Oct 18, 2023

Eurex

VSTOXX® Monthly Update October 2023

VSTOXX® Futures (FVS) October Update

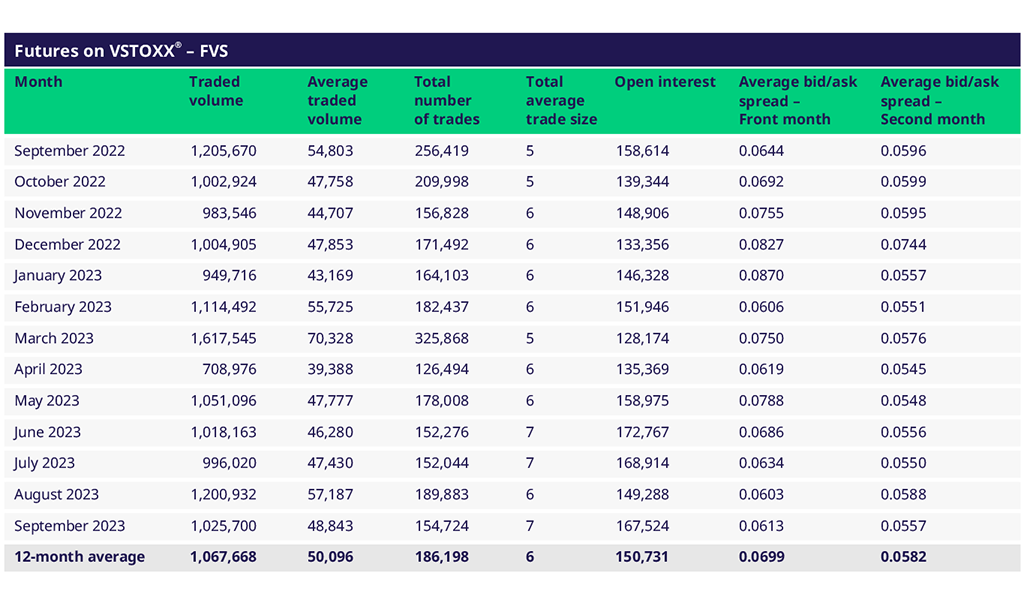

An average month in VSTOXX® Futures in terms of trading activity. The days between 13 and 19 September were quite busy with trading between 66k and 91k contracts.

