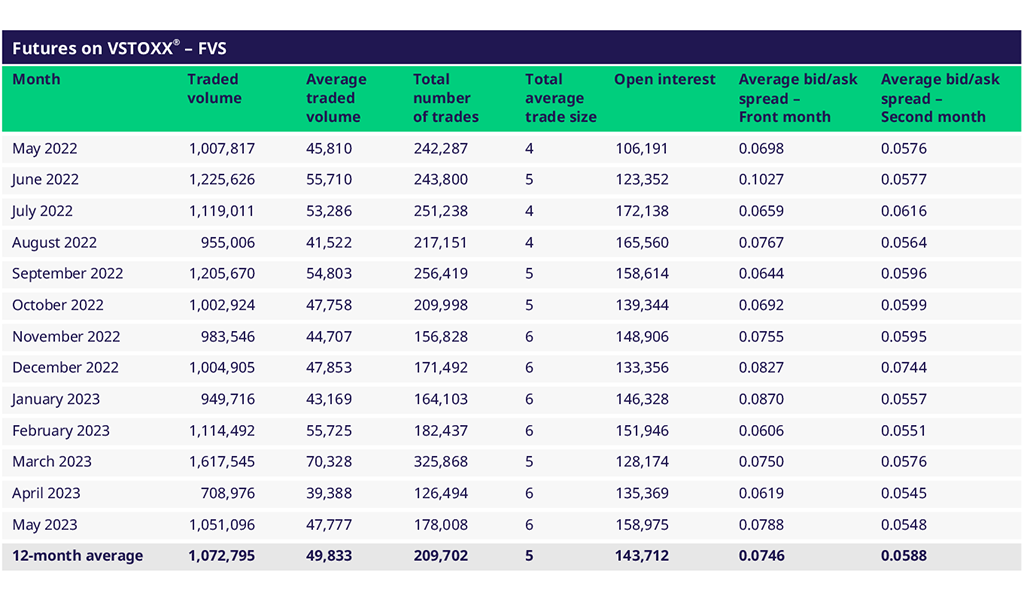

VSTOXX® Futures (FVS) June Update

Trading activity in VSTOXX® futures picked up again from April. Open interest moved up by 20%.

Most active day was 16 May with 81K lots traded.

