Nov 15, 2023

Eurex

VSTOXX® Monthly Update November 2023

VSTOXX® Futures (FVS) November Update

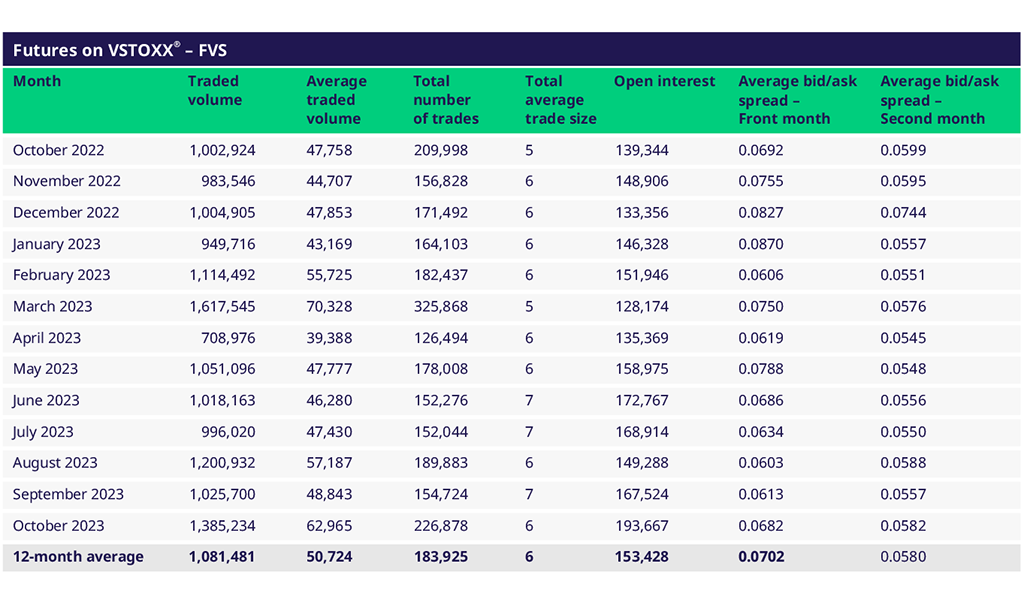

October was a very active month in VSTOXX® Futures, with 13 October the most active day with 97k lots traded. We saw seven days with more than 70k traded contracts.