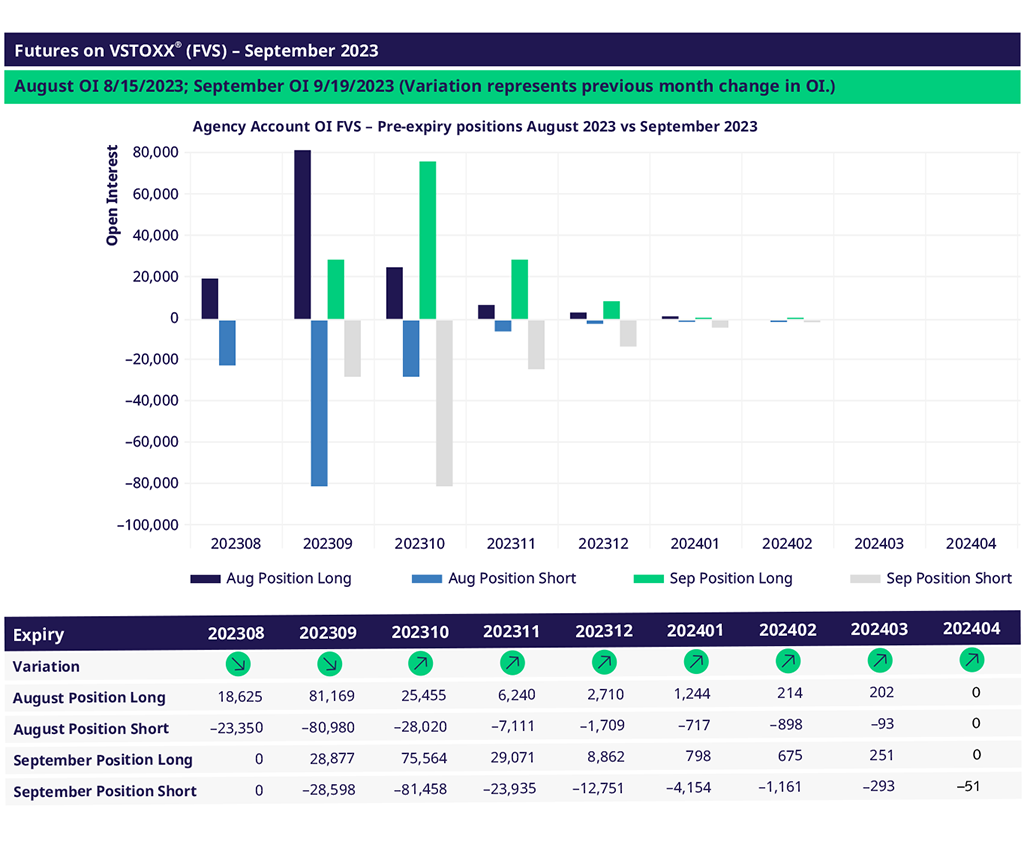

Between August and September expiry, end clients net sold front months and were net buyers of all other expiries. This pattern continued after September expiry until 11 October with the exception that the front month.

Since September expiry, end users gradually changed their positions from net short to net long. On 11 October end clients are net long futures across all expiries, with focus on November. The recent geopolitical developments and the resulting increase in volatility have sped up this trend.