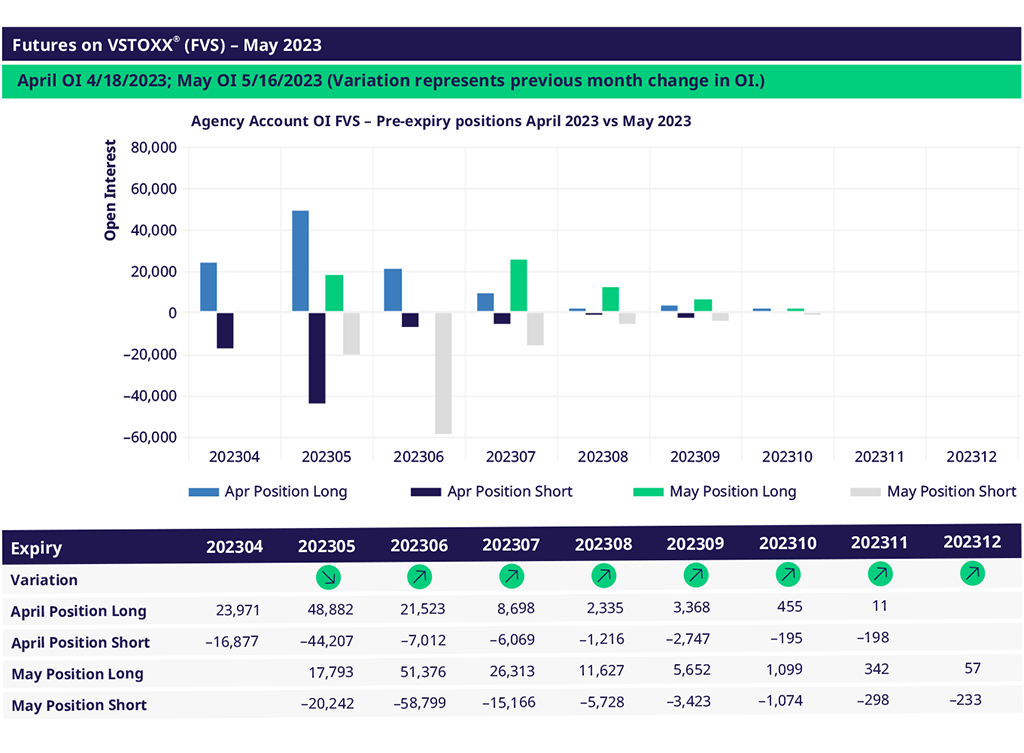

End clients rolled into a net shirt position in JUN at MAY expiry. Since May expiry until mid June, end clients were net buyers of JUN and net sold JUL and AUG. This turned their net short position in JUN to flat and their net long positions in JUL and AUG to net short. It seems that end clients don’t want to be exposed to short term spikes in volatility but don’t expect vol to move up in the next two months.

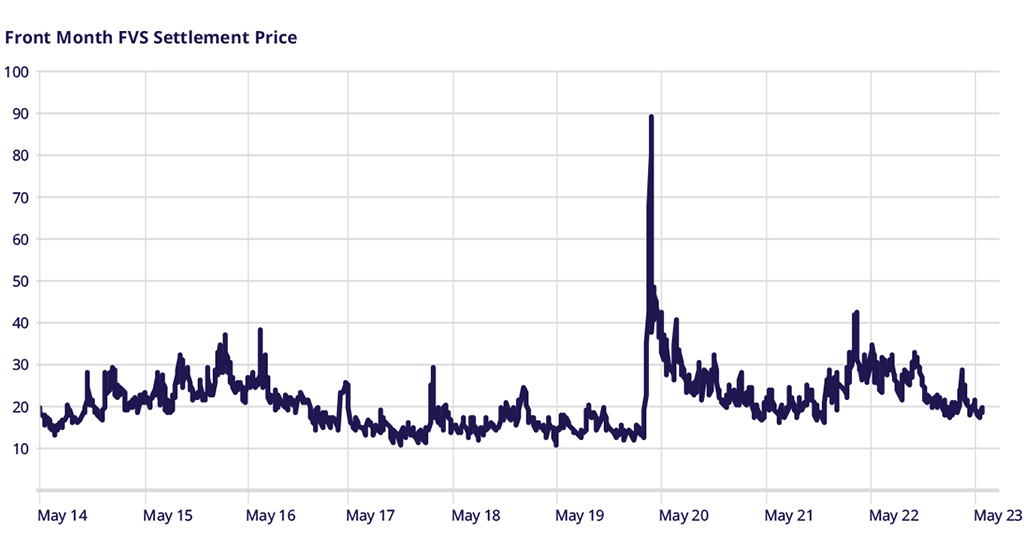

The VSTOXX® index moved between 15 and 20 in May and is in a gradual decline since end of May, now down to 14.50. The term structure went steeper into Contango with 4.7 points between front- and last expiry (after 1.7 points last month).

The EURO STOXX 50® index realized 9.4 volatility between April VSTOXX and May EURO STOXX expiries. Versus a Final Settlement price of the VSTOXX® futures in March of 17.01, the volatility risk premium was 7.61 vol points. After 11.8 (March/ April) and negative 4.6 between Feb and March.