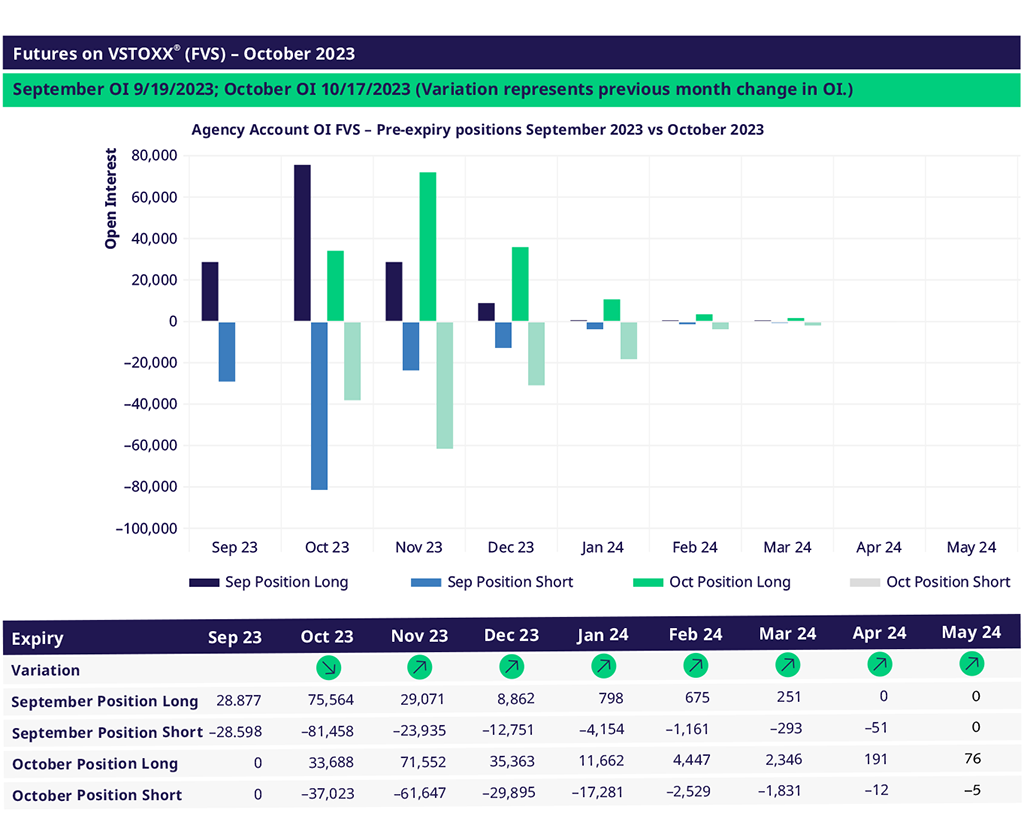

In October, end clients net bought November and December futures and sold October. This includes the roll of the long positions into November and a reduction of the shorts.

Since the September expiry, end users gradually changed their positions from net short to net long. On 9 November, end clients are net long NOV and DEC by 15 and 20k, respectively.