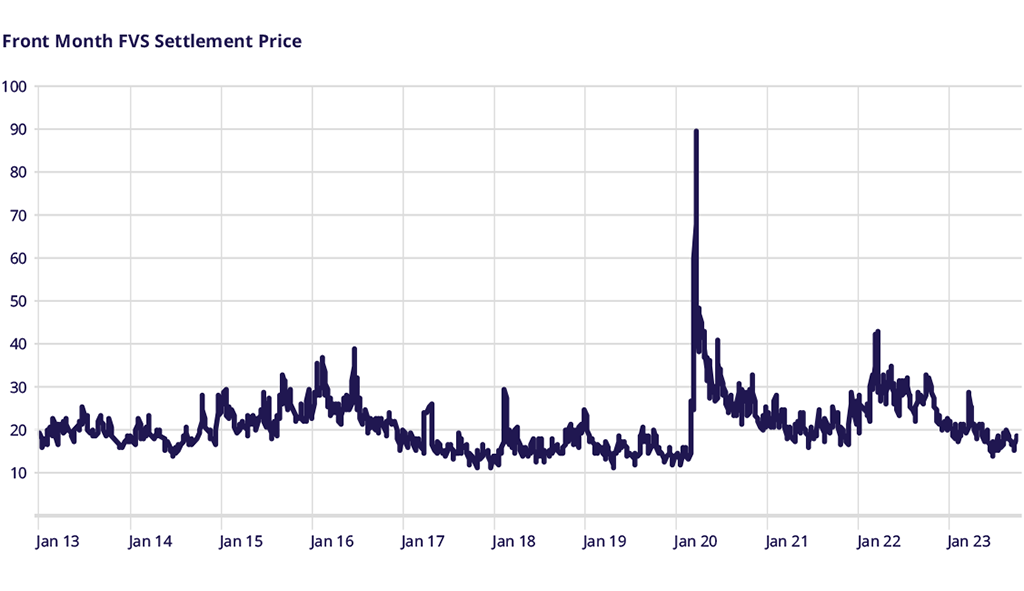

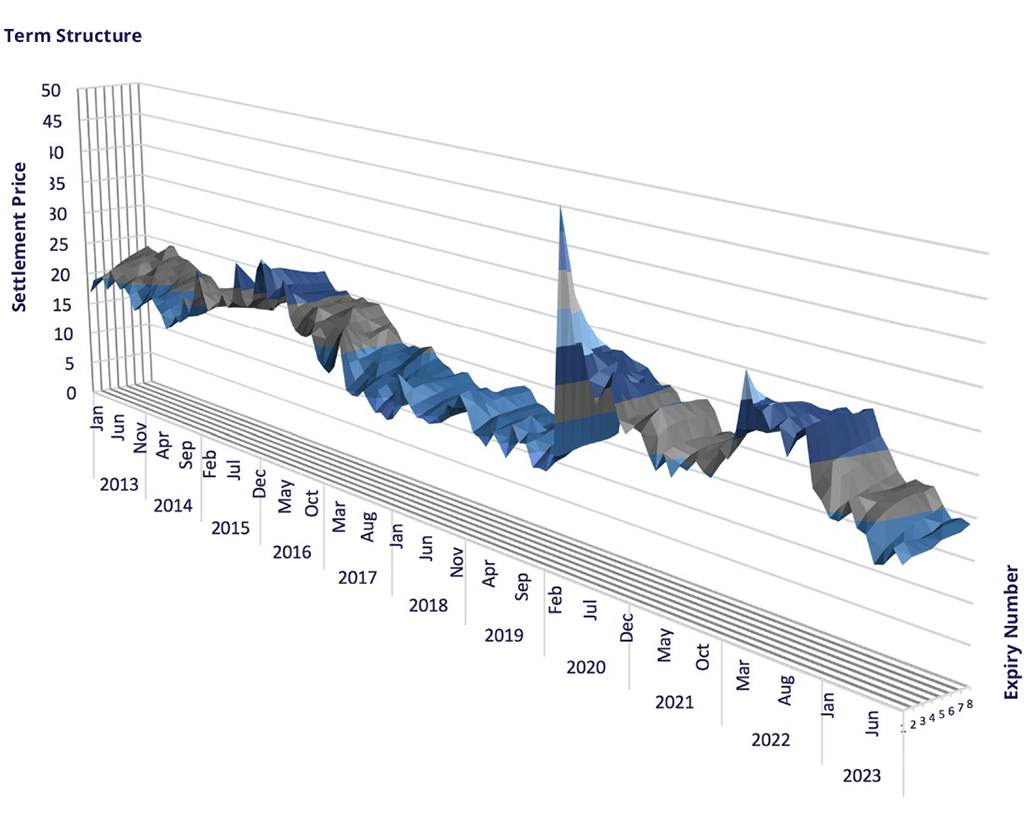

The VSTOXX® index moved between 15 in the beginning of September and 20 towards the end of the month. Early October VSTOXX® spiked from 18 to 20 on 3 October and again from 18.6 to 20.2 on 9 October. The term structure went flat again to 1.5 points between front- and last expiry (after 3 points last month). The December dip is now at around 0.6 when interpolating Nov and Jan expiries.

The EURO STOXX 50® index realized 10.34 volatility between August VSTOXX® and September EURO STOXX® expiries. Versus a final settlement price of the VSTOXX® Futures in June of 19.02 the volatility risk premium was negative 8.68 vol points. After negative 0.9 (July/August) and negative 1.01 between June and July.