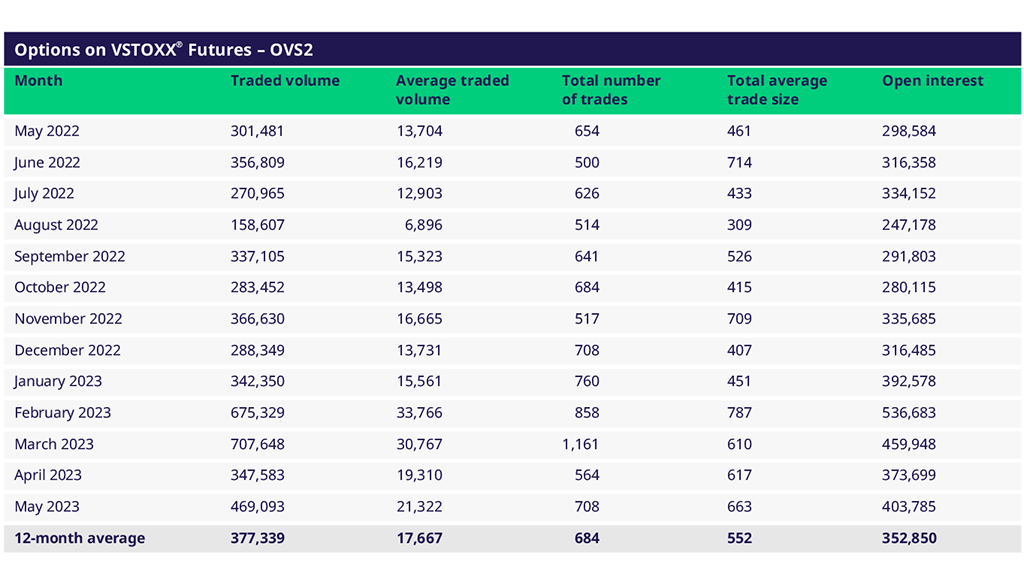

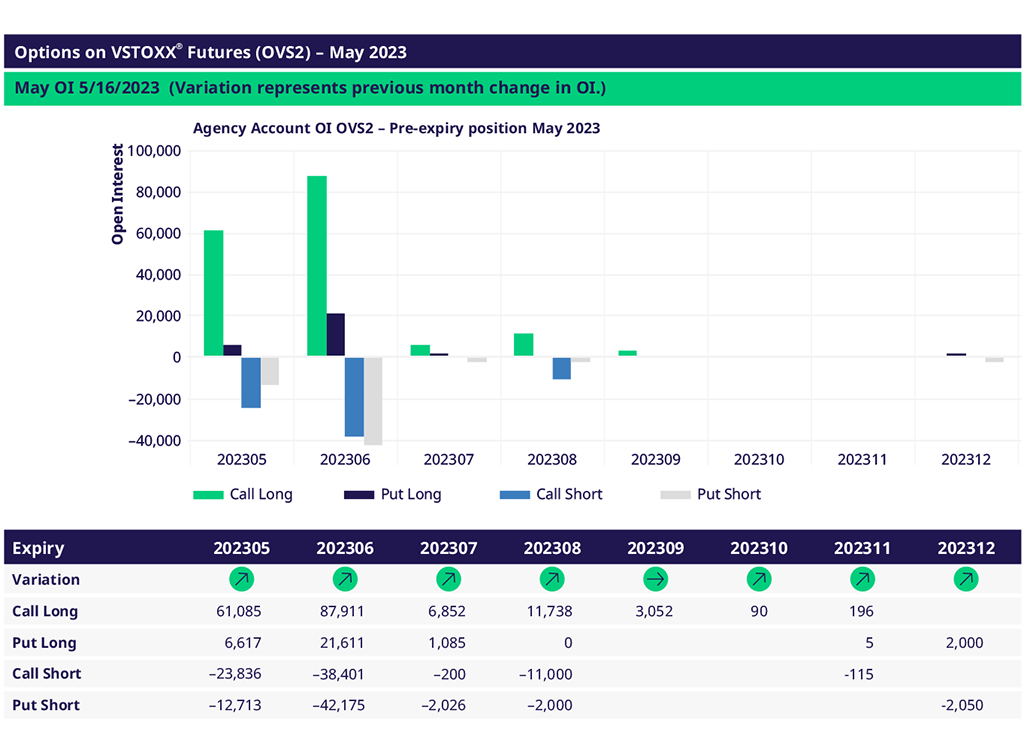

Options on VSTOXX® Futures (OVS2) June Update

The options traded a little more than in April. Most active day was 16 May with 95K lots traded.

End clients focus their trading activity on August. They sell more calls than they buy. This corresponds to the futures positioning and expresses an expectation of low volatility levels in the next two months. Overall, clients reduce their exposure but remain long Call and short Put.

Beginning of June, end clients are long Calls in JUN between 20 and 30 and short the 17 and 18 strike Puts. The open interest is heavily concentrated in JUN. The only meaningful position beyond JUN is the 22 Calls in JUL which end clients own.

For more information, please visit the website or contact:

Americas: Eugen Mohr or T +1 312-544-1084

Europe: Matthew Riley or T +44 (0) 207 8 62-72 13