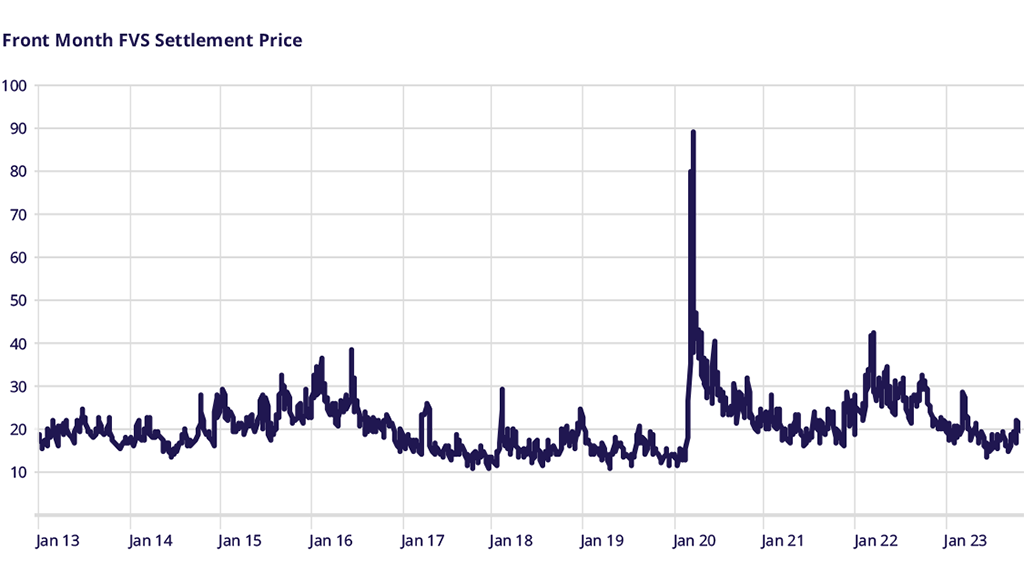

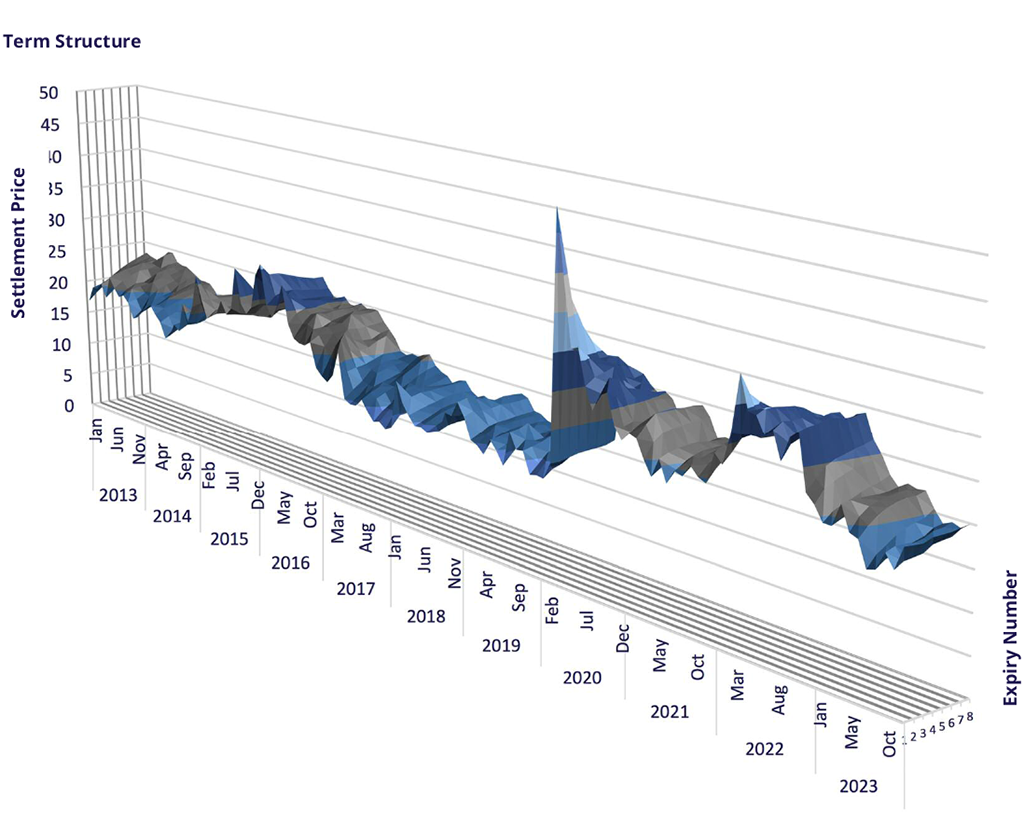

The VSTOXX® entered October at 17, spiked to 23 on 20 October and retreated to 19.5 at the end of the month. The term structure went further into Contango with 2.3 points between the front- and last expiry (after 1.5 points last month). The December dip is now at around 0.75 when interpolating Nov and Jan expiries, after 0.6 last month.

The EURO STOXX 50® Index realized 14.6 volatility between September VSTOXX® and October EURO STOXX® expiries. The volatility risk premium was 1.26 vol points compared to 8.68 in August/September and 0.09 between July and August, versus the final settlement price of the VSTOXX® Futures in September of 15.86.