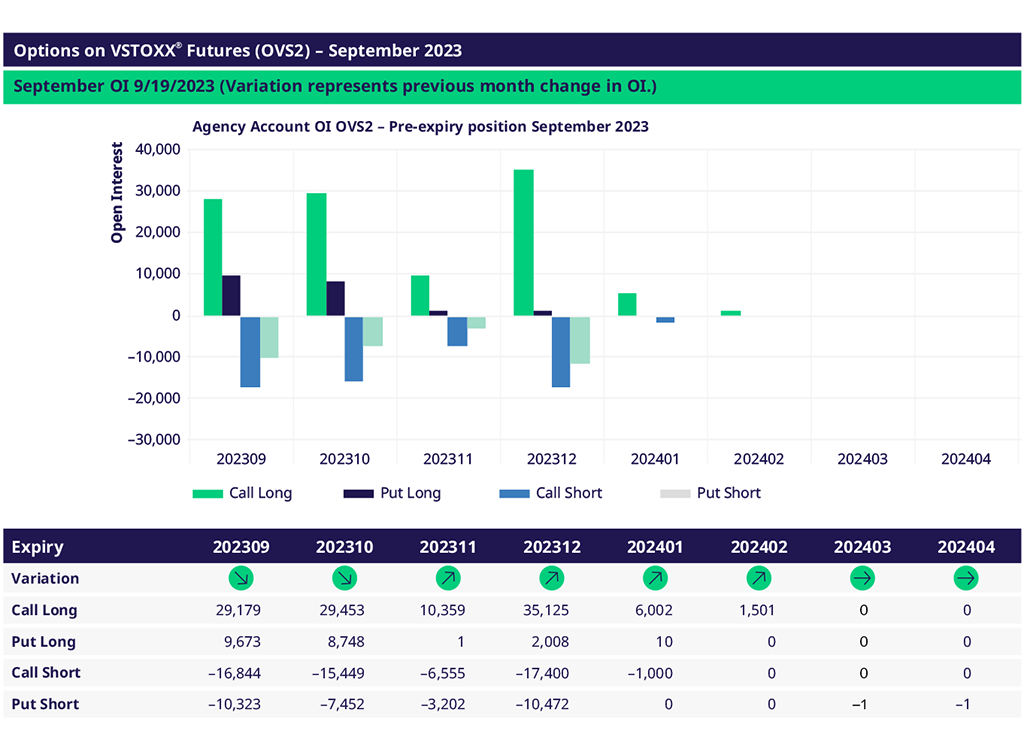

Options on VSTOXX® Futures (OVS2) October Update

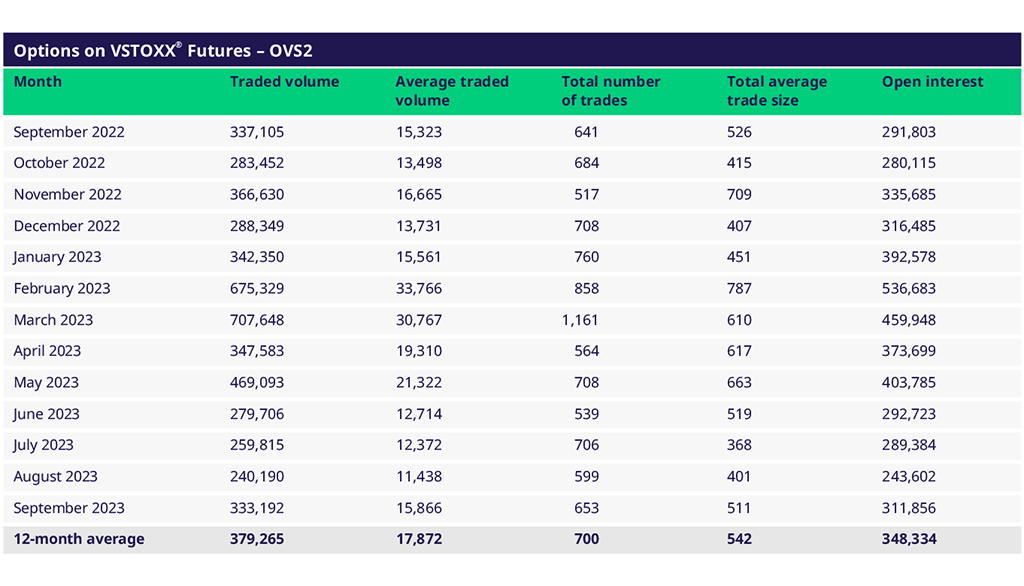

Options on VSTOXX® Futures have recovered from the low volumes in August. Most active day was 18 September with 34k lots traded followed by 20-22 September where around 30k were traded each day. Also, open interest has recovered to more than 300k.

End clients were net buyers of options across calls and puts in September. On the calls, they were net buyers of the December expiry and on the puts they net bought Sep, Oct and Nov.

In terms of moneyness end user were buyers of 20% OTM calls and sellers of 30% to 50% OTM calls. On the puts, end clients were net buyers of the 20% OTM puts. In early October trading activity by end clients is more balanced except for net purchases of 20% OTM puts.

The positioning of end clients has changes between September expiry and 11 October from long call/ short put to long call/ long put. In the calls they reduced the net long position from 50k to 30k and flipped the put position from short 14k to long 14k, net.

For more information, please visit the website or contact:

Americas: Eugen Mohr or T +1 312-544-1084

Europe: Matthew Riley or T +44 (0) 207 8 62-72 13