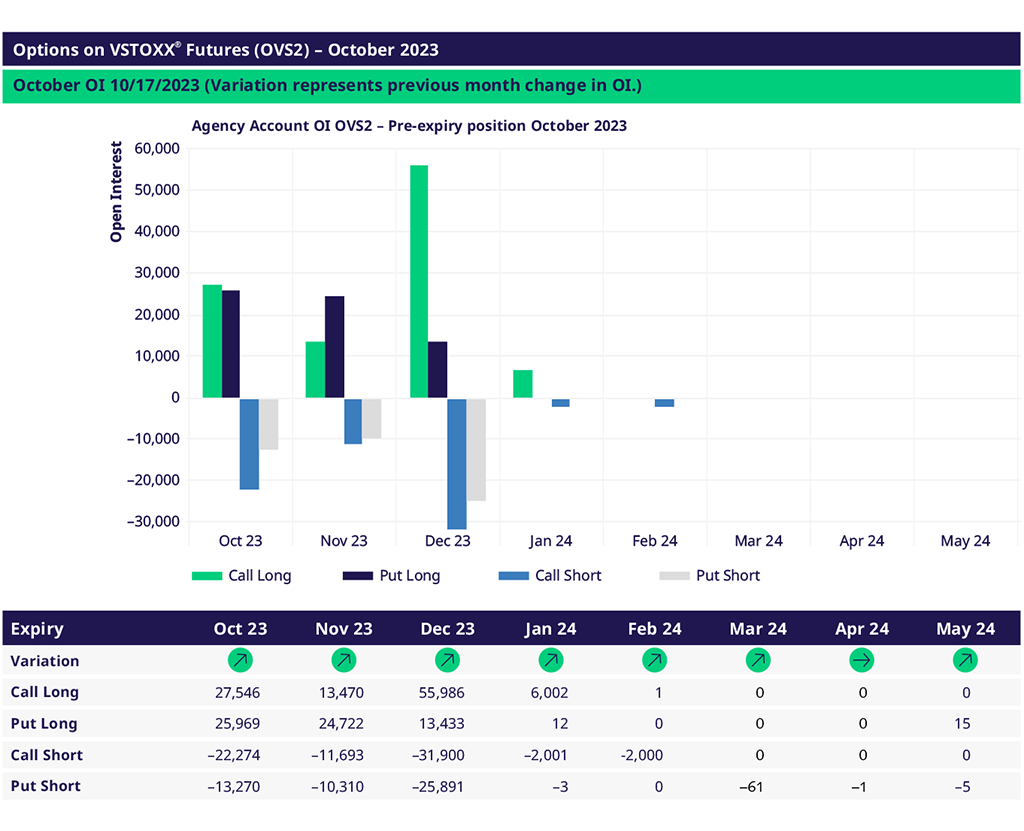

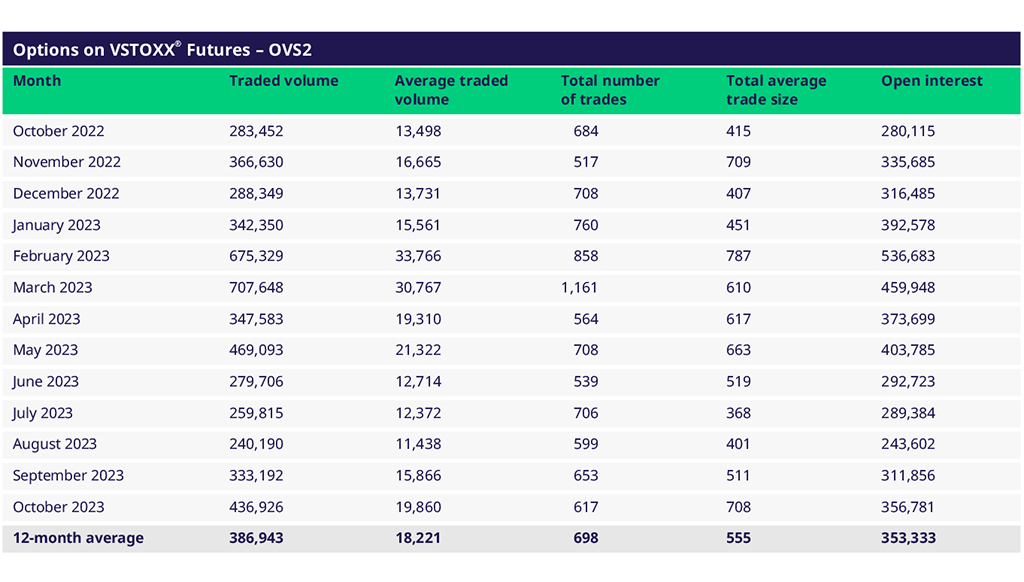

Options on VSTOXX® Futures (OVS2) November Update

Options on VSTOXX® Futures volume almost doubled in October compared to the low volumes in August. Open Interest further increased to more than 350k.

The most active day was 11 October, with 41k lots traded, followed by 9, 17 and 26 October, with more than 35k traded contracts.

At the beginning of November, end users were net long DEC calls by 30k and net short Feb calls by 12k. On the puts, they are long NOV and short DEC by 30k and 20k, respectively. The largest long positions are NOV 16 puts and DEC 40 calls.

Overall, in the options, end clients currently don’t carry a pronounced exposure to volatility, unlike the futures, where the net long position is more pronounced, focusing on NOV and DEC.

For more information, please visit the website or contact:

Americas: Eugen Mohr or T +1 312-544-1084

Europe: Matthew Riley or T +44 (0) 207 8 62-72 13